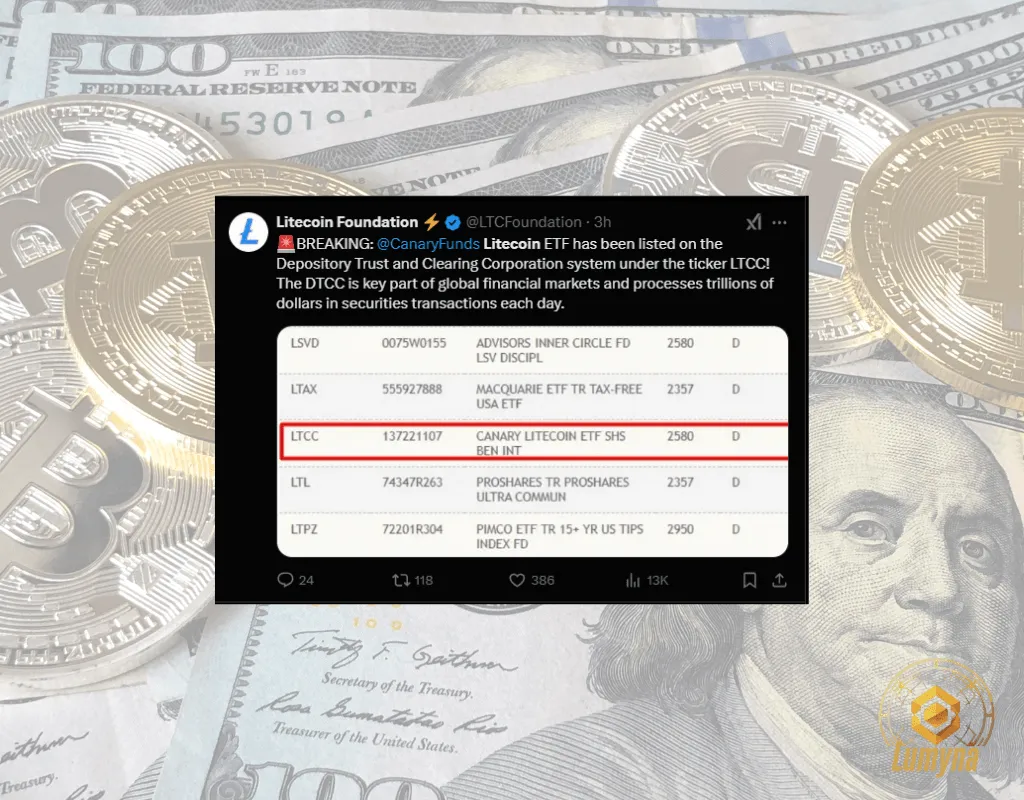

Breaking News: In a historic development for cryptocurrency, the Litecoin Foundation has officially announced the listing of the first-ever Litecoin ETF in the Canary Islands. This groundbreaking move signals a new era for institutional investment in Litecoin ($LTC) and could pave the way for broader adoption in global markets.

The Big Announcement

A few hours ago, the Litecoin Foundation confirmed on Twitter that the first Litecoin ETF has been officially listed and recognized in the Spanish Canary Islands. This milestone comes as a surprise to many in the crypto community, as major jurisdictions like the United States and European Union have yet to approve a Litecoin-based exchange-traded fund (ETF).

The ETF has been reportedly listed on the Depository Trust and Clearing Corporation (DTCC) system under the ticker LTCC. This marks a significant step forward for investors looking to gain regulated exposure to Litecoin without directly holding the asset.

Why the Canary Islands?

The Canary Islands, an autonomous community of Spain located in the Atlantic Ocean, have a unique economic and regulatory environment that makes them an interesting jurisdiction for financial innovations, including cryptocurrency-based investment products.

Some key facts about the Canary Islands:

- Population: Approximately 2.24 million people.

- GDP per Capita (2021): Around €18,990, with 40% of the economy dependent on tourism.

- Informal Economy: Estimated to be around 17.9% of GDP, exceeding €8 billion annually.

The region’s high level of informal economic activity, including tax loopholes and money laundering risks, raises questions about why it was chosen as the launchpad for the Litecoin ETF. However, some experts suggest that lighter financial regulations in the Canary Islands compared to mainland Spain may have played a role in this decision.

What This Means for Litecoin

This ETF listing is a huge milestone for Litecoin and could have several significant implications:

- Institutional Adoption: The listing allows institutional investors to gain exposure to Litecoin in a regulated investment vehicle, boosting credibility and mainstream adoption.

- Price Surge Potential: Historically, crypto ETF approvals have been bullish for the underlying asset, and Litecoin’s price has already seen a 3.31% increase, trading at $137.15 following the news.

- A Test Case for Larger Markets: The Canary Islands may serve as a testing ground for the eventual listing of a Litecoin ETF in larger financial hubs such as the EU, UK, or even the US.

Regulatory Concerns and the Informal Economy Factor

While this listing is an exciting development, it also raises regulatory questions. The Canary Islands have been known for their large informal economy, with businesses avoiding taxes and criminals laundering money through various loopholes.

This has led to concerns about whether the regulatory framework surrounding this ETF is robust enough to prevent illicit financial activities. Some financial analysts argue that launching an ETF in a jurisdiction with a high percentage of undocumented economic activity could raise red flags for global regulators.

What’s Next?

- Market Response: Traders and investors will closely watch Litecoin’s price movements in the coming days.

- Regulatory Scrutiny: Will Spanish and EU regulators step in to evaluate the legitimacy of this ETF?

- Expansion to Other Markets: If successful, could we see similar ETFs launching in other crypto-friendly jurisdictions?

Final Thoughts

The first Litecoin ETF listing is a historic achievement for both Litecoin and the broader cryptocurrency industry. While the choice of the Canary Islands raises regulatory concerns, the move represents a step toward wider crypto adoption in traditional financial markets.

With institutional interest growing and the crypto ETF market expanding, could this be the beginning of a Litecoin revolution? Only time will tell.

Disclaimer:

This article contains third-party opinions and is for informational purposes only. It does not constitute financial advice. Cryptocurrency investments are volatile, and you should conduct your own research before making investment decisions.