As digital assets redefine investing, the iShares Bitcoin Trust ETF (IBIT), launched by BlackRock, the world’s largest asset manager, has emerged as a standout choice for those seeking bitcoin exposure without the hassles of direct ownership. Since its 2024 debut, IBIT has surged in popularity, blending the familiarity of traditional ETFs with cryptocurrency’s promise. This guide explores IBIT’s essentials, features, performance, risks, benefits, and how it stacks up against rival crypto ETFs, to help you decide if it’s right for your portfolio.

Why Digital Assets Matter

Bitcoin, the trailblazer of digital assets, has evolved from a fringe experiment to a recognized store of value, fueled by its decentralized design and capped supply of 21 million coins. Yet, owning it directly means wrestling with wallets, private keys, and tax complexities— hurdles that deter many. IBIT offers a solution: a regulated ETF that tracks bitcoin’s price, bringing crypto into the mainstream via a familiar financial wrapper. Volatility, regulatory shifts, and security risks remain, but IBIT softens some of these edges, making bitcoin accessible to a wider audience.

IBIT at a Glance: What Sets It Apart

IBIT combines simplicity with sophistication. Here’s what makes it tick:

- Effortless Access: No digital wallets or custody worries—IBIT trades on NASDAQ like any stock, fitting seamlessly into your brokerage account.

- Top-Tier Liquidity: Since its launch, IBIT has led U.S. bitcoin ETFs in trading volume, with narrow bid-ask spreads that cut costs and stabilize pricing.

- BlackRock’s Edge: With $10 trillion in assets under management and a tech partnership with Coinbase Prime, IBIT merges institutional prowess with cutting-edge custody.

These strengths make it a compelling option for novices and seasoned investors alike, bridging crypto’s wild frontier with Wall Street’s polish.

Performance Snapshot: Numbers to Know

As of February 21, 2025, IBIT’s metrics paint a vivid picture:

- Net Asset Value (NAV): $54.10

- 52-Week Range: $29.07–$60.61

- 1-Day NAV Change: -$1.92 (-3.43%)

- Year-to-Date Return (as of Feb 20): 5.12%

- Expense Ratio: 0.25%

The 52-week range reflects bitcoin’s rollercoaster nature, while the modest YTD return hints at resilience amid turbulence. At 0.25%, the fee is competitive, though investors must weigh it against crypto’s unpredictable swings. These numbers offer a snapshot of opportunity—and risk.

Decoding the Prospectus: Objectives and Risks

IBIT’s mission is clear: mirror bitcoin’s spot price, minus expenses. Unlike traditional ETFs under the Investment Company Act of 1940, it operates under a lighter regulatory framework tailored to digital assets. This flexibility has pros and cons:

- Upside: Direct exposure to bitcoin’s performance without owning it outright.

- Downside: Extreme volatility, custody risks, and fewer investor protections than conventional funds.

The prospectus spells it out—price swings can be brutal, and digital security isn’t ironclad. Reviewing it is essential to grasp what’s at stake.

Staying in the Loop: SEC Reports and Beyond

IBIT’s periodic SEC filings keep investors in the know with updates on:

- Performance Trends: NAV shifts, trading volumes, and bitcoin holdings.

- Operational Health: Governance and compliance insights.

- Transparency: Structural or strategic changes.

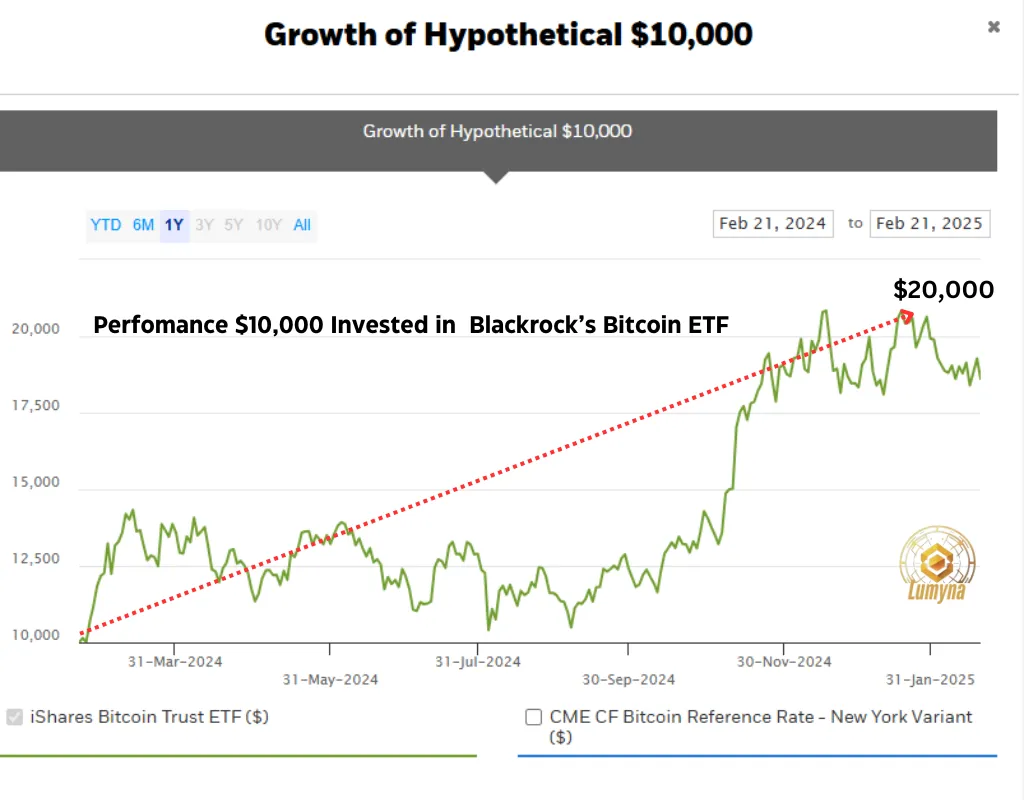

Paired with fact sheets, legal disclosures, and historical data—like hypothetical $10,000 growth charts—these resources, available on BlackRock’s site, empower you to track IBIT’s pulse. Downloadable NAV histories and trading stats invite deeper dives for data-savvy investors.

IBIT vs. the Competition: How It Stacks Up

IBIT isn’t alone in the crypto ETF arena, competitors like Grayscale Bitcoin Trust (GBTC), Fidelity Wise Origin Bitcoin Fund (FBTC), and ARK 21Shares Bitcoin ETF (ARKB) vie for attention. Here’s how they compare:

Grayscale Bitcoin Trust (GBTC):

- Overview: The longest-running bitcoin fund, GBTC converted to an ETF in 2024 after years as a trust. It holds over $40 billion in BTC.

- Fees: 1.5%—steep compared to IBIT’s 0.25%.

- Liquidity: High trading volume, but wider bid-ask spreads than IBIT increase costs.

- Edge: Early mover advantage and brand recognition.

- Drawback: Higher fees and a history of trading at discounts to NAV (pre-ETF conversion) may deter cost-conscious investors.

Fidelity Wise Origin Bitcoin Fund (FBTC)

- Overview: Launched in 2024, FBTC leverages Fidelity’s financial pedigree and holds $10 billion in assets.

- Fees: 0.25%, matching IBIT.

- Liquidity: Strong, though it trails IBIT’s volume and market share.

- Edge: Fidelity’s in-house custody cuts reliance on third parties like Coinbase, potentially boosting security.

- Drawback: Less dominant in inflows—$8 billion YTD vs. IBIT’s $60 billion, suggesting weaker institutional pull.

ARK 21 Shares Bitcoin ETF (ARKB)

- Overview: A collaboration between ARK Invest and 21Shares, ARKB targets innovation-driven investors with $3 billion in assets.

- Fees: 0.21%, slightly below IBIT.

- Liquidity: Decent but lags IBIT’s towering volumes and tighter spreads.

- Edge: Backed by Cathie Wood’s forward-thinking ethos, appealing to growth-focused portfolios.

- Drawback: Smaller scale limits its heft in a market where size drives stability.

- IBIT’s Advantage:

IBIT leads with over 50% of U.S. bitcoin ETF market share and $60 billion in inflows since launch. Its BlackRock backing, Coinbase Prime integration, and unmatched liquidity set it apart. While GBTC carries legacy weight, its fees are higher. FBTC matches IBIT’s cost but lacks its scale. ARKB’s lower fee is enticing and good for investors, but its niche appeal can’t rival IBIT’s institutional clout. X posts often tout IBIT’s “Wall Street polish” as a game-changer, though some warn its dominance could集中 risk if BlackRock stumbles.

For investors, the choice hinges on priorities—cost (ARKB), custody control (FBTC), history (GBTC), or scale and liquidity (IBIT). IBIT’s blend of all four makes it a frontrunner, though no ETF fully tames bitcoin’s volatility.

How to Buy IBIT—and What to Consider

Ready to invest? IBIT (ticker: IBIT) trades on NASDAQ via any brokerage. Key factors:

- Timing: Bitcoin’s swings—like the recent -3.43% NAV drop—demand vigilance. Monitor market trends.

- Costs: High liquidity keeps spreads tight, but fees and taxes apply.

- Horizon: IBIT suits long-term bitcoin believers who can handle risk.

Consult a financial advisor to ensure it fits your strategy—crypto’s unpredictability punishes rash moves.

Why IBIT Shines

Three strengths elevate IBIT:

- Simplified Access: It strips away crypto’s technical barriers, delivering bitcoin via a familiar ETF wrapper.

- Liquidity Leader: Its dominance in trading volume ensures smoother trades—a rarity in digital assets.

- Tech Backbone: BlackRock’s expertise and Coinbase Prime’s custody offer security and efficiency few match.

These explain IBIT’s meteoric rise, capturing institutional and retail interest alike in 2025.

Performance in Focus

Past results don’t guarantee the future, but IBIT’s track record offers context:

- A hypothetical $10,000 investment chart shows growth potential, factoring in fees and swings.

- The $54.10 NAV and 5.12% YTD return signal stability, though the 52-week range ($29.07–$60.61) underscores bitcoin’s wild side.

X chatter praises IBIT’s resilience over peers like GBTC, though critics note its bitcoin tie keeps it volatile. It’s a high-wire act—risk and reward in tandem.

Is IBIT Right for You?

IBIT offers a polished gateway to bitcoin, blending accessibility, liquidity, and institutional credibility. It’s perfect for diversification-minded investors who see digital assets as the future but prefer a regulated vehicle over raw crypto. Compared to GBTC’s heft, FBTC’s custody edge, or ARKB’s innovation, IBIT’s scale and execution shine brightest—though its bitcoin core ensures volatility lingers.

Before jumping in, pore over the prospectus, track SEC filings, and weigh your risk tolerance. IBIT’s transparency and data access make this straightforward. If bitcoin’s long-term narrative excites you—and you can stomach the ride—it’s a smart contender. For now, it’s a bridge between crypto’s chaos and finance’s order, evolving with the digital era.