What are stablecoins?

Stablecoins are cryptocurrencies engineered to hold a steady value, typically pegged to assets like fiat currencies (e.g., the U.S. dollar), commodities (e.g., gold), or other digital tokens. Unlike Bitcoin or Ethereum, which swing wildly, stablecoins aim for price stability, making them ideal for payments, savings, and decentralized finance (DeFi) applications. Popular examples include Tether (USDT), USD Coin (USDC), and emerging interest-bearing options like YLDS. They merge crypto’s decentralized appeal with the reliability of traditional money, serving as a bridge between Web3 and conventional systems.

Who uses stablecoins?

They draw a wide audience: crypto traders dodging market volatility, DeFi developers powering smart contracts, and everyday users seeking a stable store of value. Institutional players, exchanges, miners, and even some governments, use them for liquidity and efficiency. In 2025, adoption spans retail investors swapping USDT on exchanges to protocols leveraging stablecoins for billions in DeFi transactions. Regulators and central banks also engage, either issuing their own (e.g., digital yuan) or scrutinizing private variants for oversight.

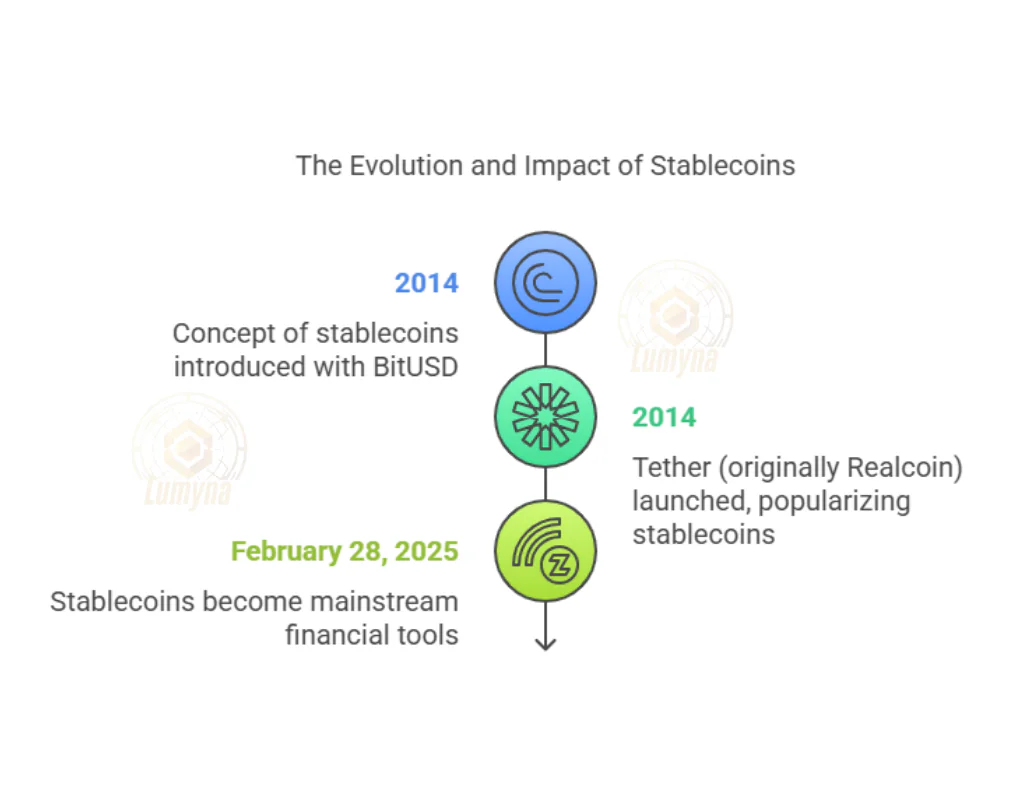

When did stablecoins emerge?

The idea kicked off with BitUSD in 2014, but Tether, launched that year as Realcoin, put stablecoins on the map. Their growth exploded after 2017, driven by crypto’s volatility and DeFi’s rise. By February 28, 2025, they’re a cornerstone of digital finance, with volumes dwarfing many altcoins. Regulatory battles, like recent U.S. approvals of interest-bearing stablecoins, mark their evolution from fringe experiments to mainstream tools.

Where are stablecoins used?

They operate globally, thriving on blockchains like Ethereum, Binance Smart Chain, and Layer 2 networks. They power DeFi ecosystems, facilitate remittances, and grease cross-border trade, especially in regions with shaky currencies. From U.S.-based exchanges to Asian trading hubs, their reach is vast—USDT alone often tops daily crypto transaction charts in 2025. They’re also eyed by nations exploring sanctions evasion or digital reserves.

Why do stablecoins matter?

They tame crypto’s wild price swings, offering a dependable medium for transactions and a foothold for DeFi’s $100 billion-plus market. They enable lending, trading, and yield farming without fiat reliance, reshaping finance. Yet, their scale sparks tension—regulators fear they could disrupt monetary policy or fuel illicit flows, while users prize their freedom. In 2025, they’re a flashpoint for innovation versus control.

How do they work?

Most are collateralized: USDT and USDC are backed 1:1 by dollar reserves (ideally), while DAI uses over-collateralized crypto. Algorithmic stablecoins tweak supply to hold pegs, though flops like TerraUSD in 2022 exposed their risks. Issuers maintain stability via reserves or code, with blockchain transparency varying—centralized ones lean on audits, decentralized ones on smart contracts. Users trade or hold them via wallets or platforms.

Related Questions and Answers

- What’s the difference between stablecoins and Bitcoin?

- Stablecoins aim for price stability (e.g., $1 per USDT), while Bitcoin’s value fluctuates based on market demand.

- Are stablecoins truly safe?

- It depends, centralized ones like USDT rely on issuer trustworthiness; decentralized ones like DAI hinge on code and collateral.

- Why are regulators targeting them in 2025?

- Their size and use in cross-border flows threaten capital controls and monetary sovereignty.

- Can stablecoins earn interest?

- Yes, newer ones like YLDS offer yields, approved in places like the U.S. by 2025.

- How do I get stablecoins?

- Buy them on exchanges (e.g., Binance) with fiat or crypto, or earn them via DeFi protocols.