The cryptocurrency world is full of opportunities, but it’s also a breeding ground for scams. One term you’ve likely come across if you’re new to crypto is “rug pull.” But what is a rug pull, exactly? In simple terms, a rug pull is a type of cryptocurrency scam where developers or promoters of a project abandon it after collecting investors’ money, leaving them with worthless tokens. This beginner’s guide will break down everything you need to know about rug pulls, how they work, red flags to watch for, and tips to protect yourself from falling victim to these crypto scams.

What Does “Rug Pull” Mean in Crypto?

A “rug pull” gets its name from the phrase “pulling the rug out from under someone,” meaning to suddenly take away support, leaving the victim helpless. In the crypto space, it refers to a fraudulent scheme where the creators of a cryptocurrency project hype it up, attract investors, and then disappear with the funds, leaving the project’s tokens worthless.

Rug pulls often occur in decentralized finance (DeFi) projects, where new tokens or platforms promise high returns. Scammers take advantage of the hype surrounding crypto and the lack of regulation to exploit unsuspecting investors. According to industry reports, billions of dollars have been lost to rug pulls since the DeFi boom began, making it a critical topic for anyone entering the cryptocurrency market.

How Does a Rug Pull Work?

Understanding how a rug pull operates is the first step to avoiding one. Here’s a breakdown of the typical process:

1. Creation of a New Token or Project

Scammers launch a new cryptocurrency token or DeFi platform, often with catchy names, flashy websites, and promises of massive profits. These projects are usually built on blockchain networks like Ethereum or Binance Smart Chain, where creating tokens is relatively easy.

2. Aggressive Marketing and Hype

The team promotes the project heavily on social media, Discord, Telegram, and other platforms popular with crypto enthusiasts. They may pay influencers or fake testimonials to build credibility and attract investors.

3. Liquidity Pool Manipulation

In many rug pulls, scammers add liquidity to a decentralized exchange (DEX) like Uniswap or PancakeSwap. Investors buy the token, driving up its value. However, the scammers retain control of the liquidity pool or the majority of the tokens.

4. The Exit Strategy

Once enough money flows into the project, the scammers “pull the rug.” They either drain the liquidity pool, sell off their massive token holdings (crashing the price), or simply abandon the project. Investors are left holding tokens with no value and no way to recover their funds.

This cycle can happen in days, hours, or even minutes, depending on the scam’s scale.

Types of Rug Pulls in Cryptocurrency

Not all rug pulls are the same. Crypto scammers use different tactics to deceive investors. Here are the most common types:

1. Liquidity Pull Rug Pull

In this type, scammers remove the liquidity they initially provided to a DEX pool, making it impossible for investors to trade the token. The token becomes worthless overnight.

2. Dump Rug Pull

Here, the developers or insiders hold a large portion of the token supply. After hyping the project and inflating the price, they dump their tokens on the market, causing a price crash and leaving other investors with losses.

3. Soft Rug Pull

A soft rug pull is subtler. The team doesn’t disappear but gradually abandons the project, stops updates, and lets it fizzle out, leaving investors with diminishing returns.

4. Hidden Code Rug Pull

Some scammers embed exploitable code in the project’s smart contracts. This allows them to steal funds or lock investors out at a later date, often unnoticed until it’s too late.

Each type exploits the trust and enthusiasm of newbie crypto investors, making education on these scams essential.

Famous Rug Pull Examples in Crypto History

Rug pulls have made headlines as some of the most infamous crypto scams. Here are two well-known examples:

1. Squid Game Token (SQUID)

Inspired by the Netflix show Squid Game, this token launched in 2021 and skyrocketed in value due to massive hype. Investors poured in millions, only for the developers to vanish with $3.38 million, crashing the token’s value from $2,800 to near zero in minutes.

2. AnubisDAO

In late 2021, AnubisDAO raised $60 million in a token sale promising a new DeFi protocol. Less than a day later, the funds were siphoned to an unknown wallet, and the project’s social media went silent. It was a textbook liquidity pull rug pull.

These cases highlight how quickly rug pulls can devastate investors and why vigilance is crucial in the crypto space.

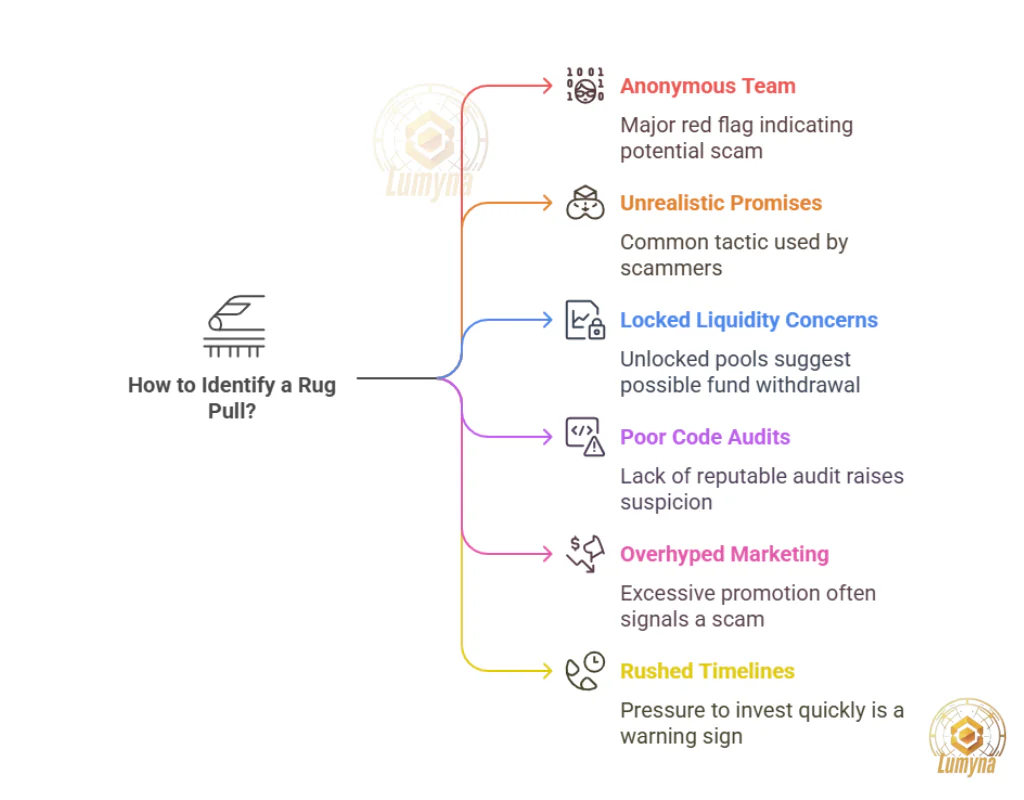

Red Flags of a Potential Rug Pull

Spotting a rug pull before it happens can save you from losing your hard-earned money. Watch for these warning signs:

- Anonymous Team: If the project’s developers hide their identities, it’s a major red flag. Legitimate projects typically have transparent teams.

- Unrealistic Promises: Claims of “guaranteed 1000% returns” or “revolutionary technology” with no substance are common scam tactics.

- Locked Liquidity Concerns: Check if the liquidity pool is locked and verifiable. Unlocked or short-term locks suggest the team could pull funds anytime.

- Poor Code Audits: Reputable projects undergo third-party smart contract audits. If there’s no audit or it’s from an unknown source, be cautious.

- Overhyped Marketing: Excessive shilling by unknown influencers or bots on social media often signals a scam.

- Rushed Timelines: Pressure to “invest now or miss out” is a tactic to prevent due diligence.

By recognizing these signs, you can avoid falling into a rug pull trap.

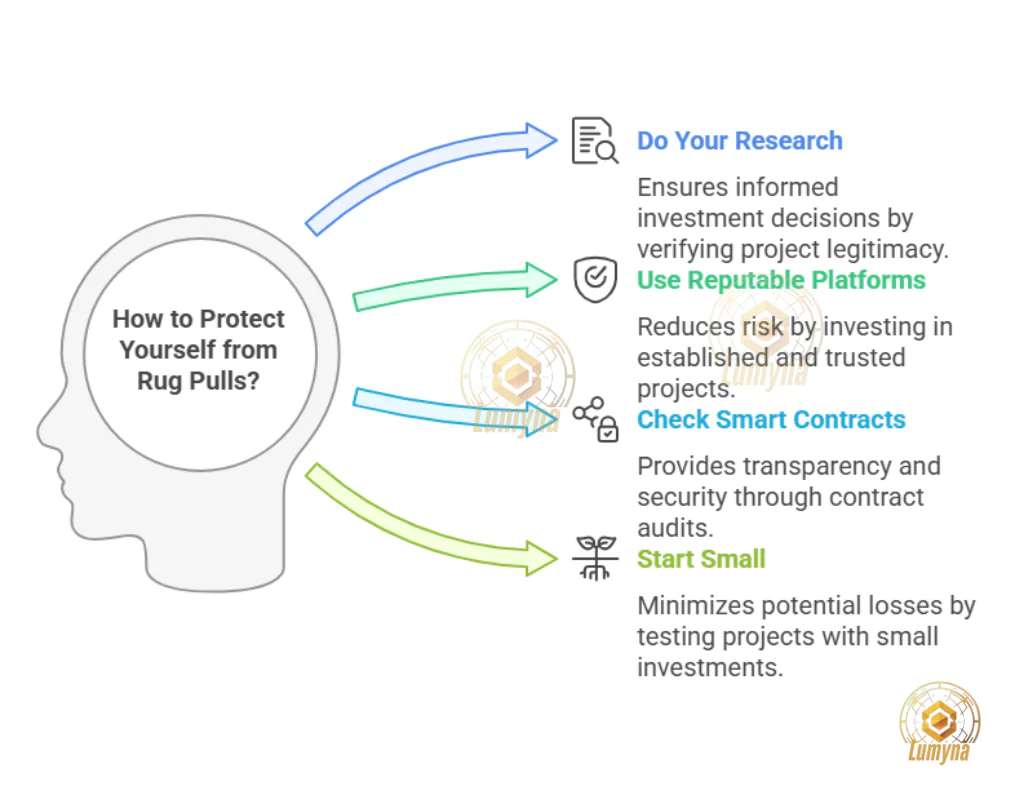

How to Protect Yourself from Crypto Scams Like Rug Pulls

The good news? You don’t have to be a victim. Here are practical steps to safeguard your investments:

1. Do Your Research (DYOR)

Always research a project before investing. Check the team’s background, read the whitepaper, and verify claims independently.

2. Use Reputable Platforms

Stick to well-known exchanges and projects with a track record. Avoid obscure tokens unless you fully understand the risks.

3. Check Smart Contracts

Use tools like Etherscan or BscScan to review a project’s smart contract. Look for audits from trusted firms like CertiK or OpenZeppelin.

4. Start Small

If you’re unsure about a project, invest only what you can afford to lose. Test the waters before going all in.

5. Secure Your Wallet

Use a hardware wallet and never share your private keys. Scammers often target wallets during rug pull hype.

6. Trust Your Gut

If something feels off—whether it’s the hype, the team, or the promises, walk away. Gut instincts can save you from crypto fraud.

Why Are Rug Pulls So Common in Crypto?

Rug pulls thrive in the cryptocurrency ecosystem for several reasons:

- Lack of Regulation: Crypto’s decentralized nature means fewer legal protections and oversight compared to traditional finance.

- Low Barriers to Entry: Anyone can create a token or DeFi project with minimal cost or technical know-how.

- Hype-Driven Market: The fear of missing out (FOMO) drives investors to jump into unverified projects without research.

- Anonymity: Blockchain’s pseudonymity makes it easy for scammers to hide their identities and disappear with funds.

Until the industry matures with better regulations and investor education, rug pulls will remain a persistent threat.

What to Do If You’re a Victim of a Rug Pull

If you’ve been caught in a rug pull, don’t panic—though recovery is tough, here are steps to take:

- Document Everything: Save screenshots of the project’s website, social media, and your transactions.

- Report the Scam: File reports with platforms like the FTC (U.S.), local authorities, or crypto scam trackers like RugDoc.

- Warn Others: Share your experience on forums or social media to prevent more victims.

- Consult a Professional: In rare cases, blockchain forensic experts might trace funds, though success isn’t guaranteed.

Unfortunately, due to crypto’s irreversible transactions, recovering funds is unlikely. Prevention is your best defense.

Final Thoughts: Staying Safe in the Wild West of Crypto

Rug pulls are a stark reminder that the crypto market, while exciting, is still the “Wild West” of finance. For beginners, the key to avoiding crypto scams like rug pulls is education, caution, and skepticism. By understanding what a rug pull is, recognizing the signs, and taking proactive steps to protect yourself, you can navigate this space with confidence.

The cryptocurrency world offers incredible potential—but only if you play it smart. Have you encountered a suspicious project? Share your thoughts below, and let’s keep the conversation going to build a safer crypto community.