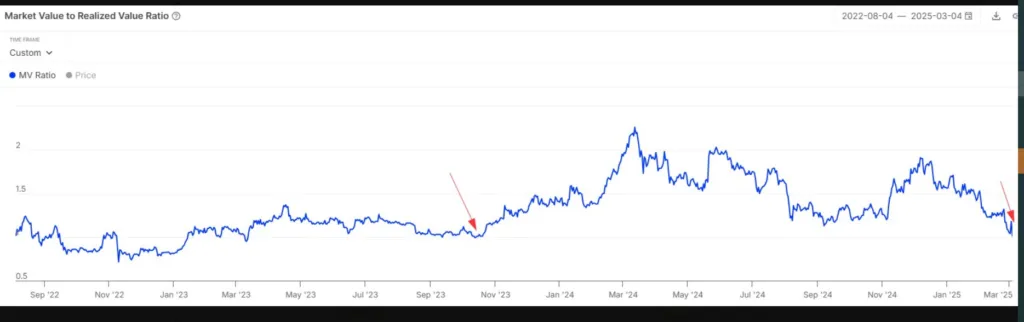

Lumyna Crypto News: In the ever-evolving world of cryptocurrency, a significant development has caught the attention of investors and analysts alike. According to blockchain analysis platform IntoTheBlock, Ethereum’s Market Value to Realized Value (MVRV) ratio has dropped to 1.01, marking its lowest level since October 2023. This metric, widely regarded as a key indicator of market sentiment and valuation, often signals a local bottom when it dips to such levels, potentially hinting at a buying opportunity for Ethereum (ETH) enthusiasts. As of March 08, 2025, this news has sparked discussions about whether the second-largest cryptocurrency by market capitalization is poised for a rebound.

Ethereum’s MVRV Ratio

The MVRV ratio, a tool used to assess whether an asset is overvalued or undervalued, compares the market value of Ethereum (what investors are willing to pay) to its realized value (the price at which coins were last moved). When the ratio falls to around 1, as it has now, it suggests that the market value is nearly equal to the realized value, often indicating that the asset is trading at a level where selling pressure may be nearing exhaustion. Historically, an MVRV of 1.01 has coincided with local bottoms—points in the market cycle where prices stabilize before a potential upward move. Back in October 2023, when Ethereum last saw this level, it was trading just below $1,600, a far cry from its recent highs.

Ethereum’s price

Ethereum’s price trajectory in early 2025 has been turbulent. After a challenging start to the year, ETH has shed significant value, dropping nearly 20% over the past month to hover around $2,169 as of this writing, according to market data. This decline follows a broader market correction that rattled investor confidence, with ETH briefly testing the $2,000 psychological support level earlier this week. The dip to an MVRV of 1.01, however, offers a glimmer of hope for long-term holders and bargain hunters. IntoTheBlock’s analysis underscores that such a low ratio is rare during bull markets and more commonly seen in bearish phases, where it can drop even further—sometimes below 0.70—before a significant recovery.

Analysts are divided on what this means for Ethereum’s short-term future. Some see the MVRV drop as a classic signal to accumulate, pointing to past cycles where Ethereum rebounded after hitting similar levels. For instance, after its October 2023 low, ETH embarked on a steady climb, eventually surpassing $4,000 by late 2024. Others caution that macroeconomic factors, including volatility in traditional markets and regulatory uncertainty in the crypto space, could prolong the current downturn. The upcoming Pectra upgrade, expected to enhance Ethereum’s scalability and developer appeal, adds another layer of intrigue, though its impact remains speculative at this stage.

Ethereum’s Social Sentiments

The sentiment on X reflects a mix of optimism and skepticism. Posts from users highlight the historical significance of an MVRV of 1.01, with some suggesting it’s a “rare bull low” that could precede an “explosive upside.” Others warn of risks if bearish trends persist, potentially driving the ratio lower. Meanwhile, institutional interest in Ethereum remains a wildcard. Recent moves by companies like BioNexus Gene Lab Corp to adopt ETH as a treasury reserve asset signal growing confidence in its long-term value, despite the current price slump.

As Ethereum navigates this critical juncture, the MVRV drop to 1.01 serves as a reminder of the cyclical nature of crypto markets. Whether this marks a true local bottom or a precursor to further declines, one thing is clear: all eyes are on ETH as it tests the resilience of its investor base and its position in the blockchain ecosystem. For now, the market watches and waits.