Crypto trading bots are automated software programs designed to execute cryptocurrency trades on your behalf based on pre-defined parameters and trading strategies.

These digital assistants operate 24/7, continuously analyzing market data and making trading decisions without requiring constant human oversight.

Unlike manual stock and forex trading, where emotions and fatigue can affect decision-making, bots execute trades with great precision according to their programmed logic.

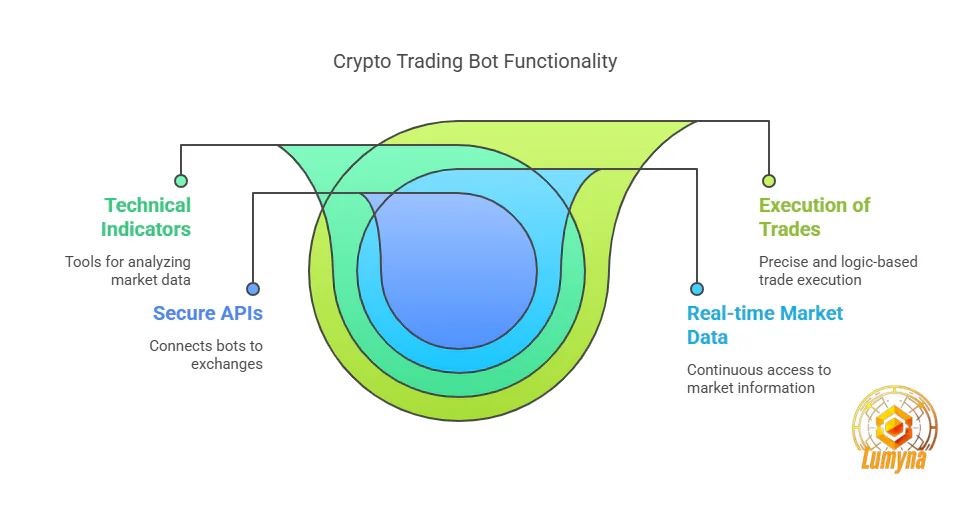

At their core, crypto bots work by connecting to exchanges through secure APIs (Application Programming Interfaces), accessing real-time market data, analyzing this information through various technical indicators, and executing buy or sell orders when specific conditions are met.

This automation eliminates the need for traders to constantly monitor price charts and manually place orders, potentially capturing opportunities that human traders might miss due to sleep, work, or other commitments.

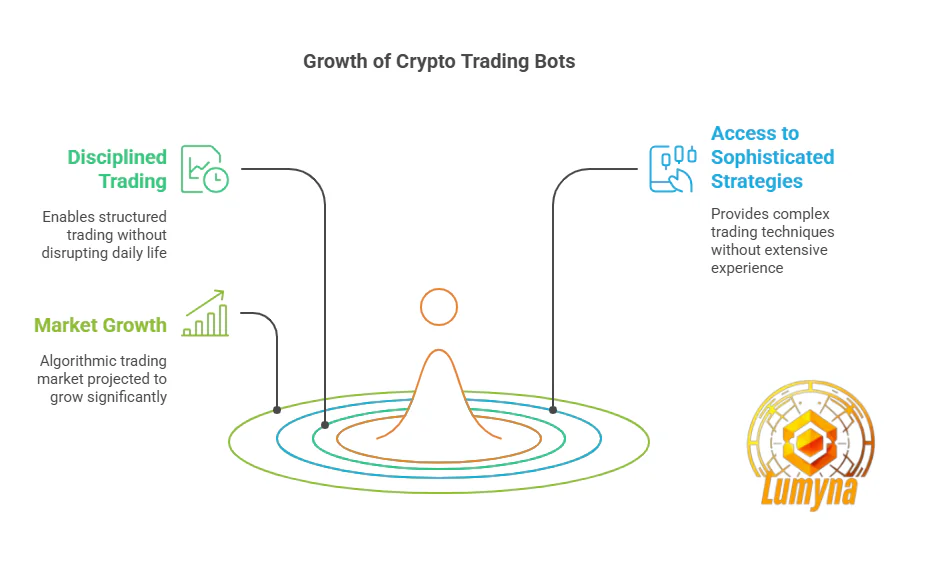

For beginners entering the cryptocurrency space, understanding automated trading technology has become increasingly essential. The crypto market operates around the clock, with significant price movements often occurring during off-hours.

Trading bots offer a solution to this challenge, allowing newcomers to implement disciplined trading strategies without sacrificing their daily routines. Moreover, as trading strategies grow more complex and technical, bots provide access to sophisticated approaches that might otherwise require years of trading experience to execute effectively.

The adoption of crypto trading bots has seen remarkable growth in recent years. According to market research, the global algorithmic trading market size was valued at approximately $12.14 billion in 2020 and is projected to reach $31.49 billion by 2028, growing at a CAGR of 12.7%.

Within the cryptocurrency sector specifically, bot usage has increased by nearly 40% year-over-year since 2021, with an estimated 20-30% of retail crypto traders now utilizing some form of automation in their trading activities.

This guide will walk you through everything you need to know about crypto bots, from basic concepts to implementation strategies. Whether you’re looking to save time, remove emotional biases from your trading, or implement complex strategies beyond your manual capabilities, understanding the fundamentals of automated trading is your first step toward making informed decisions in this rapidly evolving technological frontier.

What Are Crypto Trading Bots?

If you’ve ever tried your luck into the wild world of cryptocurrency, you’ve probably heard of crypto trading bots. But what exactly are they?

In simple terms, crypto trading bots are automated software programs designed to buy and sell cryptocurrencies on your behalf. Think of them as your tireless little helpers, working 24/7 to spot opportunities in the market while you’re sleeping, eating, or binge-watching your favorite show. They follow pre-set rules or algorithms to make trades, aiming to maximize profits or minimize losses, all without you lifting a finger.

At their core, these bots analyze market data like price trends, trading volume, and historical patterns. Based on that info, they execute trades faster and more efficiently than most humans ever could. Whether you’re a newbie or a seasoned trader, they’re a tool to simplify the chaos of crypto markets.

How They Differ from Manual Trading

Manual trading is like cooking a meal from scratch, you’re in control, but it takes time, focus, and a lot of effort. You’re glued to charts, watching prices, and deciding when to hit “buy” or “sell.”

Crypto trading bots, on the other hand, are like having a robot chef. You set the recipe (your trading strategy), and they handle the rest.

Unlike manual trading, bots don’t get tired, emotional, or distracted. They stick to the plan, even when the market gets crazy—which, let’s be honest, happens a lot in crypto!

The tradeoff? You lose some control. With manual trading, you can adapt on the fly. Bots follow their programming, so if the market throws a curveball they weren’t built for, they might stumble.

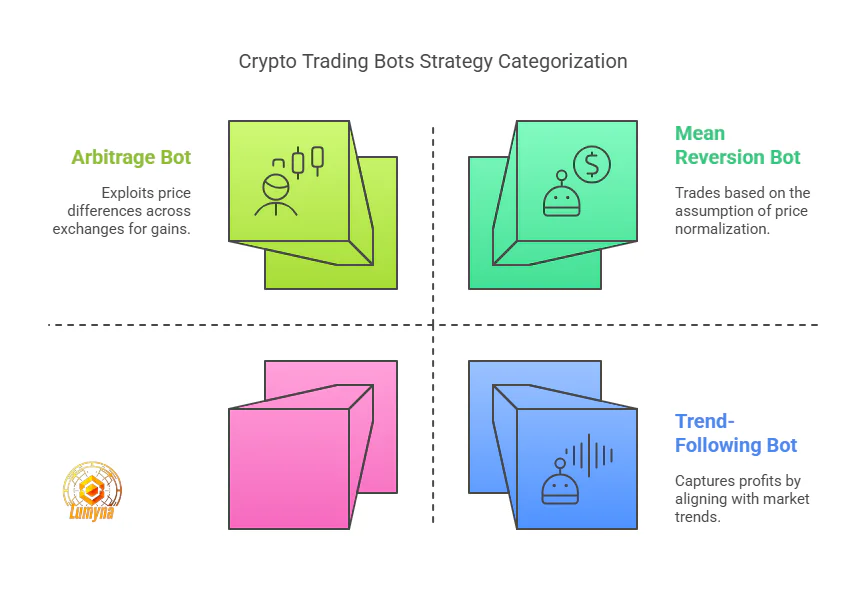

Types of Algorithms Used (The Basics)

Crypto bots rely on algorithms, fancy math rules, to decide what to do. Some common ones include:

- Trend-Following: These bots chase price movements, buying when prices rise and selling when they drop.

- Arbitrage: They spot price differences between exchanges and profit from the gap.

- Mean Reversion: These assume prices will return to an average, trading accordingly.

It’s not rocket science (okay, maybe a little), but you don’t need to understand the nitty-gritty to use them—just pick a bot that matches your goals!

A Quick History Lesson: Traditional vs. Crypto Markets

Automated trading isn’t new. Back in the 1980s, stock markets started using computers to trade faster than humans could blink—think Wall Street with less shouting. By the 2000s, high-frequency trading dominated traditional finance. Crypto, though? It’s the wild child. When Bitcoin hit the scene in 2009, trading was all manual—enthusiasts swapping coins on forums.

As crypto exchanges like Binance and Coinbase grew, bots followed, evolving rapidly to handle the 24/7, rollercoaster nature of digital currencies. Today, they’re a a must for anyone serious about crypto profits.

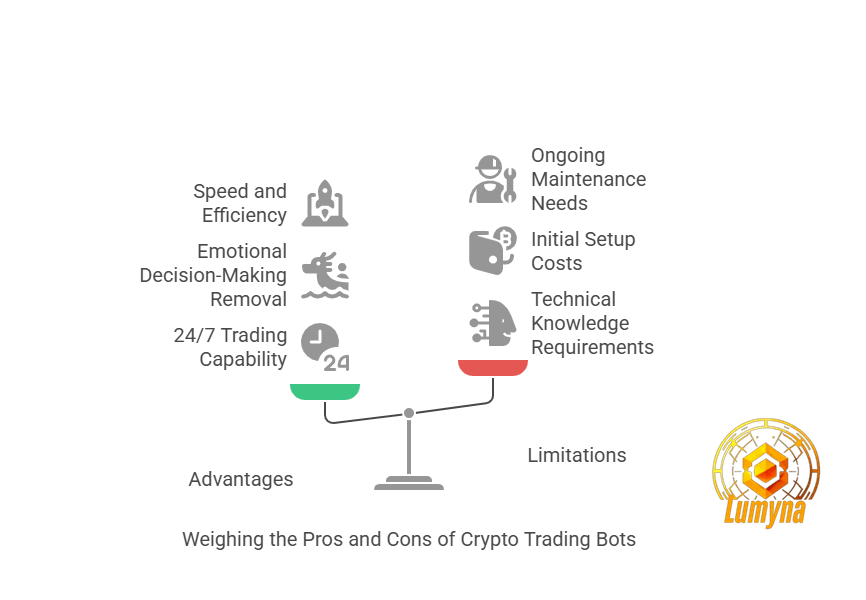

Why Use Crypto Trading Bots? Advantages and Limitations

So, you’re thinking about jumping into crypto trading bots—cool! But why bother?

Are they really worth it?

Let’s break it down with the good stuff (advantages) and the not-so-fun stuff (limitations) to help you decide if they’re your crypto BFF or just a passing fad.

Advantages: Why Bots Rock

24/7 Trading Capability

Crypto markets never sleep. Unlike stocks, which take a break when the bell rings, Bitcoin and friends keep buzzing all day, every day. Trading bots are like caffeine-fueled superheroes—they don’t need naps. They’ll watch the market and trade for you while you’re dreaming about lambos or grabbing a midnight snack.

Removal of Emotional Decision-Making

Ever panic-sold a coin because the price dipped, only to watch it soar later? Yep, emotions can mess with trading. Bots don’t care about fear or greed—they stick to the plan. No sweaty palms or second-guessing, just cold, calculated moves.

Speed and Efficiency

Humans are slow. By the time you spot a trend and click “buy,” the opportunity might be gone. Bots? They’re lightning-fast, executing trades in milliseconds. That speed can mean the difference between a profit and a “doh!” moment.

Ability to Backtest Strategies

Want to test your trading idea without risking real cash? Bots let you backtest—running your strategy on past market data to see how it’d perform. It’s like a crystal ball (minus the magic) to tweak your game plan before going live.

Diversification Across Multiple Markets

Why stick to one coin or exchange? Bots can juggle multiple markets at once—trading Bitcoin on Binance, Ethereum on Coinbase, you name it. It’s like having a team of traders in one neat package, spreading your risk and boosting your chances.

Limitations: The Catch You Need to Know

Technical Knowledge Requirements

Bots aren’t plug-and-play toys. Setting them up might mean understanding APIs, coding basics, or at least picking the right pre-built bot. If “algorithm” sounds like a foreign language, you’ll need to learn or lean on a friend who gets it.

Initial Setup Costs

Good bots aren’t always free. You might pay for software, a subscription, or even a VPS (virtual private server) to keep it running. It’s an investment—great if it pays off, but a bad if you’re on a tight budget.

Ongoing Maintenance Needs

Bots aren’t set-it-and-forget-it. Markets change, software glitches, and strategies need tweaking. You’ll have to check in, update settings, or fix bugs—think of it like tending a high-tech garden.

Market Volatility Risks

Crypto’s wild. A bot might follow its rules perfectly but still lose if a sudden crash or pump blindsides it. No bot can predict Elon’s next tweet or a random hack—volatility’s the name of the game.

Dependency on Stable Internet Connections

No Wi-Fi, no bot. If your internet drops or the exchange goes offline, your bot’s stuck. A shaky connection could mean missed trades or worse—lost cash. You’ll need reliable tech to keep it humming.

So, Should You Use One?

Crypto trading bots are awesome if you want speed, automation, and a break from emotional rollercoasters. But they’re not perfect—you’ll need some know-how, cash, and a stomach for crypto’s ups and downs. Weigh the pros and cons, and you’ll know if a bot’s your ticket to trading glory or just a cool experiment!

Common Types of Crypto Trading Bots

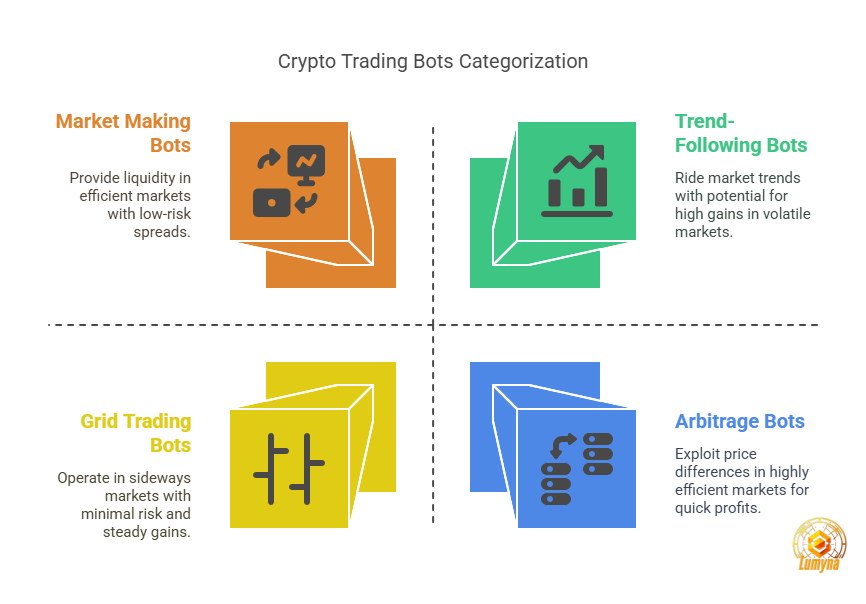

Crypto trading bots come in all shapes and sizes, each with its own superpower for tackling the market. Whether you’re chasing profits or just want to automate the grind, there’s a bot for you.

Let’s dive into four popular types—Arbitrage Bots, Trend-Following Bots, Market Making Bots, and Grid Trading Bots—and see what makes them tick.

Arbitrage Bots: The Price Difference Hustlers

What They Do

Arbitrage bots are the bargain hunters of the crypto world. They sniff out price differences for the same coin across different exchanges and pounce on the opportunity. For example, if Bitcoin price is $60,000 on Binance but $60,200 on Coinbase, the bot buys low and sells high, pocketing the difference. It’s like flipping crypto for a quick buck!

Cross-Exchange Examples

Picture this: Ethereum’s lagging on Kraken at $2,500 while it’s pumping on Bitfinex at $2,520. An arbitrage bot spots this, buys on Kraken, sells on Bitfinex, and boom—profit. These gaps happen because crypto exchanges aren’t perfectly synced, especially during wild price swings.

Typical ROI Expectations🤑

Returns vary, but arbitrage is often low-risk, low-reward—0.1% to 2% per trade. With enough volume and speed, though, those small wins add up. Just watch out for fees and transfer delays eating into your gains!

Trend-Following Bots: Riding the Market Wave

How They Work

Trend-following bots are like surfers—they ride market waves. They analyze price patterns to spot uptrends (prices climbing) or downtrends (prices dipping) and trade accordingly. Buy when the market’s hot, sell when it cools off—simple, right?

Common Indicators

These bots lean on tools like:

- Moving Averages: Smooths out price data to spot trends.

- MACD: Tracks momentum to signal buy/sell moments.

- RSI: Measures if a coin’s overbought or oversold. If the RSI says “overbought,” the bot might sell, expecting a dip.

Bull vs. Bear Markets

They shine in bull markets (prices soaring) when trends are clear, raking in gains as coins climb. In bear markets (prices tanking), they can struggle—choppy, sideways action confuses them. Pick your timing wisely!

Market Making Bots: The Middlemen of Profit

What They Do

Market making bots play both sides, placing buy (bid) and sell (ask) orders around the current price. They profit from the bid-ask spread—the gap between what buyers pay and sellers get. Say Bitcoin’s at $60,000: the bot bids $59,990 and asks $60,010, earning $20 if both trades hit.

Liquidity Provision

By constantly offering trades, they keep the market flowing—exchanges love them for this! More liquidity means easier buying and selling for everyone.

Risk Management

Volatility’s the enemy here. If prices swing too fast, the bot might buy high and sell low by accident. Smart settings—like tight spreads and stop-losses—keep risks in check.

Grid Trading Bots: The Set-and-Forget Strategists

How They Work

Grid trading bots create a “grid” of buy and sell orders at set price levels. Imagine Bitcoin’s at $60,000: the bot places buy orders at $59,800, $59,600, etc., and sell orders at $60,200, $60,400, and so on. As prices bounce, it buys low and sells high automatically.

Optimal Conditions

They thrive in sideways markets—when prices wiggle up and down without a clear trend. In a raging bull or bear run, they might miss the big moves, so they’re best for chill, range-bound times.

Example Setup

Let’s say you’re trading Ethereum at $2,500. You set a grid with:

- Buy orders: $2,480, $2,460, $2,440.

- Sell orders: $2,520, $2,540, $2,560.

- Grid spacing: $20. If ETH bounces between $2,440 and $2,560, the bot keeps flipping for profit. Easy peasy!

Which Bot’s Your Match?

Arbitrage bots chase quick wins, trend-followers ride waves, market makers grind steady gains, and grid bots chill in the range. Each has its vibe—pick one that fits your style, market conditions, and goals. Ready to let these bots loose in the crypto jungle?

How Crypto Trading Bots Work: The Technical Framework

Ever wondered what’s under the hood of a crypto trading bot? These little digital wizards don’t just magically make money—they’re built on a technical framework that connects, analyzes, and executes trades like clockwork. Let’s break it down into three key pieces: API connections, signal generation, and execution mechanisms—plus some stats to keep it real.

API Connections: The Bot’s Lifeline

How Bots Connect to Exchanges

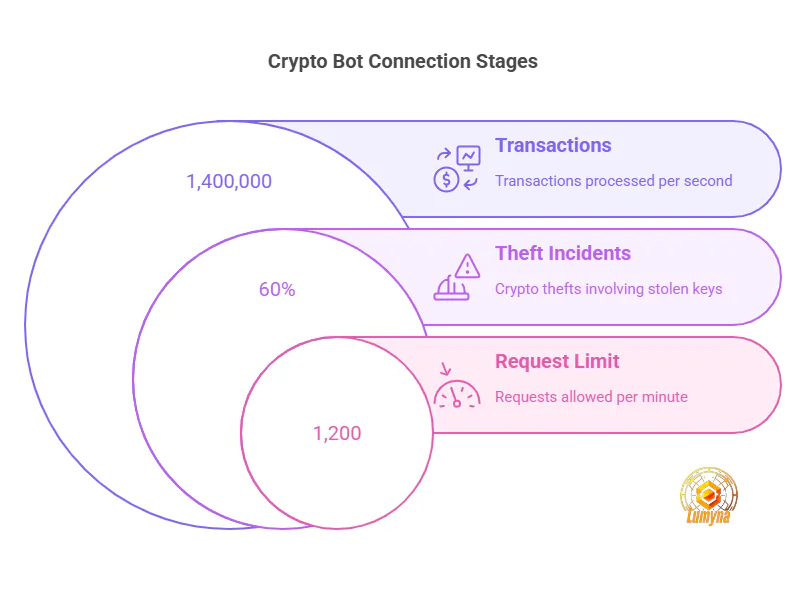

Crypto bots talk to exchanges (think Binance, Coinbase, or Kraken) through APIs—Application Programming Interfaces. These are like secure phone lines letting the bot check prices, place orders, and manage your account. In 2023, Binance alone processed over 1.4 million transactions per second during peak times, per their API usage reports—bots need that speed to keep up!

Security Considerations for API Keys

To connect, you give the bot an API key—a unique code tied to your exchange account. Security’s huge here: 60% of crypto thefts in 2022 (Chainalysis data) involved stolen keys. Never share your key publicly, use IP whitelisting, and avoid giving bots withdrawal permissions unless you want an empty wallet.

Rate Limiting and Constraints

Exchanges cap how often bots can ping them—called rate limiting. Binance, for example, allows 1,200 requests per minute for free accounts. Hit that limit, and your bot’s stuck twiddling its thumbs. Slow internet or laggy servers can also trip things up, so a solid setup’s a must.

Signal Generation: The Brain of the Bot

Technical Indicators and Implementation

Bots don’t guess—they analyze. They use indicators like Moving Averages (tracking price trends), RSI (spotting overbought/oversold conditions), or Bollinger Bands (measuring volatility). A 2021 study by CryptoCompare found 70% of pro traders rely on these classics, and bots code them in to crunch numbers fast.

How Bots Process Market Data

Bots process real-time data—price, volume, order book depth—from exchanges via APIs. They churn through thousands of data points per second, way beyond what your eyes could catch staring at a chart. It’s like having a supercomputer scanning the market 24/7.

Decision-Making Algorithms

Once the data’s in, algorithms decide: buy, sell, or hold? Simple bots might follow “if RSI > 70, sell” rules. Smarter ones use machine learning, adapting to patterns. The logic’s pre-set by you or the bot’s developer—your strategy’s the boss.

Execution Mechanisms: Making It Happen

Order Types Explained

Bots use different orders to trade:

- Market Orders: Buy/sell instantly at the current price—fast but pricey in volatile markets.

- Limit Orders: Set a specific price—cheaper but might not fill.

- Stop-Loss: Auto-sell if prices crash, capping losses. A 2022 Bitfinex report showed 45% of bot trades used limit orders for cost control.

Order Routing and Slippage Management

Orders zip to the exchange, but slippage—when prices shift mid-trade—can sting. In high-volatility moments (like a 10% BTC dip in May 2023), slippage hit 2-3% on average (CoinGecko data). Bots minimize this by splitting big trades or timing entries better than humans can.

Position Sizing and Risk Allocation

Bots don’t YOLO your cash. They calculate how much to trade based on your risk settings—say, 1% of your $10,000 portfolio per trade ($100). This keeps losses manageable, even if the market tanks. Smart bots balance risk across coins, avoiding all-in bets.

Tying It Together

Crypto bots work by plugging into exchanges with APIs, crunching market data into signals, and firing off trades with precision. They’re fast—handling millions of trades daily across platforms—and powerful, but they lean on solid tech and your strategy. Set them up right, and they’re your ticket to trading like a pro!

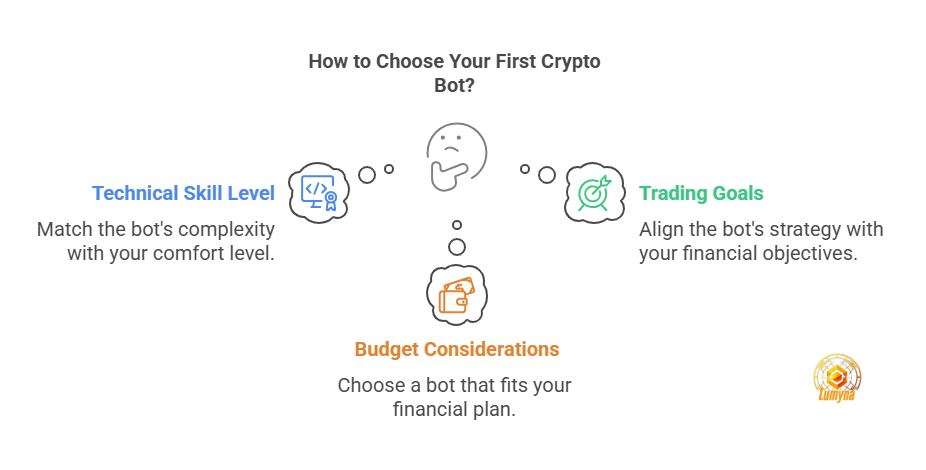

Getting Started: How to Choose Your First Crypto Bot

Ready to dive into crypto trading bots but not sure where to start?

Picking your first bot doesn’t have to feel like rocket science. It’s all about matching the bot to you—your skills, goals, and wallet.

Let’s walk through the big three: assessing your tech skills, figuring out your trading goals, and setting a budget. By the end, you’ll be ready to pick a bot that fits like a glove!

Assess Your Technical Skill Level

Coding Requirements vs. No-Code Solutions

First things first: how comfy are you with tech? Some bots, like those you build from scratch on Python, need coding chops—think APIs, loops, and debugging. If “code” sounds like a secret language, don’t sweat it! No-code options like Cryptohopper or 3Commas let you point, click, and trade with zero programming. They’re pre-built with drag-and-drop interfaces—perfect for beginners.

Learning Curve Considerations

Even no-code bots have a learning curve. You might spend a few hours (or days) figuring out settings, connecting exchanges, or tweaking strategies. Coding a bot? That could take weeks to master. Ask yourself: do you want plug-and-play ease or the power (and headache) of full control? A 2022 survey by CoinBureau found 65% of new bot users preferred no-code platforms to skip the tech overwhelm.

Determine Your Trading Goals

Short-Term vs. Long-Term Objectives

What’s your crypto dream? Quick profits from day trading or steady gains over months? Short-term goals pair well with bots like arbitrage or trend-followers—they thrive on fast moves. Long-term vibes? Grid bots or market makers can grind out returns in chill markets. Your bot should match your timeline, so decide if you’re sprinting or marathon-ing.

Risk Tolerance Assessment

How much risk can you stomach? If a 20% dip makes you panic, go for low-risk setups like arbitrage (small, steady wins) and set tight stop-losses. Love the thrill? Trend-following bots in wild bull markets might be your jam—just brace for bigger swings. Be honest—picking a bot that fits your comfort zone keeps you sane when crypto gets crazy.

Budget Considerations

Free vs. Paid Options

Bots range from free to “whoa, that’s steep.” Open-source gems like Gekko are free but need coding know-how and setup time. Paid platforms—like Bitsgap ($29/month) or HaasOnline ($100+/month)—offer slick interfaces and support. Free sounds tempting, but paid often means less hassle and more features.

Subscription Models vs. One-Time Purchases

Most bots run on subscriptions—$10 to $100 monthly—keeping costs spread out but ongoing. One-time buys, like Pionex’s built-in bots (free with exchange fees) or custom scripts ($50-$200), can save cash long-term. A 2023 CryptoBotReviews poll showed 55% of users preferred subscriptions for flexibility over one-time costs.

Hidden Costs to Watch

Don’t get blindsided! Trading fees (0.1%-0.5% per trade on exchanges) add up fast. Some bots need a VPS ($10-$20/month) to run 24/7, and premium features might cost extra. Factor these in—your $20/month bot could creep to $50 with the fine print.

Your First Bot Awaits!

Choosing your first crypto bot boils down to you: your tech skills (code or no-code?), your goals (fast cash or slow growth?), and your budget (freebie or splurge?). Start small—test a no-code, low-cost option like Pionex or Cryptohopper. Play around, see what clicks, and soon you’ll be bot-trading like a pro. Ready to roll?

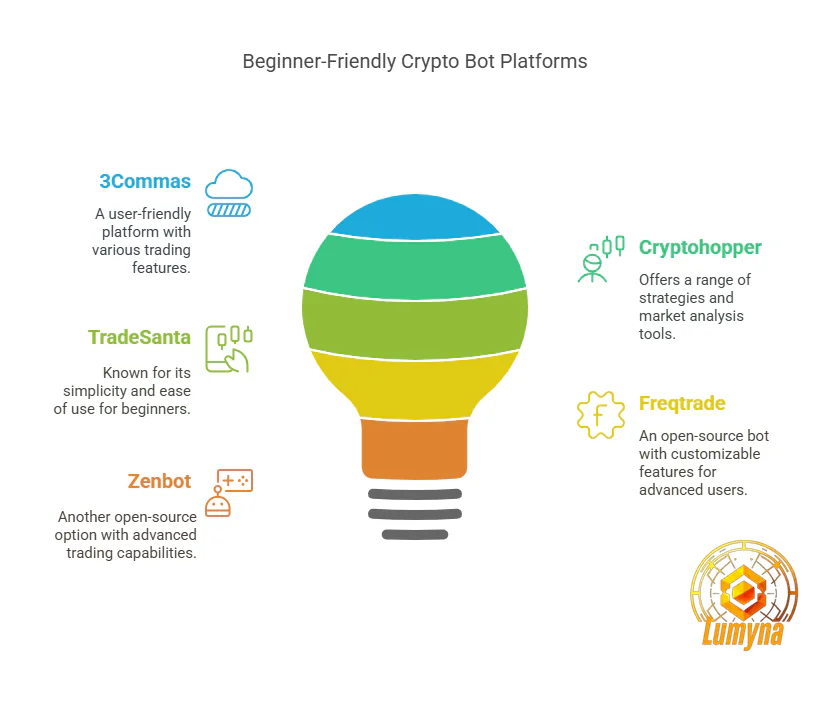

Popular Crypto Bot Platforms for Beginners

New to crypto trading bots and feeling overwhelmed? Don’t worry—there are platforms designed with beginners in mind that make automation a breeze.

Let’s explore four popular options: 3Commas, Cryptohopper, TradeSanta, and open-source picks like Freqtrade and Zenbot. Each has its own flavor, so let’s see which might be your perfect starter bot!

3Commas: The All-in-One Starter Kit

Features Overview

3Commas is like a Swiss Army knife for traders. It offers bots for Dollar-Cost Averaging (DCA), grid trading, and even signal-based trades—great for beginners who want options without overcomplicating things. You can also copy top traders’ moves with its SmartTrade terminal.

Pricing Structure

There’s a free tier with basic features, but for the good stuff—like unlimited bots—you’ll need a paid plan: Starter ($29/month), Advanced ($49/month), or Pro ($99/month). Annual billing slashes those prices by up to 50%, so it’s wallet-friendly if you commit.

User Interface Evaluation

The interface is clean and intuitive—think “grandma could use it” simple. Dashboards show your portfolio and bot performance clearly, though it might take an afternoon to master all the bells and whistles.

Suitable Trading Strategies

Perfect for DCA (spreading out buys to reduce risk) or grid trading (buying low, selling high in a range). It’s a solid pick if you’re dipping your toes into automation with a safety net.

Cryptohopper: The Beginner’s Playground

Features Overview

Cryptohopper’s got everything a newbie needs: paper trading (fake money practice), backtesting, and over 130 indicators to tweak your bot. It’s cloud-based, so it runs 24/7 without your laptop wheezing.

Marketplace for Strategies

The real gem? Its marketplace. You can buy pre-made strategies or signals from pro traders—ideal if you’re not ready to DIY. Some are free, others cost a few bucks, but it’s like renting a trading brain.

Ease of Use Assessment

Super user-friendly. Setup’s a snap with templates, and the dashboard feels like a game—colorful and clickable. Beginners can start with a “copy bot” and feel like pros in no time.

Integration Capabilities

Hooks up to 15+ exchanges (Binance, Coinbase, Kraken—you name it). It’s a plug-and-play dream for anyone with accounts scattered across platforms.

TradeSanta: The Simple Sidekick

Key Differentiators

TradeSanta keeps it lean with DCA and grid bots, plus long/short options for bull or bear markets. It’s cloud-based and boasts quick setup—less tech, more trading.

User Experience Highlights

The dashboard’s a breeze to navigate, with analytics right where you need them. It’s not flashy, but it’s functional—perfect for folks who want results without fuss.

Strategy Templates

Pre-built templates for DCA and grid strategies get you going fast. You can tweak them with indicators like RSI or MACD if you’re feeling adventurous.

Pricing Comparison

Free for 1-2 bots, then $25/month (Basic), $45/month (Advanced), or $90/month (Maximum). Cheaper than 3Commas or Cryptohopper for basic needs, especially with annual discounts.

Open-Source Options (Freqtrade, Zenbot): The Freebie Route

Pros and Cons of Free Solutions

Pros: Freqtrade and Zenbot are 100% free—no subscriptions, no catch. You get full control to customize, and they’re backed by active coder communities. Freqtrade’s Python-based with backtesting; Zenbot’s JavaScript-driven with tons of pre-loaded strategies.

Cons: Setup’s a slog—think installing software, tweaking code, and maybe a VPS ($10-$20/month) to run them. Not beginner-friendly unless you’re tech-savvy.

Community Support

Both shine here. Freqtrade’s Discord and GitHub are buzzing with helpful folks; Zenbot’s community offers forums and updates. You’re never totally alone, but you’ll need to dig for answers.

Customization Possibilities

Endless! Freqtrade lets you code strategies with Python and pandas—great for data nerds. Zenbot’s tweakable too, with a genetic algorithm backtester if you’re into next-level stuff. It’s DIY heaven if you’ve got the patience.

Which One’s for You?

For a feature-packed start, 3Commas balances power and simplicity. Cryptohopper’s marketplace and ease make it a beginner’s dream. TradeSanta’s affordable and straightforward—ideal for no-frills trading. Open-source like Freqtrade or Zenbot? Perfect if you’re broke or love tinkering, but expect a learning curve. Test a free trial (most offer one) and see what vibes with your style—your bot journey’s just beginning!

Case Study: My First Month Using a Crypto Bot

Recently, I had a chat with a friend who uses bots to trade crypto. In our talk, I discovered he’d made a classic newbie blunder: picking a bot that didn’t match his goals. He went for a flashy, complex one hyped online, thinking “more features = more money.” Spoiler: it didn’t quite work out that way. Here’s how his first month unfolded—and what he learned the hard way.

Initial Setup Experience

He dove in with this bot—fancy, but a beast to set up. Linking it to his exchange took an hour; he fumbled the API key and had to restart twice. “The instructions were like alien code,” he grumbled. It promised a million options, but he just wanted something simple. By the end, he was sweaty and confused—not the smooth start he’d hoped for.

Strategy Selection Process

He chose a trend-following strategy, lured by promises of big wins in wild markets. Bitcoin was at $60K, bouncing a bit, so he threw $200 at it, expecting the bot to ride some epic wave. Problem? He didn’t realize trend-followers need strong momentum—something his flat market lacked.

First Week Results: Expectation vs. Reality

He pictured 10% gains in a week—beginner optimism at its finest. Reality? The bot made three trades, lost $6, and sat idle most of the time. “It kept waiting for a trend that never came,” he sighed. Fees nibbled more, and he realized he’d picked a bot for bull runs, not the sideways slog he was in.

Adjustments Made After Learning

After a week of flops, he switched gears. He ditched the trend-chaser for a basic grid strategy—better for choppy prices. He cut the range to $100 swings, upped his stake to $300, and added a stop-loss. “Less sexy, more practical,” he said. It was like swapping a sports car for a reliable sedan.

One-Month Performance Metrics

By month’s end, he’d made 18 trades, netting $12 (4% ROI on $300). Not dazzling, but a win after that rough start. His best day was a $5 gain when BTC wiggled up 2%. “Could’ve been worse,” he shrugged—small losses early taught him fast.

Lessons Learned

His big takeaway? Match the bot to your market and skill level. “I grabbed the shiniest toy, not the right one,” he admitted. Simple beats complex for beginners, fees kill if you don’t watch them, and research trumps hype. Next time, he’s picking a bot that fits—not just one that sounds cool.

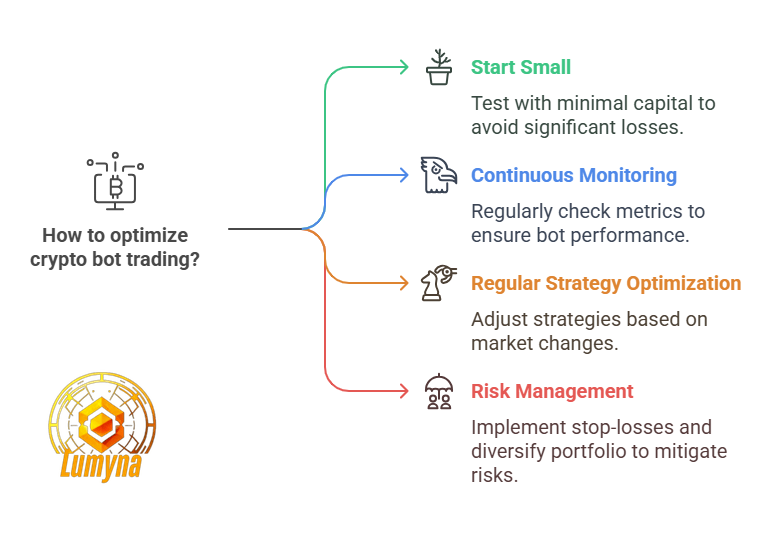

Best Practices for Crypto Bot Trading

Crypto trading bots can feel like magic money machines, but they’re not foolproof. To make them work for you—and not against you—follow these best practices. From starting small to managing risks, here’s how to trade smarter and keep your sanity in the wild crypto jungle.

Start Small

Testing with Minimal Capital

Don’t YOLO your life savings into a bot on day one. Start with a tiny chunk—like $50 or $100—to test the waters. My friend learned this the hard way, dropping $500 on a bot that tanked his first week. Small stakes let you learn without crying over spilled crypto.

Scaling Strategies Gradually

Once your bot’s humming, scale up slowly. Boost your capital by 10-20% after a solid month, not overnight. Gradual growth keeps you in control and cuts the panic if the market flips.

Continuous Monitoring

Why Bots Aren’t “Set and Forget”

Bots don’t babysit themselves. Markets shift, glitches happen, and strategies stale out. Leaving it unchecked is like letting a toddler cook dinner—messy and risky. Check in daily or weekly to keep it on track.

Key Metrics to Track

Watch these like a hawk: profit/loss (daily and weekly), trade frequency (is it too quiet?), and win/loss ratio (are you bleeding slow?). If your bot’s ROI dips below 1% weekly when you expected 5%, something’s off—time to dig in.

Regular Strategy Optimization

Backtesting Frequency

Run backtests monthly—or after big market swings—to see if your strategy still holds up. Use historical data (say, 3-6 months) to spot weaknesses. A bot that crushed it in a bull run might flop in a bear hug—test it to know.

Parameter Adjustment Methodology

Tweak with purpose, not panic. Adjust one thing at a time—like tightening a grid range from $200 to $100—and watch the results for a week. Random fiddling’s a recipe for chaos; methodical changes keep you winning.

Risk Management Essentials

Position Sizing Guidelines

Never bet the farm on one trade. Stick to 1-2% of your total funds per position—$20 max if you’ve got $1,000. It’s boring but keeps you alive when crypto goes nuts.

Stop-Loss Implementation

Set stop-losses religiously—say, 5% below entry—to cap losses. My buddy skipped this once and lost $50 in a flash crash. Automate it in your bot; it’s your safety net.

Portfolio Allocation Recommendations

Spread the love: 50% in stable coins (BTC, ETH), 30% in mid-tiers, 20% in wildcards. Don’t dump it all in one bot or coin—diversify to dodge total wipeouts.

Keep It Tight, Win Big

Start small, monitor like a pro, optimize smart, and manage risks—those are your golden rules. Bots are tools, not miracles. Stick to these practices, and you’ll turn rookie moves into steady gains. Ready to bot like a boss?

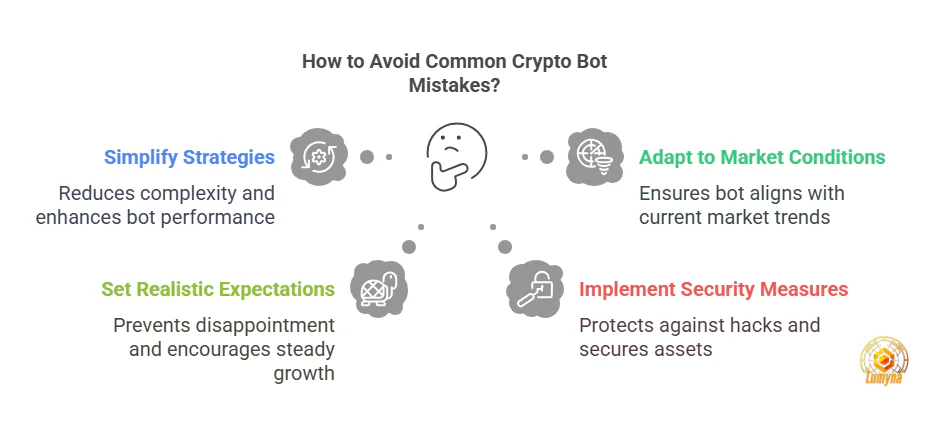

Common Mistakes Beginners Make With Crypto Bots

Crypto bots can be game-changers, but beginners often trip over the same pitfalls. From overcomplicating things to skimping on security, these mistakes can turn a promising start into a pricey lesson. Let’s unpack four big ones and how to dodge them—because nobody wants to learn the hard way!

Overcomplicating Strategies

The Danger of Parameter Overload

Newbies love cramming every bell and whistle into their bot—RSI, MACD, Bollinger Bands, you name it. But piling on parameters can backfire. Too many rules confuse the bot, leading to missed trades or losses. My friend once set 10 indicators and ended up with a bot that just… sat there, overthinking.

Simplicity vs. Complexity Trade-Offs

Simple strategies—like a basic grid or trend-follower—often beat complex ones for beginners. They’re easier to tweak and less likely to choke in real-time. Start with one or two settings; you can flex your guru muscles later.

Ignoring Market Conditions

How Different Market Phases Affect Bot Performance

Bots aren’t one-size-fits-all. A trend-follower rocks in a bull market but flops when prices go sideways. Grid bots shine in choppy waters but stall in a straight climb. Ignoring this? You’re begging for a bot that trades against the tide.

Adapting Strategies to Changing Conditions

Check the market vibe—bullish, bearish, or flat—and adjust. Bitcoin’s $60K stall last month killed my buddy’s trend bot until he switched to a grid. Stay flexible; a static bot in a shifting market is a recipe for red.

Unrealistic Profit Expectations

Typical Bot Performance Benchmarks

Dreaming of 50% monthly gains? Pump the brakes. Most bots average 5-15% ROI monthly in good conditions, per 2023 CryptoBotReviews data. Wild spikes happen, but steady wins are the norm—not moonshots.

Managing Expectations Responsibly

Set realistic goals—think 1-2% weekly to start. Bots aren’t ATMs; they’re tools. Overhyped expectations lead to rash moves, like dumping more cash when you’re down. Slow and steady keeps you in the game.

Neglecting Security Practices

API Key Management Pitfalls

Your API key’s a golden ticket—lose it, and hackers cash out. Beginners often screenshot keys or leave them in plain text. One guy I know lost $1,000 because he emailed his key to himself. Store it offline, encrypted, always

Two-Factor Authentication Importance

Skipping 2FA on your exchange or bot account? Big no-no. It’s an extra lock on your crypto door—90% of 2022 breaches (Chainalysis) hit unprotected accounts. Turn it on, or regret it later.

Keep It Simple, Stay Sharp

Overcomplicating, ignoring markets, chasing unicorns, or lax security—these rookie slip-ups sting. Stick to basics, match your bot to the moment, aim modest, and lock it down. Skip these traps, and you’ll bot-trade like a pro in no time!

Advanced Strategies: Where to Go Next

You’ve nailed the basics of crypto bot trading—now what? Time to level up with advanced strategies that turn your bots into a profit-chasing squad. From running multiple bots to dabbling in AI, here’s where to take your game when you’re ready to go big.

Multi-Bot Implementations

Diversifying Across Strategy Types

Why stick to one bot when you can run a team? Mix it up—pair a grid bot for steady gains with a trend-follower for big swings and an arbitrage bot for quick flips. Each thrives in different markets, so you’re covered no matter what crypto throws at you.

Resource Allocation Considerations

Don’t stretch yourself thin. Split your capital smartly—say, 40% in a grid bot, 30% in a trend-follower, and 30% in arbitrage. Keep some cash on the sidelines for tweaks, and monitor CPU or VPS usage if you’re hosting them yourself. Balance is key to avoid bot overload.

Custom Indicator Development

Creating Proprietary Signals

Off-the-shelf indicators like RSI are cool, but custom ones? Next-level. Build your own—like a “volatility spike” signal that triggers trades when prices jump 5% in an hour. It’s your secret sauce, tailored to your style.

Coding Resources for Strategy Development

No PhD needed—Python’s your friend here. Libraries like TA-Lib (technical analysis) or Pandas (data crunching) make it doable. Check GitHub for open-source bot codebases or hit up Udemy for a $15 Python-for-trading course. Start small, test big.

Machine Learning Integration

How AI Enhances Trading Bots

AI takes bots from rule-followers to market predictors. Machine learning (ML) can spot patterns—like a coin’s pre-pump behavior—that humans miss. A 2022 study by CryptoQuant showed ML-driven bots beat basic ones by 20% in volatile markets. It’s like giving your bot a brain upgrade

Accessible ML Tools for Traders

You don’t need to be a tech wizard. Tools like TensorFlow (free, open-source) or H2O.ai let you train models with minimal coding. Platforms like TradeRiser even bake ML into their bots for a fee. Dip your toes in—it’s less scary than it sounds.

Portfolio Rebalancing Strategies

Automating Portfolio Maintenance

Tired of manually juggling BTC, ETH, and altcoins? Automate it. Set a bot to rebalance your portfolio monthly—say, 50% BTC, 30% ETH, 20% alts—selling winners and buying dips. It keeps your mix on point without the hassle.

Risk-Based Allocation Systems

Go smarter with risk-based rebalancing. Allocate more to low-volatility coins (BTC) when markets crash, less to wildcards (memecoins) when they’re pumping. Code it to adjust based on a 30-day volatility index—steady gains, fewer heart attacks.

Your Advanced Adventure Awaits

Multi-bot squads, custom signals, AI brains, and auto-rebalancing—these are your tickets to pro-level trading. Start with one, experiment, and scale as you learn. The crypto world’s yours to conquer—time to unleash the big guns!

The Future of Crypto Bot Trading

Emerging Technologies

The next frontier for crypto trading bots lies in advanced artificial intelligence and deep learning applications. While current bots primarily rely on predetermined technical indicators and rule-based strategies, next-generation systems are increasingly incorporating neural networks capable of identifying complex patterns human traders might miss. These AI-powered bots can analyze vast datasets spanning multiple timeframes, sentiment analysis from social media, on-chain metrics, and traditional market correlations simultaneously. Companies like Fetch.ai and SingularityNET are pioneering autonomous agents that not only execute trades but continuously evolve their strategies based on market feedback without human intervention.

Quantum computing represents another technological horizon with transformative potential for crypto trading. As quantum systems become more accessible, they could revolutionize the speed and complexity of market analysis. Traditional encryption might be vulnerable to quantum attacks, but quantum-resistant blockchain protocols are already under development. Trading algorithms leveraging quantum computing could potentially analyze every possible market scenario in microseconds, creating both unprecedented opportunities and challenges for market equilibrium.

Regulatory Considerations

The current regulatory landscape for crypto trading bots exists in a gray area. While algorithmic trading itself isn’t illegal, regulators worldwide are increasingly scrutinizing market manipulation tactics like “wash trading” and “spoofing” that can be automated through bots. The European Union’s MiCA (Markets in Crypto-Assets) regulation and evolving SEC guidelines in the United States suggest a future where bot operators may need to register their algorithms and provide transparency into their trading strategies.

Forward-thinking bot developers are already building compliance features into their platforms, including audit trails, trade reporting mechanisms, and geofencing capabilities to restrict operations in certain jurisdictions. Preparing for future compliance may soon involve KYC verification for bot deployment and algorithm certification processes that verify bots don’t engage in market manipulation.

Democratization of Trading Technology

Perhaps the most significant trend is the democratization of sophisticated trading technology. What once required a team of quantitative analysts and developers can now be deployed by retail investors with minimal technical knowledge. No-code platforms with intuitive drag-and-drop interfaces allow users to create complex trading strategies through visual programming. Subscription services offering strategy marketplaces have created entire ecosystems where successful algorithms can be rented or purchased.

This accessibility revolution extends to education as well. Interactive simulations, paper trading environments, and community-driven learning resources have dramatically shortened the learning curve. As natural language processing advances, we’re beginning to see bots that can be programmed through conversational interfaces—simply describing your trading strategy in plain English may soon be enough to deploy a sophisticated automated system tailored to your risk tolerance and investment goals.

Conclusion

Crypto trading bots represent a powerful evolution in how investors interact with digital asset markets. Throughout this guide, we’ve explored how these automated systems can eliminate emotional decision-making, enable 24/7 market participation, and execute complex strategies with precision that would be impossible to maintain manually. From simple arbitrage bots capturing price differences between exchanges to sophisticated AI-powered systems adapting to changing market conditions, automated trading tools continue to transform the cryptocurrency landscape.

For beginners entering this space, a measured approach is essential. Start with thoroughly understanding a single, simple strategy before implementing it with minimal capital. Use paper trading features to test your configurations without financial risk, and resist the temptation to over-optimize or frequently change strategies based on short-term results. Remember that no bot can guarantee profits, especially in volatile markets, and the most successful automated traders combine technological tools with fundamental market knowledge.

As you embark on your automated trading journey, commit to continuous learning and responsible risk management. Set realistic expectations about potential returns, never invest more than you can afford to lose, and develop a clear understanding of how market conditions affect your chosen strategies. The most valuable aspect of trading bots isn’t the possibility of passive income but rather the discipline, consistency, and emotional detachment they can bring to your overall trading approach.

By embracing automated trading as one component of a well-rounded investment strategy—rather than a magical solution—you’ll be positioned to leverage this technology responsibly while continuing to grow as a more sophisticated digital asset investor.

Related Questions (FAQ Section)

- Are crypto trading bots legal? Yes, crypto trading bots are legal in most jurisdictions. However, how you use them matters. Market manipulation tactics like wash trading or spoofing remain illegal regardless of whether they’re executed manually or via bots. Always check your local regulations as some countries have specific restrictions on algorithmic trading.

- How much money do I need to start using a trading bot? You can start with as little as $100 on many platforms, though $500-1,000 is recommended to overcome transaction fees and generate meaningful data. Some sophisticated strategies may require higher minimum balances ($5,000+) to be effective, especially for grid trading or market making.

- Can I run a crypto bot on my phone? Yes, many modern trading bot platforms offer mobile apps or responsive web interfaces. While setup is often easier on desktop, monitoring and adjustments can be handled through your smartphone. Some platforms like 3Commas and Cryptohopper have fully-featured mobile experiences.

- Do I need to know programming to use trading bots? Not necessarily. Many platforms offer visual strategy builders and pre-built templates requiring zero coding knowledge. However, learning basic programming (Python) can significantly expand your capabilities if you want to create custom strategies or indicators.

- What’s the average ROI for crypto bot trading? ROI varies dramatically based on strategy, market conditions, and risk management. Conservative bot strategies typically aim for 1-3% monthly returns, while more aggressive approaches might target 5-15% monthly but with substantially higher risk of losses. Be wary of services promising consistent double-digit monthly returns.

- How do crypto bots handle market crashes? Most bots perform poorly during sudden crashes unless specifically programmed with robust risk management protocols. Stop-loss mechanisms, trend-reversal detection, and volatility-based position sizing can help mitigate damage, but no bot is crash-proof. Some traders switch to bear market strategies or temporarily pause bots during extreme volatility.

- Are free crypto bots worth using? Free bots can be valuable learning tools but often have limitations in features, exchange connections, or strategy options. Open-source options like Freqtrade offer full functionality but require technical knowledge to set up. For beginners, free trial periods of premium services often provide better value than permanently free options.

- How much time per day should I spend monitoring my bot? Even “set and forget” strategies require at least 15-30 minutes of daily monitoring to check performance and market conditions. More active strategies might need 1-2 hours for adjustments and optimization. The time investment typically decreases as you gain experience and confidence in your setup.