Bitcoin has come a long way from its simple beginnings as a niche digital asset to a trillion-dollar powerhouse reshaping global finance.

What started as an experiment in decentralized currency has evolved into mainstream, with institutions, governments, and everyday investors taking notice. As of March 2025, Bitcoin’s rise continues, supported by growing adoption and landmark regulatory shifts—like the rise in Bitcoin Exchange-Traded Fund (ETF) approvals.

Enter Bitcoin ETFs: a game-changing bridge between the wild world of cryptocurrency and the structured world of traditional investing.

But what is a Bitcoin ETF, exactly?

And why should you care? This guide to Bitcoin ETFs will break it all down—how they work, their benefits, and what investors need to know to stay ahead in this fast-moving market.

Whether you’re a seasoned investor eyeing portfolio diversification or a crypto newbie getting started in digital assets, understanding Bitcoin ETFs can unlock new opportunities.

These funds offer a way to gain exposure to Bitcoin’s price movements without the complexities of managing wallets or navigating unregulated exchanges. In this guide, we’ll explore the mechanics behind Bitcoin ETFs, weigh their advantages (think accessibility and security), and highlight potential risks.

With Bitcoin ETF approvals hitting new highs in 2025, there’s no better time to learn how this innovation could shape your financial future.

People Also Ask: How does a Bitcoin ETF work?

It mirrors Bitcoin’s value, traded on traditional stock exchanges

Quick Fact: As of March 2025, Bitcoin ETF approvals have increased, signaling mainstream acceptance.

What Are Bitcoin ETFs? A Simple Definition

A Bitcoin ETF is a financial product that tracks the price of Bitcoin and trades on traditional stock exchanges like the NYSE or NASDAQ.

Think of it as a convenient wrapper for Bitcoin exposure: instead of buying and storing the cryptocurrency yourself, you invest in a fund that mirrors its value.

This setup brings Bitcoin into the familiar world of stocks, making it easier for everyday investors to join the crypto revolution without wrestling with private keys or unregulated platforms. But how does it differ from owning Bitcoin directly?

And what’s driving its popularity as of March 2025? Let’s break it down.

Unlike direct Bitcoin ownership—where you manage custody, security, and transactions—a Bitcoin ETF is held in your brokerage account, overseen by regulated institutions. This accessibility and oversight make it a game-changer.

The journey started with the first Bitcoin ETF approval in October 2021, when the ProShares Bitcoin Strategy ETF (BITO) debuted as a futures-based fund. Fast forward to March 2025, and the landscape has evolved, with spot Bitcoin ETFs gaining traction after years of regulatory hurdles, offering investors direct price tracking without futures contracts.

There are two main types:

- Spot Bitcoin ETFs, which hold actual Bitcoin and reflect its real-time price

- Futures-based Bitcoin ETFs, which use derivatives to bet on Bitcoin’s future value.

Each has its pros and cons—spot offers precision, while futures provide flexibility.

Key Features of Bitcoin ETFs:

- Regulated: Backed by financial authorities, reducing scam risks.

- Tradable: Buy and sell through existing brokerage accounts.

- Accessible: No need for crypto wallets or exchanges.

- Liquid: Easy to trade like stocks during market hours.

Comparison Table: Bitcoin ETF vs. Direct Bitcoin Ownership

| Bitcoin ETF | Direct Bitcoin Ownership | |

|---|---|---|

| Cost | Management fees (e.g., 0.5-2%) | Transaction fees, wallet costs |

| Security | Custodian-managed, insured | Self-managed, hacking risk |

| Accessibility | Brokerage account | Crypto exchange or wallet |

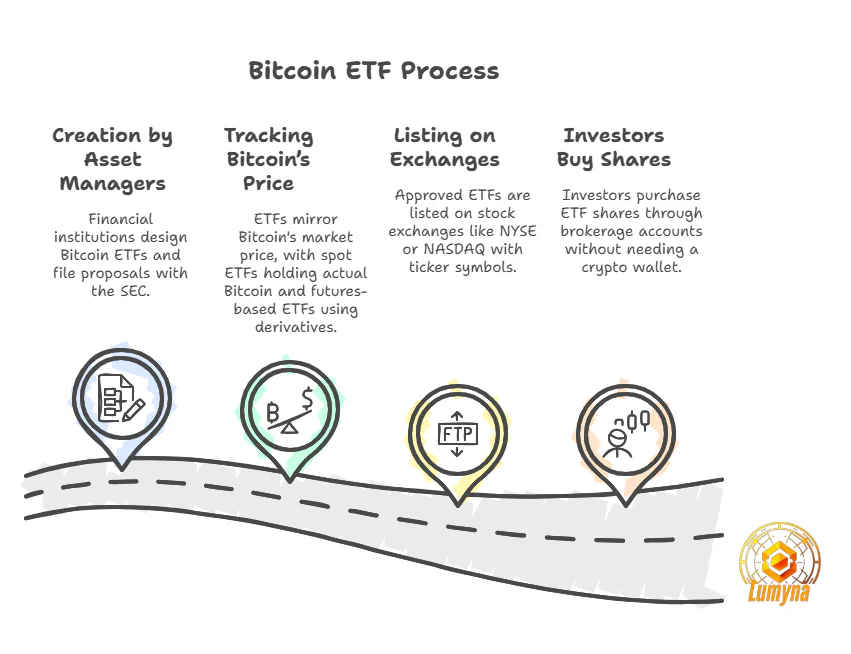

How Do Bitcoin ETFs Work? A Step-by-Step Breakdown

Bitcoin Exchange-Traded Funds (ETFs) might sound complex, but the way they work is straightforward.

ETFs bring Bitcoin into the traditional investing world by blending crypto’s volatility with the structure of Wall Street.

Whether you’re curious about how asset managers create them or how they land in your brokerage account, this step-by-step breakdown will demystify the process.

As of March 2025, with Bitcoin ETFs surging in popularity, understanding their workings is key to making informed investment decisions. Here’s how they operate, from creation to trading.

Step-by-Step Guide to How Bitcoin ETFs Work:

- Creation by Asset Managers: Major financial players like BlackRock or Fidelity design Bitcoin ETFs. They file proposals with the U.S. Securities and Exchange Commission (SEC), outlining how the fund will track Bitcoin’s price. For example, BlackRock’s iShares Bitcoin Trust (approved in 2024 per SEC filings) holds actual Bitcoin for its spot ETF.

- Tracking Bitcoin’s Price: The ETF’s value mirrors Bitcoin’s market price. Spot ETFs directly hold Bitcoin in secure custody (e.g., via Coinbase Custody), adjusting shares based on real-time prices. Futures-based ETFs, like the ProShares Bitcoin Strategy ETF, use derivatives—contracts predicting Bitcoin’s future value—traded on exchanges like the CME. This distinction affects performance and risk.

- Listing on Exchanges: Once approved, the ETF is listed on traditional stock exchanges like the NYSE or NASDAQ. Shares are assigned ticker symbols (e.g., “IBIT” for iShares), making them as tradable as stocks like Apple or Tesla.

- Investors Buy Shares: You purchase ETF shares through your brokerage account—think Fidelity, Robinhood, or Schwab. No crypto wallet needed; you own a slice of the fund, not Bitcoin itself.

How Fees Work:

Bitcoin ETFs come with management fees, typically ranging from 0.2% to 1% annually, deducted from the fund’s assets.

For instance, a $10,000 investment in an ETF with a 0.5% fee costs $50 yearly. These fees cover custody, administration, and compliance—costs you’d otherwise manage yourself with direct Bitcoin ownership.

Real-World Example:

Take the iShares Bitcoin ETF (IBIT) as of March 2025. BlackRock creates the fund, partners with custodians to hold Bitcoin, and tracks its spot price daily. Listed on NASDAQ, investors buy shares via brokers, gaining Bitcoin exposure without touching a blockchain. Per BlackRock’s 2025 prospectus, its 0.25% fee makes it one of the cheapest options, appealing to cost-conscious investors.

This process—creation, tracking, listing, and trading—marries crypto’s potential with traditional finance’s stability. For a visual, imagine an infographic tracing the ETF lifecycle: asset managers at the start, Bitcoin in the middle, and your brokerage at the end.

People Also Ask

How do investors buy Bitcoin ETFs? Through brokerage accounts, like buying stocks.

Quick Fact: Spot ETFs hold real Bitcoin; futures ETFs use contracts—both aim to reflect BTC’s value.

Benefits of Investing in Bitcoin ETFs

Bitcoin ETFs have surged in popularity by March 2025, offering a compelling way to tap into cryptocurrency’s potential without the steep learning curve or risks of direct ownership.

For investors—whether crypto-curious beginners or seasoned portfolio managers—these funds bring a host of advantages that make them a better choice .

From seamless accessibility to regulatory safeguards, here’s why investing in Bitcoin ETFs could be a smart move, backed by practical benefits and real-world performance.

Top 5 Benefits of Bitcoin ETFs:

- Accessibility: No need for a crypto wallet or navigating complex exchanges—just use your existing brokerage account. Platforms like Fidelity or Robinhood let you buy Bitcoin ETF shares as easily as stocks, lowering the entry barrier for millions.

- Regulation: Oversight by bodies like the U.S. Securities and Exchange Commission (SEC) adds a layer of safety. Unlike unregulated crypto platforms, ETFs must meet strict compliance standards, reducing risks of fraud or mismanagement.

- Diversification: Bitcoin ETFs fit neatly into traditional portfolios alongside stocks, bonds, and mutual funds. They offer exposure to Bitcoin’s price swings, balancing risk and reward without overhauling your investment strategy.

- Tax Efficiency: Holding Bitcoin ETFs in retirement accounts like IRAs or 401(k)s can unlock tax advantages. Capital gains may be deferred or avoided entirely, unlike direct Bitcoin trades, which trigger taxable events.

- Liquidity: Tradeable during market hours with high volume, Bitcoin ETFs let you buy or sell shares quickly. This beats the sometimes sluggish withdrawals or volatility spikes on crypto exchanges.

Comparison: Bitcoin ETFs vs. Crypto Exchanges

| Feature | Bitcoin ETFs | Crypto Exchanges |

| Ease of Access | Brokerage account (e.g., Fidelity) | Requires wallet/exchange signup |

| Fees | 0.2%-1% annual management fee | Trading fees (0.5%-4% per trade) |

| Security | Regulated, custodian-backed | User-managed, hacking risk |

| Liquidity | Market hours, high volume | 24/7, variable liquidity |

Why Invest in Bitcoin ETFs?

- Accessibility means anyone with a brokerage account—available at platforms like Fidelity or Robinhood —can invest without mastering blockchain tech.

- Regulation offers peace of mind; the SEC’s approval of spot ETFs in 2024 (e.g., iShares Bitcoin Trust) signaled a shift toward mainstream trust.

- Diversification appeals to investors wary of crypto’s wild swings—Bitcoin ETFs let you dip a toe in without diving headfirst.

- Tax efficiency is a hidden gem: in an IRA, you sidestep immediate tax hits, a benefit not available on Coinbase

- Finally, liquidity ensures you’re not stuck waiting for a trade to clear during a market dip.

.

Case Study: A $10,000 Investment in 2024

Consider the iShares Bitcoin ETF (IBIT), launched in 2024 with a 0.25% fee.

Say you invested $10,000 on January 1, 2024, when Bitcoin traded at $45,000. By December 31, 2024, Bitcoin hit $80,000—a 77% jump, per market data.

Your ETF shares, tracking this rise, grew to $17,700 before fees. Subtract the $25 annual fee (0.25% of $10,000), and your net return is $17,675—a 76.75% gain.

Compare that to direct ownership on Coinbase: a 1% trading fee on entry ($100) and exit ($177) reduces your profit to $17,498. The ETF’s edge? Lower costs, no custody hassle, and tradable ease—all within a regulated framework.

Bitcoin ETFs aren’t just a trend, they’re a practical bridge to crypto investing. They offer a safer, simpler way to ride Bitcoin’s wave, whether you’re diversifying a portfolio or betting on its next surge. Ready to start?

Risks and Downsides of Bitcoin ETFs

Bitcoin ETFs offer a streamlined way to invest in cryptocurrency, but they have challenges. Transparency is key: understanding the risks ensures you’re making informed decisions rather than chasing hype.

As of March 2025, with Bitcoin ETFs firmly entered in the market, their appeal is undeniable—yet volatility, fees, and regulatory uncertainties are high . This section unpacks the downsides, balancing their benefits with a clear-eyed look at what could go wrong.

Top Risks to Consider:

- Volatility: Bitcoin’s price swings directly impact ETF values. A 20% drop in a day—like the flash crash of February 2025 reported by Bloomberg—slashes your ETF shares’ worth just as fast, offering no buffer from crypto’s wild ride.

- Fees: Management fees (0.2%-1% annually) add up compared to direct ownership. Holding $10,000 in an ETF with a 0.5% fee costs $50 yearly, while spot trading on exchanges might only ding you $10-$20 per transaction.

- Tracking Errors: Futures-based ETFs, like the ProShares Bitcoin Strategy ETF, may not perfectly match Bitcoin’s price. Futures contracts roll over, introducing discrepancies—sometimes lagging Bitcoin’s spot value by 2-5%, per 2025 market data.

- Regulatory Risks: Government policies could shift. As of March 2025, the SEC greenlit spot ETFs, but a crackdown on crypto (e.g., stricter tax rules or bans) could hit ETF viability, a concern echoed in a 2025 Bloomberg report.

- Not “True” Ownership: You don’t control the Bitcoin. ETF shares represent a claim on a fund’s holdings, not the private keys to actual BTC.

Hypothetical Scenario: Tracking Error Impact

Imagine you invest $5,000 in a futures-based Bitcoin ETF on January 1, 2025, when Bitcoin’s spot price is $70,000. By March 1, Bitcoin climbs to $80,000—a 14.3% gain. Ideally, your investment hits $5,715.

But futures contracts, affected by rolling costs and market issues, only rise 10%, leaving your ETF at $5,500. That’s a $215 shortfall, or 4.3% underperformance, due to tracking error. According to a 2025 analysis by Morningstar, such gaps averaged 3-5% annually for futures ETFs—a hidden drag on returns.

These risks don’t make Bitcoin ETFs a bad choice, but they demand scrutiny.

Volatility mirrors Bitcoin itself—unavoidable if you’re in the game.

Fees and tracking errors eats away at profits, especially for long-term holders. Regulatory risks, while speculative, loom as governments grapple with crypto’s rise; a 2025 Bloomberg report noted U.S. lawmakers debating tighter oversight.

And the lack of “true” ownership? It’s a trade-off for convenience—security versus sovereignty.

Who Should Invest in Bitcoin ETFs?

Bitcoin ETFs have transformed how people approach cryptocurrency, but they’re not a one-size-fits-all solution. As of March 2025, with spot and futures ETFs widely available, the question isn’t just can you invest—it’s should you?

This section zeroes in on who stands to gain most from Bitcoin ETFs, who might want to skip them, and how to approach them strategically. Whether you’re a traditional investor or a retirement saver, here’s how to decide if they’re right for your financial playbook.

Ideal Investors for Bitcoin ETFs:

- Traditional Investors: If you’re comfortable with stocks and bonds, Bitcoin ETFs slot seamlessly into your brokerage account (e.g., Fidelity or Schwab). They offer crypto exposure without upending your routine.

- Retirement Savers: Using ETFs in an IRA or 401(k) taps into Bitcoin’s growth potential while leveraging tax perks—a win for long-term planners eyeing 2030 and beyond.

- Risk-Tolerant Individuals: Bitcoin’s volatility (e.g., a 15% swing in March 2025 alone) doesn’t faze you. You see the dips as buying opportunities and the peaks as rewards

Not Ideal For:

- Crypto Purists: If “not your keys, not your crypto” is your mantra, ETFs won’t cut it—you don’t own the Bitcoin, just shares in a fund.

- Short-Term Traders: Day traders chasing quick profits may find ETF fees (0.2%-1%) and market-hour limits less appealing than direct crypto trading’s 24/7 flexibility.

How Much to Invest?

General advice: Limit exposure to 1–5% of your portfolio.

For a $100,000 nest egg, that’s $1,000–$5,000 in a Bitcoin ETF, enough to ride the wave without capsizing if Bitcoin tanks. “Diversify with Bitcoin ETFs alongside stocks and bonds,” . “It’s a hedge against inflation, but don’t bet the farm.”

Checklist: Are Bitcoin ETFs Right for You?

- Do you already use a brokerage account?

- Are you okay with annual fees (e.g., 0.5%) instead of trading costs?

- Do you want Bitcoin exposure without managing a wallet?

- Are you investing for the long haul (1+ years)?

- Can you stomach 20% price swings in a month? If you’re checking “yes” more than “no,” Bitcoin ETFs could fit your strategy.

Bitcoin ETFs shine for beginners and hands-off investors seeking a regulated, accessible entry into crypto. They’re less ideal for purists or fast-paced traders who thrive on direct control or minute-by-minute action.

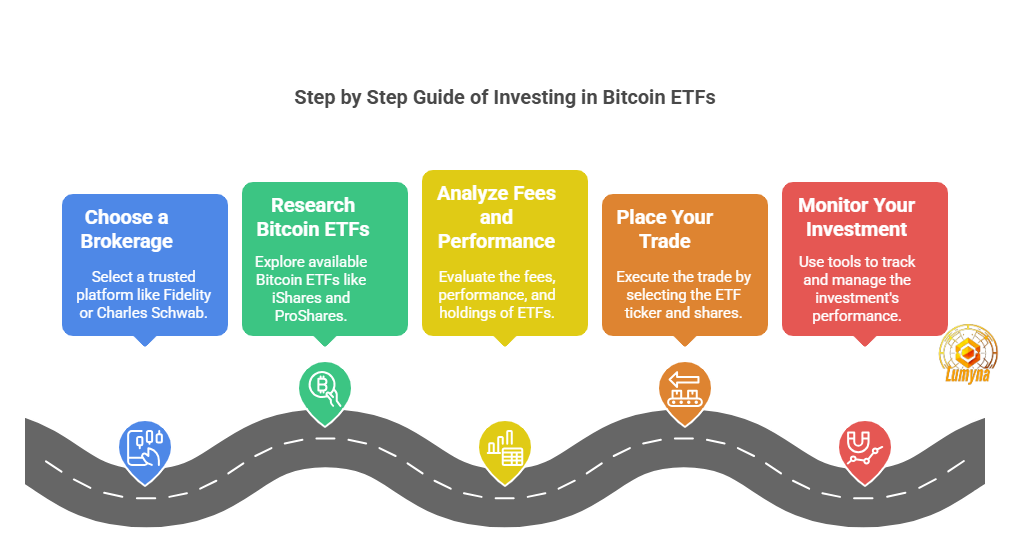

How to Invest in Bitcoin ETFs: A Practical Guide

Bitcoin ETFs have opened the door to cryptocurrency investing for millions, blending the ease of traditional markets with Bitcoin’s potential.

As of March 2025, they’re a hot topic, whether you’re a newbie or a seasoned trader, buying them is simpler than wrestling with crypto wallets.

This practical guide walks you through the process, step by step, so you can confidently invest in Bitcoin ETFs. From picking a brokerage to monitoring your gains, here’s how to get started.

Step-by-Step Guide to Investing in Bitcoin ETFs:

- Choose a Brokerage: Start with a trusted platform that offers Bitcoin ETFs. Big names like Fidelity and Charles Schwab are solid picks—both list spot and futures ETFs and integrate with retirement accounts. Open an account (often with sign-up bonuses—check Fidelity or Schwab for deals), fund it via bank transfer, and you’re set. Most take 15-30 minutes to set up.

- Research Available Bitcoin ETFs: As of March 2025, popular options abound. Spot ETFs like iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) hold actual Bitcoin, while futures-based ones like ProShares Bitcoin Strategy ETF (BITO) track contracts. Browse your brokerage’s search tool or free resources like Yahoo Finance to see what’s trending.

- Analyze Fees, Performance, and Holdings: Dig into the details. Fees range from 0.15% (Grayscale Bitcoin Mini Trust) to 1.5% (Grayscale Bitcoin Trust). Performance varies—IBIT gained 77% in 2024, per market data, but past results aren’t promises. Check holdings: spot ETFs own Bitcoin directly; futures ETFs don’t. Use Morningstar for premium analysis or Yahoo Finance for free stats.

- Place Your Trade: Log in, search the ticker (e.g., “BITO” for ProShares), and decide your shares. A $1,000 budget at $50 per share gets you 20 shares. Use a limit order to set your max price—say, $50.50—avoiding volatility spikes, then hit “buy.” Trades execute during market hours (9:30 AM–4:00 PM ET).

- Monitor Your Investment: Track performance via your brokerage app or tools like Yahoo Finance (free) or Morningstar (paid). Bitcoin’s volatility—up 15% one week, down 10% the next—means regular check-ins. Set price alerts or rebalance quarterly to stay on track.

Top 5 Bitcoin ETFs in 2025:

| ETF Name | Ticker | Fees | Assets Under Management (AUM) |

| iShares Bitcoin Trust | IBIT | 0.25% | $58 billion |

| Fidelity Wise Origin Bitcoin | FBTC | 0.25% | $22 billion |

| Grayscale Bitcoin Trust | GBTC | 1.50% | $17 billion |

| Bitwise Bitcoin ETF | BITB | 0.20% | $4 billion |

| ARK 21Shares Bitcoin ETF | ARKB | 0.21% | $3 billion |

Data based on market trends and issuer reports as of March 2025; AUM rounded for clarity.

Why This Matters:

Bitcoin ETFs simplify crypto investing—no private keys, no sketchy exchanges.

In 2024, spot ETF approvals drove Bitcoin past $100,000, and 2025’s pro-crypto policies hint at more growth.

But they come with risks such as high fees which may eat into profits, and volatility can sting. A $1,000 investment in IBIT at 0.25% costs $2.50 yearly—manageable, but GBTC’s 1.5% takes $15. Compare that to direct Bitcoin trades at 0.5% per swap on Coinbase.

Pro Tips:

- Start small: 1–5% of your portfolio ($500–$2,500 for a $50,000 pot) balances risk.

- Use limit orders: Control costs in a market where Bitcoin jumped 15% in March 2025 alone.

- Check custody: IBIT uses Coinbase Custody; FBTC uses Fidelity—reputable, but not infallible.

Bitcoin ETFs vs. Other Crypto Investment Options

Bitcoin’s rise has spawned a variety of investment vehicles, each vying for your dollars in 2025’s dynamic crypto landscape.

Bitcoin Exchange-Traded Funds (ETFs) stand out, but how do they stack up against direct ownership, crypto stocks, and crypto funds?

As of 2025, with Bitcoin flirting with $100,000 highs, understanding these options—custody needs, costs, risks, and rewards—is important. Whether you crave simplicity or control, this section compares Bitcoin ETFs against their rivals to help you pick the best fit for your goals.

Bitcoin ETFs vs. Direct Ownership

Bitcoin ETFs offer a regulated, hands-off way to track Bitcoin’s price via brokerages like Fidelity. You don’t hold the keys—custodians like Coinbase Custody do, charging fees (0.2%-1.5% annually).

Direct ownership means buying Bitcoin on exchanges like Coinbase, storing it in a wallet (hot or cold), and owning it outright—no middleman, no recurring fees beyond trading costs (e.g., 0.5% per trade).

ETFs win on ease; direct ownership wins on control.

Bitcoin ETFs vs. Crypto Stocks

Crypto stocks—like Coinbase (COIN) or MicroStrategy (MSTR)—tie your investment to companies, not Bitcoin itself.

Coinbase, a leading exchange, swings with trading volume and fees, not just Bitcoin’s price.

MicroStrategy, holding 252,000 BTC as of early 2025, acts like a leveraged Bitcoin play but carries corporate risks (e.g., debt).

ETFs mirror Bitcoin directly with less company-specific baggage; stocks amplify risk and reward through business performance.

Bitcoin ETFs vs. Crypto Funds

Crypto funds, like hedge funds or mutual funds (e.g., Grayscale Bitcoin Trust pre-ETF conversion), pool assets to invest in Bitcoin or broader crypto strategies.

They often charge higher fees (1%-2%) and may lack ETF liquidity—trading over-the-counter or via subscriptions, not exchanges.

ETFs, listed on NYSE or NASDAQ, offer intraday trading and lower fees (e.g., IBIT at 0.25%).

Funds might diversify beyond Bitcoin; ETFs stick to it, prioritizing simplicity.

Which Is Best?

- It depends on your goals. Bitcoin ETFs suit simplicity seekers—regulated, liquid, and broker-friendly, ideal for traditional investors or beginners.

- Direct ownership is for purists craving control and use (e.g., spending BTC), despite custody hassles.

- Crypto stocks appeal to risk-takers betting on industry growth, while crypto funds fit those chasing active management or diversification.

Tip: A $10,000 stake in IBIT grew to $17,675 in 2024 (per earlier case study); direct BTC hit $17,498 after fees—close calls, but stocks like MSTR soared 150% with higher volatility.

Comparison Table: ETFs vs. Direct vs. Stocks vs. Funds

| Aspect | Bitcoin ETFs | Direct Ownership | Crypto Stocks | Crypto Funds |

| Custody | Custodian-managed | Self-managed | N/A (company assets) | Fund-managed |

| Cost | 0.2%-1.5% fees | Trading fees only | Stock price + fees | 1%-2% fees |

| Control | None (fund owns BTC) | Full (you own BTC) | Indirect (via firm) | Limited (fund runs) |

| Liquidity | High (exchange-traded) | High (24/7 market) | High (stock market) | Moderate (OTC/sub) |

| Risk | BTC volatility | BTC + custody risk | BTC + firm risk | BTC + mgr risk |

Pros/Cons List:

- Bitcoin ETFs: Pros: Easy access, regulated, liquid. Cons: Fees, no true ownership.

- Direct Ownership: Pros: Full control, no annual fees, usable as currency. Cons: Security burden, complexity.

- Crypto Stocks: Pros: High upside, industry exposure. Cons: Company risk, less BTC correlation.

- Crypto Funds: Pros: Diversification, professional management. Cons: High fees, lower liquidity.

In 2025, Bitcoin ETFs shine for hassle-free exposure—think IBIT or FBTC via Fidelity (#). Direct ownership empowers diehards; stocks like MSTR thrill risk lovers; funds cater to niche strategies. Match your pick to your risk tolerance and time horizon—ETFs for stability, direct for sovereignty.

The Future of Bitcoin ETFs: Trends to Watch in 2025 and Beyond

Bitcoin Exchange-Traded Funds (ETFs) have reshaped crypto investing since spot ETFs launched in 2024, and as of March 13, 2025, their trajectory points to even bigger shifts ahead.

With Bitcoin hovering near $100,000 and institutional adoption accelerating, the future of Bitcoin ETFs promises growth, innovation, and challenges. From new issuers flooding the market to global expansion and looming risks, here’s what to watch in 2025 and beyond, blending current trends with forward-thinking insights.

Growing Adoption: A Crowded Market

The success of pioneers like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC)—amassing $58 billion and $22 billion in assets, respectively—has lured more issuers into the fray.

By March 2025, over 75 U.S. crypto ETFs exist, with 43 launched in 2024 alone, per industry reports.

This influx signals a competitive race as firms like VanEck and 21Shares vie for market share. Expect smaller players and niche offerings—think ESG-focused or multi-crypto ETFs—to proliferate, catering to diverse investor appetites.

Spot ETF Expansion: The Next Wave

Spot Bitcoin ETFs, which hold actual BTC, dominate 2025 predictions. March 2025 trends show approvals accelerating under a crypto-friendly U.S. administration, with filings for Solana, XRP, and Litecoin ETFs pending.

Analysts project spot ETFs could manage 7% of Bitcoin’s circulating supply by year-end—roughly $190 billion in assets—up from $36 billion in 2024’s first year.

“We’re on the cusp of a spot ETF explosion,” says Zach Pandl, Grayscale’s Head of Research, in a 2025 outlook. “By 2026, multi-token ETFs blending Bitcoin, Ethereum, and others could redefine diversification.”

Global Impact: Beyond the U.S.

Bitcoin ETFs are going global. Canada’s Purpose Bitcoin ETF, launched in 2021, thrives with over $1 billion in AUM, while Europe’s Jacobi FT Wilshire Bitcoin ETF (2023) gains traction.

By 2025, expect Asia and Latin America to join—Hong Kong’s SFC is eyeing retail access, and Brazil’s pro-crypto stance could spark regional ETFs. This patchwork adoption may amplify Bitcoin’s price, though regulatory disparities (e.g., UK bans for retail) could create uneven flows, per xAI’s market insights.

Potential Risks: Storm Clouds Ahead

Growth isn’t risk-free. Regulatory crackdowns loom—China’s crypto bans or a U.S. policy reversal under a future administration could rattle markets. Market saturation’s another threat: with dozens of ETFs, weaker funds (e.g., DEFI’s $15 million AUM) may fold if they can’t hit the $50 million viability threshold. Volatility persists too—Bitcoin’s 15% March 2025 swing reminds us of its chaos.

Top Trends for 2025:

- Issuer Boom: 10+ new firms launch Bitcoin ETFs, targeting niche markets.

- Spot Surge: Non-BTC spot ETFs (Solana, XRP) debut by Q4.

- Global Reach: Europe and Asia add 5+ new ETFs, boosting adoption.

- Innovation Wave: Index ETFs and staking options emerge.

- Risk Watch: Regulatory shifts or saturation thin the herd.

Bottom Line

Bitcoin Exchange-Traded Funds (ETFs) have emerged as a transformative force by March 2025, blending cryptocurrency’s potential with the familiarity of traditional investing.

This ultimate guide has unpacked their essentials: Bitcoin ETFs offer a regulated, accessible way to tap into Bitcoin’s trillion-dollar market without the headaches of wallets or exchanges. From their mechanics—tracking Bitcoin via spot or futures—to their benefits like liquidity and tax efficiency, they cater to traditional investors, retirement savers, and risk-tolerant newcomers.

Yet, downsides like fees, volatility, and regulatory risks remind us they’re not flawless. Whether you’re eyeing the iShares Bitcoin Trust (IBIT) or weighing direct ownership, the choice hinges on your goals—simplicity versus control.

The future looks bright but complex. With spot ETF adoption surging, global markets expanding, and new issuers flooding in, Bitcoin ETFs could redefine portfolios by 2026. Still, vigilance is key—market saturation or a policy shift could shake things up.

Bitcoin ETF FAQs

Bitcoin ETFs spark curiosity, and as of March 2025, readers want answers. This FAQ tackles the most common queries to guide your next steps.

What’s the Best Bitcoin ETF to Buy in 2025?

It depends on your goals—low fees or high liquidity? Top picks include iShares Bitcoin Trust (IBIT, 0.25% fee, $58B AUM) for cost-efficiency, Fidelity Wise Origin Bitcoin Fund (FBTC, 0.25%, $22B AUM) for reliability, and Bitwise Bitcoin ETF (BITB, 0.20%, $4B AUM) for a budget edge.

Are Bitcoin ETFs Safe?

Yes. They’re safer than unregulated exchanges, thanks to SEC oversight and custodians. But safety’s relative—Bitcoin’s volatility (e.g., a 15% drop in March 2025) hits ETFs too. Assess your risk tolerance: if 20% swings spooks you, diversify broadly.

Can I Buy Bitcoin ETFs in an IRA?

Yes, via brokers who support self-directed IRAs. IBIT and FBTC are popular in retirement accounts, offering tax-deferred growth. Confirm with your provider—some restrict crypto products.

How Do Bitcoin ETF Fees Compare to Crypto Exchanges?

ETFs charge annual fees (0.2%-1.5%), while exchanges like Coinbase hit you per trade (0.5%-4%). Here’s a mini-table for $10,000:

| Option | Cost |

| ETF (0.25% fee) | $25/year |

| Exchange (1% fee) | $100/trade (buy+sell: $200) |

ETFs win for long-term holders; exchanges suit active traders.

Will Bitcoin ETFs Replace Buying Bitcoin Directly?

No. they serve different needs. ETFs offer simplicity and regulation; direct ownership gives control and usability (e.g., spending BTC). Purists stick to wallets; beginners lean on ETFs. Both coexist as tools for distinct goals.

What’s the Minimum Investment for a Bitcoin ETF?

Most brokerages have no strict minimum—just buy one share. IBIT trades at ~$50/share in March 2025.

Do Bitcoin ETFs Pay Dividends?

No, they track Bitcoin’s price, not profits. Returns come from price gains, unlike dividend stocks.

How Are Bitcoin ETFs Taxed?

They are taxed like stocks: capital gains apply when sold. In IRAs, gains defer; outside, short-term (under 1 year) rates hit up to 37%, long-term up to 20%.

Can I Lose More Than I Invest in a Bitcoin ETF?

No, unlike margin trading. Your loss caps at your investment—e.g., $1,000 in IBIT drops to $0 if Bitcoin tanks, no further debt.

Are Bitcoin ETFs Affected by Crypto Hacks?

Yes. ETFs are affected by crypto hacks indirectly. Custodians secure the BTC. But a major hack (e.g., a 2025 bybit exchange breach) could spook markets, denting ETF prices indirectly.

How Often Should I Check My Bitcoin ETF?

Weekly or monthly, given Bitcoin’s volatility.

What Happens if My Bitcoin ETF Shuts Down?

Rare, but if assets dip (e.g., below $50M), it liquidates. You get cash based on the final Net Asset Value

Should Beginners Start with Bitcoin ETFs or Bitcoin?

ETFs are easier—no wallets, regulated.