“Bitcoin Halving” is an important event in the cryptocurrency world, shaping Bitcoin’s supply and value. Whether you’re a crypto investor, miner, or Web3 enthusiast, understanding this process is key. Below, we define “Bitcoin Halving”.

Who is Involved in Bitcoin Halving?

Bitcoin Halving involves several key players. Miners are directly affected—they receive the block reward, which halves during the event. In 2025, miners like those in pools (e.g., Foundry USA) adjust operations post-halving. Satoshi Nakamoto, Bitcoin’s creator, designed the halving mechanism, embedding it in the protocol. Developers maintain Bitcoin Core, ensuring the code executes halvings. Investors and traders watch closely, as halvings influence price. Nodes—computers running Bitcoin software—enforce the updated reward, syncing the network globally.

What is Bitcoin Halving?

Bitcoin Halving is an event where the block reward for mining a new block is cut in half, reducing the rate of new Bitcoin issuance. Initially 50 BTC in 2009, it’s now 6.25 BTC as of 2025, dropping to 3.125 BTC after the next halving. Defined in Bitcoin’s code, it controls the 21 million BTC supply cap. For example, a miner earning 6.25 BTC plus fees (~0.1 BTC) per block pre-halving gets half that post-event. This impacts Bitcoin’s inflation rate, making it a deflationary asset over time.

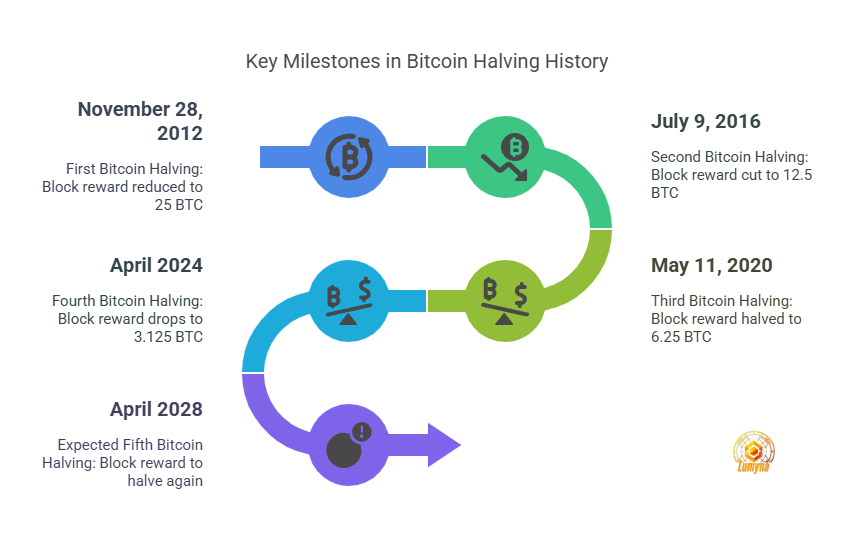

When Does Bitcoin Halving Occur?

Bitcoin Halving happens every 210,000 blocks, roughly every four years, due to Bitcoin’s 10-minute block time. The first was on November 28, 2012 (25 BTC), the second on July 9, 2016 (12.5 BTC), and the third on May 11, 2020 (6.25 BTC). The fourth occurred in April 2024, with the fifth expected around April 2028, based on block height (~840,000). As of March 20, 2025, we’re post-fourth halving, with ~19.6M BTC mined. Exact timing varies slightly with hash rate fluctuations.

Where Does Halving Take Place?

Bitcoin Halving occurs within the Bitcoin blockchain, a decentralized ledger with no physical location. It’s coded into Bitcoin Core software, executed by full nodes—over 15,000 worldwide in 2025—spanning data centers, homes, and cloud servers.

Miners, from Texas rigs to Siberian farms, adjust to the new reward, tracked via block explorers like Blockchain.com or Etherscan (for forks). Price effects ripple through exchanges (e.g., Binance, Coinbase), visible globally. In Web3, it’s a digital event with real-world economic impact.

Why Does Bitcoin Halving Happen?

Bitcoin Halving exists to enforce scarcity and mimic precious metals like gold. Satoshi designed it to cap Bitcoin at 21 million, halving rewards to slow issuance—e.g., from 1.7% inflation in 2025 to 0.8% post-2028. It incentivizes mining early while ensuring long-term security via transaction fees. Economically, it often drives price surges—post-2020 halving, BTC hit $69K by 2021. It’s why Bitcoin’s dubbed “digital gold,” balancing miner incentives with finite supply, a model Web3 projects admire.

How Does Bitcoin Halving Work?

Halving is hardcoded in Bitcoin’s protocol. Every 210,000 blocks, the block reward halves—e.g., from 6.25 BTC to 3.125 BTC in 2024. Miners solve cryptographic puzzles (SHA-256) to add blocks; post-halving, their payout drops, but fees remain.

The network adjusts difficulty every 2016 blocks (~2 weeks) to maintain 10-minute timing. Nodes validate the new reward, syncing the chain. Tools like Foundry simulate this; post-halving, miners may sell BTC or upgrade hardware (e.g., $10K ASICs) to stay profitable.

Expanded Insights on Halving

Let’s dive deeper into Bitcoin Halving’s mechanics and impact. In 2009, miners earned 50 BTC per block—7,200 BTC daily. By 2025, it’s 900 BTC daily (6.25 × 144 blocks), halving again to 450 BTC in 2028. This scarcity drives value—post-2016 halving, BTC rose from $650 to $20K in 18 months.

In 2025, with 6.25 BTC worth $375K (at $60K/BTC), miners lean on fees ($6K/block) as rewards shrink. Energy costs (1.5 MW/block) force efficiency—post-2024, some shut down.

Halving’s baked into Bitcoin’s DNA. Satoshi’s whitepaper (2008) outlined it, tying block height to supply control. By 2140, all 21M BTC will be mined, and fees alone sustain miners—a shift Web3 watches.

Historically, halvings spark hype—2020’s preceded a $1T market cap (2021). In 2025, post-April 2024, BTC hovers near $70K, per CoinMarketCap, with miners adapting via pools or renewables.

Security ties in. Halving ensures miners stay engaged early, building hash rate—Bitcoin’s 600 EH/s (2025) deters 51% attacks (cost: billions). Yet, reduced rewards test resilience—fees must rise, or hash power drops, a risk SunSec’s DeFiHackLabs might study. Nodes log every halving in blocks, viewable on Blockchain.com, a transparent shift echoed in Web3’s trustless ethos.

Related Questions

- What is Bitcoin Halving? – A reward cut every 210,000 blocks.

- Who triggers Halving? – It’s automatic, per Satoshi’s code.

- When is the next Halving? – Around April 2028.

- Where can I track Bitcoin Halving? – On block explorers like Blockchain.com.

- Why does Bitcoin Halving affect price? – It reduces supply, boosting scarcity.

- How does Bitcoin Halving impact miners? – It halves their BTC earnings.