Imagine a blockchain that can handle over 65,000 transactions per second—faster than most of its competitors.

That’s Solana, a platform turning heads in the cryptocurrency world with its incredible speed and efficiency. If you’re curious about what Solana is and why it’s making waves, you’ve come to the right place.

Solana is a scalable blockchain designed to power decentralized apps, NFTs, and more, all while keeping costs low and performance high. In this blog, we’ll break it down for you: who created

Solana, what it’s all about, when it got started, where you can buy it, why it’s worth your attention, and how it actually works. Plus, we’ll compare it to other big names in crypto to see how it stacks up. Ready to dive into the world of Solana? Let’s get started!

What is Solana?

So, what exactly is Solana? Solana is a high-performance, decentralized blockchain built to handle fast and low-cost transactions—think of it as a superhighway for the crypto world.

Unlike traditional blockchains that can get clogged with traffic, Solana is designed to keep things moving smoothly, no matter how busy it gets. It’s become a go-to platform for developers and users who want speed without breaking the bank.

What sets Solana apart?

One of its unique feature is its Proof of History (PoH) system, a clever way to timestamp transactions so the network can process them lightning-fast.

Together with its ability to scale up and handle over 65,000 transactions per second (TPS), Solana leaves many competitors in the dust.

That’s a huge leap from older blockchains struggling with double-digit TPS numbers. Plus, fees are tiny—often less than a penny per transaction—which makes it practical for everyday use.

Now, you might be wondering: “What is Solana cryptocurrency used for?” The answer is plenty! Its native token, SOL, powers a thriving ecosystem.

Developers use it to build decentralized finance (DeFi) platforms, letting people trade, lend, or borrow without banks.

It’s also a hotspot for non-fungible tokens (NFTs), where artists and collectors buy and sell digital art.

Gaming is another big area—imagine fast-paced blockchain games that don’t lag. And then there are decentralized apps (DApps), from social platforms to marketplaces, all running smoothly thanks to Solana’s tech.

In short, Solana is a blockchain that’s all about speed, affordability, and real-world use. Whether you’re into DeFi, NFTs, or just curious about crypto, Solana offers a glimpse into where this technology is headed.

Who Created Solana?

Ever wondered who’s behind Solana, the blockchain that’s shaking up the crypto scene?

Anatoly Yakovenko, the mastermind who kicked things off.

In 2017, he founded Solana Labs with a bold idea: build a blockchain that’s faster and more efficient than anything out there.

Yakovenko wasn’t new to this—he brought years of expertise in distributed systems, honed during his time at Qualcomm, where he worked on cutting-edge tech like mobile networks. His goal? To solve the bottlenecks slowing down other blockchains.

But Yakovenko didn’t do it alone. Solana Labs brought together a talented crew, including Greg Fitzgerald, a co-founder and tech whiz who helped turn the vision into reality.

Together, they created a system that’s now a powerhouse in the crypto world.

You might be asking, “Who is behind Solana?” It’s this team at Solana Labs, a company based in San Francisco, driving the project forward with a mix of innovation and practical know-how.

Their big breakthrough came with Proof of History, a concept Yakovenko dreamed up to make transactions lightning-fast. It’s no surprise that Solana’s founders caught the attention of heavy hitters like Andreessen Horowitz, who backed the project early on.

Since then, Solana Labs has grown into a key player, with Yakovenko and his team leading the charge to make blockchain tech more accessible and scalable. These are the minds behind Solana—smart, driven, and ready to rethink how crypto works.

When Was Solana Launched?

So, when did Solana come into the picture? The story starts in 2017, when Anatoly Yakovenko began dreaming up a faster blockchain. That’s when the seeds for Solana were planted. Things got serious in 2018 with the release of its whitepaper, laying out the plan for a high-speed, scalable network.

But the real milestone—the one people often ask about with “When did Solana start?”—came in March 2020. That’s when Solana’s mainnet officially launched, bringing its tech to life for the world to use.

Since then, Solana has hit some big moments. It started gaining traction in 2021, thanks to the NFT and DeFi booms, which showed off its ability to handle heavy traffic. Key updates, like network upgrades to boost stability, have kept it evolving.

The Solana launch date of March 2020 marks the beginning of its journey, but its growth since then is what’s turned heads.

From a quiet start to a major player, Solana’s timeline shows how quickly it’s risen in the crypto space. It’s proof that good ideas, launched at the right time, can make a huge impact.

Where Can I Buy Solana?

Wondering where you can buy Solana (SOL)? You’re in luck—it’s available on some of the biggest platforms out there. Top exchanges like Binance, Coinbase, and Kraken are great places to start. Binance is a giant in the crypto world, offering SOL trading with tons of options, from USD to Bitcoin (BTC).

Coinbase is perfect if you’re new to this—it’s user-friendly and lets you buy SOL with dollars or swap it with other crypto.

Kraken stands out for its security and low fees, supporting SOL purchases with USD or BTC too. FTX used to be an option, but since its collapse in 2022, it’s off the table—stick to the active players.

The process is pretty straightforward. First, pick an exchange and set up an account—most require some ID verification, so have that handy. Once you’re in, add funds using USD via bank transfer or card, or deposit BTC if you’ve already got some crypto. Then, search for SOL, decide how much you want, and hit buy. It’s that simple! Your SOL will land in your exchange wallet, ready to use or move to a personal one for safety.

So, to answer the big question—”Where can I buy Solana?”—Binance, Coinbase, and Kraken are solid choices. For beginners, start with Coinbase for its ease, or Binance if you want more trading flexibility. Just double-check fees and security features before diving in. Happy buying!

Why Choose Solana?

Why use Solana?

It all comes down to one big idea: solving the scalability problem that plagues so many blockchains.

Take Ethereum, for example—its high fees and slow speeds can make simple transactions feel like a chore. Solana’s founders saw this and said, “We can do better.”

Their goal was to create a network that’s fast, affordable, and ready for real-world use, and they’ve delivered in a big way.

The benefits are hard to ignore.

Transactions on Solana cost less than a penny— under $0.01—compared to Ethereum’s fees, which can spike into the double digits during busy times. Speed is another win; with over 65,000 transactions per second, Solana handles traffic like a champ.

Developers love it too, thanks to its flexible tools and support for languages like Rust and C. It’s no wonder they’re flocking to build on it.

So, why is Solana so popular? Look at its use cases. Serum DEX, a decentralized exchange, runs on Solana, letting users trade crypto lightning-fast with almost no cost.

Then there’s Solana Pay, a system that lets merchants accept SOL payments instantly—imagine buying coffee with crypto without the wait. These projects show off Solana’s power, making it a favorite for DeFi fans, NFT creators, and gamers alike.

Solana’s popularity isn’t just hype—it’s built on solving real problems.

Low costs, blazing speed, and a developer-friendly setup make it a standout. Whether you’re a user or a builder, Solana offers a glimpse of what blockchain can be when it’s designed to work for everyone, not just the tech elite.

How Does Solana Work?

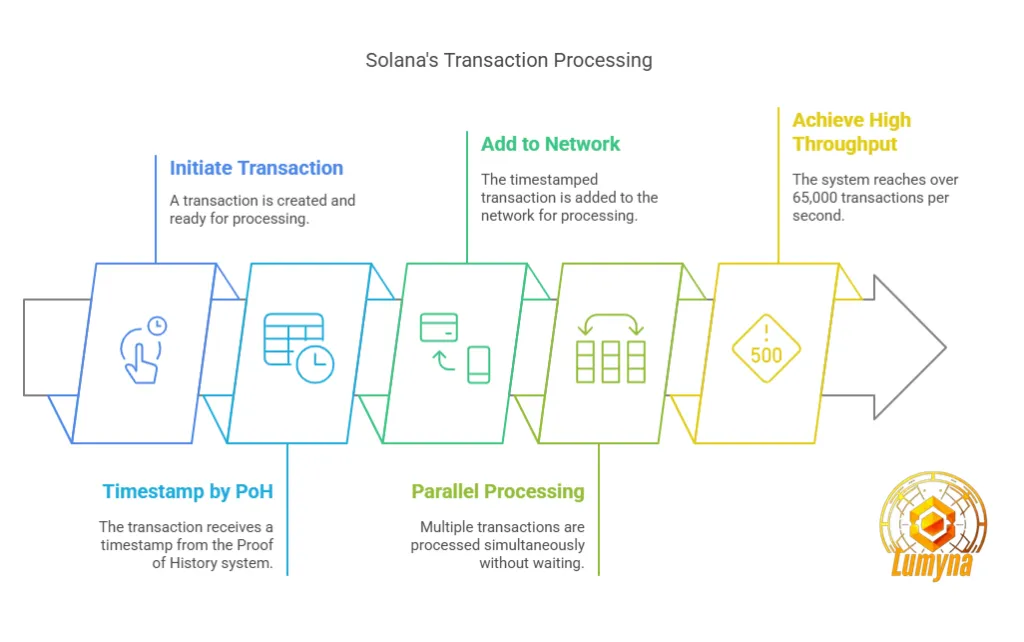

Curious about how Solana pulls off its blockchain magic? Let’s break it down. At its heart, Solana uses a unique system called Proof of History (PoH), which works hand-in-hand with Proof of Stake (PoS).

Together, they make Solana lightning-fast and efficient. So, how does the Solana blockchain work? It’s all about smart timing and teamwork.

Proof of History is the star here. Imagine a clock that timestamps every transaction before it even hits the network. PoH creates a historical record, letting Solana process thousands of transactions at once without waiting to agree on what happened when. This parallel processing—handling multiple tasks simultaneously—is why Solana can hit over 65,000 transactions per second. Compare that to older blockchains slogging through one task at a time, and you see the difference.

Then there’s Proof of Stake, where validators (think of them as network referees) stake SOL to keep things secure. They verify transactions and earn rewards, ensuring the system stays honest. Solana’s Tower BFT, a twist on Byzantine Fault Tolerance, ties it all together. It’s like a voting system that quickly confirms transactions, even if some validators disagree, keeping the network humming.

For the tech-curious, here’s the flow: transactions get timestamped by PoH, split across validators for processing, and finalized with Tower BFT. The result? A blockchain that’s fast, secure, and scalable. Solana technology explained simply is this: it’s built to handle heavy loads without the lag or high fees you’d see elsewhere. Whether it’s powering DeFi or NFTs, Solana’s design makes it a powerhouse for the future of crypto.

Solana vs. Ethereum, BSC,Cardano,Polygon, Avalanche & Polkadot

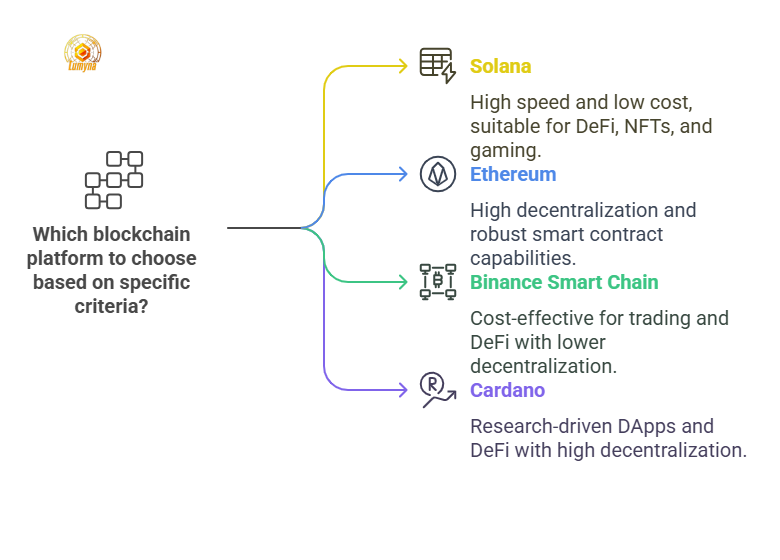

How does Solana stack up against the competition? Let’s compare it to Ethereum, Binance Smart Chain (BSC), and Cardano—three big names in crypto. People often ask, “How does Solana compare to Ethereum?” The answer lies in speed and cost, though each has its strengths.

Here’s a quick breakdown:

| Blockchain | Year Founded | TPS (Theoretical Max) | Avg. Transaction Fee | Market Cap (Approx., Mar 2025) | Consensus Mechanism | Decentralization | Key Use Cases |

|---|---|---|---|---|---|---|---|

| Solana | 2017 | 65,000+ | <$0.01 | ~$85B | PoH + PoS | Moderate (~1,900 validators) | DeFi, NFTs, gaming, Solana Pay |

| Ethereum | 2015 | 15 (100,000 post-sharding) | $1-$10+ (varies) | ~$300B | PoS (post-Merge) | High (~500,000 validators) | DeFi, NFTs, smart contracts |

| Binance Smart Chain (BSC) | 2020 | 160 | $0.10-$0.50 | ~$60B (BNB) | PoSA (PoS variant) | Low (~21 validators) | Cheap trading, DeFi, DApps |

| Cardano | 2015 | 250 (1M with Hydra) | ~$0.17 | ~$25B | Ouroboros PoS | High (~3,000 nodes) | Research-driven DApps, DeFi |

| Polygon | 2017 | 65,000 (as Layer 2) | $0.01-$0.05 | ~$10B | PoS (Layer 2 for Ethereum) | Moderate (100+ validators) | Ethereum scaling, NFTs, DeFi |

| Avalanche | 2020 | 4,500 | $0.01-$0.10 | ~$15B | Avalanche PoS | High (~1,300 validators) | DeFi, custom subnets, NFTs |

| Polkadot | 2020 | 1,000 (per parachain) | $0.01-$0.20 | ~$20B | Nominated PoS | High (~1,000 validators) | Interoperability, custom chains |

FAQ Section

Got questions about Solana? Here’s your Solana FAQ with quick answers!

What makes Solana different from other blockchains?

It’s all about Proof of History (PoH), a system that timestamps transactions for blazing speed and scalability. Unlike most blockchains, Solana handles thousands of tasks at once—think 65,000+ TPS.

When did Solana become popular?

Solana took off in 2021, riding the NFT and DeFi waves. Its ability to support fast, cheap transactions made it a favorite for creators and traders alike.

Why does Solana have outages?

It’s had some hiccups—network congestion caused crashes in the past, like in 2021 and 2022. The team’s been tweaking it, adding upgrades to keep it stable.

Is Solana better than Cardano?

Depends on your view. Solana’s speed (65,000 TPS) crushes Cardano’s 250 TPS, but Cardano’s research-driven approach appeals to those prioritizing security and theory over raw performance.

More questions? Keep exploring Solana’s world!

Conclusion

So, what’s the scoop on Solana? It’s a high-speed, low-cost blockchain dreamed up by Anatoly Yakovenko and Solana Labs, kicking off in 2017 and hitting the mainnet in March 2020.

You can grab some SOL on exchanges like Binance or Coinbase, and it’s built to tackle scalability—think 65,000+ TPS thanks to Proof of History. From DeFi to NFTs, Solana’s purpose is clear: make crypto fast and practical for everyone.

Looking ahead, the Solana future feels bright. With Web3 and DeFi growing, its speed and affordability could make it a cornerstone of decentralized tech. Ongoing upgrades to fix past outages only sweeten the deal.

Want in? Explore Solana’s ecosystem—dive into its projects or consider investing wisely. It’s a blockchain worth watching as it shapes the n/ext wave of crypto innovation. What do you think—ready to check it out?