Cryptocurrencies have changed how we think about money, offering a decentralized alternative to traditional finance.

Bitcoin, launched in 2009, sparked this revolution, followed by thousands of digital assets.

Yet, one challenge exists: price volatility.

Bitcoin’s value can rise or drop by 30% within hours, making it unreliable for everyday use or as a store of value. This is where stablecoins come into picture.

Designed to maintain a consistent value, stablecoins address the unpredictability that defines most cryptocurrencies by linking their value to stable assets like the U.S. dollar or gold. They combine the efficiency of blockchain technology with the reliability of traditional currency.

In this article, we’ll explore stablecoin, explaining who uses them, what they are, when and where they emerged, why they matter, and how they function.

We’ll also compare them to other assets, such as fiat currency and Bitcoin. Whether you’re new to cryptocurrency or seeking deeper insight, this guide offers a clear path to understanding stablecoins and their role in the evolving financial landscape.

FAQs

What is the most popular stablecoin?

Tether (USDT) holds the top spot by market capitalization, widely used for its early adoption and liquidity. USD Coin (USDC) follows closely, favored for its transparency.

Are stablecoins risk-free?

No, they carry risks. Fiat-backed stablecoins like Tether have faced scrutiny over reserve mismanagement, while algorithmic ones, such as TerraUSD, can fail if their mechanisms falter.

Can stablecoins lose their peg?

Yes, they can deviate from their target value during extreme market stress or if trust erodes. TerraUSD’s collapse in 2022, dropping from $1 to near zero, is a notable example.

How are stablecoins regulated?

Regulation varies globally. The U.S. is crafting policies to oversee issuers, while the European Union’s MiCA framework provides structured guidelines for stablecoin operations.

What’s the difference between USDT and USDC?

USDT offers less visibility into its reserves, raising concerns, whereas USDC provides regular audits, enhancing trust and accountability.

Can I earn interest on stablecoins?

Yes, platforms like Aave in Decentralized Finance (DeFi) or crypto savings accounts offer interest by lending stablecoins to borrowers.

Are stablecoins a good investment?

They aren’t designed for price growth due to their stable value, but they excel for stability and utility in trading or payments.

What Are Stablecoins?

Stablecoins are a category of cryptocurrencies engineered to maintain a consistent value over time.

Unlike most digital assets, which experience dramatic price swings, stablecoins are typically tied to established assets such as fiat currencies like the U.S. dollar, commodities like gold, or even other cryptocurrencies.

This connection, known as a peg, ensures their stability, making them a practical tool in the volatile world of digital finance. Stablecoins have become a cornerstone of the cryptocurrency ecosystem, balancing the innovation of blockchain with the reliability of traditional value systems.

Key characteristics define stablecoins:

- Price stability: Their value remains steady, avoiding the wild fluctuations seen in other cryptocurrencies.

- Backed by reserves or algorithms: Some hold collateral, like cash or bonds, while others use automated systems to adjust supply and demand.

- Examples: Tether (USDT), USD Coin (USDC), and Dai (DAI) are among the most recognized, each with distinct mechanisms to achieve stability.

Stablecoins stand in sharp contrast to cryptocurrencies like Bitcoin and Ethereum, which are known for their unpredictability. Bitcoin, for instance, might surge from $20,000 to $60,000 or drop suddenly, driven by market sentiment, speculation, or external events.

Ethereum, while powering a vast network of applications, shares this volatility, making both unsuitable for tasks requiring steady value—like everyday payments or long-term savings.

Stablecoins address this gap. Tether and USDC, for example, aim to mirror the U.S. dollar’s value, typically trading at or near $1. Dai, on the other hand, uses a decentralized system tied to cryptocurrency collateral, adjusting its supply to maintain its peg.

This stability makes stablecoins a bridge between the traditional financial world and the decentralized future, offering a reliable alternative in a market often defined by uncertainty.

Who Uses Stablecoins?

Stablecoins have gained traction across diverse groups, each leveraging their consistent value for specific purposes. These digital assets appeal to individuals and organizations navigating the unpredictable cryptocurrency landscape or seeking efficient financial tools.

Three key players stand out in their adoption:

- Crypto traders: Traders use stablecoins to shield themselves from sudden market drops, converting volatile assets like Bitcoin into stablecoins to preserve value during uncertainty.

- Businesses: Companies adopt stablecoins for payments and cross-border remittances, benefiting from fast, low-cost transactions compared to traditional banking systems.

- DeFi (Decentralized Finance) users: In decentralized platforms, stablecoins serve as a reliable medium for lending, borrowing, and trading, anchoring protocols that would otherwise be disrupted by price swings.

Beyond these groups, stablecoins are increasingly embraced by institutions and retail investors.

Large financial entities, such as payment processors and investment firms, recognize their potential to streamline operations and integrate cryptocurrency into mainstream finance.

For example, firms like Visa have explored stablecoins like USD Coin (USDC) for settlement processes, signaling trust in their stability. Retail investors, meanwhile, view stablecoins as an entry point into cryptocurrency, a way to participate without the risk of sharp losses.

This growing adoption reflects stablecoins’ ability to blend the accessibility of digital assets with the dependability of traditional currency, appealing to both seasoned professionals and newcomers.

Consider a real-world scenario: A crypto trader holds Bitcoin valued at $50,000.

Sensing a market decline, they convert it to Tether (USDT), which holds steady at $1 per token. When Bitcoin’s price falls to $45,000, the trader’s funds remain intact at $50,000 in USDT.

They can later reinvest when conditions improve, locking in profits without exiting the crypto ecosystem. This practical use underscores why stablecoins have become essential for so many.

When Did Stablecoins Begin?

Stablecoins emerged as a response to the cryptocurrency market’s need for stability, with their origins tracing back to the early 2010s.

The first notable stablecoin, BitUSD, launched in 2014 on the BitShares blockchain, introducing the concept of a digital asset pegged to the U.S. dollar.

That same year, Tether (USDT) debuted, marking a turning point. Backed by dollar reserves, Tether quickly gained traction, offering a practical solution for traders and exchanges seeking a steady value amidst crypto’s volatility. Its launch laid the foundation for stablecoins to become a vital part of the digital economy.

The growth of stablecoins followed a clear timeline. Between 2017 and 2018, their popularity surged alongside the broader cryptocurrency boom, as Bitcoin’s price soared to nearly $20,000.

This period highlighted the need for stable alternatives, driving adoption. The 2020s brought an explosion of interest, fueled by the rise of Decentralized Finance (DeFi) platforms and growing institutional involvement.

Stablecoins like USD Coin (USDC) and Dai became integral to DeFi, while companies like Circle attracted mainstream attention, amplifying their reach.

Market conditions, particularly the 2018 crypto crash, significantly boosted stablecoins’ appeal. After Bitcoin’s peak in late 2017, its value plummeted over 70% in 2018, shaking investor confidence.

Traders turned to stablecoins like Tether to safeguard their funds without leaving the crypto ecosystem. This shift underscored their utility as a safe haven, cementing their role during turbulent times and paving the way for their widespread use today.

Where Are Stablecoins Used?

Stablecoins operate on a global scale, their reach extending wherever internet access and blockchain technology converge. While they are accessible worldwide, their use is particularly pronounced in regions with unstable fiat currencies, such as Venezuela and Argentina.

In these countries, where hyperinflation erodes the value of local money, residents turn to stablecoins like Tether (USDT) or USD Coin (USDC) to preserve wealth and conduct transactions.

This geographic flexibility highlights their role as a practical alternative to unreliable national currencies, offering stability in areas where traditional finance falters.

In the digital realm, stablecoins thrive within specific ecosystems:

- Crypto exchanges: Platforms like Binance and Coinbase rely on stablecoins as trading pairs, enabling users to move funds quickly without converting to fiat.

- DeFi platforms: Decentralized Finance systems, such as Uniswap and Aave, use stablecoins as a consistent medium for lending, borrowing, and swapping assets, ensuring predictable outcomes in complex protocols.

Beyond local adoption, stablecoins excel in facilitating cross-border transactions, bypassing the delays and costs of traditional banking.

Sending money internationally through banks can take days and incur high fees, especially for small businesses or individuals in developing nations. Stablecoins, however, leverage blockchain technology to settle transfers in minutes at a fraction of the cost.

For instance, a freelancer in Argentina can receive payment in USDC from a U.S. client instantly, avoiding currency exchange losses and wire transfer wait times.

This efficiency makes stablecoins a powerful tool for global commerce, bridging gaps that conventional systems struggle to address. Their use in both volatile regions and digital platforms underscores their versatility in today’s interconnected financial landscape.

Why Are Stablecoins Important?

Stablecoins play a critical role in the cryptocurrency ecosystem by addressing key challenges and unlocking new opportunities. Their importance stems from several distinct benefits:

- Stability in a volatile market: Unlike Bitcoin or Ethereum, which can fluctuate wildly, stablecoins maintain a steady value, offering a reliable option for users.

- Bridge between fiat and crypto: They connect traditional currencies, like the U.S. dollar, to the digital asset world, easing the transition for newcomers and businesses.

- Efficiency in transactions: Built on blockchain technology, stablecoins enable fast, low-cost transfers, outpacing traditional financial systems.

Beyond these advantages, stablecoins contribute significantly to financial inclusion and decentralization. In regions where access to stable banking is limited—such as parts of Africa or Latin America—stablecoins provide an alternative for storing value and making payments, requiring only a smartphone and internet connection.

For example, someone in a rural area can receive remittances in USDC without relying on a local bank, empowering individuals excluded from conventional finance.

Additionally, decentralized stablecoins like Dai, which operate without a central authority, align with the ethos of cryptocurrency by reducing dependence on intermediaries.

This fosters a more open and equitable financial system, appealing to those seeking autonomy over their money.

However, stablecoins are not without risks. Centralized options, such as Tether (USDT), face scrutiny over whether their reserves fully back their issued tokens, raising concerns about transparency and trust.

Regulatory oversight is another challenge, as governments worldwide debate how to classify and control these assets, potentially impacting their growth. Despite these hurdles, stablecoins remain vital for their ability to stabilize the crypto market and expand financial access, balancing innovation with practical utility.

How Do Stablecoins Work?

Stablecoins achieve their consistent value through distinct mechanisms, each relying on different strategies to anchor their price to a target asset. These approaches ensure stability, making them functional in a fluctuating market. Three primary types exist:

- Fiat-collateralized: These stablecoins, like Tether (USDT) and USD Coin (USDC), are backed by reserves of fiat currency, such as U.S. dollars, held in bank accounts.

- Crypto-collateralized: Stablecoins like Dai use other cryptocurrencies (e.g., Ethereum) as collateral, often over-collateralized to absorb price swings.

- Algorithmic: These, such as TerraUSD (before its 2022 collapse), rely on smart contracts to adjust supply and demand, maintaining the peg without physical reserves.

Maintaining stability involves a structured process:

- Pegging to an asset: The stablecoin’s value is tied to a reference, like $1 for USDT or USDC.

- Reserve management or algorithmic adjustments: Fiat-backed coins hold collateral, while algorithmic ones expand or contract supply based on market conditions.

- Transparency: Regular audits (for fiat-backed) or real-time data (for decentralized coins) build trust by verifying the peg’s integrity.

USD Coin (USDC), a prominent fiat-collateralized stablecoin, exemplifies this technology in action. Issued by Circle, USDC operates on blockchain networks like Ethereum, where it exists as a digital token.

For every USDC in circulation, Circle holds $1 in reserve, typically in cash or short-term U.S. Treasury bonds, stored with regulated financial institutions. These reserves are audited monthly by independent firms to confirm full backing, ensuring each token can be redeemed for $1.

Transactions occur on the blockchain, where smart contracts—self-executing programs—facilitate instant transfers without intermediaries.

This combination of traditional banking oversight and decentralized technology allows USDC to offer stability and efficiency, appealing to users ranging from traders to businesses. While not immune to scrutiny, its transparent reserve system illustrates how stablecoins blend reliability with innovation.

Comparison with Other Assets

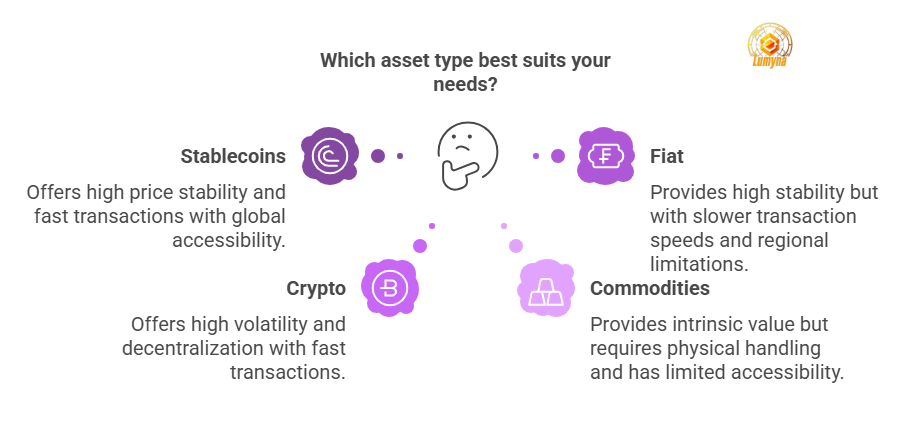

Stablecoins occupy a unique position in the financial world, blending traits of fiat currencies, traditional cryptocurrencies, and commodities.

Unlike fiat, such as the U.S. dollar, which relies on government backing, or volatile cryptocurrencies like Bitcoin, driven by market forces, stablecoins aim for consistency. Commodities like gold, with their tangible value, offer another contrast.

By examining these assets side by side, we can better understand stablecoins’ strengths and limitations, highlighting their role as a hybrid solution in modern finance.

Comparison of Stablecoins with Other Assets

| Feature | Stablecoins (e.g., USDT) | Fiat (e.g., USD) | Crypto (e.g., BTC) | Commodities (e.g., Gold) |

|---|---|---|---|---|

| Price Stability | High | High | Low | Moderate |

| Decentralization | Varies (e.g., Dai yes, USDT no) | No | Yes | No |

| Transaction Speed | Fast (blockchain) | Slow (banks) | Fast | Slow (physical) |

| Accessibility | Global (crypto wallet) | Regional | Global | Limited |

| Backing | Reserves/Algorithms | Government | None | Intrinsic value |

The table reveals key insights about stablecoins’ appeal. They mirror fiat’s high price stability, a stark contrast to Bitcoin’s volatility, while offering blockchain-driven transaction speed that outpaces fiat’s reliance on sluggish banking systems.

Unlike gold, which requires physical handling, stablecoins provide global accessibility through digital wallets, akin to Bitcoin.

However, decentralization varies, Dai operates without central control, while USDT depends on reserve management, unlike Bitcoin’s fully decentralized model.

Backing also differs: stablecoins use reserves or algorithms, fiat leans on government trust, and gold holds inherent worth. This blend of fiat-like stability and crypto-like efficiency positions stablecoins as a versatile tool, bridging traditional and digital finance with a balance unmatched by other assets.

Bottom Line

Stablecoins represent a vital innovation in the cryptocurrency space, addressing the volatility that has long hindered digital assets’ practical use.

By maintaining a steady value—whether through reserves, collateral, or algorithms—they offer a reliable alternative to unpredictable coins like Bitcoin, while retaining the speed and accessibility of blockchain technology.

From traders hedging against market swings to businesses streamlining cross-border payments, stablecoins have proven their worth across diverse applications. Their ability to bridge traditional finance and the decentralized world underscores their significance, making them a cornerstone of the evolving digital economy.

Looking ahead, stablecoins’ growth seems promising, though not without challenges.

As regulatory frameworks emerge, such as those in the European Union or the United States, clarity could pave the way for broader mainstream adoption. Institutions and individuals alike may increasingly turn to stablecoins as trust and infrastructure solidify.

For readers intrigued by this financial tool, now is an opportune moment to explore their potential. Whether for trading, payments, or engaging with Decentralized Finance (DeFi), stablecoins offer a practical entry point into cryptocurrency.

Dive in, experiment, and discover how they can fit into your financial journey.