- 2. Key Considerations for Offshore Crypto Banking

- 3. Top Offshore Jurisdictions for Crypto Banking

- 4. Top Offshore Crypto-Friendly Banks for HNWIs

- 5. Wealth Management & Asset Protection Strategies

- Wealth Management & Asset Protection Strategies

- 6. Risks & Challenges of Offshore Crypto Banking

- Risks & Challenges of Offshore Crypto Banking

- 7. Final Thoughts

Offshore banking has long been a favored financial strategy for high-net-worth individuals (HNWIs) seeking bitcoin or other crypto asset protection, tax optimization, and financial privacy.

Key Takeaways

- Offshore Crypto Banking Demand – In 2025, high-net-worth individuals (HNWIs) are increasingly seeking offshore banks that support Bitcoin and other crypto assets for wealth protection, tax efficiency, and financial privacy.

- Top Crypto-Friendly Jurisdictions – Switzerland, Singapore, Liechtenstein, the Cayman Islands, Puerto Rico, and the UAE stand out as the best offshore locations for crypto banking, offering regulatory clarity, tax benefits, and secure financial infrastructure.

- Key Offshore Crypto Banking Solutions Considerations – HNWIs must evaluate regulatory compliance (AML/KYC), bank stability, crypto transaction policies, security measures (cold storage, encryption), and wealth management services when choosing an offshore crypto-friendly bank.

- Leading Offshore Crypto Banks – SEBA Bank, Sygnum Bank, Bank Frick, Deltec Bank, Signature Bank, Xapo Bank, and Capital Security Bank provide premium crypto banking services, including custody, lending, multi-currency accounts, and investment advisory.

- Risks & Future Trends – Offshore crypto banking faces challenges such as evolving regulations, KYC/AML compliance, transaction restrictions, and cybersecurity risks, while trends like DeFi integration, improved regulatory clarity, and crypto-backed loans shape the future.

Offshore crypto-friendly banking solutions for high-net-worth individuals is something that is in high demand in 2025.

As the adoption of cryptocurrencies continues to grow, many HNWIs are turning to offshore banking solutions that accommodate digital assets.

This shift is driven by the unique needs of crypto investors who require seamless integration of their digital wealth into traditional financial systems while navigating a complex regulatory landscape.

It necessitates specialized banking solutions that offer robust security, efficient transaction processing, and access to a global financial network.

Offshore banks that are crypto-friendly provide these services, along with benefits such as multi-currency accounts, investment advisory, and tailored financial planning. These features make them attractive to affluent crypto investors seeking to diversify their holdings and protect their wealth.

Global regulatory trends further complicate the landscape.

While some jurisdictions, such as Switzerland and Singapore, have established clear and supportive frameworks for crypto banking, others remain cautious or hostile. The rise of regulatory bodies focusing on anti-money laundering (AML) and know-your-customer (KYC) requirements has made it imperative for HNWIs to choose banking partners that not only support crypto but also ensure compliance with international standards.

In this article, we will explore the best offshore crypto-friendly banking options available for high-net-worth individuals, highlighting their unique offerings, regulatory compliance, and benefits for crypto investors.

Key Considerations for offshore crypto banking solutions

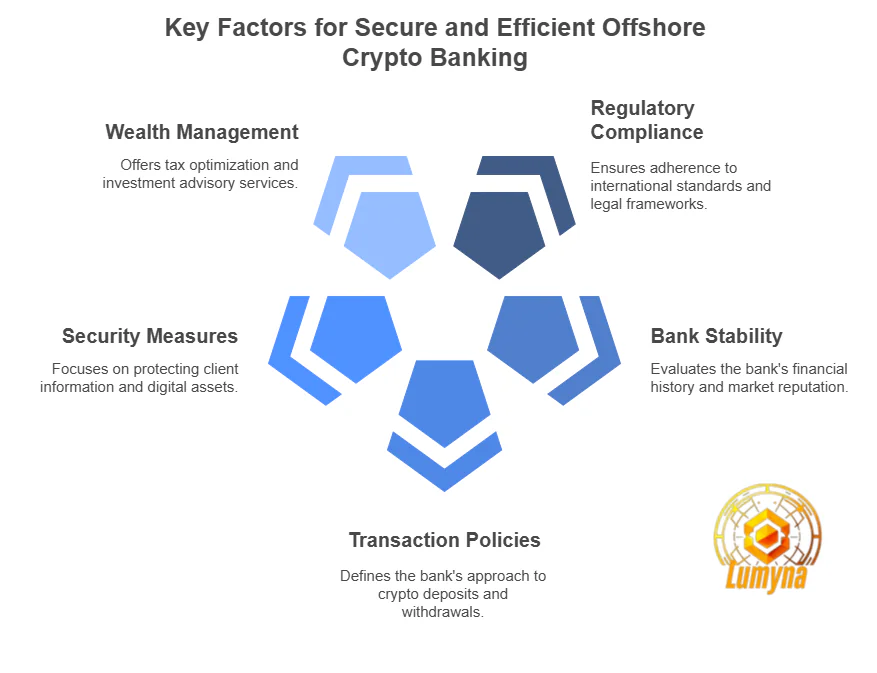

When selecting offshore crypto-friendly banks, high-net-worth individuals (HNWIs) must evaluate several critical factors to ensure their digital assets are secure, compliant, and efficiently managed.

Regulatory Compliance & Legal Frameworks

Navigating the legal complexities of crypto banking is paramount. Offshore banks that accommodate cryptocurrencies must adhere to international standards such as those set by the Financial Action Task Force (FATF).

Compliance with Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations is essential, not only to protect the investor but also to ensure the bank’s operations remain transparent and above board.

HNWIs should prioritize banks that have clear policies for crypto-related transactions and demonstrate a strong commitment to regulatory adherence across jurisdictions.

Bank Stability & Reputation

However, finding crypto-friendly banks is challenging due to the evolving and often strict regulatory environment. Many traditional banks are still hesitant to engage with cryptocurrencies due to concerns over money laundering, regulatory compliance, and volatility. This has led to a limited number of financial institutions that openly support crypto-related transactions, especially for high-net-worth clients.

The stability and reputation of an offshore bank are crucial indicators of its reliability. HNWIs should assess the bank’s credit ratings, financial history, and overall market standing.

A bank with a long-standing history of serving high-net-worth clients and a proven track record in managing digital assets is often a safer choice. Factors such as political stability in the bank’s host country, risk management policies, and crisis response capabilities should also be carefully considered.

Crypto Deposit, Withdrawal & Transaction Policies

Not all offshore banks offer seamless crypto transactions. Understanding a bank’s policies on crypto deposits, withdrawals, and day-to-day transactions is vital.

HNWIs need to ensure that their chosen bank supports major cryptocurrencies, provides competitive fees, and facilitates easy conversion between digital assets and fiat currencies. Moreover, transaction limits, processing times, and associated fees can significantly impact the efficiency of managing crypto wealth offshore.

Security & Privacy Measures

Security is a cornerstone of offshore banking, especially when digital assets are involved. Top-tier offshore banks employ Swiss-style confidentiality measures, ensuring client information is protected through strict privacy laws and advanced cybersecurity protocols.

Multi-signature wallets, cold storage solutions, and encrypted communication channels are standard practices in crypto-friendly offshore banks. Additionally, the legal advantages of banking in offshore jurisdictions often provide enhanced privacy protections compared to domestic banking options.

Tax Efficiency & Wealth Management Services

One of the main attractions of offshore crypto banking solutions for HNWIs is tax optimization. Offshore banks often offer tailored tax planning services, helping clients manage their crypto wealth in a tax-efficient manner.

Wealth management services such as portfolio diversification, estate planning, and investment advisory further enhance the value proposition for affluent crypto investors. By leveraging these services, HNWIs can ensure their digital assets are not only protected but also strategically grown over time.

Multi-Currency Support & Integration with Crypto Exchanges

A well-rounded offshore crypto banking solutions should offer multi-currency accounts, enabling HNWIs to hold, convert, and transfer funds in various fiat currencies alongside their crypto assets.

Seamless integration with major crypto exchanges is another key factor, allowing investors to manage their digital portfolios without friction. This integration ensures that HNWIs can quickly capitalize on market opportunities, execute trades efficiently, and access liquidity when needed.

Top Offshore Jurisdictions for Crypto Banking

A. Switzerland

Switzerland has established itself as a leading jurisdiction for crypto banking, thanks to its robust financial system and progressive regulatory environment.

Crypto-friendly private offshore crypto banking solutions like SEBA Bank, Sygnum Bank, and Julius Baer offer tailored services for high-net-worth individuals (HNWIs), including crypto custody, trading, and asset management.

The Swiss Financial Market Supervisory Authority (FINMA) has set clear regulations for digital assets, ensuring a secure and compliant environment for crypto investors. Switzerland’s strong banking secrecy laws and emphasis on wealth protection make it an attractive choice for HNWIs looking to safeguard their digital wealth.

B. Singapore

Singapore is another top destination for crypto-friendly banking, supported by its strategic location and advanced financial infrastructure.

Leading financial institutions such as DBS Bank, OCBC Bank, and Xfers provide comprehensive crypto banking services, including crypto-fiat conversions, custody, and investment solutions.

The Monetary Authority of Singapore (MAS) has introduced a licensing regime for crypto businesses, ensuring regulatory clarity and fostering innovation. Singapore’s low-tax environment and global banking access further enhance its appeal, making it ideal for HNWIs seeking to manage and grow their crypto portfolios efficiently.

C. Liechtenstein

Liechtenstein has emerged as a crypto banking hub, thanks to its Blockchain Act, which provides a comprehensive legal framework for digital assets. Bank Frick is a notable institution offering specialized crypto banking services, including custody, token issuance, and trading.

The jurisdiction’s favorable tax policies and wealth structuring options attract HNWIs looking for flexible and secure crypto banking solutions. Liechtenstein’s integration with the European financial system also offers easy access to European markets, making it a strategic choice for crypto investors.

D. Cayman Islands

The Cayman Islands is renowned for its offshore financial services and offers unique advantages for crypto banking.

Although it lacks direct crypto-specific regulations, its banking secrecy laws and robust financial ecosystem provide a favorable environment for HNWIs.

The jurisdiction is particularly popular for corporate crypto accounts and crypto investment funds, offering flexibility and confidentiality. Offshore banks in the Cayman Islands facilitate crypto transactions while ensuring asset protection and tax efficiency for high-net-worth clients.

E. Puerto Rico (for US HNWIs)

The territory’s crypto-friendly offshore crypto banking solutions support both individual and business crypto accounts, providing services such as custody, trading, and wealth management.

Additionally, Puerto Rico benefits from a strong US-dollar banking system while offering offshore perks, making it a unique hybrid option for US HNWIs seeking tax benefits without leaving the US financial system.

F. UAE (Dubai & Abu Dhabi)

The United Arab Emirates (UAE), particularly Dubai and Abu Dhabi, has positioned itself as a leading crypto financial hub in the Middle East. The Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM) offer comprehensive regulatory frameworks for digital assets, ensuring a secure and transparent environment for crypto banking.

The UAE’s zero personal and corporate tax policies, together with high privacy standards and strong asset protection laws, make it an ideal jurisdiction for HNWIs looking to manage their crypto wealth offshore.

Top Offshore Crypto-Friendly Banks for HNWIs

1. SEBA Bank (Switzerland)

SEBA Bank is a pioneer in crypto banking, being one of the first regulated banks in Switzerland to offer seamless fiat and crypto services. Licensed by FINMA, SEBA provides high-net-worth individuals (HNWIs) with a comprehensive suite of services, including crypto custody, trading, lending, and wealth management.

The bank’s institutional-grade security measures, such as multi-signature wallets and cold storage solutions, ensure the safety of digital assets. SEBA’s tailored financial planning and investment advisory services make it a top choice for HNWIs seeking secure and sophisticated crypto banking solutions.

2. Sygnum Bank (Switzerland & Singapore)

Sygnum Bank operates in both Switzerland and Singapore, offering digital asset banking services to high-net-worth clients. As a fully regulated bank, Sygnum provides crypto-backed loans, allowing HNWIs to leverage their digital assets without liquidating their holdings.

As an offshore crypto banking solution, it also offers institutional-grade custody services, ensuring top-notch security for crypto assets. With its dual presence in two leading financial hubs, Sygnum delivers a blend of European stability and Asian market access, making it highly attractive for global crypto investors.

3. Bank Frick (Liechtenstein)

Located in the crypto-friendly jurisdiction of Liechtenstein, Bank Frick offers both business and personal banking solutions tailored for crypto investors. The bank holds an EU banking license, ensuring regulatory compliance and financial stability.

Bank Frick’s crypto services include custody, trading, and token issuance, making it a versatile option for HNWIs. Its integration with the European financial system and favorable tax environment further enhance its appeal to affluent crypto investors looking for secure and efficient banking solutions.

4. Deltec Bank (Bahamas)

Deltec Bank, based in the Bahamas, is known for its crypto-friendly private banking services. Catering to high-net-worth individuals, Deltec offers multi-currency accounts, wealth structuring, and crypto transaction services.

The bank’s offshore location provides tax advantages and enhanced privacy protections, making it a preferred choice for HNWIs managing substantial crypto portfolios. Deltec’s commitment to innovation in digital finance and its strong financial ecosystem position it as a leading offshore crypto bank.

5. Signature Bank (Puerto Rico, US-based option)

Signature Bank offers crypto business accounts and specialized services for high-net-worth clients through its operations in Puerto Rico. The bank’s integration with US banking networks provides seamless access to US-dollar transactions while offering offshore benefits through Puerto Rico’s unique financial incentives.

Signature Bank supports crypto-related businesses, providing tailored banking solutions, including custody, transaction processing, and financial advisory, making it an excellent choice for US-based HNWIs.

6. Xapo Bank (Gibraltar)

Xapo Bank is a fully licensed offshore bank in Gibraltar, known for its innovative integration of Bitcoin with traditional banking services. The bank offers both USD and crypto deposits, enabling HNWIs to manage their digital and fiat assets with ease.

Xapo’s global access and advanced security measures, including multi-signature wallets and cold storage, ensure the safety and accessibility of clients’ funds. Its regulatory compliance and offshore advantages make it a top pick for high-net-worth crypto investors.

7. Capital Security Bank (Cook Islands)

Capital Security Bank in the Cook Islands provides high-net-worth offshore banking solutions with integrated crypto services. Known for its strong privacy laws and asset protection, the bank offers multi-currency accounts, crypto custody, and wealth management services.

Capital Security Bank’s offshore location ensures confidentiality and tax efficiency, making it an attractive option for HNWIs seeking secure and discreet crypto banking solutions.

Wealth Management & Asset Protection Strategies

Managing and protecting crypto wealth requires strategic planning, especially for high-net-worth individuals (HNWIs) with significant digital assets. Offshore jurisdictions offer a variety of tools and services to help HNWIs safeguard their crypto holdings while optimizing their financial portfolios.

Using Trusts & Offshore Corporations for Crypto Wealth

Establishing offshore trusts and corporations as an alternative to offshore crypto banking solutions is a popular strategy for protecting crypto assets. Trusts, particularly in jurisdictions like the Cayman Islands and Cook Islands, offer strong legal protections against creditors, lawsuits, and political risks.

By transferring crypto assets into a trust, HNWIs can ensure that their wealth is managed according to specific terms, providing both security and privacy. Offshore corporations, such as International Business Companies (IBCs), allow HNWIs to hold and transact crypto assets through a legal entity, offering tax benefits, reduced personal liability, and enhanced confidentiality.

Multi-Jurisdictional Banking Diversification

Diversifying assets across multiple offshore jurisdictions mitigates risk and enhances financial flexibility.

By holding crypto and fiat funds in banks across jurisdictions like Switzerland, Singapore, and the UAE, HNWIs reduce their exposure to regulatory changes, political instability, and financial crises in any single country.

This approach ensures that even if one jurisdiction imposes stricter regulations on crypto, investors still have access to their wealth through other jurisdictions. Multi-jurisdictional diversification also allows for optimized tax strategies and access to various financial services globally.

Staking & Yield-Bearing Crypto Accounts

Many offshore crypto-friendly banks and financial platforms offer staking and yield-bearing accounts, allowing HNWIs to earn passive income on their digital assets. Staking involves locking up crypto holdings to support blockchain networks and earning rewards in return.

Yield-bearing accounts, similar to interest-earning savings accounts, provide returns on deposited crypto assets. Offshore jurisdictions often offer more competitive yields, flexible terms, and lower tax rates on crypto earnings, making them attractive for wealth growth.

Crypto-Backed Loans & Leveraging Assets for Liquidity

HNWIs can leverage their crypto holdings to access liquidity without selling their assets through crypto-backed loans. Offshore banks like SEBA, Sygnum, and Bank Frick offer loans secured by crypto collateral, enabling investors to borrow fiat currencies or stablecoins while retaining ownership of their digital assets.

This strategy provides immediate liquidity for investments, business operations, or personal expenses, all while allowing the investor to benefit from potential future appreciation of their crypto holdings.

Insurance Options for Crypto Holdings

Insurance plays a critical role in protecting crypto wealth, particularly against theft, hacking, and accidental loss.

Offshore jurisdictions offer a range of crypto insurance solutions, including custody insurance for assets held in cold storage, transaction insurance for large transfers, and coverage for digital wallets.

High-net-worth individuals can work with specialized offshore insurers to tailor policies that cover their unique crypto portfolios, ensuring peace of mind and financial security.

Risks & Challenges of Offshore Crypto Banking

While offshore crypto banking offers numerous benefits to high-net-worth individuals (HNWIs), it also presents several risks and challenges that must be carefully considered to safeguard assets and ensure smooth financial operations.

Regulatory Risks & Sudden Policy Changes

One of the most significant risks in offshore crypto banking is the ever-changing regulatory landscape. Governments and financial regulators worldwide are continuously updating policies related to cryptocurrencies, which can impact offshore banks and their clients.

Sudden changes, such as bans on crypto transactions, increased tax scrutiny, or stricter reporting requirements, can pose substantial risks to HNWIs.

For instance, jurisdictions that are currently crypto-friendly may introduce unfavorable regulations, potentially freezing assets or restricting transactions. Staying updated on global regulatory trends and diversifying across multiple jurisdictions helps mitigate this risk.

Banking Restrictions on Crypto Transactions

Despite the growing acceptance of cryptocurrencies, many offshore banks still impose restrictions on crypto-related transactions. Some banks may limit the types of cryptocurrencies they accept, impose high fees on crypto transactions, or restrict the frequency and volume of crypto deposits and withdrawals.

These limitations can hinder HNWIs from efficiently managing their digital assets, leading to liquidity challenges. It is essential to thoroughly research and choose banks with transparent and flexible crypto policies to avoid unexpected disruptions.

KYC/AML Compliance & Audits

Offshore banks must adhere to stringent Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations, particularly when dealing with crypto assets.

HNWIs may face frequent audits, requiring them to provide detailed documentation on the source of their funds, transaction history, and business activities. Non-compliance or failure to meet these requirements can result in account freezes, fines, or legal complications.

Ensuring that all transactions are well-documented and working with banks that offer streamlined compliance processes can help mitigate these challenges.

Access to Funds & International Transaction Limits

Another critical challenge in offshore crypto banking is maintaining unrestricted access to funds. Some jurisdictions impose capital controls, limiting the amount of money that can be transferred internationally.

Additionally, crypto transactions, while often faster than traditional banking, can still face delays due to bank processing times, especially during audits or regulatory reviews.

HNWIs need to ensure that their chosen offshore banks provide flexible access to both fiat and crypto funds, with minimal restrictions on international transfers to avoid liquidity shortages during critical times.

Cybersecurity Risks & Importance of Cold Storage

Cybersecurity remains a top concern for HNWIs managing crypto assets through offshore banks. The decentralized nature of cryptocurrencies makes them attractive targets for hackers, with breaches resulting in substantial financial losses.

Offshore banks that offer crypto services must employ advanced security measures, including multi-signature wallets, end-to-end encryption, and regular security audits.

Additionally, utilizing cold wallet storage solutions, offline wallets that are less vulnerable to cyberattacks — is essential for protecting large crypto holdings.

HNWIs should prioritize banks with robust cybersecurity protocols and consider maintaining a significant portion of their digital assets in cold storage for maximum protection.

Bottom Line

Choosing the best offshore crypto-friendly banking option for high-net-worth individuals (HNWIs) depends on specific financial needs, including privacy, tax efficiency, and accessibility. Switzerland remains the top choice for HNWIs prioritizing privacy and wealth protection due to its strict banking secrecy laws and FINMA’s clear regulatory framework.

Meanwhile, the Cayman Islands and Puerto Rico stand out for their favorable tax policies, making them ideal for US-based HNWIs looking to optimize their crypto holdings without complex tax burdens.

Selecting the right offshore bank involves thorough research and due diligence.

HNWIs should assess a bank’s regulatory compliance, reputation, and the range of crypto services offered, such as custody, lending, and multi-currency support

Evaluating transaction fees, withdrawal limits, and security measures is also essential to ensure that the chosen bank aligns with their financial strategies. Partnering with legal and financial advisors specializing in offshore banking and cryptocurrencies can simplify the process and ensure compliance with international regulations.

The future of crypto-friendly banking for HNWIs looks promising, with more offshore jurisdictions embracing digital assets. Trends such as DeFi integration, increased regulatory clarity, and the growth of crypto-backed financial products will shape the offshore banking landscape. As more traditional financial institutions adopt crypto services, HNWIs can expect enhanced flexibility, improved security, and innovative financial products tailored to digital assets.

Before opening an offshore crypto bank account, HNWIs should follow this checklist:

- Verify the bank’s crypto licenses and regulatory status in its jurisdiction.

- Assess the bank’s security measures, including cold storage and encryption protocols.

- Review the bank’s crypto policies, including supported cryptocurrencies, transaction fees, and limits.

- Prepare necessary KYC/AML documents to streamline the onboarding process.

- Consult with tax and legal experts to ensure compliance and optimize tax benefits.

- Diversify across multiple jurisdictions to mitigate regulatory and financial risks.

Offshore crypto-friendly banking offers immense opportunities for HNWIs, but careful planning and strategic decision-making are essential to maximize benefits and minimize risks.

FAQ For Offshore Crypto Banking Options

What is offshore crypto banking, and why do high-net-worth individuals use it?

Offshore crypto banking refers to managing cryptocurrency assets through banks located in foreign jurisdictions, often for benefits such as tax efficiency, privacy, asset protection, and access to specialized financial services.

Which countries are the most crypto-friendly for offshore banking?

Top crypto-friendly countries include Switzerland, Singapore, Liechtenstein, the Cayman Islands, Puerto Rico, and the UAE due to their favorable regulations, tax policies, and advanced financial infrastructure.

Are offshore crypto banks legal and safe to use?

Yes, offshore crypto banks are legal when operating within regulated jurisdictions. Safety depends on the bank’s regulatory compliance, cybersecurity measures, and reputation in the financial industry.

What are the main benefits of offshore banking for crypto investors?

Benefits include enhanced privacy, reduced tax liabilities, asset protection, multi-currency support, and access to crypto-specific financial services like custody, loans, and staking.

What are the risks of offshore crypto banking?

Risks include regulatory changes, banking restrictions on crypto transactions, KYC/AML compliance challenges, limited access to funds during audits, and cybersecurity threats.

How do I choose the best offshore crypto-friendly bank?

Evaluate factors such as the bank’s licensing, reputation, security protocols, crypto transaction policies, fee structures, and additional financial services like wealth management and tax planning.

Can I get loans against my cryptocurrency holdings in offshore banks?

Yes, many offshore banks, such as SEBA and Sygnum, offer crypto-backed loans, allowing you to borrow fiat currencies while using your digital assets as collateral.

What documents are required to open an offshore crypto bank account?

Commonly required documents include proof of identity, proof of address, source of funds documentation, business details (if applicable), and crypto transaction history for KYC/AML compliance.

What is the best offshore bank for crypto privacy and security?

Switzerland’s SEBA and Sygnum banks are highly regarded for their strong privacy laws, regulatory clarity, and top-tier security measures, including cold storage and encrypted transactions.

What trends are shaping the future of offshore crypto banking for HNWIs?

Emerging trends include the integration of decentralized finance (DeFi) services, crypto-backed investment products, enhanced regulatory frameworks, and the growing adoption of blockchain technology by traditional financial institutions.