- Key Takeaways

- What Are Binance and Coinbase in 2025?

- Why Compare Binance vs. Coinbase for Beginners?

- Binance vs. Coinbase: Ease of Use for Beginners in 2025

- Coinbase’s Design

- Binance’s Learning Curve for Newbies

- Which Wins for Ease of Use?

- Binance vs. Coinbase: Fees for Beginners in 2025

- Binance Fees Explained

- Binance vs. Coinbase: Security for Beginners in 2025

- Binance vs. Coinbase: Features for Beginners in 2025

- Binance vs. Coinbase: Availability

- Binance vs. Coinbase: Customer Support in 2025

- How to Choose Between Binance and Coinbase in 2025

- Final Thoughts

- Related Questions

Crypto in 2025 is booming, will Binance or Coinbase kickstart your journey? If you’re a beginner stepping into the world of cryptocurrency, choosing the right exchange can feel like navigating a maze. This article is for you: crypto newbies exploring two of the biggest names in the game—Binance and Coinbase. We’re diving into a head-to-head comparison tailored for new investors in 2025, breaking down which crypto exchange best suits your needs. Whether you’re buying your first Bitcoin or trying altcoins, this comparison guide will help you decide with confidence.

As of March 11, 2025, the crypto landscape continues to evolve, with Binance and Coinbase leading the charge. Updated March 2025 for the latest insights, this comparison reflects current trends, fees, and features to ensure you’re getting the most relevant advice. We’re looking globally—because crypto knows no borders. but we’ll zoom in with U.S.-specific notes where it matters, like Binance.US restrictions or Coinbase’s nationwide reach. Why does this matter? For beginners, picking a beginner-friendly exchange can mean the difference between a smooth start and a frustrating flop. The stakes are high: usability, cost, security, and support all play a role in your success.

So, how do we figure this out? By comparing Binance vs. Coinbase across key factors—ease of use, fees, safety, and more—we’ll provide actionable tips to guide your choice. Do you prioritize a simple interface or lower costs? Are you in the U.S. or trading abroad? We’ve got you covered with practical steps to get started. Here’s the key takeaway:

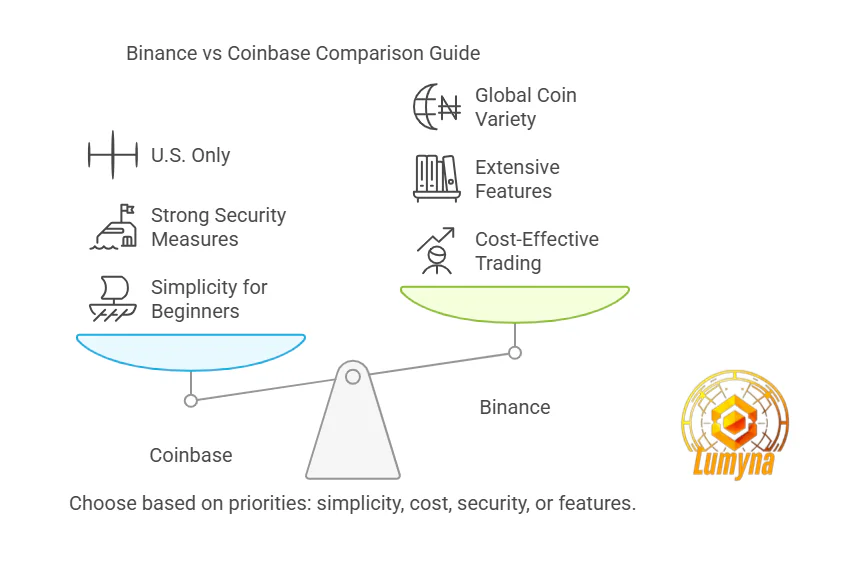

Coinbase excels in simplicity, making it a go-to for first-timers, while Binance shines in savings, appealing to cost-conscious learners. Let’s explore which one’s right for you in 2025.

Key Takeaways

- Coinbase is best for simplicity: Its clean interface, Learn and Earn ($5 in 10 minutes), and phone support make it ideal for beginners starting in 2025—test with $10 for ease

- Binance saves money: With 0.1% fees ($0.05 on $50) vs. Coinbase’s $0.99, Binance cuts costs—use Lite mode and BNB for 25% off if you’re budget-focused.

- Security leans Coinbase: Never hacked, with insurance and 2FA, Coinbase beats Binance’s SAFU-backed resilience (post-2019 hack)—secure either with 2FA and wallets.

- Features favor Coinbase for newbies: Staking (5-10%) and curated tools keep it simple; Binance’s 600+ coins and higher staking (5-15%) suit the curious—start small.

- U.S. access tips to Coinbase: Available in all 50 states and 100+ countries, it’s more reliable than Binance.US (limited in NY, TX)—check your region, then decide.

Binance vs. Coinbase: What You Need to Know

Before diving into the nitty-gritty of Binance vs. Coinbase, let’s set the stage with what these platforms are and why they matter for beginners in 2025. Whether you’re looking to trade your first crypto or stake for passive income, understanding the basics of these exchanges is step one. This section breaks it down, giving you a clear picture of what’s on offer as of March 11, 2025, and why comparing them is worth your time.

What Are Binance and Coinbase in 2025?

Binance and Coinbase are powerhouse crypto exchanges designed for trading, staking, and learning digital assets.

Binance, founded by Changpeng Zhao in 2017, is the global leader, known for its vast reach and feature-packed platform. Coinbase, launched in 2012 by Brian Armstrong, is a U.S.-focused pioneer that’s become synonymous with beginner-friendly crypto access.

By 2025, both have evolved with updated features to meet the growing demands of users worldwide.

Binance operates globally, with a U.S.-specific version (Binance.US), while Coinbase spans over 100 countries, including all 50 U.S. states. Their mission? To make crypto accessible, but they take different paths to get there.

Here’s a quick snapshot of their offerings:

- Binance: 600+ coins, from Bitcoin to obscure altcoins, plus staking and advanced trading tools.

- Coinbase: 200+ coins, curated for quality, with simple staking and educational resources.

These numbers highlight Binance’s variety versus Coinbase’s streamlined approach, a key distinction we’ll explore further.

Why Compare Binance vs. Coinbase for Beginners?

Why compare Binance against Coinbase? Because beginners need clarity in a crowded market with many options. The best crypto exchange comparison for 2025 beginners—like this one—cuts through the noise to focus on what matters: ease, cost, and trust. Here’s why it’s critical:

- Overwhelm: Too many platforms confuse newbies—Binance and Coinbase are proven starting points.

- Learning Curve: Beginners deserve a platform that matches their skill level.

- Future-Proofing: Picking the right exchange now sets you up for success in 2025 and beyond.

For someone just starting, this comparison isn’t just helpful—it’s essential. Binance and Coinbase dominate for a reason, but their differences could shape your crypto journey. Let’s dig deeper.

Binance vs. Coinbase: Ease of Use for Beginners in 2025

For crypto beginners in 2025, ease of use is everything. A clunky interface or steep learning curve can turn excitement into frustration fast. So, how do Binance and Coinbase stack up when it comes to getting started?

As of March 11, 2025, both platforms cater to newbies, but their approaches differ sharply. This section breaks down Coinbase and Binance design and which one takes the crown for simplicity. Whether you’re buying your first crypto or just exploring, here’s what you need to know.

Our Rating

Coinbase’s Design

Coinbase shines as the go-to for beginners, thanks to its clean user interface (UI) and thoughtful onboarding process. How does it pull this off? From the moment you sign up, Coinbase feels like a friendly guide, not a tech overload.

Its dashboard is intuitive, think big buttons, clear labels, and no jargon overload. Plus, Coinbase Learn offers free tutorials that teach you crypto basics while rewarding you with small amounts of free coins. It’s a win-win: you learn, you earn, and you don’t feel lost.

Here’s how to buy crypto on Coinbase:

- Sign up

- Verify

- Buy

- Create an account

- Add ID and payment method

- Select crypto and pay

- 2 minutes

- 5 minutes

- 3 minutes

- Total time? About 10 minutes from zero to owning crypto. That’s hard to beat for someone who doesn’t know a wallet from a blockchain. Coinbase’s focus on simplicity makes it a haven for new investors who want to dip their toes without drowning in options.

Binance’s Learning Curve for Newbies

Binance, on the other hand, is a bit of a double-edged sword. It’s the world’s largest exchange for a reason—offering everything from spot trading to futures, but that power comes with complexity.

For beginners, the default interface can feel like staring at a spaceship dashboard: charts, order books, and 600+ coins vying for attention.

How does it help newbies?

Binance offers a “Lite” mode, stripping things down to basics like buying, selling, and staking. It’s a lifeline, but you have to know to switch to it—something a rookie might miss.

Even in Lite mode, Binance packs more features than Coinbase, which can still intimidate newbies. Want to buy Bitcoin? You’ll get it done, but the extra options (margin trading, anyone?) might loom overhead.

Pro Tip: Stick to Binance Lite for simplicity. It’s not as polished as Coinbase’s one-size-fits-all ease, but it gets the job done if you’re willing to poke around a little.

Which Wins for Ease of Use?

So, who’s the best crypto exchange for beginners in 2025?

Coinbase leads for beginners, hands down. Its streamlined design and educational nudge give newbies a soft landing in crypto’s wild world. Binance tries with Lite mode, but it is still a step behind in the simplicity.

Coinbase doesn’t just lower the barrier—it practically removes it, letting you focus on learning crypto, not the platform.

Winner: Coinbase. If you’re starting from scratch and want to be trading in minutes without a headache, Coinbase is your pick. Binance has its perks (we’ll get to those), but for ease of use, Coinbase is the beginner’s best friend in 2025.

Binance vs. Coinbase: Fees for Beginners in 2025

Our Rating

Fees can make or break your crypto experience, especially as a beginner in 2025. Every dollar counts when you’re starting small, so understanding what you’ll pay on Binance and Coinbase is crucial.

As of March 11, 2025, these platforms take different approaches to pricing—one’s straightforward but pricier, the other’s cheaper but requires a little know-how. This section unpacks Coinbase’s fee structure, Binance’s cost-saving edge, and which one wins for budget-conscious newbies. Let’s dive into the numbers and see how they impact your wallet.

Coinbase Fees Explained

Coinbase keeps things simple, but that ease comes at a cost. What are the fees?

For its Advanced Trading platform, you’ll pay 0% to 0.60% per trade (maker/taker fees), depending on your 30-day trading volume—pretty competitive for serious traders.

But for beginners using the “simple buy” option, fees jump higher, often 1.49% to 3.99%, depending on payment method (e.g., debit card vs. bank transfer).

Why the premium? Coinbase bundles convenience into those rates, covering conversion and processing costs. It’s transparent, but it stings on small trades.

Here’s how Coinbase fees scale with trade size:

| Trade Size | Simple Buy Fee | Cost |

| $10 | 3.99% (min $0.99) | $0.99 |

| $100 | 1.49% | $1.49 |

For a $10 Bitcoin buy, you’re paying nearly 10% in fees—ouch. Beginners often start small, so these costs add up fast. Coinbase’s clarity is a plus, but the price tag might make you think twice.

Binance Fees Explained

Binance, by contrast, is a the cheapest place to buy crypto. What’s the deal?

Spot trading fees are a flat 0.1% globally (0% to 0.38% on Binance.US), whether you’re buying or selling.

That’s a fraction of Coinbase’s simple buy rates. Plus, Binance has a better offer: “pay with its native BNB token, and you’ll slash fees by 25%. The “Save 25% with BNB—here’s how” offer“

If you enable the “Use BNB for fees” option in your account settings, then hold some BNB (usually pennies per trade). A $100 trade drops from $0.10 to $0.075—small, but it scales.

Binance’s low base rate shines for frequent or larger trades, and there’s no “convenience” markup like Coinbase’s. The catch? You’ll need to navigate to the trading interface (Lite mode works fine) instead of a one-click buy. For beginners willing to learn a little, the savings are worth it.

Which Is Cheaper?

Binance wins for cost—hands down.

Coinbase’s simplicity is expensive: a $10 trade costs $0.99, while Binance charges just $0.01 (or $0.0075 with BNB). That’s a 100x difference! Even on a $100 trade, Binance’s $0.10 beats Coinbase’s $1.49 by a mile.

Why does this matter for beginners? Early trades are often small as you test the waters, and high fees can eat into your gains—or discourage you altogether.

Coinbase argues its fees buy peace of mind, but Binance’s low rates empower you to keep more of your money. If you’re budget-conscious and okay with a slight learning curve, Binance is the clear champ. For tiny trades in 2025, it’s the smarter pick.

Binance vs. Coinbase: Security for Beginners in 2025

Our Rating

Security is a dealbreaker for crypto beginners in 2025.

When you’re trusting a platform with your hard-earned money, you need to know it’s safe from hackers, glitches, and shady practices.

As of March 11, 2025, Binance and Coinbase both have robust safety measures, but their track records and approaches differ. This section explores Coinbase’s rock-solid defenses, Binance’s battle-tested resilience, and which one earns your trust as a newbie.

Spoiler: peace of mind matters more than you might think.

Coinbase’s Safety Features

Coinbase sets the gold standard for security, especially for beginners who prioritize trust. What’s in its arsenal? It stores 98% of user funds in cold storage—offline vaults untouchable by hackers. The remaining 2% online is backed by insurance, covering losses from breaches (not user errors, though). Two-factor authentication (2FA) is standard, and biometric logins add an extra layer. Why does this matter? Coinbase has never been hacked as of 2025, a rare feat in crypto’s wild west. Its U.S.-based, SEC-regulated status further cements its reliability.

Here are the Top 3 Coinbase Security Tips for beginners:

- Enable 2FA (use an app like Google Authenticator, not SMS).

- Store big holdings in Coinbase Wallet, separate from the exchange

- Double-check email links—phishing is the real threat.

Coinbase’s focus on compliance and a clean slate make it a better for newbies who can’t afford to lose a dime.

Binance’s Safety Features

Binance takes a different tack, blending proactive safeguards with a history of resilience. What’s its setup?

The Secure Asset Fund for Users (SAFU), launched in 2018, acts as an emergency reserve, funded by 10% of trading fees.

Most assets are in cold storage, and 2FA is mandatory. Binance faced a $40 million hack in 2019 but fully reimbursed users via SAFU—proof it can bounce back. Post-2023 Binance security upgrades upped the ante: real-time monitoring, AI-driven fraud detection, and withdrawal whitelists now bolster its defenses.

Why the upgrades?

Regulatory scrutiny and a 2023 plea deal pushed Binance to tighten up. It’s not spotless like Coinbase, but its global scale—handling billions daily—shows it’s no pushover. For beginners, Binance’s past hiccups might raise eyebrows, but its recovery game is strong.

Which Is Safer?

So, which platform is safer for beginners in 2025?

Coinbase beats Binance, thanks to its unblemished record and beginner-friendly trust factor. Binance’s SAFU and upgrades are impressive—especially for a platform serving millions—but its 2019 breach lingers in memory, even if it paid up.

Coinbase’s never-been-hacked status, plus insurance and U.S. oversight, feels like a warm blanket for newbies who’d rather not test a platform’s resilience.

Binance argues it’s battle-hardened, and that’s fair—SAFU has your back if disaster strikes. But for someone just starting, why gamble?

Coinbase’s simplicity extends to its security: no past scars, no “what ifs.”

Winner: Coinbase—beginner trust priority. If your goal is to sleep easy knowing your $50 in Bitcoin is safe, Coinbase delivers that peace of mind in 2025. Binance is secure, but Coinbase feels invincible.

Binance vs. Coinbase: Features for Beginners in 2025

When you’re new to crypto in 2025, the features a platform offers can shape your journey—whether it’s earning rewards or exploring coins.

Binance and Coinbase both cater to beginners, but their toolkits differ in scope and style.

As of March 11, 2025, these exchanges have honed their offerings, balancing simplicity with opportunity. This section digs into Coinbase’s beginner-friendly perks, Binance’s broader options, and which one takes the lead for newbies. Let’s see what’s on the table.

Coinbase Features for Newbies

Coinbase keeps it simple and rewarding for beginners. What’s the draw?

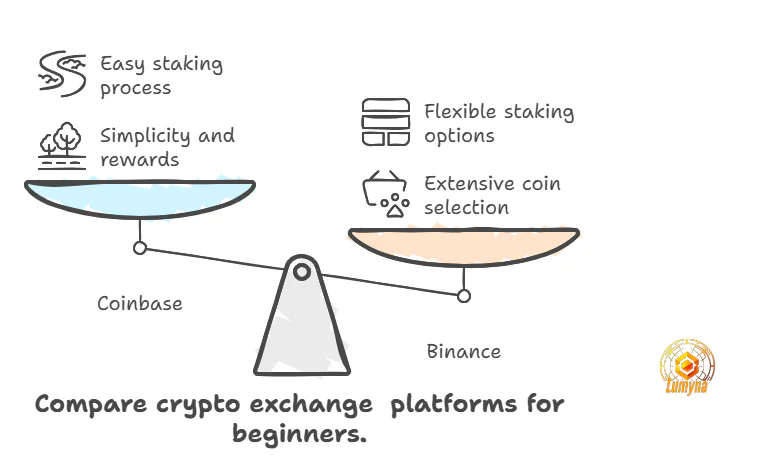

Two standout features: staking and Learn and Earn. Staking lets you lock up coins like Ethereum or Solana to earn passive income—think of it as crypto savings with up to 5-10% annual rewards, depending on the asset. It’s easy: pick a supported coin, stake it, and watch rewards roll in every few days. No tech wizardry required. Then there’s Learn and Earn, a gem for newbies. Watch short videos or read bite-sized lessons about crypto, answer a quiz, and pocket free coins—usually $1 to $5 per task.

Earn $5 in 10 minutes—Coinbase guide: Sign up, head to Coinbase Learn, pick a lesson (say, on Stellar Lumens), watch a 2-minute video, ace the quiz, and claim your $5 in XLM. Repeat a couple times, and you’ve got a small stack to start trading. It’s not just freebies—it’s a crash course in crypto basics, perfect for building confidence. Coinbase curates these features tightly, ensuring you’re not overwhelmed, making it a cozy entry point in 2025.

Binance Features for Newbies

Binance throws a wider net, offering beginners more to play with. What’s on offer?

This variety means more chances to explore, though it can feel like drinking from a firehose. Staking is here too, with options galore: lock up coins like BNB or Cardano for rewards often hitting 5-15%, depending on terms (flexible or fixed). Binance’s “Lite” mode simplifies this, letting newbies stake without diving into advanced settings.

Here’s a quick look at Binance vs Coinbase staking rewards:

| Feature | Binance | Coinbase |

| Staking Coins | 100+ (e.g., BNB, ADA) | 10+ (e.g., ETH, SOL) |

| Typical APY | 5-15% | 5-10% |

| Minimum Stake | Often $1-$10 | Varies, ~$1 |

| Flexibility | Fixed or Flexible | Mostly Fixed |

Binance’s edge? More coins and higher potential yields, though you’ll need to pick wisely—some options lock funds for 30-90 days. It’s less hand-holding than Coinbase, but the payoff can be bigger if you’re curious and proactive.

Which Has Better Features?

So, which platform wins for beginners in 2025? Coinbase takes the crown for curated simplicity.

Our Rating

Coinbase staking is straightforward due to the fewer coins, yes, but no guesswork. Learn and Earn doubles as education and a quick cash grab, ideal for someone who’s just landed in crypto land.

Binance’s wider coin options and staking flexibility are tempting, but they come with a catch: more choices mean more decisions, which can paralyze a newbie. Coinbase trims the fat, delivering what you need without the clutter.

Why Coinbase? It’s like training wheels—safe, guided, and rewarding. Binance suits the bold beginner ready to experiment, but for most starting out in 2025, Coinbase’s focused features hit the sweet spot. You’ll grow faster without getting lost.

Binance vs. Coinbase: Availability

Our Rating

Where can you use Binance and Coinbase in 2025? For beginners, availability is a make-or-break factor—nothing’s worse than finding the perfect platform only to discover it’s off-limits in your region.

As of March 11, 2025, Binance and Coinbase dominate the crypto scene, but their global footprints differ, especially for U.S. users. This section explores Coinbase’s worldwide reach, Binance’s more complex map (including Binance.US limitations), and which exchange comes out on top for accessibility. Let’s break it down so you know where you stand.

Coinbase’s Global Reach

Coinbase boasts an impressive scope in 2025, operating in over 100 countries and all 50 U.S. states. Where does it shine?

Everywhere from Canada to Kenya, Australia to Argentina—Coinbase has built a reputation for broad, reliable access. In the U.S., it’s a seamless fit, with no state exclusions, thanks to its strict adherence to regulations like those from the SEC. This makes it a go-to for Americans dipping their toes into crypto, whether you’re in New York or Nebraska. Why so widespread?

Coinbase’s (COIN) public status (listed on Nasdaq since 2021) and focus on compliance mean it’s welcome where others stumble.

Not sure if Coinbase is available where you are? Check Coinbase in your region—visit their official availability page for the latest list. It’s a quick way to confirm you’re in the clear. For beginners, this universality is a big win—no VPNs or workarounds needed, just sign up and start trading.

Binance’s Global Reach

Binance’s reach is a tale of two platforms.

Globally, it’s a juggernaut, serving over 180 countries with its main exchange—think France, Japan, or the UAE.

But for U.S. users, it’s a different story: Binance.US is the only option, and it’s not as far-reaching. Where’s it limited?

Post-2023 scrutiny (including a $4.3 billion fine), some states like Michigan have paused new signups, and others restrict features like USD trading.

Binance.US vs. Binance global differences: The global platform offers 600+ coins and advanced tools like futures trading, while Binance.US caps at 150+ coins and skips margin or futures due to U.S. laws. Globally, Binance is a beast; in the U.S., it’s a tamed version, built to comply but less robust. Beginners outside the U.S. can tap into the full Binance experience, but Americans face a narrower path.

Which Is More Accessible?

Who wins the availability race for beginners in 2025? Binance takes the lead, especially for newbies.

Binance vs. Coinbase: Customer Support in 2025

Our Rating

When you’re a crypto beginner in 2025, good customer support can be a lifeline—whether you’re locked out of your account or confused about a trade. Binance and Coinbase both promise help, but how they deliver it varies.

As of March 11, 2025, support quality is a hot topic for newbies who need fast, reliable answers. This section breaks down Coinbase’s support options, Binance’s responsiveness (especially on X), and which crypto exchanges has the best support beginners. Let’s see who’s got your back when things go sideways.

Coinbase Support Options

Coinbase offers a trio of support channels: phone, live chat, and email. How does it work? Phone support (1-800-HELP-COIN) is a rare gem in crypto—ideal for urgent issues like a frozen withdrawal.

Live chat, available 24/7 for logged-in users, tackles quick questions, while email suits detailed problems, with replies often in 24-48 hours. Why does this matter?

Beginners need hand-holding, and Coinbase’s phone line feels like a safety net—especially if you’re panicking over a $50 trade gone wrong. That said, response times can lag; high volumes mean chat wait times stretch to 10-20 minutes, and email isn’t instant.

Fastest Coinbase support help: Use X. Tweet @CoinbaseSupport with your issue (keep it vague, no sensitive details), and you’ll often get a reply—or at least a nudge—faster than chat. It’s not official escalation, but public visibility lights a fire. Coinbase’s multi-channel approach is solid, but speed isn’t always its strength.

Binance Support Options

Binance leans on digital-first support: live chat and X responsiveness. How does it function?

Chat, accessible via the app or site, is your main route—24/7, with AI bots handling basics before humans step in. Wait times hover around 15-30 minutes during peak hours. Email’s phased out for most queries, but Binance shines on X.

Binance X support—real user examples: In January 2025, @CryptoJane tweeted @BinanceHelpDesk about a stuck deposit; they replied in 2 hours with a fix. @TraderMike got a phishing warning resolved in 90 minutes after posting in February. Why X? Binance’s team monitors it closely, often outpacing chat for public queries.

Binance’s global scale means high ticket volumes, but its X game gives beginners a workaround. No phone line hurts, though—newbies craving a human voice are out of luck. It’s efficient if you’re tech-savvy, less so if you’re not.

Which Offers Better Support?

Who wins for beginners in 2025? Coinbase is the winner in support because of its phone option.

Binance’s chat and X responsiveness are strong—especially if you’re comfortable tweeting—but Coinbase’s broader toolkit (phone, chat, email) feels more beginner-friendly. Why the edge? A newbie locked out at 2 a.m. can call Coinbase and hear a voice, while Binance leaves you typing. X speeds things up for both, but Coinbase’s phone line tips the scale.

Both struggle with delays—crypto’s growth in 2025 taxes support teams—but Coinbase’s variety beats Binance’s digital-only focus. For beginners needing reassurance, Coinbase delivers just a bit more in a pinch.

How to Choose Between Binance and Coinbase in 2025

By now, you’ve seen how Binance and Coinbase stack up in 2025—simplicity versus savings, security versus variety.

But how do you, a crypto beginner, pick the right one? It’s not about which platform is “best” overall; it’s about what’s best for you on March 11, 2025, and beyond.

This section gives you a clear, actionable roadmap to decide between Binance and Coinbase, tailored to your needs. Whether you’re in the U.S. or abroad, here’s how to choose with confidence in just a few steps.

First, define your goals. What matters most? If you want a dead-simple start—think “buy Bitcoin in 10 minutes”—Coinbase’s clean design and Learn and Earn perks are your match.

Prioritizing savings? Binance’s 0.1% fees (or lower with BNB) beat Coinbase’s pricier simple buys, especially for small trades. Are you U.S.-based and need guaranteed access? Coinbase covers all 50 states; Binance.US skips a few. Your “why” shapes your choice—simplicity for ease, savings for growth.

Next, test with $10. Don’t commit big upfront. Sign up for both (it’s free), deposit $10, and buy a fraction of Bitcoin or Ethereum. On Coinbase, you’ll pay ~$0.99 in fees—pricey but painless. On Binance, it’s $0.01 (Lite mode)—cheap but slightly trickier. Feel the vibe: Is Coinbase’s polish worth the cost? Does Binance’s interface click after a try? This hands-on test, doable in 20 minutes, reveals what suits you.

Finally, secure your account. Whichever you pick, lock it down. Enable 2FA (use an app, not SMS), set a strong password, and whitelist withdrawal addresses (Binance) or use Coinbase Wallet. Why? A hacked $10 is a cheap lesson; a hacked $100 isn’t. Security seals the deal.

Here’s your 5-Minute Decision Checklist:

- Do I want simplicity (Coinbase) or low fees (Binance)?

- Is my state/country supported (check Coinbase’s 100+ vs. Binance.US gaps)?

- How’s the $10 test—smooth or stressful?

- Did I enable 2FA and extra security?

- Which feels right for my crypto goals?

By March 2025, your choice is clear: Coinbase for an easy start, Binance if you’re ready to save and explore. Test, secure, and jump in—you’re ready.

Final Thoughts

After comparing Binance vs. Coinbase for beginners, the verdict is clear: each platform has a superpower for beginners, but your needs decide the winner. What’s the takeaway?

Coinbase excels for ease, Binance for cost—two paths for newbies stepping into crypto’s wild world on March 11, 2025.

This isn’t about crowning a universal champ; it’s about matching your goals to the right tool. Let’s recap why and how these exchanges fit into your journey.

Coinbase is the gentle guide. Its clean interface, Learn and Earn perks, and phone support make it a haven for anyone who’s never heard of a private key. Security? Spotless—never hacked, with insurance to boot. Availability? All 50 U.S. states and 100+ countries. Sure, fees sting ($0.99 on a $10 trade), but you’re paying for simplicity—a fair trade when you’re just starting.

Binance, meanwhile, is the thrifty adventurer’s pick. With 0.1% fees (or $0.01 on $10), 600+ coins, and staking options, it saves cash and opens doors. The catch? A steeper learning curve and spotty U.S. access (Binance.US skips states like New York). It’s secure—SAFU-backed—but lacks Coinbase’s pristine trust factor.

So, who’s it for? If you’re a beginner craving a smooth launch, Coinbase is your 2025 go-to. Want to stretch your dollars and don’t mind a little DIY? Binance shines.

Best for 2025 beginners: Start simple, scale up. Kick off with Coinbase to learn the ropes—stake some ETH, earn $5 via tutorials. As confidence grows, graduate to Binance for cheaper trades and broader horizons. Where you start matters, but growth is the goal. Sign up today—Coinbase for comfort, Binance for ambition—and take your first crypto step in 2025.

Related Questions

How to pick between Binance.US and Coinbase?

Check your state—Coinbase works in all 50, Binance.US skips some like New York. Prioritize ease? Go Coinbase. Want lower fees? Pick Binance.US. Test both with $10 to feel the vibe, then choose based on comfort and cost.

Which exchange saves more on $50 trades?

Binance.US wins—0.1% fee ($0.05) vs. Coinbase’s $0.99 simple buy fee. Use Binance.US spot trading or Coinbase Advanced (0-0.60%) to cut costs. Compare a $50 trade on both to see the difference.

How to stake on Binance vs. Coinbase?

On Coinbase, pick ETH, click “Stake,” and confirm—easy, 5-10% APY. Binance offers 100+ coins: use Lite mode, select “Earn,” choose a coin (e.g., BNB), and lock it for 5-15%. Start small, test both.

Is Binance safe post-2023 hack for beginners?

Yes, SAFU covers hacks, and 2023 upgrades (e.g., AI fraud detection) boost security. Enable 2FA and whitelists. It’s safe enough—start with $10 to build trust.

What’s Coinbase Learn vs. Binance Academy?

Coinbase Learn: Watch videos, earn $5 in 10 minutes—great for basics. Binance Academy: Read detailed guides, no rewards—deeper learning. Try Coinbase first, then Academy later.

Top Binance and Coinbase alternatives 2025?

Kraken (security), Coinmama, Bybit, Poloniex,Bitfinex, KuCoin (variety), and Gemini (U.S. compliance) shine. Sign up, deposit $10, and test features—pick based on fees and ease.