The Future of Bitcoin Has Never Looked Brighter

Bitcoin ($BTC) has had its fair share of volatility, skepticism, and regulatory hurdles. But as we move further into 2025, the signs are clearer than ever—Bitcoin is on a trajectory toward new highs, and this time, it’s not just speculation. The cryptocurrency’s fundamentals have never been stronger, and three key forces are shaping its inevitable rise: political support, influential figures like Elon Musk, and the unwavering backing of institutional investors such as MicroStrategy, which now holds over $47 billion in Bitcoin as of February 20, 2025.

While past bull runs were often driven by retail speculation, the next decade will be different. The Bitcoin ecosystem is maturing, and its journey to becoming a truly global asset is now fueled by confidence from governments, tech leaders, and financial giants.

Trump’s Pro-Bitcoin Stance: A Game-Changer for Confidence

One of the biggest shifts in recent years has been the changing political climate surrounding Bitcoin. The return of Donald Trump to the political stage has injected a renewed sense of optimism among Bitcoin advocates. Unlike past administrations that viewed cryptocurrency as a regulatory headache, Trump has positioned himself as a supporter of financial innovation and a champion of free markets, a stance that naturally aligns with Bitcoin’s ethos.

While his policies may not be explicitly pro-crypto, his administration has signaled a willingness to embrace Bitcoin rather than fight it. With increasing pressure on traditional financial institutions due to inflation and economic uncertainty, Bitcoin is emerging as a viable alternative store of value. If the U.S. moves toward a more Bitcoin-friendly regulatory environment, it could set the stage for institutional investors to go all in, pushing prices to levels we haven’t seen before.

Elon Musk’s Influence: The “Bitcoin Effect” in Full Force

Elon Musk has been a key figure in the crypto space for years, with his tweets and actions often sending markets into a frenzy. While Musk’s love for Dogecoin ($DOGE) is well-documented, his relationship with Bitcoin has remained strategic and long-term.

Tesla’s early Bitcoin purchases and Musk’s continued endorsement of decentralized financial systems highlight his belief in Bitcoin as a hedge against inflation and a long-term asset. The more Musk and other high-profile figures publicly support Bitcoin, the more it strengthens public trust in Bitcoin’s long-term viability.

Beyond just buying and holding BTC, Musk’s companies, from Tesla to SpaceX, are exploring ways to integrate Bitcoin into their business models. Whether it’s using BTC for payments, energy solutions for mining, or other crypto-based innovations, Musk remains a pivotal force in mainstream Bitcoin adoption.

Institutional Confidence: MicroStrategy’s $47 Billion Bitcoin Bet

The biggest game-changer in Bitcoin’s long-term trajectory is undoubtedly institutional adoption. The days of Bitcoin being dismissed as a niche asset are long gone. Today, financial giants, hedge funds, and publicly traded companies are accumulating Bitcoin like never before.

MicroStrategy, led by Michael Saylor, has been at the forefront of this movement. As of February 20, 2025, the company now holds over $47 billion worth of Bitcoin, making it the single largest corporate holder of BTC.

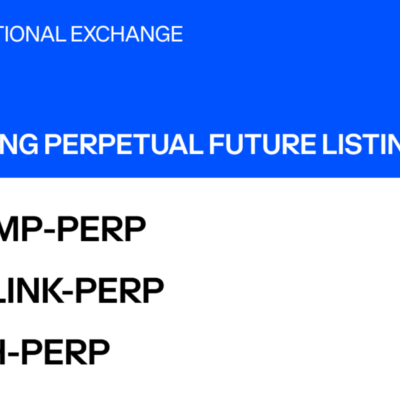

Caption: “If the ducks quack feed them” Source

Saylor’s strategy is clear: Bitcoin is the ultimate store of value. His bet on Bitcoin isn’t about short-term price movements; it’s about positioning the company for long-term wealth preservation and growth.

But MicroStrategy is just one piece of the puzzle. Other institutional investors, sovereign wealth funds, and even nation-states are accumulating Bitcoin, signaling that its role as a global reserve asset is becoming more solidified. If more companies follow MicroStrategy’s lead, Bitcoin’s supply shock could push prices to unprecedented levels.

Bitcoin’s Next Decade: What’s in Store?

Looking ahead, the next decade will be a defining era for Bitcoin. Unlike previous cycles driven purely by hype, Bitcoin now has real-world momentum. Here’s why its growth is inevitable:

✅ Supply is Fixed, Demand is Rising: With only 21 million BTC ever to exist, scarcity will continue to drive long-term value appreciation. As demand surges, supply constraints will fuel price growth.

✅ Institutional Investment Will Accelerate: More companies, pension funds, and even governments will add Bitcoin to their balance sheets. When big money moves in, the price follows.

✅ Regulatory Clarity Will Improve: Governments are slowly realizing that banning Bitcoin is not an option. Clearer regulations will give institutional investors more confidence to invest heavily.

✅ Bitcoin as a Global Reserve Asset: Some analysts predict that Bitcoin could replace gold as the ultimate safe-haven asset, pushing its valuation well beyond current levels.

Final Thoughts: A Bitcoin Supercycle? A Bitcoin new highs Expected?

With political backing, visionary leaders, and institutional adoption, Bitcoin is set to embark on what many call a supercycle—a period of sustained, long-term price appreciation.

While short-term volatility will remain, the macro trends point to an inevitable rise in Bitcoin’s value over the next decade. Whether you’re a retail investor or an institution, one thing is clear: Bitcoin is no longer just an alternative asset—it’s the future of global finance.

🚀 Are you ready for Bitcoin’s next big move? What is the next Bitcoin new highs mean? The countdown to a new all-time high has already begun.