February 27, 2025

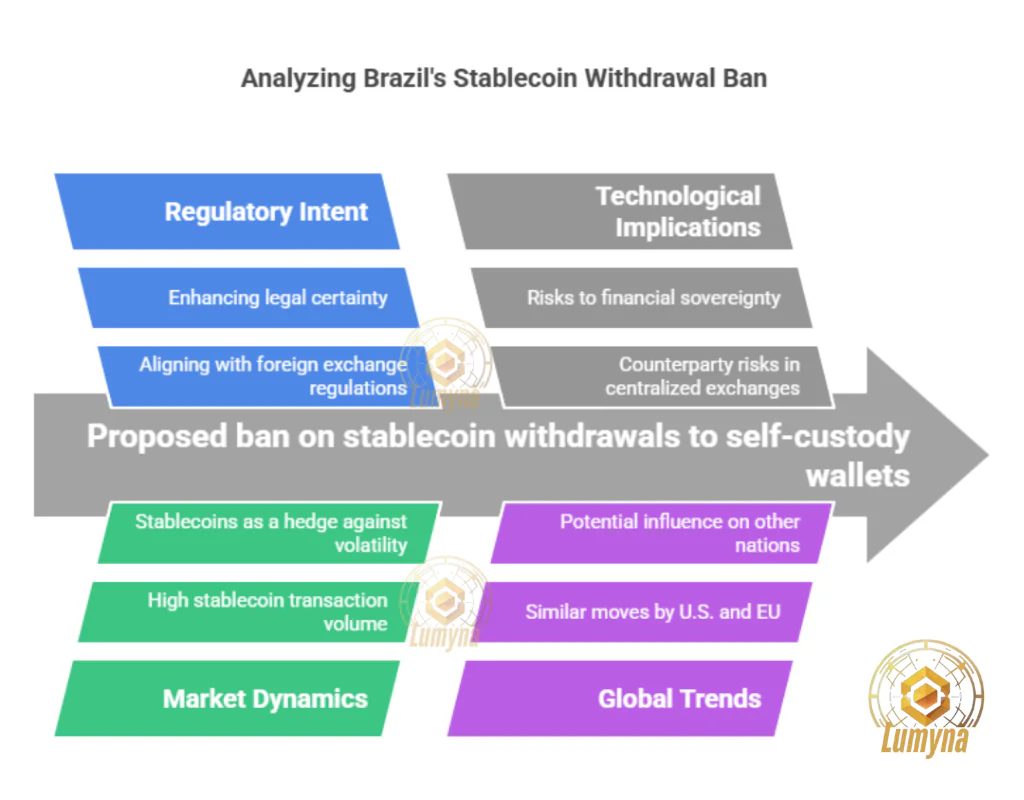

In a bold step toward tightening control over digital assets, the Central Bank of Brazil (BCB) has proposed a groundbreaking regulation that could reshape the country’s crypto landscape. A public consultation notice, first reported by Gino Matos on November 29, 2024, via CryptoSlate, reveals the BCB’s intent to prohibit centralized exchanges from allowing stablecoin withdrawals to self-custody wallets. This move, part of a broader regulatory framework stemming from Brazil’s 2022 crypto bill, signals a shift toward centralized oversight in a nation that’s become a hotbed for cryptocurrency adoption.

The proposal targets stablecoins, referred to by the BCB as “tokens denominated in foreign currencies”, and aims to restrict their transfer between residents in scenarios where Brazilian law already permits foreign currency payments. The BCB frames this as a necessary adaptation, stating, “The initiative reflects our commitment to adapting the financial system to the realities of digital assets while safeguarding the integrity of international capital flows.” With the consultation period open until February 28, 2025—the current date—market participants have a narrow window to voice concerns, though the BCB retains the authority to push forward regardless of feedback.

Brazil stablecoin ban: A Crypto Crackdown?

This isn’t a blanket crypto crackdown. The BCB’s proposal seeks to balance innovation with stability, outlining three key activities for virtual asset service providers in the foreign exchange market: facilitating international payments and transfers via crypto, offering exchange or custody services for tokens pegged to the Brazilian real for non-residents, and managing transactions tied to foreign currency-backed tokens. Centralized exchanges would need a foreign exchange license to handle stablecoin services, aligning them with traditional financial regulations. Crypto investments—both inbound and outbound—would also fall under the same rules as conventional capital flows, covering external credit, direct foreign investment, and Brazilian capital abroad.

Brazil Stablecoins

The stakes are high in Brazil, a significant crypto market. Data from the Internal Revenue Service (RFB) in November 2024 showed that 4.4 million Brazilians moved $4.2 billion in crypto in September alone. Stablecoins dominated, accounting for 71.4% of the value—roughly $3 billion—with Tether’s USDT leading at $2.77 billion. This massive volume underscores why the BCB is zeroing in on stablecoins: they’re a lifeline for cross-border transactions and a hedge against local currency volatility in a country with a history of economic turbulence.

Crypto Ethos,What does Brazil stablecoin ban mean?

Critics see this as a blow to crypto’s ethos of decentralization. Self-custody wallets—where users control their private keys—embody the “not your keys, not your coins” mantra. Barring withdrawals to these wallets could trap stablecoins within centralized exchanges, exposing users to counterparty risks and undermining financial sovereignty. For a population increasingly turning to crypto as an inflation shield, this could spark backlash. On the flip side, the BCB argues it’s enhancing legal certainty and competition in the foreign exchange market, potentially attracting institutional players who thrive under clear rules.

The timing is notable. With the consultation closing today, February 28, 2025, the crypto community is buzzing on platforms like X, where reactions range from alarm to cautious optimism. Some speculate this could curb illicit flows—Brazil’s porous financial borders have long been a concern—while others fear it’s a step toward stifling innovation. The BCB’s ability to override public input adds urgency to the debate, as the final rules could take effect swiftly.

Brazil Crypto Regulation

Globally, Brazil’s move fits a pattern of regulators grappling with stablecoins’ rise. From the U.S. to the EU, authorities are tightening grips on these assets, wary of their potential to disrupt monetary policy. Yet Brazil’s approach—targeting self-custody—stands out as particularly restrictive. As stablecoins like USDT cement their role in emerging markets, this could set a precedent, influencing other nations to follow suit or diverge.

For now, Brazil’s crypto users and exchanges brace for impact. If enacted, the ban could reshape how millions interact with digital assets, pushing stablecoin activity deeper into regulated channels. Whether this fosters a safer, more competitive market or alienates a thriving community remains to be seen. One thing’s clear: the BCB’s gamble will echo far beyond Brazil’s borders.