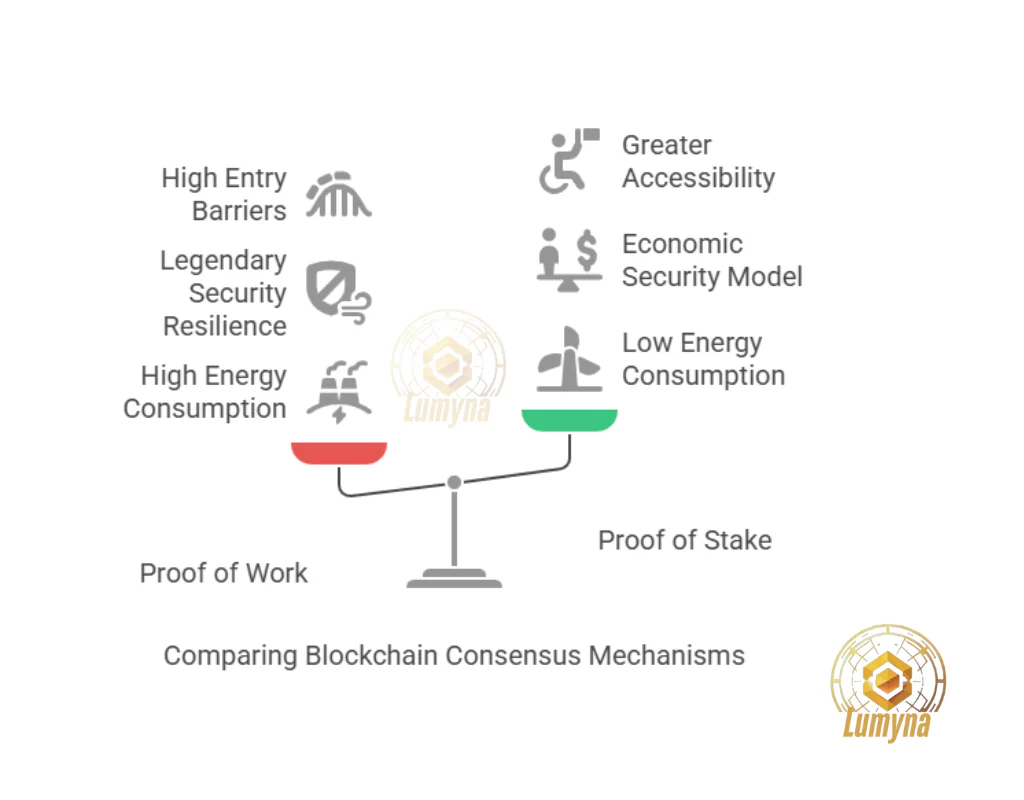

Proof of Work (PoW) and Proof of Stake (PoS) are the two most prominent consensus mechanisms powering blockchain networks, each shaping the evolution of decentralized technologies like cryptocurrencies. Introduced at different stages of blockchain’s history, they address the same core challenge, achieving agreement among distributed nodes without a central authority, but take fundamentally distinct paths. PoW relies on computational effort, while PoS relies on economic commitment. This comparison looks into their mechanics, strengths, weaknesses, use cases, and broader implications, highlighting why they remain important in the blockchain landscape as of today.

PoW vs PoS Origins and Evolution

PoW emerged first, pioneered by Satoshi Nakamoto with Bitcoin’s launch in January 2009. Nakamoto adapted earlier concepts, like Hashcash (1997) by Adam Back, designed to thwart email spam, into a system where miners compete to solve cryptographic puzzles, securing a decentralized ledger. This innovation birthed the cryptocurrency era, proving that trustless consensus could work at scale. Bitcoin’s success cemented PoW as the gold standard, adopted by early networks like Litecoin and Ethereum (until 2022).

PoS arrived later, introduced by Sunny King and Scott Nadal with Peercoin in 2012. It was a response to PoW’s escalating energy demands, offering a mechanism where validators are chosen based on the cryptocurrency they “stake” rather than their computing power. Ethereum’s transition to PoS in September 2022, dubbed “The Merge,” marked a turning point, shifting one of the largest blockchains away from PoW and spotlighting PoS as a viable, sustainable alternative. Today, PoS powers networks like Cardano, Tezos, and Binance Smart Chain, reflecting a growing shift in priorities.

Mechanics: PoW vs PoS Operation

PoW’s process is labor-intensive. Miners use specialized hardware (e.g., ASICs) to solve complex mathematical problems—finding a nonce that, when hashed with transaction data, yields a result below a network-defined target. This trial-and-error approach, known as hashing, requires immense computational power. The first miner to succeed adds a block to the chain, earning a reward (e.g., 6.25 BTC per block in 2025, halved every four years, plus fees). The network verifies the solution, and difficulty adjusts (e.g., every 2,016 blocks in Bitcoin) to maintain consistent block times, like 10 minutes. This “work” secures the chain by making tampering prohibitively costly—altering a block requires re-mining all subsequent ones.

PoS, conversely, is asset-driven. Validators lock up a portion of their cryptocurrency (e.g., 32 ETH for Ethereum) as a stake, signaling their commitment to the network’s integrity. The protocol selects validators to propose or attest to blocks, often based on stake size, duration, or randomization algorithms. For instance, staking 100 ETH in a 1,000 ETH pool gives a 10% chance of selection. Successful validation earns rewards (typically transaction fees), while misbehavior, like proposing invalid blocks, triggers “slashing,” where part of the stake is forfeited. PoS eliminates energy-heavy mining, relying instead on economic incentives to enforce honesty.

Security: Strengths and Vulnerabilities

How do PoW vs PoS security compare? PoW’s security is legendary. Bitcoin’s uninterrupted operation since 2009 demonstrates its resilience, its hash rate, a measure of total mining power, often exceeds 500 exahashes per second, making attacks like a 51% takeover (controlling majority hash power) astronomically expensive (billions of dollars daily). However, vulnerabilities exist: mining centralization in pools (e.g., Foundry USA, AntPool) concentrates power, and energy dependence ties security to electricity costs and availability.

PoS offers robust security differently. Attackers must acquire and stake a supermajority of a network’s cryptocurrency—e.g., 51% of Ethereum’s ETH, worth tens of billions in 2025, then risk losing it to slashing. This economic deterrent mirrors PoW’s cost barrier but avoids physical resources. Critics argue PoS is less battle-tested than PoW, citing theoretical risks like “nothing-at-stake” attacks (where validators support multiple chain forks cost-free), though modern implementations (e.g., Ethereum’s penalties) mitigate this. Wealth concentration—where rich stakers dominate—also poses a decentralization risk, though PoW’s mining pools face similar consolidation issues.

PoW vs PoS Energy and Environmental Impact

Energy use divides them further. PoW’s computational demands are high, Bitcoin alone consumes ~150 terawatt-hours annually, rivaling nations like Argentina, driven by miners in regions like Texas or Kazakhstan with cheap power. Critics decry its carbon footprint, especially when tied to fossil fuels, though some argue renewable energy (e.g., Iceland’s geothermal) offsets this. Still, PoW’s environmental cost fueled PoS’s rise.

PoS slashes energy use by over 99%, per Ethereum’s post-Merge data. Validators run on standard computers, consuming watts rather than megawatts—no mining rigs required. This efficiency aligns with 2025’s eco-conscious trends, making PoS a darling of sustainability advocates. However, its environmental edge assumes widespread adoption; if PoW networks like Bitcoin persist, global energy impacts remain significant.

Accessibility and Participation

PoW’s entry barrier is high. Mining profitably demands expensive hardware (ASICs cost thousands) and cheap electricity, favoring industrial-scale operations over individuals. Hobbyists once mined Bitcoin on laptops, but by 2025, solo mining is obsolete—pools dominate, pooling resources for consistent payouts. This centralizes participation, though anyone can join a pool with modest gear.

PoS democratizes access. Staking requires only cryptocurrency and a basic device—e.g., staking 32 ETH (~$80,000 in 2025) lets you validate on Ethereum. Smaller holders join staking pools (e.g., via Coinbase), lowering the threshold to mere dollars. No hardware race exists, but wealth skews influence: bigger stakers earn more, potentially entrenching “rich-get-richer” dynamics. Still, PoS’s low technical overhead broadens participation compared to PoW’s industrial tilt.

PoW vs PoS Speed and Scalability

PoW sacrifices speed for security. Bitcoin’s 10-minute blocks and ~7 transactions per second (TPS) limit throughput, though solutions like the Lightning Network help. Ethereum’s PoW era capped at ~15 TPS, constraining DeFi growth. PoW’s deliberate pace ensures consensus but bottlenecks high-volume use cases.

PoS excels in scalability. Ethereum’s PoS upgrade hit ~15 TPS base, with sharding promising thousands more. Cardano and others achieve faster finality (seconds vs. minutes), suiting dApps and real-time payments. PoS’s efficiency—fewer resource constraints—supports higher throughput, though network design (e.g., congestion) still matters.

Use Cases and Adoption

PoW supports Bitcoin, the crypto store of value, and Litecoin, a payment coin. Its proven track record suits conservative, security-first applications. PoS powers Ethereum’s DeFi and NFT ecosystem, Cardano’s smart contracts, and emerging chains, thriving in innovative, scalable contexts. PoW’s legacy endures; PoS’s flexibility drives growth.

Conclusion: Trade-Offs and Future

PoW offers unmatched security and decentralization at the cost of energy and speed—ideal for Bitcoin’s “digital gold” ethos. PoS delivers efficiency, accessibility, and scalability, fitting modern blockchain ambitions, though its security model evolves. Neither is “better”; PoW’s resilience suits purists, while PoS’s adaptability leads innovation. In 2025, both coexist, their fates tied to community values, regulatory pressures, and technological advances—PoW as the pioneer, PoS as the reformer.