- What Are Stablecoins and Why Build One?

- Types of Stablecoins Overview

- Why Create a Stablecoin?

- Choosing the Right Stablecoin Model

- Fiat-Backed Stablecoins: Stability Through Reserves

- Crypto-Backed Stablecoins: Decentralized Trust

- Algorithmic Stablecoins: Code-Driven Balance

- Commodity-Backed Stablecoins: Tangible Value

- Frameworks and Platforms for Stablecoin Development

- Ethereum: The Go-To Blockchain for Stablecoins

- Solana: High-Speed Stablecoin Creation

- Binance Smart Chain: Cost-Effective Development

- Polkadot and Substrate: Custom Stablecoin Chains

- Comparison Table:

- Step-by-Step Guide to Creating a Stablecoin

- Step 1: Define Your Stablecoin’s Purpose and Peg

- Key Considerations:

- Step 2: Design Tokenomics and Governance

- Tokenomics Elements:

- Governance Options:

- Step 3: Select a Blockchain and Framework

- Matching to Needs:

- Step 4: Develop Smart Contracts

- Key Libraries:

- Step 5: Test and Audit Contracts

- Testing Process:

- Auditing:

- Step 6: Deploy and Maintain Peg

- Regulatory and Compliance Considerations

- Marketing and Adoption Strategies

- Building Trust and Credibility

- Challenges and Risks in Stablecoin Creation

- Bottom Line

- FAQs; Creating Stable Coins

Stablecoins have become an important asset in the cryptocurrency world, offering a solution to volatility that makes Bitcoin and other digital currencies unpredictable.

Unlike traditional cryptocurrencies, stablecoins are designed to hold a steady value, often tied to assets like the U.S. dollar or gold.

This stability has made them important in areas like decentralized finance (DeFi), where they power lending and trading platforms, as well as in everyday uses like sending money across borders quickly and cheaply.

As businesses, developers, and communities see their potential, more people are asking: how can I create a stablecoin?

This guide is your roadmap to building a stablecoin from the ground up.

We’ll explain what stablecoins are, why their reliability matters compared to volatile cryptocurrencies, and how they’re transforming payments and finance.

You’ll learn about the different types of stablecoins, the platforms you can use to develop one, and the clear steps to bring your idea to life.

Whether you’re a business looking to launch a digital currency or a developer curious about blockchain, this article covers the methods and tools you need.

Our goal is to make the process simple and approachable, answering questions like “What is a stablecoin?” and “Why create a stablecoin?”

By the end, you’ll have a clear path forward. Ready to explore how to create a stablecoin? Keep reading for a step-by-step guide, and check out our related article on designing a strong token economy for more insights.

What Are Stablecoins and Why Build One?

Stablecoins are a unique type of cryptocurrency designed to maintain a steady value by being tied to a specific asset, such as the U.S. dollar, gold, or even another cryptocurrency.

Unlike Bitcoin or Ethereum, which can see dramatic price swings, stablecoins aim to offer predictability.

This makes them ideal for everyday transactions, savings, or as a reliable store of value in the digital world.

Their primary purpose is to reduce volatility, allowing users to trade, lend, or send money without worrying about sudden price drops.

They also enable trustless transactions, meaning you can deal directly with others on a blockchain without needing a bank or middleman.

Types of Stablecoins Overview

Stablecoins come in different forms, each with its own approach to achieving stability. Here’s a quick look at the main types:

| Type | Definition | Examples |

|---|---|---|

| Fiat-Backed | Pegged to a currency like USD, backed by cash reserves. | USDT (Tether), USDC |

| Crypto-Backed | Pegged to a value but backed by other cryptocurrencies, often over-collateralized. | DAI (MakerDAO) |

| Algorithmic | Uses software to adjust supply and maintain a peg, no physical backing. | UST (pre-2022 collapse) |

| Commodity-Backed | Tied to assets like gold or oil, blending digital and physical value. | PAXG (Pax Gold) |

Each type suits different needs, from simple payments to complex decentralized systems.

Why Create a Stablecoin?

Building a stablecoin opens up exciting possibilities. Here are key reasons to consider:

- DeFi Liquidity: Stablecoins support decentralized finance platforms, enabling lending, borrowing, and trading without volatility risks.

- Cross-Border Payments: They make sending money globally fast and affordable, bypassing slow bank systems.

- Tokenized Assets: Businesses can create stablecoins tied to real-world assets, like real estate or company rewards, to engage customers.

The benefits are many.

A stablecoin can boost your brand’s authority by showcasing innovation. It promotes financial inclusion by offering stable digital money to those without access to banks.

Plus, it has revenue potential through transaction fees or DeFi integrations.

Whether you’re a developer or a business, launching a stablecoin can position you at the forefront of the digital economy.

Choosing the Right Stablecoin Model

Selecting the right stablecoin model is a major step in your project.

Each type—fiat-backed, crypto-backed, algorithmic, and commodity-backed—has unique mechanics, strengths, and challenges.

Understanding these differences will help you align your stablecoin with your goals, whether it’s for payments, DeFi, or asset tokenization.

Below, we explore each model to guide your decision.

Fiat-Backed Stablecoins: Stability Through Reserves

Fiat-backed stablecoins maintain a 1:1 peg with a currency like the U.S. dollar. This means that each coin is backed by an equivalent amount held in a bank or reserve.

For example, one USDT (Tether) equals one USD in theory, ensuring users can redeem their coins for cash.

This model is straightforward, making it popular for everyday transactions and trading.

Pros and Cons:

| Aspect | Details |

| Pros | – High trust due to familiar currency backing. – Simple to understand and use. |

| Cons | – Centralized: Relies on a company to manage reserves. – Requires regular audits to prove reserves exist. |

Examples: Tether (USDT), USD Coin (USDC).

These are widely used on exchanges like Coinbase and binance, reflecting their reliability but also their reliance on trusted custodians.

Crypto-Backed Stablecoins: Decentralized Trust

Crypto-backed stablecoins achieve stability by using other cryptocurrencies, like Ethereum (ETH) or Bitcoin (BTC), as collateral.

To protect against price swings, they require over-collateralization, meaning you lock up more value in crypto than the stablecoin issued.

For instance, to create $100 of DAI, you might lock up $150 of ETH. This decentralized approach runs on blockchain smart contracts, reducing reliance on banks.

Key Features:

- Decentralization: No central authority controls the reserves.

- Transparency: Collateral is visible on the blockchain.

Pros and Cons:

- Pros: Offers trustless operations, ideal for DeFi; fully transparent.

- Cons: Crypto collateral can be volatile, risking liquidation if prices drop.

Example: DAI (MakerDAO), a leader in DeFi, lets users create stable value without fiat.

Algorithmic Stablecoins: Code-Driven Balance

Algorithmic stablecoins don’t rely on physical reserves. Instead, they use software to adjust the coin’s supply based on demand, aiming to keep the price stable.

If the price rises above $1, more coins are minted; if it falls below, supply is reduced. This innovative approach avoids banks and collateral entirely, but it’s complex.

Advantages and Risks:

- Pros: Highly scalable; no need for reserves.

- Cons: Vulnerable to market shocks; past failures like Terra’s UST (pre-2022 collapse) highlight risks.

Examples: Ampleforth adjusts supply daily, while FRAX blends algorithms with partial collateral for stability. These are experimental but promising for advanced projects.

Commodity-Backed Stablecoins: Tangible Value

Commodity-backed stablecoins are pegged to physical assets like gold, oil, or even real estate, offering a bridge between digital and tangible value.

For example, one Pax Gold (PAXG) represents one ounce of gold stored in a vault. This model appeals to investors seeking assets with intrinsic worth.

Considerations:

| Aspect | Details |

| Pros | – Tangible backing builds confidence. – Diversifies beyond fiat or crypto. |

| Cons | – Storage and verification raise costs. – Less liquid than other stablecoins. |

Example: Pax Gold (PAXG) lets users own digital gold, ideal for wealth preservation but less common in DeFi.

Each model suits different needs: fiat-backed for simplicity, crypto-backed for decentralization, algorithmic for innovation, or commodity-backed for tangible value. Your choice depends on your project’s goals, technical capacity, and market.

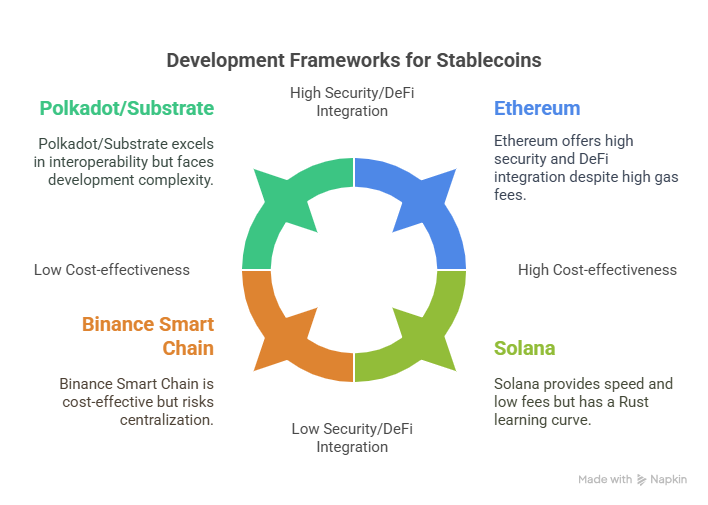

Frameworks and Platforms for Stablecoin Development

Building a stablecoin requires choosing the right blockchain platform, as each offers unique features, tools, and trade-offs.

Ethereum, Solana, Binance Smart Chain (BSC), and Polkadot (via Substrate) are among the top choices for developers.

This section explores these platforms, detailing their strengths, tools, and ideal use cases to help you decide which fits your stablecoin project. Whether you prioritize flexibility, speed, cost, or interoperability, there’s a framework to match your needs.

Ethereum: The Go-To Blockchain for Stablecoins

Ethereum is the most popular platform for stablecoin development, thanks to its robust ecosystem and flexibility.

Its smart contract functionality allows developers to create complex stablecoins using the ERC-20 standard, a widely adopted template for tokens like USDT, USDC, and DAI.

Ethereum’s decentralized network ensures security, while its vast community provides extensive resources.

Why Choose Ethereum?

- Smart Contract Flexibility: Solidity, Ethereum’s programming language, supports intricate designs, such as DAI’s over-collateralized model.

- ERC-20 Standard: Simplifies token creation with pre-built rules for transfers and balances.

- Ecosystem: Integrates with wallets (e.g., MetaMask), exchanges, and DeFi protocols.

Tools for Development:

| Tool | Purpose |

| Solidity | Write smart contracts for stablecoins. |

| Remix | Browser-based IDE for coding and testing. |

| OpenZeppelin | Secure contract templates for ERC-20. |

Challenges:

- Gas Fees: Transactions can be costly during network congestion.

- Scalability: Slower processing compared to newer chains.

Solutions:

Layer 2 (L2) scaling solutions like Arbitrum or Optimism reduce costs and speed up transactions, making Ethereum viable for high-volume stablecoins.

Use Case:

Ethereum suits projects needing strong security and DeFi integration, like a fiat-backed stablecoin for global trading.

Solana: High-Speed Stablecoin Creation

Solana offers a high-performance alternative, processing thousands of transactions per second at a fraction of Ethereum’s cost.

Its SPL (Solana Program Library) token standard is optimized for speed, making it ideal for stablecoins used in fast-paced environments.

Solana’s growing DeFi ecosystem, including protocols like Saber, supports stablecoin adoption.

Benefits of Solana:

- Low Fees: Transactions cost pennies, perfect for frequent microtransactions.

- Fast Transactions: Near-instant confirmations enhance user experience.

- SPL Token Standard: Lightweight and efficient for stablecoin design.

Development Tools:

- Rust: Solana’s programming language, known for performance and safety.

- Solana CLI: Command-line tools for deploying and managing tokens.

- Anchor Framework: Simplifies Rust coding with pre-built modules.

Challenges:

- Learning Curve: Rust is less beginner-friendly than Solidity.

- Centralization Concerns: Solana’s validator network is less decentralized than Ethereum’s.

Use Case:

Solana excels for stablecoins in high-frequency DeFi, such as algorithmic stablecoins powering decentralized exchanges or payment systems.

Example:

A Solana-based stablecoin could enable real-time remittances with minimal fees, leveraging wallets like Phantom for accessibility.

Binance Smart Chain: Cost-Effective Development

Binance Smart Chain (BSC) is a budget-friendly platform that balances affordability with functionality.

Its compatibility with Ethereum’s Virtual Machine (EVM) allows developers to reuse Ethereum tools, while the BEP-20 standard supports stablecoin creation.

BSC’s low transaction costs make it attractive for startups and projects targeting cost-sensitive markets.

Why BSC?

- Low Costs: Gas fees are significantly cheaper than Ethereum’s.

- EVM Compatibility: Use familiar tools like MetaMask and Remix.

- BEP-20 Standard: Streamlined token creation, similar to ERC-20.

Tools:

| Tool | Purpose |

| Truffle | Framework for coding and deploying contracts. |

| Remix | IDE for BEP-20 token development. |

| BSC Testnets | Test environments like Chapel for trials. |

Challenges:

- Centralization: BSC is controlled by Binance, raising trust concerns.

- Limited DeFi: Smaller ecosystem than Ethereum or Solana.

Ideal For:

- Emerging Markets: Low costs suit regions with price-sensitive users.

- Small-Scale Projects: Perfect for startups testing a stablecoin concept.

Example: A BEP-20 stablecoin could power a local payment system in Southeast Asia, listed on PancakeSwap for trading.

Polkadot and Substrate: Custom Stablecoin Chains

Polkadot, through its Substrate framework, enables developers to build custom blockchains tailored for stablecoins.

Unlike Ethereum or Solana, Substrate allows you to create a standalone chain or a parachain connected to Polkadot’s interoperable network. This flexibility supports unique stablecoin designs, especially for cross-chain ecosystems.

Advantages:

- Interoperability: Stablecoins can interact with other chains via Polkadot’s relay chain.

- Custom Blockchains: Substrate lets you define consensus, governance, and token rules.

- Scalability: Parachains handle transactions independently, reducing congestion.

Development Tools:

- Rust: Used for coding custom chains, similar to Solana.

- Polkadot.js: JavaScript library for interacting with Polkadot networks.

- Substrate Framework: Templates for blockchain logic, like token minting.

Challenges:

- Complexity: Building a chain requires advanced skills.

- Cost: Parachain slots can be expensive, though shared slots are an option.

Use Case: Substrate is ideal for cross-chain stablecoin ecosystems, such as a stablecoin bridging DeFi on Ethereum and Solana.

Example: A Substrate-based stablecoin could enable seamless value transfer between Polkadot’s DeFi and NFT marketplaces, using wallets like Fearless.

Comparison Table:

| Platform | Token Standard | Key Strength | Main Challenge | Best For |

| Ethereum | ERC-20 | Security, DeFi ecosystem | High gas fees | DeFi-integrated stablecoins |

| Solana | SPL | Speed, low fees | Rust learning curve | High-frequency transactions |

| Binance Smart Chain | BEP-20 | Cost-effective | Centralization risks | Budget-conscious projects |

| Polkadot/Substrate | Custom | Interoperability | Development complexity | Cross-chain ecosystems |

Choosing Your Platform:

- Ethereum for established DeFi projects needing trust and integration.

- Solana for fast, low-cost stablecoins in dynamic markets.

- BSC for quick, affordable launches targeting new users.

- Polkadot/Substrate for innovative, interoperable designs.

Each platform offers tools to streamline development, but your choice depends on budget, technical expertise, and project goals. Ethereum’s maturity suits most, while Solana and BSC prioritize efficiency. Polkadot shines for forward-thinking, multi-chain visions.

Step-by-Step Guide to Creating a Stablecoin

Creating a stablecoin involves careful planning, technical execution, and ongoing maintenance to ensure stability and trust.

This guide walks you through six essential steps, from defining your vision to deploying a functional stablecoin.

By following these steps, you’ll understand how to build a stablecoin tailored to your goals, whether for payments, DeFi, or asset tokenization. Let’s dive in.

Step 1: Define Your Stablecoin’s Purpose and Peg

The first step is to clarify why you’re creating a stablecoin and what asset it will be tied to. The peg determines how your stablecoin maintains its value—common options include fiat (e.g., USD), cryptocurrencies (e.g., ETH), or commodities (e.g., gold). Your use case shapes this choice.

Key Considerations:

- Purpose: Is it for remittances, DeFi liquidity, or tokenized assets?

- Peg Value: A USD peg suits payments (e.g., $1 per coin), while gold fits wealth preservation (e.g., 1 coin per ounce).

- Example: A USD-pegged stablecoin for remittances ensures stable cross-border transfers, unlike a gold-backed coin for long-term savings.

Define these early to align your technical and marketing strategies. For instance, a DeFi-focused stablecoin might prioritize crypto compatibility, while a retail-focused one needs fiat simplicity.

Step 2: Design Tokenomics and Governance

Tokenomics defines how your stablecoin operates economically, balancing supply, demand, and stability. Governance determines who controls key decisions, like adjusting fees or upgrading contracts.

Tokenomics Elements:

| Aspect | Description |

| Supply | Fixed (e.g., 10M coins) or dynamic (adjusts to demand). |

| Collateral Ratios | For crypto-backed coins, set ratios (e.g., 150% ETH to stablecoin value). |

| Stability Fees | Charges to maintain peg, like DAI’s borrowing fees. |

Governance Options:

- Centralized: A company controls reserves and rules, like Tether (USDT). Simple but less transparent.

- DAO: Decentralized governance via token holders, like MakerDAO’s DAI. Complex but trustless.

Example: A fiat-backed stablecoin might use a fixed supply with centralized governance for simplicity, while a crypto-backed one could adopt dynamic supply and a DAO for DeFi integration.

Step 3: Select a Blockchain and Framework

Choosing the right blockchain is crucial for performance, cost, and compatibility. Ethereum, Solana, Binance Smart Chain (BSC), and Polkadot (via Substrate) are top contenders, each suited to different needs.

Blockchain Comparison:

| Platform | Cost | Speed | Decentralization | Best For |

| Ethereum | High (gas fees) | Moderate | High | DeFi, security-focused projects |

| Solana | Low | Very fast | Moderate | High-frequency transactions |

| BSC | Very low | Fast | Low | Budget-conscious projects |

| Polkadot | Moderate | Fast | High | Cross-chain ecosystems |

Matching to Needs:

- Ethereum: Ideal for DeFi integration (e.g., USDC).

- Solana: Great for low-cost, high-speed payments.

- BSC: Suits startups with tight budgets.

- Polkadot: Best for interoperable stablecoins.

Select based on your budget, target audience, and technical expertise. For most stablecoins, Ethereum’s ERC-20 standard is a safe starting point.

Step 4: Develop Smart Contracts

Smart contracts are the backbone of your stablecoin, handling minting, transfers, and peg maintenance. For an Ethereum-based stablecoin, you’ll use Solidity and the ERC-20 standard. Libraries like OpenZeppelin and Chainlink simplify development.

Basic Solidity Example (ERC-20 Stablecoin):

Solidity Code

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.0;

import "@openzeppelin/contracts/token/ERC20/ERC20.sol";

contract MyStablecoin is ERC20 {

constructor(uint256 initialSupply) ERC20("MyStablecoin", "MST") {

_mint(msg.sender, initialSupply);

}

}This code creates a basic ERC-20 token with a name (“MyStablecoin”) and symbol (“MST”). The initialSupply sets the starting amount minted to the deployer.

For a Fiat-Backed Stablecoin: Add a reserve management function to ensure 1:1 backing:

solidity

contract FiatStablecoin is ERC20 {

address public admin;

constructor() ERC20("FiatCoin", "FUSD") {

admin = msg.sender;

}

function mint(address to, uint256 amount) external {

require(msg.sender == admin, "Only admin can mint");

_mint(to, amount);

}

}This restricts minting to an admin, simulating fiat reserve control.

Key Libraries:

- OpenZeppelin: Provides secure ERC-20 templates to prevent bugs.

- Chainlink: Supplies price feeds (e.g., USD/ETH rates) for crypto-backed pegs.

Steps:

- Write the contract using Remix IDE.

- Integrate OpenZeppelin for ERC-20 functionality.

- Add Chainlink for real-time price data if needed.

This ensures your stablecoin is functional and secure before testing.

Step 5: Test and Audit Contracts

Testing and auditing are non-negotiable to avoid costly errors. Use testnets to simulate your stablecoin’s behavior, then hire professionals for audits.

Testing Process:

- Testnets: Ethereum’s Sepolia, Solana’s Devnet, or BSC’s Chapel let you deploy without real funds.

- Scenarios: Test minting, transfers, and peg stability (e.g., price feed failures).

- Tools: Hardhat (Ethereum), Mocha (Solana) for automated tests.

Auditing:

- Why It Matters: Bugs can lead to hacks or depegging, as seen in past exploits.

- Top Firms:

- CertiK: Comprehensive security checks.

- Quantstamp: Focuses on smart contract integrity.

Example: Test a crypto-backed stablecoin by simulating ETH price drops to ensure collateral ratios hold.

Step 6: Deploy and Maintain Peg

Once tested, deploy your stablecoin to the mainnet (e.g., Ethereum, Solana). Maintaining the peg is an ongoing task to ensure user trust.

Deployment:

- Use tools like Truffle (Ethereum) or Solana CLI to deploy.

- Verify the contract on explorers like Etherscan for transparency.

Peg Maintenance:

- Fiat-Backed: Regular audits to prove reserves (e.g., USDC’s monthly reports).

- Crypto-Backed: Monitor collateral via Chainlink oracles.

- Algorithmic: Adjust supply with algorithms, tested for edge cases.

Depegging Risks:

- Market Shocks: Diversify collateral to reduce volatility.

- Oracle Failures: Use multiple oracle providers.

- Example: UST’s collapse showed the need for robust mechanisms.

Strategies:

- Publish reserve reports for transparency.

- Integrate redundancy in price feeds.

- Engage a community or DAO for governance input.

By following these steps, you’ll launch a stablecoin that’s secure, stable, and ready for adoption.

Regulatory and Compliance Considerations

Launching a stablecoin involves navigating a complex web of global regulations to ensure legality and user trust.

Compliance is not just a legal obligation—it’s a foundation for credibility in the crypto market. This section outlines key regulatory frameworks, best practices, and the risks of ignoring compliance, helping you build a stablecoin that stands up to scrutiny.

Navigating Global Stablecoin Regulations

Stablecoin regulations vary widely, with major frameworks shaping the landscape.

In the United States, the Securities and Exchange Commission (SEC) oversees stablecoins that resemble investment products, potentially classifying them as securities.

This requires registration and adherence to strict disclosure rules.

The European Union’s Markets in Crypto-Assets (MiCA) regulation, effective from 2024, sets a comprehensive standard, mandating 100% reserve backing, regular audits, and consumer protections for stablecoin issuers.

Globally, the Financial Action Task Force (FATF) provides guidelines focusing on anti-money laundering (AML) and know-your-customer (KYC) measures to prevent illicit transactions.

Key Compliance Issues:

- KYC/AML: Verifying user identities and monitoring transactions to block money laundering, a must in most jurisdictions.

- Reserve Audits: Proving your stablecoin is fully backed, especially for fiat-pegged coins, through independent audits.

- Securities Classification: Ensuring your stablecoin isn’t deemed a security, which triggers heavier regulations, particularly in the U.S.

These requirements aim to protect users and maintain market stability but can be challenging to implement across borders.

Best Practices for Compliance

Staying compliant requires proactive steps and strategic choices. Working with legal experts specializing in crypto is essential to navigate local laws and avoid missteps.

Maintaining transparent reserves—whether fiat, crypto, or commodities—builds trust and satisfies regulators. Regular public reports, like those from Circle (USDC), show proof of backing and reduce skepticism.

Recommended Jurisdictions:

| Jurisdiction | Advantages |

| Switzerland | Crypto-friendly laws, clear licensing rules. |

| Singapore | Supportive fintech hub, robust AML/KYC. |

| Cayman Islands | Flexible regulations, tax benefits. |

These regions offer clear guidelines and incentives, making them ideal for stablecoin projects. For example, Switzerland’s FINMA provides tailored licenses, while Singapore’s Monetary Authority fosters innovation with compliance.

Risks of Non-Compliance

Ignoring regulations can derail your project and erode trust. Tether (USDT) faced a $41 million fine from the U.S.

Commodity Futures Trading Commission in 2021 for misrepresenting its reserves, highlighting the need for transparency.

Similarly, Facebook’s Libra (later Diem) project collapsed under global regulatory pressure, with concerns over financial stability and privacy forcing its cancellation in 2022.

Consequences:

- Fines and Penalties: Heavy financial costs for violations.

- Project Delays: Regulatory pushback can stall or kill launches.

- Reputation Damage: Loss of user and investor confidence.

Compliance isn’t optional—it’s a safeguard against these risks, ensuring your stablecoin thrives in a regulated world.

Marketing and Adoption Strategies

Launching a stablecoin is only the beginning—success depends on gaining trust and widespread use. Effective marketing and adoption strategies can turn your stablecoin into a trusted and valuable asset. By focusing on transparency, strategic listings, and user incentives, you can build a loyal community and drive real-world adoption.

Building Trust and Credibility

Trust is the cornerstone of any stablecoin’s success. Transparency sets you apart in a market wary of scams and mismanagement.

Publish regular audits and reserve reports to prove your stablecoin’s backing, whether it’s fiat, crypto, or commodities. For example, Circle’s monthly USDC reserve reports reassure users of its 1:1 USD peg.

Clear communication about your pegging mechanism and financial health builds confidence among users and regulators alike.

Engaging your community is equally vital. Platforms like X, Discord, and Telegram are ideal for connecting with users. Share updates, answer questions, and host AMAs (Ask Me Anything) to foster loyalty. A strong community not only supports your stablecoin but also spreads the word organically, amplifying your reach.

Trust-Building Actions:

- Post audit results on your website and X.

- Create a Discord channel for real-time support.

- Share reserve data via Telegram updates.

Listing and Integration

Visibility drives adoption, and getting listed on trusted platforms is key. Aim for CoinMarketCap and CoinGecko to showcase your stablecoin’s price and stats, boosting credibility.

Listing on decentralized exchanges (DEXs) like Uniswap or PancakeSwap ensures easy trading, while centralized exchanges like Binance can expand your reach.

Partnering with DeFi protocols and payment platforms unlocks practical use cases. For instance, integrating with Aave allows your stablecoin to be used for lending, while a partnership with a payment processor like BitPay enables retail transactions. These integrations make your stablecoin functional and appealing.

Driving Adoption

To spark initial interest, consider airdrops—free distributions of your stablecoin to targeted users, like DeFi enthusiasts or wallet holders. Offer incentives, such as staking rewards or fee discounts, to encourage holding and using your coin. Partnerships with wallets (e.g., MetaMask) and exchanges streamline access, making it easier for users to adopt your stablecoin in everyday transactions or investments.

Adoption Strategies:

- Launch an airdrop campaign on X to attract early users.

- Offer rewards for DeFi users who stake your stablecoin.

- Collaborate with exchanges for seamless trading.

By combining trust, visibility, and incentives, you can position your stablecoin for long-term success.

Challenges and Risks in Stablecoin Creation

Building a stablecoin is a rewarding but complex endeavor, fraught with technical and market challenges.

Understanding these risks and preparing mitigation strategies is crucial to ensure your stablecoin’s stability and success. Below, we outline the primary hurdles and how to address them effectively.

Technical Risks

Technical issues can undermine a stablecoin’s reliability. Smart contract bugs, such as coding errors in minting or transfer functions, can lead to exploits or loss of funds, as seen in past DeFi hacks.

Oracle failures pose another threat, especially for crypto-backed or algorithmic stablecoins relying on price feeds—if an oracle delivers inaccurate data, it can disrupt the peg.

Depegging events, where the stablecoin’s value deviates from its target (e.g., $1), can erode trust, as experienced by some algorithmic coins during market stress.

Market Risks

The stablecoin market is highly competitive, with giants like Tether (USDT) and USDC dominating trading and DeFi. Breaking through this dominance requires a unique value proposition and strong marketing.

Regulatory shifts add uncertainty—new laws, like the EU’s MiCA or U.S. SEC rulings, can impose stricter reserve or KYC requirements, impacting operations.

Sudden policy changes in key markets could limit your stablecoin’s reach or viability.

Mitigation Strategies

Proactive measures can reduce these risks significantly:

- Robust Testing: Use testnets (e.g., Ethereum’s Sepolia) and audits from firms like CertiK to catch bugs before deployment.

- Diversified Collateral: For crypto-backed stablecoins, blend assets (e.g., ETH, BTC) to buffer volatility.

- Community Governance: Adopt a DAO model, like MakerDAO, to involve users in decisions, enhancing trust and resilience.

Bottom Line

Creating a stablecoin is an exciting opportunity to innovate in the crypto space. We’ve explored the key types—fiat-backed, crypto-backed, algorithmic, and commodity-backed—each offering unique benefits for payments, DeFi, or asset tokenization.

Platforms like Ethereum, Solana, Binance Smart Chain, and Polkadot provide powerful frameworks to bring your vision to life.

By following the six steps—defining your purpose, designing tokenomics, choosing a blockchain, coding smart contracts, testing rigorously, and maintaining the peg—you can launch a stablecoin that meets user needs and regulatory standards.

Now it’s your turn to act. Start planning your stablecoin, explore tools like OpenZeppelin or Chainlink, and dive into our related guides on tokenomics or Ethereum development for deeper insights.

Have questions or ideas? Share them in the comments or on X to join the conversation. Let’s build the future of stable digital money together!

FAQs; Creating Stable Coins

What is a stablecoin?

A cryptocurrency pegged to a stable asset (e.g., USD, gold) to minimize price volatility, used in DeFi and payments.

Why create a stablecoin?

To enable stable transactions, power DeFi, or build a tokenized economy for your brand or community.

How do you create a stablecoin?

Define its purpose, choose a peg (fiat, crypto), select a blockchain (e.g., Ethereum), code smart contracts, test, and deploy.

Who can create a stablecoin?

Developers, businesses, or communities with technical skills and regulatory awareness can launch a stablecoin.

When should you launch a stablecoin?

When you have a clear use case (e.g., DeFi, remittances) and resources for development, compliance, and marketing.

Where are stablecoins regulated?

Globally, with strict rules in the U.S. (SEC), EU (MiCA), and guidelines from FATF for AML/KYC compliance.

What types of stablecoins exist?

Fiat-backed (e.g., USDT), crypto-backed (e.g., DAI), algorithmic (e.g., FRAX), and commodity-backed (e.g., PAXG).

How do fiat-backed stablecoins work?

They maintain a 1:1 peg with fiat (e.g., USD) held in reserves, verified through audits.

Why are stablecoins important for DeFi?

They provide stable liquidity for lending, trading, and yield farming without crypto’s volatility

Who regulates stablecoins in the U.S.?

The SEC, CFTC, and Treasury oversee stablecoins, focusing on securities and financial stability

Will stablecoins replace traditional money?

Unlikely soon, but they’re growing in payments and DeFi due to speed and accessibility.

Are stablecoins safe to create?

Yes, if you follow security practices (e.g., audits) and comply with regulations, but risks like depegging remain.

How much does it cost to create a stablecoin?

Costs range from $10,000 (basic ERC-20) to millions for custom chains, audits, and compliance.

What blockchain is best for stablecoins?

Ethereum (secure, flexible), Solana (fast, cheap), or BSC (low-cost) depending on your needs.

Why do stablecoins depeg?

Due to market shocks, low collateral, or algorithmic flaws, as seen with UST’s collapse in 2022.

How do you market a stablecoin?

Build trust with audits, list on exchanges, and engage communities on X or Discord

Are algorithmic stablecoins risky?

Yes, they’re complex and prone to failure (e.g., UST), but innovations like FRAX show promise.

Will regulations kill stablecoin innovation?

They may slow it, but clear rules (e.g., MiCA) could boost adoption by ensuring trust.

What tools are needed to create a stablecoin?

Solidity (Ethereum), Rust (Solana), OpenZeppelin (templates), Chainlink (oracles), and testnets.

How do you ensure a stablecoin’s peg?

Use reserves (fiat-backed), over-collateralization (crypto-backed), or algorithms, monitored by oracles.