Crypto leverage trading has taken the financial world by storm, and it’s easy to see why. More and more people are jumping into this exciting way of trading cryptocurrencies, drawn by the promise of big profits in a market that never sleeps.

But with great rewards come great risks, and that’s where this guide comes in.

Whether you’re a curious beginner or a seasoned trader looking to sharpen your skills, we’re here to walk you through everything you need to know about crypto leverage trading and how to do it smartly.

So, what exactly is leverage trading in the crypto space?

In simple terms, it’s a method where you borrow money to increase the size of your trade. Instead of just using the cash you have, you can control a much larger amount—sometimes 10, 20, or even 100 times more.

This means a small price move in the right direction can lead to a huge win. It’s no wonder traders love it: the crypto market is famous for its wild ups and downs, and leverage lets you make the most of those swings without needing a fortune to start.

But here’s the catch—it’s not all smooth sailing. Those same price swings can wipe out your investment if you’re not careful.

That’s why having a solid plan is so important. Jumping in without a strategy is like sailing a boat without a map; you might get lucky, but chances are you’ll hit rough waters.

We’ll break down the ins and outs of crypto leverage trading, share practical strategies you can actually use, and show you how to balance the thrill of big gains with the safety of smart decisions. Let’s dive in and explore how you can master this high-stakes game!

What Is Crypto Leverage Trading?

Crypto leverage trading might sound complicated, but it’s really just a way to make your money work harder in the wild world of cryptocurrencies. Let’s break it down step by step so you can see what it’s all about, how it works, and why it’s both exciting and tricky.

Defining Leverage in Crypto Markets

At its core, leverage trading means borrowing money to boost the size of your trade. Imagine you have $1,000 to spend on Bitcoin, but you want to act like you’ve got $10,000.

With leverage, you can! Exchanges let you borrow extra funds—usually shown as ratios like 2x (double your money), 10x (ten times), or even 100x (a hundred times).

It’s like getting a loan to play bigger in the crypto game. But how does it stack up against regular trading?

Here’s a quick look:

| Feature | Leverage Trading | Spot Trading |

|---|---|---|

| Funds Used | Your money + borrowed funds | Just your own money |

| Profit Potential | Much higher with small price moves | Limited to what you invest |

| Risk Level | High (can lose more than you put in) | Lower (only lose your cash) |

Spot trading is straightforward—you buy and sell with what you’ve got. Leverage trading, though, is like stepping on the gas pedal.

How Leverage Works in Practice

Let’s say you’ve got $1,000 and use 10x leverage. That gives you $10,000 to trade with. If Bitcoin’s price goes up 5%, your position is now worth $10,500—a $500 profit instead of just $50 without leverage.

Sweet, right?

But there’s a catch. You need to keep some money aside as “margin” to cover the loan. If the price drops too far, say 10%, you could lose your $1,000 fast.

That’s called liquidation, when the exchange closes your trade to protect itself. It’s a tightrope walk!

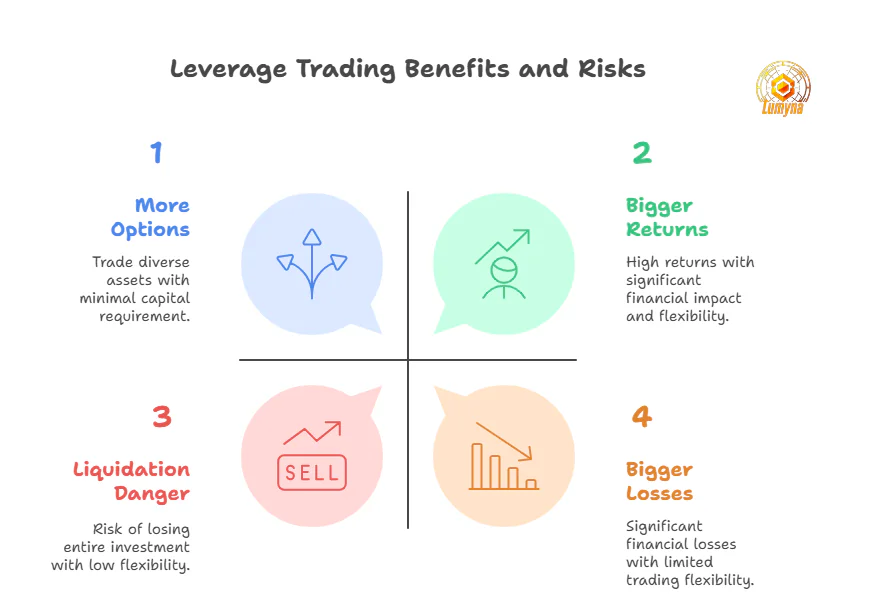

Benefits and Risks of Leverage Trading

Here’s why people love leverage trading:

- Bigger Returns: Small price changes turn into big wins.

- More Options: Trade more coins without needing tons of cash.

- Flexibility: Jump in and out of trades quickly.

But watch out for these risks:

- Liquidation Danger: A bad move can wipe you out.

- Bigger Losses: Losses grow just as fast as gains.

- Market Swings: Crypto’s ups and downs hit harder with leverage.

Leverage trading is a powerful tool, but it’s not for the faint-hearted. Understanding it is the first step to using it wisely!

Tools and Platforms for Leverage Trading

To succeed in crypto leverage trading, you need more than just luck—you need the right tools and a solid platform to trade on.

This section will walk you through how to pick the best exchange, the must-have tools to keep you on track, and a quick look at some key terms like margin and funding rates that can make or break your trades.

Choosing the Right Exchange

Not all trading platforms are created equal, especially when it comes to leverage. You’ll want one that’s safe, affordable, and gives you plenty of options.

Look for strong security (like two-factor authentication), low fees (so profits don’t get eaten up), good leverage choices (from 2x to 100x), and high liquidity (so trades happen fast). Here’s a rundown of three popular platforms to consider:

| Platform | Max Leverage | Trading Fees | Supported Pairs | Standout Feature |

| Binance | 125x | 0.02% – 0.04% | 300+ | Huge variety of coins |

| Bybit | 100x | 0.01% – 0.06% | 50+ | Fast, user-friendly design |

| Kraken | 50x | 0.01% – 0.02% | 70+ | Top-notch security |

Binance is great for variety, Bybit shines for speed, and Kraken keeps your funds safe. Pick one that fits your style!

Key Tools for Success

Having the right tools is like having a good toolbox for a home project—they make everything easier. Here are the essentials:

- Charting Software: To spot trends and price moves (TradingView is a favorite).

- Stop-Loss Orders: Automatically sell if a trade goes bad, saving your account.

- Risk Calculators: Figure out how much to bet without risking it all.

Understanding Margin and Funding Rates

Margin is the money you put up to borrow for leverage.

There’s “initial margin”—what you start with to open a trade (say, $100 of your own cash for a $1,000 position at 10x)—and “maintenance margin,” the minimum you need to keep the trade alive. If your account dips below that because of a price drop, the exchange might sell your position to cover the loan.

Then there’s funding rates. These are small fees you pay (or get paid) every few hours to keep a leveraged trade open long-term.

For example, if you’re betting Bitcoin will rise with 10x leverage and hold it for a day, you might pay 0.03% of the $1,000 position—$0.30. It’s tiny, but it adds up over weeks, so plan ahead!

These tools and basics set you up to trade smarter, not just harder. Let’s keep building from here!

Top Crypto Leverage Trading Strategies

Leverage trading in crypto is like riding a rollercoaster—you can score big thrills or take a wild tumble.

The key? Having a plan. Here are five top strategies to help you make the most of leverage, complete with how-tos, examples, and tips to keep you on track. Let’s dive into the action!

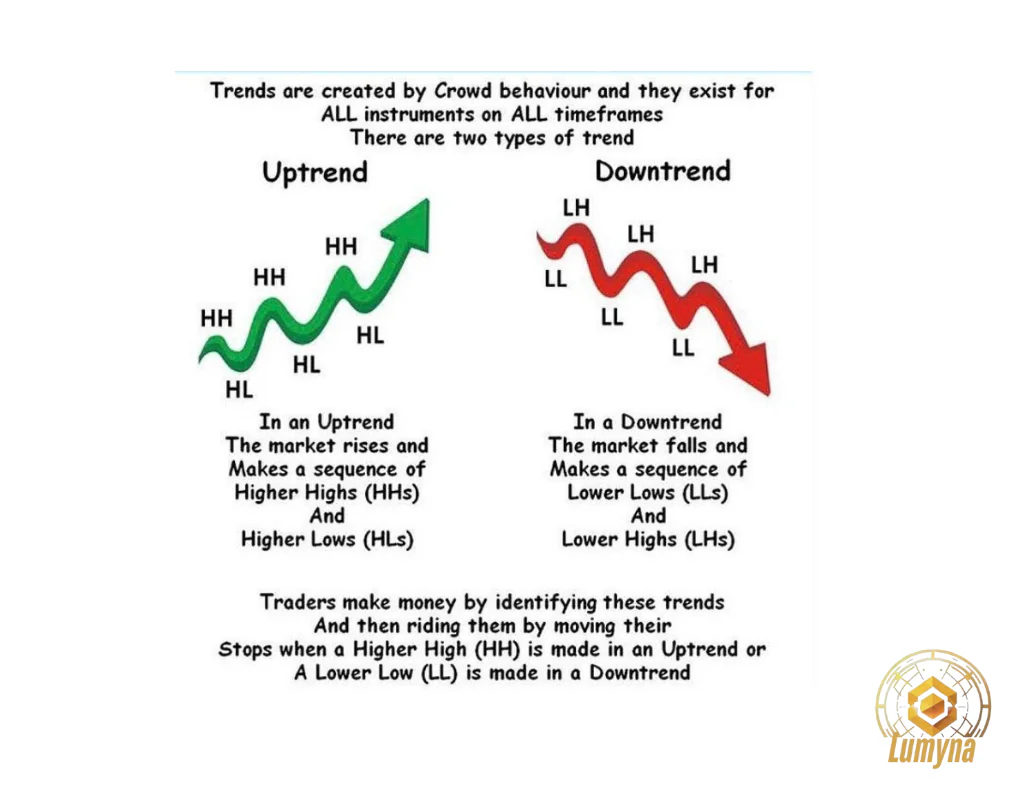

Trend Following Strategy

Want to ride the wave of a big crypto price move? Trend following is all about jumping on a direction—up or down—and sticking with it.

Traders often use moving averages, like the 50-day (short-term) and 200-day (long-term), to spot these trends.

When the 50-day line crosses above the 200-day, it’s a green light to buy; when it dips below, it’s time to sell. With leverage, you can turn a small wave into a tidal wave of profit.

Step-by-Step Guide (Using 5x Leverage):

- Pick a coin like Bitcoin (BTC) on an exchange like Binance.

- Pull up a chart on TradingView and add the 50-day and 200-day moving averages.

- Wait for the 50-day line to cross above the 200-day—say BTC is at $50,000.

- Put in $1,000 with 5x leverage, controlling a $5,000 position.

- Set a stop-loss 5% below ($47,500) to limit losses, and aim for a 10% gain ($55,000).

- Cash out when the trend fades or the lines cross back.

| Aspect | Pros | Cons |

|---|---|---|

| Profitability | Big wins in strong trends | Slow in choppy markets |

| Risk | Lower with clear signals | Losses if trends reverse fast |

This strategy shines when markets move steadily—like Bitcoin’s 2023 rally—but watch out for sudden U-turns!

Scalping with Leverage

Scalping is for the fast and furious. It’s about making quick trades—sometimes in minutes—for tiny gains that add up.

With leverage, those small wins get a serious boost. Think of it like grabbing pennies off the table, but with 20x leverage, those pennies turn into dollars fast.

Practical Example (Scalping BTC/USD with 20x Leverage):

Bitcoin’s at $50,000 on a 5-minute chart. You notice it’s bouncing between $49,900 and $50,100. You put $200 in with 20x leverage, controlling $4,000. It jumps to $50,100 in 10 minutes—a $80 profit (2% of $4,000). You close, pocket $80, and repeat all day.

5 Tips for Effective Scalping:

- Choose a platform with low fees (Bybit’s a good pick).

- Use tight stop-losses (e.g., 0.5% below entry).

- Stick to busy trading hours for fast moves.

- Focus on one coin to master its rhythm.

- Keep trades short—don’t get greedy!

Scalping is intense but perfect for quick hands and high leverage.

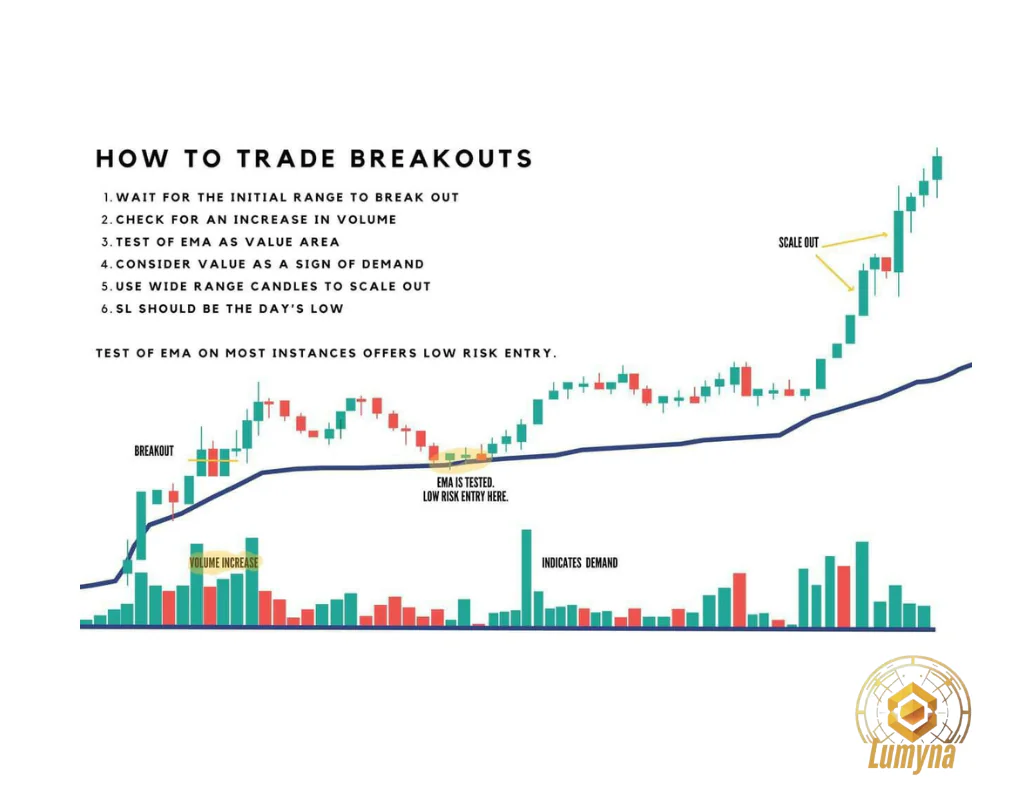

Breakout Trading Strategy

Breakout trading is about catching the moment a coin blasts past a key price level—like a ceiling (resistance) or floor (support). When it breaks through with force, prices can soar or crash, and leverage lets you ride that wave big-time.

How-To: Identify Breakouts:

- On a chart, mark support (where prices often bounce up) and resistance (where they stall).

- Watch for high trading volume—a sign the breakout’s real.

- Look at candlesticks: a big green candle smashing resistance screams “buy!”

- Example: BTC hits $52,000 (resistance), volume spikes, you go long with 10x leverage.

Here’s the tricky part: breakouts can fake you out. A price might poke above $52,000, then drop back fast—a fakeout. True breakouts have volume and momentum behind them. Fakeouts waste money, especially with leverage, so double-check before jumping in.

Hedging with Leverage

Hedging is like buying insurance. If you own Bitcoin but worry about a crash, you can use leverage to bet against it—balancing your risk. It’s a safety net for your crypto stash.

Example (Hedging a BTC Long):

You hold 1 BTC at $50,000 in your wallet. You’re nervous about a dip, so on Binance, you short 1 BTC with 10x leverage using $5,000 of your cash (controlling $50,000). If BTC drops 10% to $45,000:

- Wallet loss: $5,000.

- Short profit: $5,000.

- Net: Break even!

| Scenario | Hedging Outcome | No Hedging Outcome |

| 10% BTC Drop | $0 net loss | $5,000 loss |

| 10% BTC Rise | $5,000 net gain | $5,000 gain |

Hedging cuts losses but caps gains—great for stormy markets.

Mean Reversion Strategy

Mean reversion bets that prices will snap back to their average after going too high or low. It’s like a rubber band—stretch it too far, and it pulls back. With leverage, you can cash in when it snaps.

Tools and Guidance (10x Leverage on ETH/USD):

- Use Bollinger Bands on a chart: price hitting the outer band signals “overstretched.”

- Check RSI (Relative Strength Index): above 70 (overbought) or below 30 (oversold) hints at a reversal.

- Example: ETH is $3,000, RSI is 75, price hits the upper Bollinger Band. You short with $500 at 10x leverage ($5,000 position). It drops to $2,850 (5%)—you make $250.

This works best in sideways markets, not wild trends. Time it right, and leverage makes the rebound pay off big!

Risk Management in Crypto Leverage Trading

Leverage trading in crypto can feel like a high-stakes adventure, but without a safety net, it’s all too easy to crash and burn.

Risk management isn’t just a nice-to-have—it’s your lifeline. Let’s explore why it matters, how to do it right, and how to dodge the traps that trip up so many traders.

Why Risk Management Is Non-Negotiable

Here’s a sobering fact: studies suggest over 70% of leverage traders get liquidated at some point, often because they didn’t manage their risks.

That’s a huge number! Liquidation happens when a trade goes so wrong that the exchange takes your money to cover the borrowed funds.

Crypto’s wild price swings make this a real danger. One minute Bitcoin’s climbing to $60,000, the next it’s plunging 10% in an hour.

With leverage, that drop doesn’t just dent your account—it can wipe it out entirely.

Volatility is the fuel that makes leverage exciting, but it’s also what makes it brutal. Without a plan to handle those ups and downs, you’re playing with fire. Risk management turns that fire into a controlled flame you can actually use.

Practical Risk Management Techniques

So, how do you stay safe? Here are five must-use tricks to keep your trading smart and steady:

- Set Stop-Losses: Automatically exit a trade if it drops too far—say, 5% below your entry.

- Size Your Positions: Only risk a small chunk of your money per trade (more on this below).

- Diversify: Don’t bet everything on one coin—spread it across BTC, ETH, or others.

- Keep Cash Handy: Leave some funds untraded to cover surprises.

- Track Your Wins and Losses: Learn what works and tweak your approach.

Example: Calculating Position Size with 2% Risk

Say you’ve got $5,000 to trade and don’t want to risk more than 2% ($100) on one trade. You’re eyeing Bitcoin at $50,000 with a stop-loss 5% below ($47,500)—a $2,500 drop per BTC.

Divide your risk ($100) by that drop ($2,500), and you can trade 0.04 BTC. With 10x leverage, that’s a $2,000 position. If it goes wrong, you lose $100 max. Simple math keeps you in the game!

Avoiding Common Pitfalls

Leverage trading has its traps—here’s how to steer clear:

| Mistake | Why It Hurts | Solution |

| Over-Leveraging | 100x turns small dips into disasters | Stick to 5x or 10x to start |

| Ignoring Fees | Trading costs eat your profits | Pick low-fee platforms like Bybit |

| No Stop-Loss | Losses spiral out of control | Always set a stop-loss |

| Chasing Losses | Doubling down digs a deeper hole | Take a break, rethink your plan |

| All-In Bets | One bad trade wipes you out | Risk only 1-2% per trade |

Tip: How to Use a Leverage Calculator Effectively

Most exchanges like Binance have free leverage calculators online. Plug in your account size (e.g., $5,000), risk percentage (2%), and stop-loss distance (5%). It’ll spit out your ideal position size—like $2,000 at 10x in our example. Use it before every trade to avoid guessing and gambling. It’s like a cheat code for staying safe!

Risk management isn’t sexy, but it’s what separates winners from losers in crypto leverage trading. Master these steps, and you’ll trade with confidence, not fear.

Step-by-Step Guide to Start Leverage Trading

Ready to dip your toes into crypto leverage trading? It’s not as scary as it sounds if you take it one step at a time. This guide will walk you through setting up an account, adding funds, and making your first trade—simple and straightforward, so you can hit the ground running.

Setting Up Your Account

First things first: you need a place to trade. Platforms like Binance Futures make it easy to get started. Here’s how to set up your account in five steps:

- Sign Up: Head to Binance.com, click “Register,” and enter your email and a strong password.

- Verify Your Email: Check your inbox for a link from Binance and click it to confirm.

- Add Security: Turn on two-factor authentication (like Google Authenticator) to keep your account safe.

- Complete ID Check: Upload a photo ID (like a driver’s license) and a selfie—Binance needs this to unlock futures trading.

- Switch to Futures: From the homepage, click “Futures” to access the leverage trading section.

Once you’re in, you’re ready to roll!

Funding and Choosing Leverage

Now, let’s get some money into your account and pick your leverage. Start by depositing USDT (Tether), a stable coin that’s perfect for trading because it’s tied to the dollar. On Binance Futures, go to your wallet, hit “Deposit,” and send USDT from another wallet or exchange—it’s usually there in minutes.

Next, decide how much leverage you want. Binance offers options from 2x (doubling your money) to 125x (super risky!). For beginners, 5x or 10x is a sweet spot—enough to boost your trade without going overboard.

Check the market first: if Bitcoin’s jumping around like crazy, lower leverage keeps you safer. Think of it like choosing how fast to drive—slow and steady wins until you know the road.

Executing Your First Trade

Time to trade! Let’s say Bitcoin’s at $50,000, and you think it’s going up. Here’s an example:

- Deposit $200 into your futures wallet.

- Pick BTC/USD, select “Long” (betting on a rise), and choose 5x leverage—your $200 now controls $1,000.

- Set a stop-loss at $49,000 (2% below) to cap your loss at $20 if it drops.

- Enter the trade and watch it go—aim for $51,000 to pocket $20 profit!

That’s it—your first leverage trade is live. Start small, learn the ropes, and build from there!

Real-World Case Studies

Leverage trading can lead to big wins or brutal losses, and real stories show us how it plays out.

Let’s look at two examples: a trader who nailed it during Bitcoin’s 2023 rally and another who got burned in the 2022 crash. These tales teach us what works—and what to watch out for.

Success Story – The 2023 BTC Rally

In early 2023, Bitcoin was buzzing.

After months of hovering around $30,000, it started climbing fast, hitting $36,000 in a matter of weeks—a 20% jump.

One savvy trader saw the signs: more people were buying, and the charts showed a clear upward trend.

With $5,000 in their Binance Futures account, they decided to use 10x leverage. That turned their $5,000 into a $50,000 position.

When Bitcoin hit $36,000, their position was worth $60,000—a $10,000 profit! They cashed out, walking away with double their starting cash in less than a month.

What made this a win? Timing and control.

They jumped in when the market was clearly moving up, not just hoping for luck. Plus, they set a stop-loss at $29,000, risking only $1,000 if things went south. The lesson? Leverage works best when you catch a strong trend and keep your risks in check. It’s about playing smart, not just playing big.

Cautionary Tale – The 2022 Liquidation Wipeout

Now, rewind to May 2022—a rough time for crypto. Bitcoin was sliding from $40,000, and panic was in the air. One trader, feeling bold, put $2,000 into a 50x leverage long position on BTC/USD, controlling $100,000.

They figured it’d bounce back quick. Instead, Bitcoin crashed 20% to $32,000 in days. With 50x leverage, a 2% drop would’ve been enough to wipe them out—but this was way worse. Their $2,000 was gone in a flash, liquidated by the exchange to cover the loan.

What went wrong? Over-leveraging in a shaky market. At 50x, even a tiny dip spelled disaster, and 2022’s bear market was no place for big bets. The takeaway? Conservative leverage—like 5x or 10x—gives you breathing room when prices tank. In stormy weather, slow and steady beats reckless and ruined.

These stories show both sides of leverage trading: the highs of a well-timed win and the lows of a risky misstep. Learn from them, and you’ll trade wiser!

Bottom Line

Crypto leverage trading is an exciting way to dive into the crypto market, and we’ve unpacked some top-notch strategies to help you get started.

Trend following is your ticket to riding big price moves, using tools like moving averages to catch the wave just right. Scalping keeps things fast and fun, letting you snag quick profits with leverage if you’ve got a sharp eye.

Breakout trading jumps on those moments when prices blast through key levels, while hedging acts like a safety net to soften the blows. And mean reversion? It’s a clever play on prices bouncing back to their usual spot after going wild. Each one’s a different tool in your trading toolbox, ready for the right job.

The big takeaway, though, is finding that sweet spot between risk and reward. Leverage can supercharge your wins—turning a small bet into a big payout—but it’s a double-edged sword. One wrong move, and losses pile up fast. That’s where practical tricks come in: stop-losses to cut bad trades short, smart position sizing to keep your bets manageable, and calculators to plan ahead. Think of them as your guardrails on this high-speed ride.

The real-world wins and wipeouts we’ve explored show it clear as day—success comes from staying sharp and steady, not just swinging for the fences.

Ready to jump in? Start small and smart. Grab a demo account on a platform like Binance or Bybit—it’s like a playground where you can test these strategies with fake money.

Try them out, see what fits your style, and tweak as you learn. Build your skills step by step, and before you know it, you’ll be leveraging crypto like a pro. Go for it—you’ve got this!

FAQs: 20 Related Questions About Crypto Leverage Trading

Who should use crypto leverage trading strategies?

Leverage trading isn’t for everyone—it’s best for experienced traders who can stomach big risks and know how markets work. If you’ve got a solid grip on crypto price swings and aren’t rattled by losing money fast, it might be your thing.

Beginners should steer clear until they’ve practiced with regular trading and built some confidence.

You need to understand tools like stop-losses and charts, plus have the discipline to stick to a plan. If you’re just chasing quick cash without the know-how, leverage can burn you bad—experience is your ticket in.

Who are the top traders using leverage successfully?

Top leverage traders often keep a low profile, but you’ll spot some on X sharing wins—like @CryptoWizardd or @Trader_X (if real and verifiable).

These folks might be pros with years of market time, turning small stakes into big payouts with smart moves.

Public figures like crypto influencers sometimes hint at leverage plays, but details are scarce.

Look for traders posting real-time trades or results—anonymous or not, their success shows in consistency. Follow X communities to find these stars, just make sure their wins aren’t fake hype before you copy them!

Who regulates crypto leverage trading platforms?

Regulation depends on where you are. In the U.S., the SEC keeps an eye on some platforms, while the UK’s FCA sets rules for others.

But tons of big players—like Bybit or Binance—run from places like Seychelles or Malta with little oversight.

That means no strict government rules for many, which is why leverage can go sky-high (100x!). Check your country’s laws before trading; unregulated platforms might offer more freedom but less safety if things go wrong. It’s a trade-off—freedom vs. protection—so know where your exchange stands.

Who benefits most from high-leverage trading?

Short-term traders in wild markets get the most out of high leverage. If you love jumping on Bitcoin’s 10% daily swings or Ethereum’s sudden spikes, high leverage—like 50x or 100x—can turn a small move into a huge win. Day traders or scalpers who thrive on quick in-and-out plays benefit big-time, especially when crypto’s volatility is off the charts. Long-term holders? Not so much—high leverage eats you up with fees over time. If fast action’s your style, this is where you shine, but you’ve got to be sharp and ready for the ride.

What is the best crypto leverage trading strategy for beginners?

For newbies, trend following with low leverage—like 3x—is the way to go. It’s simple: watch a coin’s price trend using a moving average (say, 50-day), then bet it’ll keep going that way. With $500 at 3x, you control $1,500—small enough to limit damage but big enough to learn. It’s forgiving if you mess up, unlike scalping or high-leverage chaos. Start on a demo account, track Bitcoin’s moves, and set a stop-loss. Ease in, build confidence, and keep risks tiny while you figure out what works.

What are the risks of leverage trading in crypto?

Leverage trading’s risks are real and brutal. Liquidation’s the scariest—if prices drop too far, your position’s sold off, and you lose everything you put in (like a 10% dip at 10x wiping $1,000). Fees stack up too—trading costs and funding rates nibble at profits, especially if you hold long. Then there’s amplified losses: a 5% drop hurts 50% worse at 10x. Crypto’s wild swings make it dicey—one bad day, and you’re out. Know these pitfalls, or you’ll learn the hard way!

What tools do I need for crypto leverage trading?

You’ll need a few essentials to trade smart. Charting platforms like TradingView help you spot trends with moving averages or Bollinger Bands—key for timing trades. Stop-loss orders are a must; they cut losses automatically if prices tank (set one at 5% below entry, for example). Risk calculators figure out how much to bet—like risking $50 on a $1,000 account—so you don’t overdo it. These tools keep you grounded and safe in crypto’s crazy ups and downs.

What is the difference between spot and leverage trading?

Spot trading’s basic—you buy a coin with your own cash, like $100 for Bitcoin, and sell when it rises. Leverage trading borrows money to boost that bet—$100 at 10x controls $1,000. Spot’s low-risk; you only lose what you put in. Leverage ups the stakes—bigger wins if it works, but a small dip can wipe you out. Spot’s slow and steady; leverage is fast and fierce. Pick based on your guts and goals!

Where can I practice crypto leverage trading safely?

Demo accounts are your sandbox—Binance, Bybit, and Kraken all offer them. You get fake money to trade with, like $10,000 to test 5x leverage on Bitcoin, no real cash lost. It’s perfect for trying strategies—scalping, trend following—without the stress. Sign up, play around, and see what clicks before you risk a dime. Practice here first, and you’ll step into real trading with more confidence.

Where are the best platforms for leverage trading located?

The top dogs operate globally—Bybit’s based in Seychelles, Binance in Malta, and Kraken’s U.S.-friendly but stricter. These spots offer high leverage (up to 100x) and tons of coins to trade, like BTC, ETH, and more. They’re offshore hubs for a reason—fewer rules, more freedom. Pick one with low fees and good reviews, but double-check their base matches your local laws if you’re worried about regulations.

Where do I find reliable leverage trading signals?

X is buzzing with trader communities sharing signals—look for active groups or pros posting real trades. TradingView’s got free ideas too; users chart patterns like breakouts you can follow. Paid services (like CoinSignals) offer premium tips, but vet them—some are scams. Start with free X chatter, test what works, and build your own feel over time. Reliable signals cut guesswork, but always check twice!

When is the best time to use leverage in crypto markets?

Leverage shines during high volatility or clear trends—like Bitcoin jumping 20% in 2023. Big news (ETF approvals) or market buzz can spark these moves; that’s when 10x turns $1,000 into $3,000 fast. Check charts for steady climbs or drops—random choppy days won’t cut it. Time it right, and you’ll ride the wave; guess wrong, and it’s a washout.

When should I avoid leverage trading?

Skip it when big news looms—like a Fed rate hike—or markets are dead quiet with low trading. Uncertainty makes prices flip-flop, and low action means no momentum for leverage to work. A 50x bet during a crypto ban rumor could tank fast—too risky. Wait for clarity or a busy market; otherwise, you’re tossing coins in the dark.

When do funding rates impact leverage trades?

Funding rates kick in if you hold trades long—hours or days. Every 8 hours (on Binance), you pay (or get) a fee—like 0.03% of your $10,000 position ($3). Short trades in a bull run cost more; long trades might earn you cash. It’s small, but over a week, it adds up—plan for it if you’re not quick in and out.

When can I increase my leverage ratio?

Crank up leverage—like from 5x to 20x—only after you’re winning steady and handling risks like a pro. Say you’ve made 10 solid trades, pocketing $50 each, and your stop-losses save you every time. That’s when you’ve got the chops. Don’t rush—high leverage magnifies mistakes too. Master the basics, then level up with confidence.

Why is risk management critical in leverage trading?

Risk management keeps you alive in crypto’s chaos. Without it, a 5% Bitcoin drop at 10x could erase your $1,000 in minutes—poof, gone! Stop-losses, small bets, and cash on hand stop total wipeouts. Volatility’s your enemy here; one bad swing without a plan, and you’re broke. It’s not optional—it’s your shield against disaster.

Why do traders prefer crypto leverage over stocks?

Crypto’s open 24/7—no closing bell like stocks—and offers insane leverage (100x vs. stocks’ 2x). You can trade Bitcoin at 2 a.m. or flip $100 into $10,000 on a good day. Stocks move slower, with tighter rules—crypto’s a free-for-all. Traders love the speed and scale; it’s a bigger sandbox to play in.

Why do some platforms limit leverage?

Platforms like Kraken cap leverage (say, 50x) to stop users from losing everything and to dodge regulators’ wrath. High leverage—like 100x—means a 1% dip kills you; they’d rather keep you trading than broke. Places like the U.S. push rules to protect folks, so caps balance risk and compliance—it’s less fun but safer.

How do I start leverage trading crypto step-by-step?

Sign up on Binance, verify your ID, and deposit USDT (say, $200). Go to Futures, pick BTC/USD, set 5x leverage—your $200 controls $1,000. Place a long trade at $50,000, add a stop-loss at $49,000, and watch it. Start small, test it, and learn as you go—easy peasy!