What is an ASIC Miner?

An Application-Specific Integrated Circuit (ASIC) miner is a specialized hardware device designed exclusively for cryptocurrency mining. Unlike general-purpose hardware like CPUs or GPUs, ASIC miners are built to perform a single task: solving the cryptographic puzzles required for Proof of Work (PoW) consensus mechanisms. These devices are highly efficient, offering significantly higher hash rates (computational power) and lower energy consumption compared to other mining hardware. ASIC miners are primarily used for mining cryptocurrencies like Bitcoin (BTC), Litecoin (LTC), and others that rely on PoW.

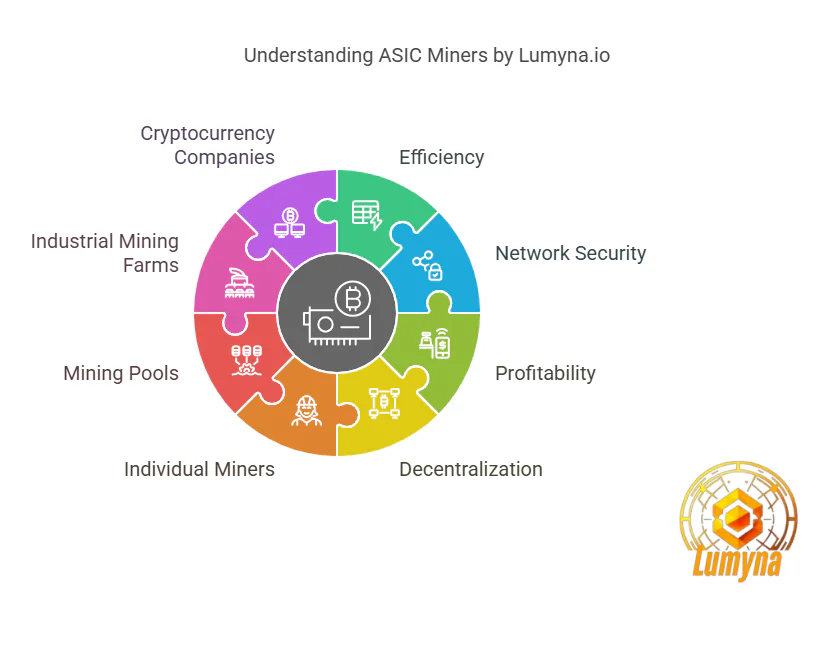

Who Uses ASIC Miners?

ASIC miners are used by a wide range of individuals and organizations, including:

- Individual Miners: Hobbyists or small-scale miners who operate from home or small setups.

- Mining Pools: Groups of miners who combine their computational resources to increase their chances of earning rewards.

- Industrial Mining Farms: Large-scale operations that deploy thousands of ASIC miners in data centers or warehouses to maximize profitability.

- Cryptocurrency Companies: Firms like CleanSpark, which specialize in energy-efficient Bitcoin mining, use ASIC miners to optimize their operations.

When Were ASIC Miners Introduced?

ASIC miners emerged in 2013, revolutionizing the cryptocurrency mining industry. Before ASICs, miners relied on CPUs and GPUs, which were less efficient and consumed more power. The introduction of ASICs, particularly for Bitcoin mining, marked a significant shift in the industry, leading to increased competition and the professionalization of mining operations.

Where Are ASIC Miners Used?

ASIC miners are used globally, but their deployment is concentrated in regions with access to cheap electricity and favorable regulatory environments. Countries like the United States, Canada, Iceland, and Kazakhstan have become hubs for large-scale mining operations due to their low energy costs and cool climates, which help reduce cooling expenses. Industrial mining farms often set up in remote areas near renewable energy sources, such as hydroelectric or geothermal plants, to minimize costs and environmental impact.

Why Are ASIC Miners Important?

ASIC miners are critical to the cryptocurrency ecosystem for several reasons:

- Efficiency: They offer unparalleled computational power and energy efficiency, making them the preferred choice for mining.

- Network Security: By providing the computational power needed to validate transactions, ASIC miners help secure blockchain networks.

- Profitability: Their high hash rates and low energy consumption make them more profitable than other mining hardware, especially for large-scale operations.

- Decentralization: While ASICs are often associated with industrial mining, they also enable individual miners to participate in the network, contributing to its decentralization.

How Do ASIC Miners Work?

ASIC miners are designed to perform a specific hashing algorithm, such as SHA-256 for Bitcoin or Scrypt for Litecoin. Here’s how they work:

- Hardware Design: ASIC chips are custom-built to execute a specific algorithm with maximum efficiency.

- Mining Process: The miner continuously performs hash computations to solve cryptographic puzzles. The first miner to solve the puzzle validates the block and earns the mining reward.

- Cooling and Maintenance: Due to their high power consumption, ASIC miners require robust cooling systems to prevent overheating. Regular maintenance is also necessary to ensure optimal performance.

- Integration with Mining Software: ASIC miners are connected to mining software and pools, which manage their operations and distribute rewards.

Comparative Discussion: ASIC Miners vs. Other Mining Hardware

ASIC Miners vs. GPUs

- Efficiency: ASIC miners are far more efficient than GPUs for specific algorithms, offering higher hash rates with lower energy consumption.

- Versatility: GPUs can mine multiple cryptocurrencies and are not limited to a single algorithm, making them more flexible.

- Cost: ASIC miners are expensive and have a shorter lifespan due to rapid technological advancements, while GPUs are more affordable and can be repurposed for other tasks.

ASIC Miners vs. CPUs

- Performance: ASIC miners outperform CPUs by several orders of magnitude in terms of hash rate and energy efficiency.

- Use Case: CPUs are no longer viable for mining most major cryptocurrencies but are still used for mining smaller, less resource-intensive coins.

ASIC Miners vs. FPGAs

- Customization: Field-Programmable Gate Arrays (FPGAs) offer some level of programmability, allowing them to be reconfigured for different algorithms.

- Efficiency: ASIC miners are more efficient for their specific algorithms but lack the flexibility of FPGAs.

Related Questions About ASIC Miners

- What are the best ASIC miners for Bitcoin in 2023?

- Popular models include the Bitmain Antminer S19 XP and the MicroBT Whatsminer M50S.

- How much does an ASIC miner cost?

- Prices range from 2,000to2,000to10,000, depending on the model and its hash rate.

- Can ASIC miners be used for other cryptocurrencies?

- ASIC miners are algorithm-specific, so they can only mine cryptocurrencies that use the same algorithm (e.g., SHA-256 for Bitcoin).

- What are the energy requirements for ASIC miners?

- Energy consumption varies by model but typically ranges from 1,500 to 3,500 watts.

- How long does an ASIC miner last?

- The lifespan is typically 2-3 years, after which newer, more efficient models may render them obsolete.

- What are the environmental impacts of ASIC mining?

- High energy consumption and e-waste are significant concerns, though some miners use renewable energy to mitigate these effects.

- Are ASIC miners legal in all countries?

- Regulations vary by country, with some nations banning or restricting cryptocurrency mining.

- How do I set up an ASIC miner?

- Setup involves connecting the miner to a power source, configuring mining software, and joining a mining pool.

- What is the ROI (Return on Investment) for an ASIC miner?

- ROI depends on factors like electricity costs, cryptocurrency prices, and mining difficulty.

- Can I use ASIC miners for cloud mining?

- Yes, some cloud mining services use ASIC miners, allowing users to rent hash power remotely.

References

- O’Reilly. “Mastering Bitcoin: Chapter 8. Mining and Consensus.”

This book provides an in-depth explanation of Bitcoin mining, including the role of ASIC miners in the Proof of Work process. - CleanSpark. “CleanSpark, Inc Form 10-K, 2023,” Page 7.

This document offers insights into the operational and financial aspects of large-scale Bitcoin mining, including the use of ASIC miners. - Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Electronic Cash System.”

The original Bitcoin whitepaper outlines the foundational principles of mining and the importance of computational power in securing the network. - Antonopoulos, Andreas M. “Mastering Blockchain: Distributed Ledger Technology, Decentralization, and Smart Contracts Explained.”

This book explores the broader context of blockchain technology, including the evolution of mining hardware. - Narayanan, Arvind, et al. “Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction.”

A detailed academic resource that covers the technical and economic aspects of cryptocurrency mining, including ASIC technology.

By adhering to Lumyna’s editorial standards, this analysis relies on primary sources and reputable publications to ensure accuracy and credibility.

« Back to Glossary Index