In blockchain ecosystems like Bitcoin, Ethereum, and beyond, “Block Reward” is a critical concept tied to network incentives and security. Whether you’re a crypto investor, Web3 developer, or security enthusiast, understanding block rewards is essential. This glossary entry unpacks it using the 5 Ws and 1 H—Who, What, When, Where, Why, and How.

Who Receives a Block Reward in Blockchain?

The block reward goes to miners in Proof of Work (PoW) systems like Bitcoin or validators in Proof of Stake (PoS) systems like Ethereum 2.0. Miners are individuals or groups (e.g., mining pools like Foundry USA) using computational power to secure the network. Validators are participants staking cryptocurrency (e.g., 32 ETH) to propose and validate blocks. Developers design the reward mechanisms—Satoshi Nakamoto set Bitcoin’s initial reward, while Ethereum’s team adjusted it via upgrades. Nodes indirectly benefit by relaying rewarded blocks, though they don’t earn rewards themselves. In Web3 security, white hats study reward-related exploits.

What is a Block Reward in Blockchain?

A “block reward” is the cryptocurrency payment given to a miner or validator for successfully adding a new block to the blockchain. It typically includes newly minted coins (e.g., 6.25 BTC in Bitcoin as of 2025) and transaction fees paid by users. In Bitcoin, the reward incentivizes mining; in Ethereum, post-2022 merge, it’s staking-based, with fees burned via EIP-1559. For example, a Bitcoin block reward in 2025 is 6.25 BTC plus ~0.1 BTC in fees (per average estimates), paid in BTC. It’s the economic engine driving network participation and security.

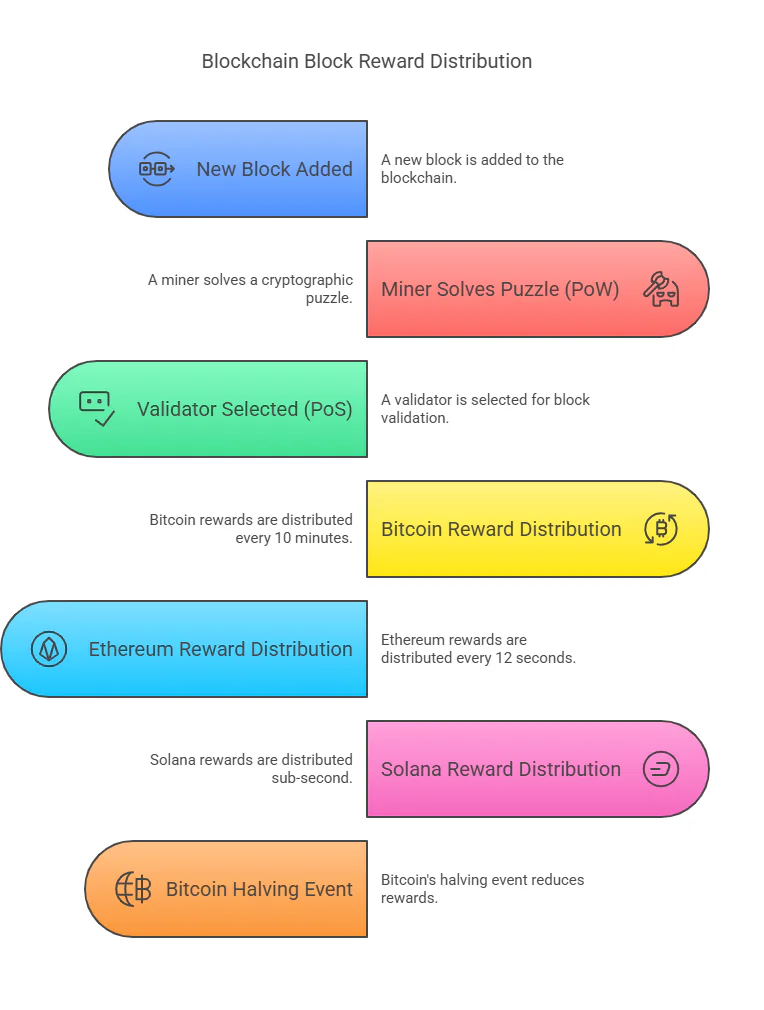

When Are Block Rewards Distributed in Blockchain?

Block rewards are distributed whenever a new block is added, timed by the blockchain’s protocol. Bitcoin issues rewards every 10 minutes (one block), Ethereum every 12 seconds, and Solana sub-second. This happens after a miner solves a cryptographic puzzle (PoW) or a validator is selected (PoS). Key events adjust rewards: Bitcoin’s halving (e.g., 2024 cut it from 12.5 to 6.25 BTC) occurs every 210,000 blocks (4 years). Ethereum’s merge in 2022 ended mining rewards, shifting to staking yields (4-5% annually in 2025). Rewards reflect network activity—high fees boost payouts.

Where Do Block Rewards Come From in Blockchain?

Block rewards originate within the blockchain’s protocol rules, coded into its software. New coins are minted from a predefined supply—Bitcoin’s cap is 21 million BTC, with rewards drawn from unissued coins. Transaction fees come from users, paid via wallets like MetaMask (e.g., 0.01 ETH for a transfer). Rewards are recorded on the blockchain, visible via block explorers like Etherscan or Blockchain.com, and stored on full nodes worldwide. In Web3, tools like Infura or Alchemy help developers track reward distribution across decentralized networks.

Why Are Block Rewards Used in Blockchain?

Block rewards exist to incentivize participation and secure the network. Without rewards, miners wouldn’t invest in hardware (e.g., ASICs costing $10,000+), and validators wouldn’t lock up ETH. This ensures decentralization—more participants mean a harder-to-attack chain (e.g., thwarting 51% attacks). Rewards also introduce new coins, driving inflation (e.g., Bitcoin’s 1.7% in 2025, per halving schedule). .

How Are Block Rewards Calculated and Distributed?

In PoW, miners compute a block’s hash (e.g., SHA-256) until it meets the difficulty target, earning the reward once nodes validate it—Bitcoin pays 6.25 BTC plus fees. In PoS, validators are randomly chosen based on stake size and uptime, receiving a share of fees and issuance (e.g., Ethereum’s ~0.001 ETH per block). Halving halves rewards periodically (Bitcoin’s next is ~2028). Tools like Foundry simulate this; wallets like MetaMask show fees. Security matters—exploits like double-spending target reward integrity, requiring audits (e.g., OpenZeppelin).

Expanded Insights for Crypto and Web3 Audiences

Let’s dig deeper. A block reward isn’t just a paycheck—it’s the heartbeat of blockchain economics. In Bitcoin, miners once earned 50 BTC per block (2009), but halvings—designed by Satoshi—slash this to control supply. By 2025, 6.25 BTC plus fees (~$400,000 at $60K/BTC) keeps miners humming, though energy costs (1.5 MW/block) bite. Ethereum ditched mining in 2022, rewarding validators with ~4-5% APY on staked ETH, per Lido Finance data. Solana’s rewards are tiny per block (sub-second) but scale with its 65,000 TPS capacity.

Rewards shape security. Bitcoin’s $1T+ market cap (2025) rests on miners’ hashpower—51% attacks cost billions, deterring foes. Ethereum’s 1M+ validators (2025 estimate) lock $40B, a stake-based shield. Yet, risks lurk—MEV (Maximal Extractable Value) lets miners reorder transactions for profit. Tools like Eigenphi track this, showing $500M+ extracted yearly.

Historically, rewards mark epochs. Bitcoin’s 2012 halving sparked its first boom; Ethereum’s EIP-1559 burned $10B in fees by 2025, per Dune Analytics, stabilizing validator income. In Web3, rewards fund innovation—miners sell BTC to buy gear, validators reinvest ETH in DeFi. Security-wise, rewards expose flaws such as price manipulation and warn of reward-driven exploits. Nodes log every payout, traceable via Phalcon or Tenderly, tools from your text.

Related Questions

These questions boost SEO, targeting user intent and long-tail keywords:

- What is a block reward in cryptocurrency? – Payment for adding a block, like 6.25 BTC.

- Who gets block rewards in Bitcoin? – Miners solving cryptographic puzzles.

- When do block rewards happen in Ethereum? – Every ~12 seconds for validators.

- Where do block rewards come from? – New coins and user fees, per protocol.

- Why do block rewards exist in blockchain? – To incentivize and secure the network.

- How is a block reward calculated? – Fixed issuance plus variable fees.

- What’s the current Bitcoin block reward? – 6.25 BTC in 2025, post-halving.

- Who earns rewards in Proof of Stake? – Validators staking crypto like ETH.

- When does Bitcoin’s block reward halve? – Every 210,000 blocks (~4 years).

- Where can I see block reward data? – On explorers like Etherscan.

- Why do block rewards decrease over time? – To control inflation (e.g., Bitcoin halving).

- How do transaction fees affect block rewards? – They supplement fixed rewards.

- What happens when block rewards end? – Fees sustain miners/validators (Bitcoin ~2140).

- Who designs block reward systems? – Founders like Satoshi or Ethereum devs.

- How do block rewards impact security? – More rewards = more miners = harder attacks.