What is HODL?

HODL is a slang term in the cryptocurrency community meaning to “Hold On for Dear Life,” referring to the strategy of holding onto crypto assets long-term despite market volatility. It’s not just a typo of “hold”, it’s a mindset embracing resilience against price swings, often paired with a belief in crypto’s future value. Beyond a tactic, HODL has become a cultural meme symbolizing loyalty to the crypto ethos.

Who created HODL?

The term originated from a user named GameKyuubi on the Bitcoin Talk forum. On December 18, 2013, amid a Bitcoin price crash (from ~$1,100 to ~$600), he posted a now-iconic, typo-laden rant titled “I AM HODLING,” explaining his refusal to sell despite being drunk and frustrated. The misspelling stuck, turning his defiance into a rallying cry for Bitcoin enthusiasts.

When did it start?

HODL entered crypto lexicon on December 18, 2013, with GameKyuubi’s post. It gained traction as Bitcoin’s volatility persisted—e.g., the 2017 bull run (BTC hit ~$20,000) and subsequent crashes—solidifying its use by 2018. By 2025, it’s a staple term, reflecting a decade-plus of market cycles and HODLers’ endurance.

Where is HODL used?

HODL is practiced globally by crypto investors, especially in online communities like X, Reddit (e.g., r/Bitcoin), and forums. It’s most associated with Bitcoin but extends to altcoins like Ethereum or Dogecoin. You’ll see it in memes, hashtags (#HODL), and trading discussions, particularly during market dips or pumps, wherever crypto culture thrives.

Why use HODL?

HODLers aim to avoid panic-selling during downturns and capitalize on long-term growth, driven by faith in crypto’s fundamentals—e.g., Bitcoin’s capped 21 million supply or Ethereum’s utility. It counters day trading’s stress, betting that prices (e.g., BTC at ~$60,000 in 2025) will rise over years. It’s also a psychological anchor, fostering discipline amid crypto’s wild fluctuations.

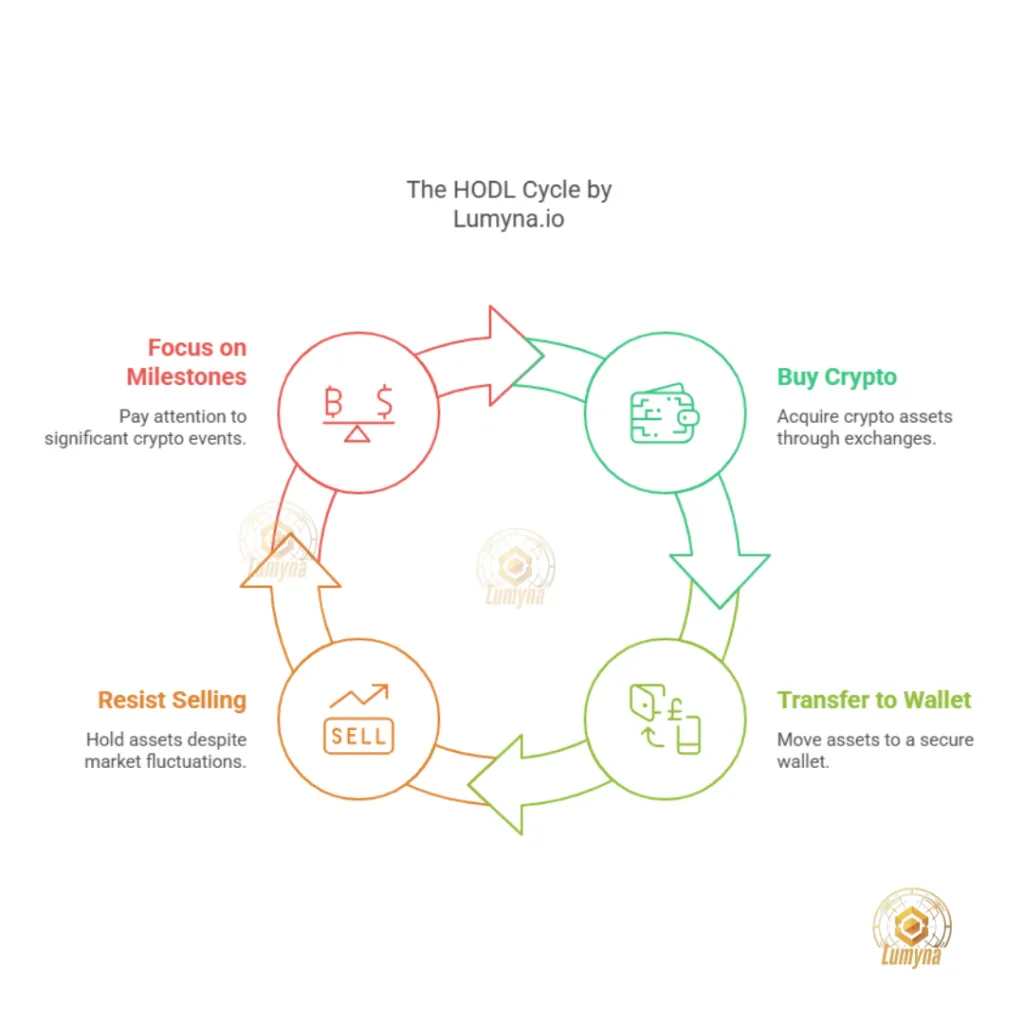

How does HODL work?

To HODL, buy crypto via an exchange (e.g., Coinbase, Binance), transfer it to a secure wallet (hardware like Ledger or software like MetaMask), and resist selling regardless of market conditions. HODLers often ignore short-term noise—e.g., a 20% drop—and focus on milestones like Bitcoin halving events (next in 2028), expecting value appreciation.

Related Questions:

- Is it a good strategy? It can be, e.g., BTC HODLers from 2013 ($600) to 2025 (~$60,000) saw 100x gains—but timing and coin choice matter; some altcoins crash to zero.

- What’s an example of HODLing? Holding Bitcoin through the 2018 bear market (from $20,000 to $3,000) and waiting for its 2021 peak (~$69,000).

- Does HODL apply to all crypto? Mostly yes, though riskier with volatile altcoins; Bitcoin’s stability makes it the HODL poster child.

- How long should you HODL? No set time, some aim for years (e.g., 5-10), others indefinitely, based on personal goals or market faith.