Who is KuCoin?

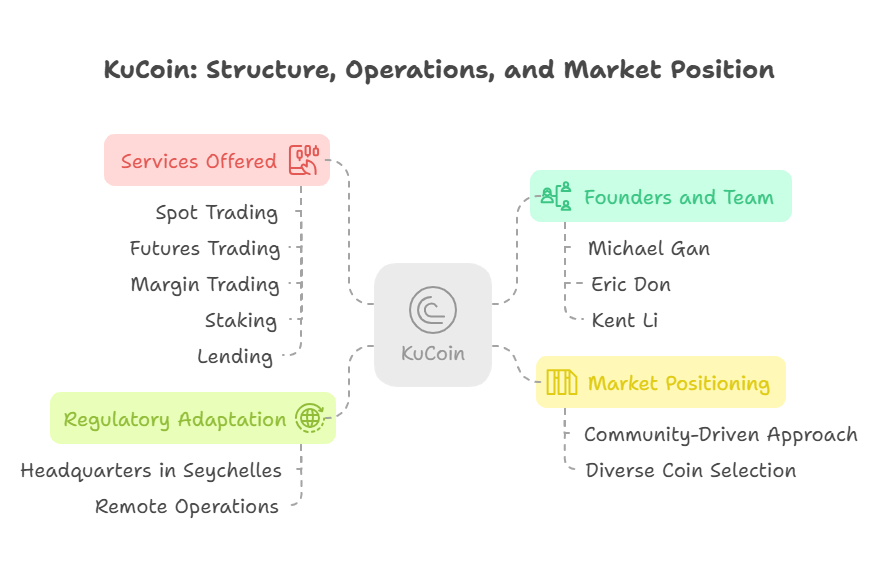

KuCoin is a prominent cryptocurrency exchange founded by Michael Gan (also known as Gan Lin), a Chinese entrepreneur with a background in software development and fintech.

Gan previously worked at Ant Financial, Alibaba’s financial arm, where he honed his skills in building scalable systems, and later ventured into crypto by co-founding a trading platform called Richcore.

Alongside Gan, a team of early collaborators, including Eric Don (COO) and Kent Li (operations lead), helped establish KuCoin in 2017.

The exchange caters to a global audience of crypto traders, ranging from beginners to seasoned investors, and has cultivated a community dubbed the “KuCoin Army.” Unlike Binance, the exchange positions itself as a more community-driven platform, emphasizing accessibility and a diverse coin selection.

The team operates remotely, with no fixed headquarters, aligning with the decentralized ethos of cryptocurrency. Its users span millions across over 200 countries, though regulatory restrictions limit its reach in places like the United States, where it operates without full fiat support.

The “who” encompasses Gan’s vision, the team’s execution, and the traders who rely on KuCoin’s offerings.

What is KuCoin?

KuCoin is a centralized cryptocurrency exchange that enables users to buy, sell, and trade a vast array of digital assets. Often called “The People’s Exchange,” it boasts over 700 cryptocurrencies, including major coins like Bitcoin (BTC) and Ethereum (ETH), as well as lesser-known altcoins and meme coins.

Its native token, KuCoin Token (KCS), launched in 2017, incentivizes users by offering trading fee discounts and a profit-sharing model where holders receive dividends from 50% of the platform’s trading fees.

Beyond spot trading, the exchange provides futures trading, margin trading, staking, lending, and a P2P marketplace.

KuCoin also features KuCoin Labs for blockchain research, KuCoin Spotlight for token sales, and a non-custodial wallet, enhancing its ecosystem. Its focus on listing new and niche projects sets it apart from competitors, appealing to traders seeking early investment opportunities.

The “what” of KuCoin is its role as a versatile, altcoin-friendly exchange with a broad service suite.

When was it Established?

KuCoin was founded in September 2017, entering the crypto market during the ICO frenzy and Bitcoin’s 2017 bull run. Its launch coincided with a surge in demand for exchanges offering diverse coins, allowing KuCoin to carve a niche alongside giants like Binance.

By 2018, it had gained traction for its altcoin listings, and in 2022, it raised $150 million in a funding round led by Circle Ventures, valuing it at $10 billion.

Key milestones include surviving a $280 million hack in 2020 and expanding its services over time. The “when” reflects its growth amid crypto’s boom-and-bust cycles.

Where is It Based?

KuCoin is headquartered in Seychelles, a crypto-friendly jurisdiction, where it is registered as its International Co., Ltd. Originally conceived in China, it shifted operations due to the 2017 Chinese crypto ban, mirroring Binance’s exodus.

Its physical presence is minimal, with Gan and the team operating remotely from various global locations, including Singapore, which serves as an operational hub.

KuCoin’s services are accessible worldwide, though it faces restrictions in the US and other regulated markets due to compliance issues. The “where” highlights its adaptability to a fragmented regulatory landscape.

Why Does it Exist?

The exchange exists to democratize access to cryptocurrency trading, as envisioned by Gan, who saw a gap in exchanges offering a wide range of altcoins with low barriers to entry. Its mission is to empower users—hence “The People’s Exchange”—by providing affordable fees (starting at 0.1%), diverse listings, and passive income opportunities via KCS dividends.

KuCoin aims to support emerging blockchain projects, giving smaller tokens a platform to gain visibility. Its existence also reflects a competitive drive to rival larger exchanges while fostering a loyal community. The “why” is about accessibility, innovation, and user empowerment in the crypto space.

How Does KuCoin Operate?

KuCoin operates as a centralized exchange, managing user funds and trades through a high-performance trading engine capable of handling millions of transactions daily.

Users sign up, deposit crypto (or fiat in supported regions), and trade via spot, futures, or margin markets. KCS integrates into the platform, reducing fees and distributing dividends, while staking and lending offer additional income streams.

Security measures include cold storage, 2FA, and encryption, though a 2020 hack exposed vulnerabilities; KuCoin recovered by reimbursing users via insurance and reserves.

The platform lists new tokens through a rigorous vetting process, often faster than competitors, appealing to speculative traders. It generates revenue from trading fees, withdrawal fees, and other services, reinvesting into growth and marketing. The “how” involves balancing innovation with resilience, navigating regulations, and maintaining user trust.

Answers to Related Questions

Who founded KuCoin, and what was their background before launching the exchange?

KuCoin was founded by Michael Gan in 2017. Gan’s prior experience at Ant Financial gave him expertise in scalable systems, while his work at Richcore, a crypto trading platform, introduced him to blockchain. His team, including Eric Don and Kent Li, brought operational and technical skills to build KuCoin into a global player.

What services does KuCoin offer beyond basic cryptocurrency trading?

KuCoin offers futures and margin trading, staking, lending, a P2P marketplace, and KuCoin Spotlight for token launches. It also provides KuCoin Labs for research, a wallet, and passive income options via KCS dividends, catering to diverse user needs.

When did KuCoin experience its most significant security breach?

KuCoin suffered a major hack on September 26, 2020, losing $280 million in crypto. It recovered most funds through insurance, reserves, and cooperation with other exchanges, reinforcing user confidence.

Where is KuCoin legally registered, and why did it leave China?

KuCoin is registered in Seychelles but operates globally with a hub in Singapore. It left China in 2017 due to a government ban on crypto trading, relocating to avoid legal risks.

Why does KuCoin emphasize listing lesser-known altcoins?

KuCoin focuses on altcoins to attract traders seeking high-risk, high-reward opportunities and to support emerging projects. This niche differentiates it from competitors and builds a speculative trading community.

How does KuCoin ensure user trust after past security incidents?

Post-2020 hack, KuCoin enhanced security with cold storage, 2FA, and real-time monitoring. It reimbursed affected users fully, using insurance and reserves, and communicates transparently to maintain trust.

What is the role of KCS in the KuCoin ecosystem?

KCS, launched in 2017, reduces trading fees and distributes 50% of KuCoin’s trading profits as dividends to holders. It also supports staking and governance, tying its value to platform success.

How does KuCoin differ from centralized exchanges like Binance?

KuCoin prioritizes altcoin variety and community engagement, offering more niche tokens than Binance. While Binance has a broader ecosystem (e.g., BNB Chain), KuCoin focuses on trading and passive income via KCS.

When did KuCoin achieve its $10 billion valuation?

KuCoin hit this valuation in May 2022 after a $150 million funding round led by Circle Ventures, reflecting its growth and investor confidence during a crypto market downturn.

Why do some countries restrict KuCoin’s operations?

Countries like the US restrict KuCoin due to its lack of full regulatory compliance, such as KYC enforcement or securities licenses, limiting fiat on-ramps and market access.

Who are the primary users of KuCoin—retail traders or institutions?

Retail traders dominate KuCoin’s user base, drawn by its altcoin focus and low fees. Institutions use it less, preferring exchanges like Binance with more robust enterprise tools.

What impact has KuCoin had on the altcoin market?

KuCoin has boosted altcoin visibility by listing hundreds of tokens early, driving speculative trading and liquidity. Its Spotlight program has helped launch projects, influencing altcoin adoption and market dynamics.