The crypto world is a goldmine of opportunity, and a playground for scammers. One of the sneakiest tricks in the book is the rug pull, where developers hype a project, pocket investors’ cash, and vanish, leaving you with worthless tokens. Billions have been lost to these scams, but you don’t have to be next. With the right rug pull detection checklist, you can spot trouble before it strikes. This guide breaks down 10 warning signs to watch for, packed with examples and tips to keep your crypto safe. Let’s dive in and arm you with the know-how to dodge the traps.

Why Rug Pulls Are a Big Deal in Crypto

Before we get to the checklist, let’s set the stage. A rug pull happens when a crypto project’s creators build hype—think flashy websites, big promises, and social media buzz—then bail after collecting funds. Your investment tanks, and they’re gone. It’s brutal, fast, and way too common, especially in decentralized finance (DeFi) and meme coin circles. The Squid Game token scam of 2021, where developers made off with $3.38 million, is a classic case. Knowing what to look for can mean the difference between profit and disaster. Ready? Here’s your 10-step rug pull detection toolkit.

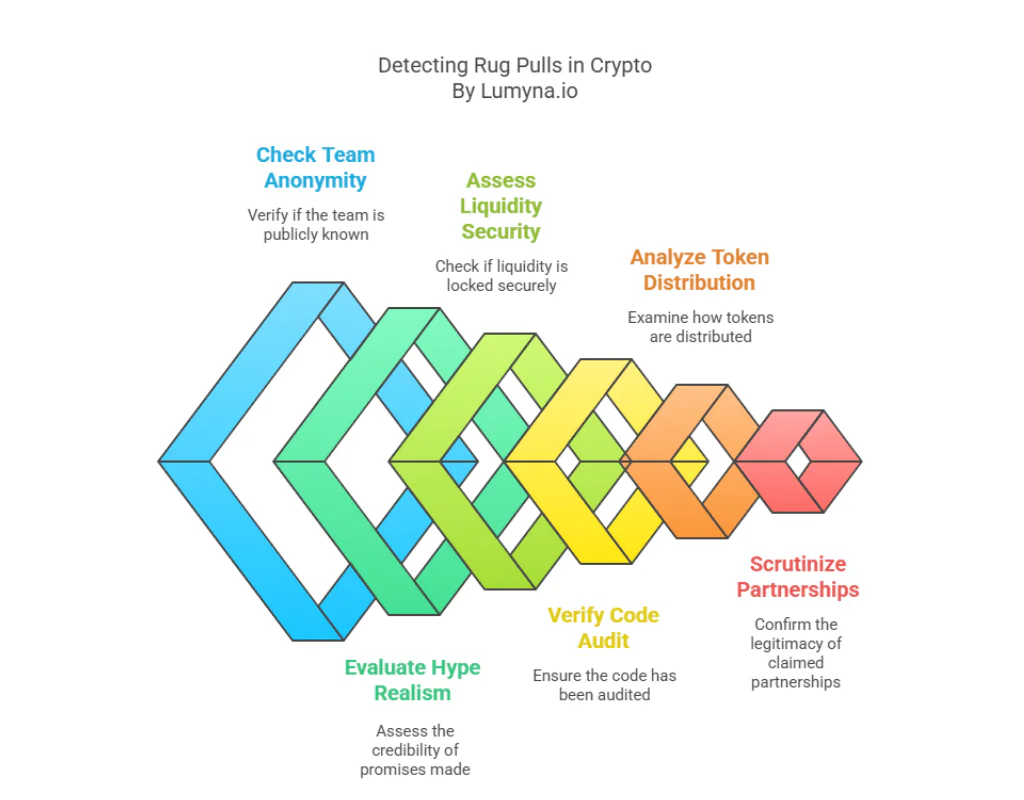

1. Anonymous Team: Who’s Behind the Curtain?

First up: who’s running the show? If the project’s team is a mystery—no names, no LinkedIn profiles, no legit track record—it’s a red flag. Legit projects like Chainlink or Aave flaunt their founders’ credentials. Scammers? They hide. Take AnubisDAO: in 2021, it raised $60 million, then poof—the anonymous team vanished with the loot. Check the website, dig on X, and Google the names. No faces? No trust.

2. Unrealistic Hype: Promises Too Good to Be True

“1000% gains in a week!” “The next Bitcoin!” Sound familiar? Scammers love over-the-top promises to hook you with FOMO (fear of missing out). Real crypto projects temper expectations—think Ethereum’s focus on utility, not moonshots. The Squid Game token (SQUID) promised insane returns tied to a fake game; it spiked to $2,800, then crashed when the rug was pulled. If it sounds like a fairy tale, it’s probably a scam. Cross-check claims with hard data.

3. Shady Liquidity: Can They Pull the Plug?

Liquidity is the lifeblood of trading on decentralized exchanges (DEXs) like Uniswap. In a rug pull, scammers control the liquidity pool and yank it when the time’s right, leaving you stuck. Look for locked liquidity—legit projects lock funds via platforms like Team Finance for months or years, proving they’re in it for the long haul. Unlocked or short-term locks? Trouble. Use tools like RugDoc or check Etherscan to verify. No lock, no luck.

4. Unaudited Code: What’s Hiding in the Tech?

Smart contracts power most DeFi and token projects, and scammers can hide nasty surprises in the code—like backdoors to drain funds. Reputable projects get audits from firms like CertiK or OpenZeppelin to prove their tech’s clean. No audit? Or a sketchy one from “Joe’s Audit Shack”? That’s a warning. The SafeMoon V1 fiasco had unaudited quirks that sparked distrust (though it wasn’t a full rug pull). Peek at the contract on BscScan or Etherscan—don’t invest blind.

5. Social Media Overload: Hype Bots on Blast

Ever see a token blow up on X or Telegram with nonstop shilling? “Buy now or miss out!” screams a swarm of bots or paid influencers. Organic buzz grows naturally—think Dogecoin’s slow rise via real fans. Scams force it. The SQUID token flooded socials with fake hype before disappearing. Scroll the comments: too many emoji-heavy “to the moon” posts from new accounts? Smells like a setup. Trust real chatter, not bot noise.

6. No Whitepaper or Roadmap: All Talk, No Plan

A legit crypto project has a whitepaper—a detailed doc explaining its purpose, tech, and goals. Bitcoin’s got one. Ethereum’s got one. Rug pulls? Crickets. Or they’ll slap together a vague, typo-riddled mess with no substance. Same goes for roadmaps—serious teams map out milestones. AnubisDAO had no clear plan, just hype, and it showed when $60 million vanished. Demand a whitepaper and timeline. No docs? No dice.

7. Token Distribution: Who’s Holding the Bag?

Check who owns the tokens. If the team or a few wallets hold a massive chunk—like 50% or more—they can dump it and crash the price. Fair launches spread tokens widely; scams hoard them. Look up the contract on a blockchain explorer (Etherscan for Ethereum, BscScan for Binance Smart Chain) to see the top holders. The SQUID scam devs owned enough to control the game. Too concentrated? You’re the exit liquidity.

8. Rushed Timelines: Pressure to Jump In

“Invest now or lose your chance!” Scammers thrive on urgency, rushing you past due diligence. Real projects build slow—Shiba Inu took time to grow its ecosystem. Rug pulls don’t. The AnubisDAO scam hit in under 24 hours: $60 million raised, then gone. If they’re pushing hard for your cash with countdowns or “limited spots,” pause. Time’s your friend—use it to research.

9. Fake Partnerships: Name-Dropping for Clout

“Partnered with Tesla!” “Backed by Binance!” Scammers love tossing out big names to seem legit, but it’s often a lie. Verify claims—check official announcements from the supposed partner. A random token called “ElonMoon” once hinted at Musk ties; it flopped with no proof. Dig into X posts, press releases, or the partner’s site. No confirmation? It’s a scam flexing fake cred.

10. Gut Check: Does It Feel Off?

Last but not least: trust yourself. Something feel weird? Maybe the site’s sloppy, the team’s evasive, or the hype’s too loud. Your instincts can catch what stats miss. I once dodged a “DeFi gem” with a glitchy site and no clear answers—it rug pulled a week later. Step back, breathe, and double-check. If it’s fishy, walk away.

Real-World Rug Pull Examples to Learn From

Let’s tie this checklist to reality with two infamous cases:

- Squid Game Token (SQUID): Anonymous team? Check. Wild promises? Check. Unlocked liquidity and unaudited code? Double check. It soared to $2,800, then devs drained $3.38 million and ghosted. Every sign was there.

- AnubisDAO: No whitepaper, rushed raise, concentrated tokens, and a faceless team. Raised $60 million in hours, then disappeared. Textbook rug pull.

These flops scream the checklist’s value. Spot the signs, save your wallet.

How to Use This Checklist Like a Pro

Here’s your game plan: before investing, run every project through these 10 steps. Start with the team—Google them. Check promises against reality. Use Etherscan or RugDoc for liquidity and code digs. Scroll X for hype vibes. Demand docs. Peek at token splits. If any step fails, reconsider. It takes 20 minutes tops and beats losing thousands. Bookmark this list—it’s your crypto shield.

Extra Tips to Stay Ahead of Rug Pulls

Beyond the checklist, level up your defense:

- Start Small: Test with a tiny amount you can lose. See how it plays out.

- Wallet Up: Use a hardware wallet (Ledger, Trezor) and never share keys.

- Stick to Knowns: New to crypto? Try established coins like DOGE or ETH first.

- Community Check: Join forums like Reddit’s r/CryptoCurrency—real users spot scams fast.

Combine these with the checklist, and you’re golden.

What If You Spot a Rug Pull Too Late?

Caught in a scam? Don’t panic. Screenshot everything—site, trades, chats. Report it to the FTC, local cops, or crypto trackers like RugDoc. Warn others on X or Reddit. Recovery’s slim—blockchain’s brutal that way—but pros like Chainalysis might trace funds if you’re lucky. Learn, share, and move on smarter.

Final Take: You’ve Got the Power to Spot Rug Pulls

Rug pulls suck, but they’re not invincible. With this 10-step rug pull detection checklist, you’re equipped to sniff out scams and protect your crypto stash. From anonymous teams to fake hype, you know the signs—and real cases like SQUID and AnubisDAO prove they work. Crypto’s wild, but you don’t have to be a victim. Got a project you’re eyeing? Run it through this list and let me know how it holds up—I’m here to help you navigate the chaos.