The crypto market offers exciting opportunities, but it’s also a breeding ground for scams, and one of the most notorious is the rug pull. Every year, thousands of investors lose money to deceptive crypto projects that seem promising but vanish overnight.

But did you know that not all rug pulls happen instantly? Some scams drain funds slowly, while others disappear in seconds. These are known as soft rug pulls and hard rug pulls, and understanding their differences is crucial for protecting your crypto investments.

In this guide, we’ll break down:

✅ What rug pulls are & how they work

✅ Soft vs hard rug pulls, key differences

✅ Real-world examples of major crypto rug pulls

✅ How to spot red flags & avoid crypto scams

By the end of this article, you’ll have the knowledge to identify rug pulls before they happen, saving your money and peace of mind!

What is a Rug Pull in Crypto?

A rug pull is a type of scam in the cryptocurrency market where developers abandon a project after collecting investors’ money, leaving them with worthless tokens. It is a form of exit scam that has become common in the decentralized finance (DeFi) and NFT spaces. These scams take advantage of the trust and hype surrounding new crypto projects, luring investors with promises of high returns, only to disappear once enough funds are collected.

Rug pulls typically happen in projects with low regulation, such as DeFi protocols, meme coins, and NFT collections. Scammers often create a seemingly legitimate token, build hype around it, and attract liquidity from investors. Once the project gains traction, the developers either remove liquidity, making it impossible for investors to sell, or manipulate the smart contract to prevent withdrawals.

In the DeFi sector, rug pulls often occur in liquidity pools. Developers list a token on a decentralized exchange (DEX) and pair it with a more established cryptocurrency like Ethereum or USDT. When enough users invest, the scammers withdraw all liquidity, leaving investors with worthless tokens. Some projects also implement malicious smart contracts that allow the developers to disable selling or mint unlimited new tokens to crash the market.

The NFT market has also seen rug pulls where creators sell digital assets with promises of future utility or roadmap developments. Once the NFTs are sold out, the team vanishes, abandoning the project without delivering any of the promised features.

Some of the most infamous rug pulls include the Squid Game Token, which prevented investors from selling, and the Frosties NFT project, where developers disappeared after selling out, leaving buyers with no further project development.

Soft vs Hard Rug pulls: Understanding Soft Rug Pulls

Definition of a Soft Rug Pull

A soft rug pull occurs when developers or project founders manipulate a project’s value for personal gain without immediately abandoning it. Unlike hard rug pulls, where investors lose funds instantly, soft rug pulls happen gradually, making them more deceptive. Developers may continue engaging with the community while secretly extracting value from the project.

How Soft Rug Pulls Work

Soft rug pulls often involve insiders slowly selling off their tokens over time, causing the price to decline. Instead of outright stealing funds, developers create false hype to attract new investors while they exit the project. Some of the most common ways soft rug pulls occur include:

- Gradual token sell-off by insiders – Developers and early investors slowly dump their holdings while maintaining an illusion of progress.

- Team slowly abandoning the project – A lack of updates, reduced communication, and ignored community concerns signal that developers are no longer committed.

- Unrealistic staking rewards leading to devaluation – Some projects lure investors with extremely high APYs, but as more tokens are issued, inflation causes severe price drops.

Examples of Soft Rug Pulls

Soft rug pulls have affected both the DeFi and NFT spaces. Some notable examples include:

- Developers overhyping a project and dumping tokens – Teams market a token aggressively, causing prices to surge, only to sell off their holdings while investors are still buying in.

- NFT projects failing to deliver promised features – Some NFT collections raise funds by promising future utilities but abandon development while continuing to earn royalties from secondary sales.

How to Spot a Soft Rug Pull

Identifying a soft rug pull requires careful observation. Here are some warning signs:

- Lack of transparency about the project’s future – The roadmap suddenly becomes vague, and developers avoid discussing long-term plans.

- Founders selling large amounts of tokens – Wallet tracking shows major sell-offs by insiders, even as they encourage the community to hold.

- No roadmap or development updates – The team stops releasing new features or updates, and communication with investors becomes sporadic.

Being aware of these red flags can help investors avoid falling victim to a soft rug pull and protect their funds in the crypto market.

Soft vs Hard Rug pulls: Understanding Hard Rug Pulls

Definition of a Hard Rug Pull

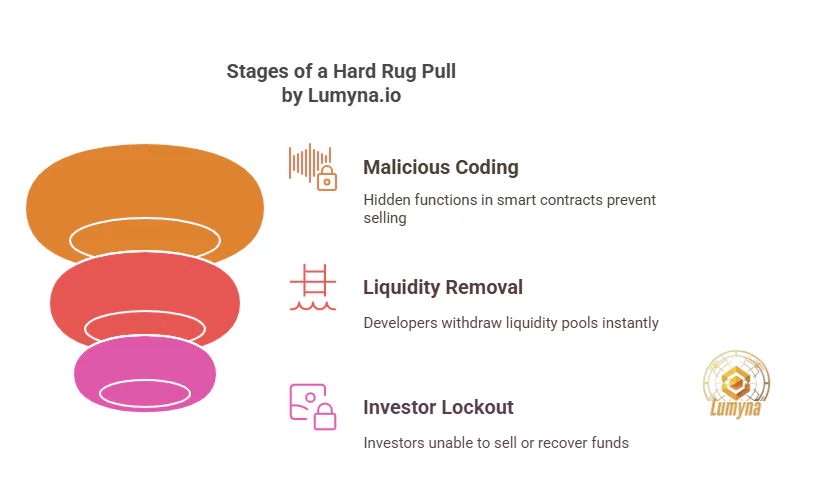

A hard rug pull occurs when developers intentionally deceive investors and exit with the funds immediately. Unlike soft rug pulls, where the project slowly declines over time, a hard rug pull is an instant scam where liquidity is drained, or investors are locked out from selling their assets. This type of scam is more aggressive and often results in total financial loss for investors within minutes or hours.

How Hard Rug Pulls Work

Hard rug pulls are executed through malicious coding and deceptive strategies that leave investors unable to recover their funds. Some of the most common tactics include:

- Malicious smart contract coding – Some projects include hidden functions in the smart contract that disable selling, allowing only insiders to cash out. Investors can buy tokens but are unable to sell them.

- Developers removing liquidity pools instantly – In decentralized exchanges (DEXs), liquidity pools are crucial for trading. Scammers add liquidity to attract investors, but once the token price rises, they withdraw all liquidity, leaving buyers with worthless tokens.

- Fake projects with no real use case – Some tokens or NFT collections are created purely for speculation, with no real product, utility, or long-term plan. These projects often disappear as soon as enough investors have bought in.

Examples of Hard Rug Pulls

Several high-profile scams have demonstrated how devastating hard rug pulls can be. Some of the most infamous examples include:

- Squid Game Token – Inspired by the hit Netflix show, this token attracted massive hype. However, its smart contract prevented investors from selling, allowing only the developers to cash out before the price crashed to zero.

- DeFi projects draining liquidity overnight – Some DeFi tokens launch with locked liquidity, but scammers use coded loopholes to withdraw funds or manipulate the protocol to their advantage. Investors wake up to find their holdings worthless.

How to Spot a Hard Rug Pull

Hard rug pulls are often disguised as legitimate projects, but there are key warning signs that investors should watch for:

- Anonymous team with no verifiable background – Scammers often use fake identities or refuse to disclose their real names to avoid accountability.

- No proper audits for smart contracts – If a project’s smart contract hasn’t been reviewed by a reputable third-party auditor, it may contain malicious code that allows developers to execute a rug pull.

- Sudden spike in price followed by a crash – A rapid increase in price, followed by an immediate sell-off, is often a sign of price manipulation and an impending rug pull.

By staying vigilant and conducting thorough research before investing, traders can reduce the risk of falling victim to a hard rug pull and protect their funds in the volatile crypto space.

Key Differences Soft vs Hard Rug Pulls

| Feature | Soft Rug Pull | Hard Rug Pull |

|---|---|---|

| Exit strategy | Gradual abandonment | Immediate exit |

| Investor Loss | Slow token depreciation | Instant loss of funds |

| Signs | Devs selling tokens, inactivity | Liquidity drain, disabled selling |

| Examples | Overpromised NFT projects | Scam tokens with fake hype |

How to Protect Yourself from Rug Pulls

Investing in crypto comes with risks, but there are key steps you can take to avoid falling victim to rug pulls. Here’s how to protect yourself:

Research the Team

Before investing in any project, verify the identity of the developers. Look for team members with a proven track record in the crypto space. If the project’s team is anonymous or lacks past experience, it could be a red flag.

Check Liquidity Lock

Ensure that the project has locked liquidity for a long duration. Locked liquidity means that developers cannot suddenly remove funds from the liquidity pool, reducing the risk of a hard rug pull. Use blockchain explorers to check whether liquidity is time-locked or permanently locked.

Look for Smart Contract Audits

Reputable projects undergo third-party smart contract audits from companies like CertiK, PeckShield, or Hacken. These audits help verify that the smart contract does not contain vulnerabilities or malicious code. If a project has no audits or refuses to provide one, be cautious.

Monitor Token Distribution

Check how tokens are distributed among holders. If a few wallets hold a large percentage of the supply, the risk of a rug pull increases because developers or insiders can dump their tokens at any time. Look for projects with fair and decentralized token allocations.

Beware of Unrealistic Promises

Scammers often lure investors with too-good-to-be-true returns. Be cautious of projects offering unrealistic staking rewards, guaranteed profits, or exaggerated claims about future success. If it sounds too good to be true, it probably is.

Follow Community Engagement

Legitimate projects have active and transparent communities. Look at how developers interact with the community on platforms like Twitter, Discord, and Telegram. If the team is responsive, open about progress, and consistently delivers updates, it’s a positive sign. If they avoid answering questions or delete negative comments, it’s a warning signal.

By following these precautionary steps, you can significantly reduce the chances of falling victim to a rug pull and make safer investment decisions in the crypto market.

What to Do If You Get Rug Pulled

If you have fallen victim to a rug pull, it’s important to take immediate action to document the scam, report it, and prevent others from getting scammed. Here’s what you should do:

Document the Evidence

Gather all possible evidence related to the project. This includes:

- Screenshots of transactions, whitepapers, and team communications.

- Copies of social media posts, website content, and marketing materials that were used to promote the project.

- Blockchain transaction records showing token movements and liquidity withdrawals.

This documentation can be useful for investigations and reporting.

Report the Scam

Notify relevant authorities and blockchain security platforms about the rug pull. Some places to report include:

- The SEC (Securities and Exchange Commission) if the project operated within a regulated jurisdiction.

- Blockchain security firms like CertiK, PeckShield, or SlowMist, which track fraudulent projects.

- Crypto exchange platforms if the token was listed and available for trading.

- Local law enforcement or cybercrime units, depending on the severity of the scam.

Warn Others

Sharing your experience can help prevent more people from being scammed. Post about the rug pull on:

- Crypto forums like Reddit (r/cryptocurrency, r/defi, r/cryptoscams).

- Twitter and Telegram communities where the project was promoted.

- Scam-tracking websites like RugDoc.io and CoinSniper, which list known rug pulls.

Learn from the Mistake

While getting rug-pulled is frustrating, use it as a learning experience. Adjust your investment strategies and due diligence practices to avoid future scams:

- Be more cautious with anonymous teams and hyped projects.

- Avoid tokens with low liquidity or excessive insider holdings.

- Always check for smart contract audits and locked liquidity before investing.

By taking these steps, you can not only protect yourself but also help others in the crypto space avoid similar scams.

Conclusion

Rug pulls remain one of the biggest risks in the cryptocurrency space, affecting both new and experienced investors. Understanding the difference between soft rug pulls and hard rug pulls can help in identifying red flags before investing in a project. While soft rug pulls happen gradually through insider sell-offs and abandoned development, hard rug pulls involve an immediate exit scam where developers drain liquidity or lock investors out of selling.

To stay safe in the crypto space, always conduct thorough research before investing. Verify the project team’s identity and past work, check for liquidity locks, and review smart contract audits. Be cautious of projects offering unrealistic rewards, and monitor token distribution to ensure that no single entity holds too much control.

The best defense against rug pulls is due diligence and skepticism. If something seems too good to be true, it probably is. Engaging with active and transparent communities, following expert analysis, and keeping up with security updates can further reduce the risks of falling victim to scams.

Cryptocurrency offers many opportunities, but scams like rug pulls are a harsh reality. By staying informed and cautious, investors can navigate the space more safely and make better financial decisions.