- FAQs: Converting Fiat to Crypto

- Understanding the Basics

- Key Differences Between Fiat and Crypto

- Preparing to Convert Fiat to Crypto

- Step 3: Gather Necessary Tools

- Choosing a Conversion Method

- Step-by-Step Conversion Process

- Using a Centralized Exchange

- Using a P2P Platform

- Using a Cryptocurrency ATM

- Tips for Success

- Security and Best Practices

- Importance of Private Keys and Seed Phrases

- Two-Factor Authentication (2FA) Setup

- Avoiding Scams

- After Conversion – What’s Next?

- Storing Cryptocurrency: Hot vs. Cold Wallets

- Using Cryptocurrency: Spending, Trading, or Holding

- Tax Implications

- Comparison Table: Fiat-to-Crypto Conversion Methods

Welcome to the world of financial transformation!

If you’ve ever wondered how to swap your dollars or euros for digital currencies like Bitcoin or Ethereum, you’re in the right place.

Fiat currency like USD, EUR, or GBP, is the government-issued money we use every day, backed by central authorities like banks and regulators.

Cryptocurrency, on the other hand, is a decentralized digital asset powered by blockchain technology, free from middlemen and border restrictions.

Bitcoin kicked off this revolution in 2009, followed by Ethereum and thousands of others, each offering unique possibilities in a rapidly evolving landscape.

So, why convert fiat to crypto?

Some see it as a golden investment opportunity, with tales of early adopters turning pocket change into fortunes.

Others are drawn to decentralization, crypto puts you in control, not a bank or government.

Then there’s the global angle: cryptocurrencies enable fast, low-cost transactions anywhere in the world, no passport required.

Whether you’re here to diversify your portfolio, escape traditional finance, or just experiment, converting fiat to crypto is your first step into this exciting frontier.

That’s where this blog comes in. Our goal? To give you a clear, actionable roadmap to make that leap, especially if you’re a beginner.

No jargon overload, no guesswork, just a step-by-step guide to get you from fiat to crypto with confidence.

In the posts ahead, you’ll learn how to pick the right platforms (exchanges, P2P, or even ATMs), secure your new digital assets, and steer clear of common pitfalls like scams or costly mistakes. By the end, you’ll be ready to join the crypto revolution on your terms. Let’s dive in and turn your curiosity into action

FAQs: Converting Fiat to Crypto

Who Can Convert Fiat to Crypto?

Answer: Anyone with access to a cryptocurrency conversion platform, a valid payment method (e.g., bank account, credit card), and basic identification for Know Your Customer (KYC) requirements can convert fiat to crypto. Platforms like Coinbase or Binance often require ID verification.

Who Regulates Fiat-to-Crypto Transactions?

Answer: Governments and financial regulatory bodies regulate these transactions, varying by country. In the United States, the Securities and Exchange Commission (SEC) plays a role, while the Financial Conduct Authority (FCA) governs in the United Kingdom. Local laws dictate compliance.

What Is the Safest Way to Convert Fiat to Crypto?

What method ensures secure fiat-to-crypto conversion?The safest approach involves using a reputable centralized exchange, such as Coinbase or Kraken, with robust security features like two-factor authentication (2FA) and cold storage. These platforms prioritize user protection and reliability.

What Cryptocurrencies Are Best for Beginners?

What cryptocurrencies should newcomers start with?

Answer: Bitcoin (BTC) and Ethereum (ETH) are ideal for beginners due to their widespread adoption, stability relative to altcoins, and strong community support. They’re available on most fiat-to-crypto platforms.

Where Can I Convert Fiat to Crypto?

Answer: Conversions occur online through centralized exchanges (e.g., Coinbase, Binance), peer-to-peer (P2P) platforms (e.g., Paxful, LocalBitcoins), or physically at cryptocurrency ATMs. Each option suits different needs and locations.

Where Should I Store Crypto After Conversion?

Question: Where do I keep cryptocurrency post-conversion?

Answer: Store cryptocurrency in a digital wallet—software wallets like MetaMask for convenience or hardware wallets like Ledger for enhanced security. Moving funds off exchanges reduces risk.

When Is the Best Time to Convert Fiat to Crypto?

Question: When should I convert fiat currency to cryptocurrency?

Answer: Timing depends on market conditions. Some buy during price dips for value, while others use dollar-cost averaging (DCA) for consistent investing. Monitoring crypto market trends helps optimize entry points.

When Should I Move Crypto Off an Exchange?

Question: When is it necessary to transfer cryptocurrency from an exchange?

Answer: Move cryptocurrency to a personal wallet immediately after purchase. This enhances security by reducing exposure to exchange hacks or outages.

Why Convert Fiat to Crypto?

Question: Why should someone convert fiat currency to cryptocurrency?

Answer: People convert fiat to crypto for investment opportunities, financial independence from traditional systems, or participation in decentralized ecosystems like DeFi. It’s a gateway to blockchain-based finance.

Why Are Fees Higher for Some Conversion Methods?

Question: Why do certain fiat-to-crypto methods charge more?

Answer: Higher fees come from added convenience (e.g., crypto ATMs), escrow services on P2P platforms, or blockchain network costs (e.g., gas fees on DEXs). Each method’s infrastructure impacts pricing.

How Do I Avoid Scams When Converting Fiat to Crypto?

Question: How can I protect myself from fiat-to-crypto scams?

Answer: Avoid scams by verifying platform legitimacy, rejecting unsolicited offers, and using escrow services on P2P trades. Stick to trusted names like Binance or Paxful and double-check URLs.

How Long Does Fiat-to-Crypto Conversion Take?

Question: How much time does converting fiat to cryptocurrency require?

Answer: Conversion duration varies—minutes for centralized exchanges and ATMs, hours for P2P trades depending on payment processing. Bank transfers may delay online methods by 1-3 days.

Understanding the Basics

Before you get into converting your hard-earned cash into crypto, let’s get the fundamentals straight.

This section breaks down what fiat currency and cryptocurrency really are, how they differ, and what you need to know about the legal side of things. Ready? Let’s start with the basics.

What Is Fiat Currency?

Fiat currency is the money you’re probably using right now— U.S. dollars (USD), euros (EUR), or Japanese yen (JPY).

It’s issued and backed by governments, meaning its value comes from trust in the system and the authorities that control it.

Central banks, like the Federal Reserve or the European Central Bank, regulate its supply.

You use it for everyday stuff—buying coffee, paying rent, or shopping online. It’s tangible (coins and bills) and digital (your bank app), but it’s always tied to a centralized power.

What Is Cryptocurrency?

Crypto, like Bitcoin (BTC) or Ethereum (ETH), is a digital-only currency built on blockchain—a decentralized ledger that no single entity controls.

Instead of a bank or government calling the shots, a network of computers (nodes) keeps it running.

Launched with Bitcoin in 2009, crypto cuts out the middleman, letting users send value directly to each other.

It’s borderless, transparent, and—here’s the kicker—its supply is often limited (Bitcoin caps at 21 million coins).

Key Differences Between Fiat and Crypto

So, how do these two stack up? Here’s the rundown:

- Control: Fiat is managed by governments and banks; crypto is peer-to-peer, giving you the reins.

- Accessibility: Fiat lives in banks or cash, while crypto is always digital, stored in wallets you control.

- Volatility: Fiat’s value is relatively stable; crypto can swing wildly.

These differences shape why people choose one over the other—or mix both into their financial lives.

Legal Considerations

One quick heads-up: legality varies by country. In the U.S., crypto is treated as property for tax purposes. The EU has its own rules, while places like China have banned it.

Before you convert fiat to crypto, check your local laws—regulations can affect how you buy, sell, or hold crypto. Knowledge is power, so stay informed and play it smart!

Preparing to Convert Fiat to Crypto

Converting fiat to crypto isn’t just a button you press, it’s a process that starts with preparation.

Whether you’re getting started into Bitcoin or eyeing Ethereum, getting ready is half the battle.

This section walks you through four key steps to set yourself up for success. Let’s break it down

Step 1: Assess Your Goals

First things first: why are you doing this?

Your goals will shape every decision ahead.

Are you here for investment, hoping to buy low and sell high as crypto prices climb?

Maybe you’re into trading, planning to swap coins daily or weekly for profit. Or perhaps you want to spend crypto—some folks use it for online purchases or even real-world transactions where it’s accepted.

Take a moment to think it over. If you’re investing, you might hold long-term (a strategy called “HODLing” in crypto lingo).

Trading demands more time and market savvy. Spending? You’ll need a coin that’s widely accepted, like Bitcoin. Clarity here keeps you focused.

Step 2: Research Cryptocurrencies

Next, pick your crypto. The market’s huge, with thousands of options, so start with the big names.

Bitcoin (BTC) is the OG—secure, popular, but pricey and volatile.

Ethereum (ETH) powers smart contracts and decentralized apps, making it a favorite for tech enthusiasts.

Then there are stablecoins like Tether (USDT), pegged to fiat (e.g., 1 USDT = 1 USD) for less wild price swings.

Check their use cases, market trends, and communities (X posts are a goldmine for real-time buzz).

Don’t just chase hype—match your choice to your goal from Step 1.

Step 3: Gather Necessary Tools

Now, let’s gear up. You’ll need a few essentials:

- A secure internet connection: Public Wi-Fi is a no-go—use a private, encrypted network to keep your funds safe.

- A device: A smartphone or computer works. Make sure it’s updated and malware-free.

- Identification for KYC: Most platforms require “Know Your Customer” verification—think driver’s license or passport. Have scans ready.

These aren’t optional. Skipping security here is like leaving your front door unlocked with cash on the table.

Step 4: Set Up a Crypto Wallet

Finally, you need a place to store your crypto. Enter the wallet—your digital vault. There are two main types:

- Software wallets: Apps like MetaMask or Trust Wallet. They’re free, convenient, and live on your device or online. Great for beginners, but keep them secure.

- Hardware wallets: Physical devices like Ledger or Trezor. They’re offline (aka “cold storage”), pricier, but way safer for big amounts.

Set one up before you buy.

Download a software wallet or order a hardware one, then follow the setup—save your private key and seed phrase somewhere safe (not your phone!).

With your wallet ready, you’re primed to make the leap from fiat to crypto. Onward!

Choosing a Conversion Method

You’ve got your goals, your crypto pick, and your tools—now it’s time to decide how to turn that fiat into crypto.

There’s no one-size-fits-all here; each method has its perks and quirks.

In this section, we’ll explore four main options—centralized exchanges, peer-to-peer platforms, crypto ATMs, and decentralized exchanges—so you can pick the one that fits your vibe.

Option 1: Centralized Exchanges (e.g., Coinbase, Binance, Kraken)

Centralized exchanges IS the beginner’s gateway to crypto.

Platforms like Coinbase, Binance, and Kraken are slick, polished, and packed with features.

Pros:

They’re super user-friendly—sign up, deposit your fiat (via bank transfer or card), and buy crypto with a few clicks. They also offer high liquidity, meaning you can trade large amounts without tanking the price. Newbies love the hand-holding: tutorials, customer support, and mobile apps make it a breeze.

Cons:

Nothing’s free. Expect fees—trading fees (0.1-2%), withdrawal costs, and sometimes deposit charges. Plus, there’s a custody risk: your crypto sits in their wallets until you move it. If they get hacked (think Mt. Gox 2014), your funds could vanish. Still, for ease and speed, they’re tough to beat.

Option 2: Peer-to-Peer (P2P) Platforms (e.g., LocalBitcoins, Paxful)

Want to skip the corporate middleman? P2P platforms like LocalBitcoins (no longer operates), localcoins and Paxful connect you directly with sellers. It’s like a crypto Craigslist.

Pros:

Privacy is king here—some trades don’t need KYC, though it’s getting rarer. You also get flexible payment methods: cash, PayPal, gift cards, even bank transfers—whatever the seller accepts. It’s perfect if you’re in a region with limited exchange access.

Cons:

Trust is the catch. There’s a risk of scams—sellers might bail after you pay, though escrow systems help. It’s also slower; deals can take hours or days depending on the seller’s responsiveness. If you’re cautious and research traders’ reputations, P2P can be a gem.

Option 3: Crypto ATMs

Crypto ATMs are the physical option—think of them as cash machines with a digital twist. They’re popping up in cities worldwide.

Pros:

They’re quick—insert cash or swipe a card, scan your wallet’s QR code, and boom, crypto’s yours in minutes. The physical access feels familiar, no online fuss required. Great for small, instant buys.

Cons:

Convenience comes at a cost. High fees (5-10% or more) can sting, and availability is spotty—urban areas have them, but rural folks might be out of luck. Check CoinATMRadar to find one near you, but weigh those fees before you go.

Option 4: Decentralized Exchanges (DEXs) (e.g., Uniswap)

For the crypto supporters, decentralized exchanges like Uniswap are the dream—no suits, no servers, just code and blockchain.

Pros:

There are no intermediaries; you trade directly from your wallet via smart contracts. That means full control—no one holds your funds but you. Privacy’s solid too, with no KYC on most DEXs. Fees? Often just network “gas” costs, which can be low outside peak times.

Cons:

It’s not newbie turf. The complexity—connecting wallets, understanding swaps, paying gas fees—can overwhelm. Worse, fiat on-ramps are limited; most DEXs only trade crypto-to-crypto, so you might need an exchange first to get started. For the tech-savvy, though, it’s pure freedom.

Which One’s for You?

It boils down to priorities. Want ease? Go centralized. Crave privacy? Try P2P. Need speed and cash?

Hit an ATM. Love control? Master a DEX. Each path gets you to crypto—pick the one that matches your style and comfort zone. Next up, we’ll walk through the how-to!

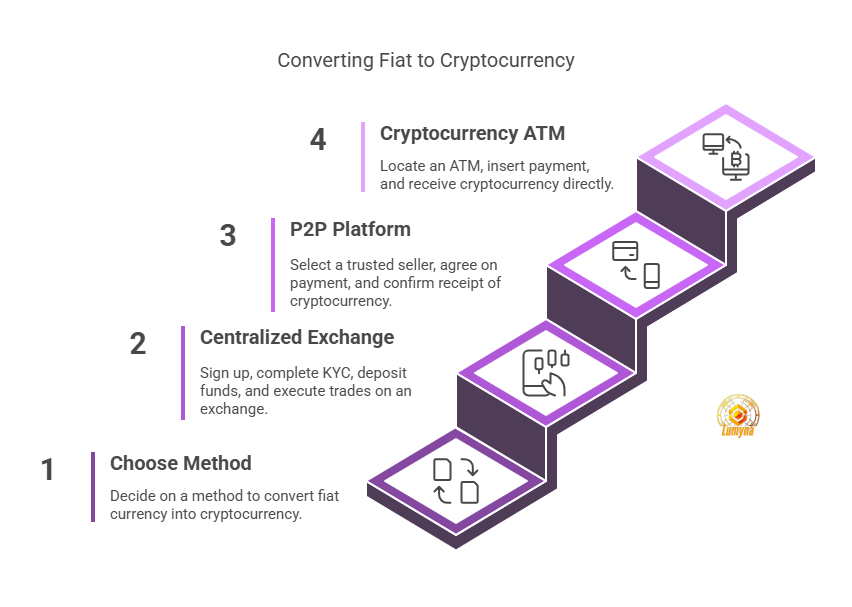

Step-by-Step Conversion Process

Once you have selected a method to convert fiat currency into cryptocurrency, the subsequent phase involves executing that choice with precision.

This section provides detailed, step-by-step instructions for three primary methods: utilizing a centralized exchange, engaging with a peer-to-peer (P2P) platform, and operating a cryptocurrency ATM. Each approach is delineated clearly to ensure accessibility for beginners.

Additionally, general tips for success are included to enhance safety and efficiency. The process requires careful attention to detail, and this guide aims to facilitate a smooth transition from fiat to cryptocurrency.

Using a Centralized Exchange

Centralized exchanges, such as Coinbase, Binance, or Kraken, offer a structured environment for purchasing cryptocurrency. The following steps outline the procedure:

Sign Up and Complete KYC Verification

Begin by visiting the official website of the chosen exchange. Locate the registration option and provide an email address and a secure password to create an account. Following registration, the platform will require completion of Know Your Customer (KYC) verification.

This entails submitting identification documents, such as a passport or driver’s license, and possibly a proof of address, such as a utility bill. The verification process may take several hours to a few days, depending on the platform’s review timeline.

Deposit Fiat via Bank Transfer, Credit Card, or Other Methods

Upon account approval, access the funding section of the exchange. Select the option to deposit fiat currency.

Available methods typically include bank transfers (ACH or wire), credit or debit card payments, or occasionally third-party services like PayPal.

Choose the preferred method, enter the amount, and follow the instructions to link a bank account or card. Bank transfers may require one to three business days, whereas card deposits are often instantaneous but incur higher fees.

Navigate to Trading Section and Select Cryptocurrency

With funds deposited, proceed to the trading or marketplace section. Identify the desired cryptocurrency—Bitcoin (BTC), Ethereum (ETH), or another option—by browsing the list or using a search function.

Exchanges display trading pairs, such as USD/BTC, indicating the fiat-to-crypto exchange rate. Review the current price and available order types, such as market (immediate purchase at current rate) or limit (purchase at a specified price).

Execute the Trade and Transfer to Wallet

Enter the amount of fiat to spend or cryptocurrency to acquire, then confirm the transaction. Upon execution, the purchased cryptocurrency will appear in the exchange’s wallet. For security, transfer the funds to a personal wallet.

Navigate to the withdrawal section, input the wallet address (obtained from the personal wallet setup in Section 2), and specify the amount.

Verify the address before submitting, as errors are irreversible. The transfer may take minutes to hours, depending on network congestion.

Using a P2P Platform

Peer-to-peer platforms, such as LocalBitcoins or Paxful, facilitate direct transactions between buyers and sellers. The steps below detail this method:

Choose a Trusted Platform and Seller

Select a reputable P2P platform by reviewing user feedback and security features online. Register an account, which may or may not require KYC, depending on the platform and transaction size.

Browse the list of sellers, filtering by location, payment method, and cryptocurrency offered. Evaluate sellers based on their trade history, response time, and ratings to ensure trustworthiness.

Agree on Payment Method

Initiate contact with a chosen seller through the platform’s messaging system. Discuss and agree upon a payment method, which could include cash (in-person or via mail), bank transfer, PayPal, or gift cards.

The platform typically specifies available options per seller. Confirm the amount of fiat to send and the corresponding cryptocurrency to receive, ensuring mutual understanding of the terms.

Send Fiat and Receive Cryptocurrency in Escrow

Proceed with the trade as directed by the platform. Send the agreed fiat amount to the seller using the specified method—bank transfers require account details, while cash trades may involve a meeting.

Simultaneously, the seller deposits the cryptocurrency into an escrow service managed by the platform, ensuring neither party can abscond prematurely. Await confirmation of payment receipt from the seller.

Confirm Receipt and Store Cryptocurrency Securely

Once the seller verifies receipt of the fiat, the platform releases the cryptocurrency from escrow to the buyer’s account or wallet address. Confirm receipt of the funds within the platform interface.

Subsequently, transfer the cryptocurrency to a personal wallet by entering the wallet address in the withdrawal section. Store the private key and seed phrase in a secure, offline location to prevent unauthorized access.

Using a Cryptocurrency ATM

Cryptocurrency ATMs provide a physical means to convert cash or card payments into cryptocurrency. The process is as follows:

Locate an ATM

Identify a nearby cryptocurrency ATM using online resources, such as CoinATMRadar, which provides maps and details of supported cryptocurrencies and fees.

ATMs are commonly situated in urban areas, convenience stores, or malls. Note the operational hours and ensure the machine supports the desired cryptocurrency, such as Bitcoin or Ethereum.

Insert Cash or Card and Select Cryptocurrency

Approach the ATM and follow the on-screen prompts. Select the option to buy cryptocurrency, then choose the specific coin. Insert cash into the bill acceptor or swipe a credit/debit card, depending on the machine’s capabilities.

Enter the amount of fiat to spend; the ATM will display the corresponding cryptocurrency amount, factoring in its exchange rate and fees, which are typically higher than online methods.

Scan Wallet QR Code and Receive Funds

Open the personal wallet application (software or hardware) on a mobile device and locate the receiving address, often presented as a QR code. Position the QR code under the ATM’s scanner.

After verification, confirm the transaction on the machine.

The cryptocurrency will be sent to the wallet address, typically arriving within minutes, though delays may occur due to network processing times.

Tips for Success

To maximize safety and efficiency across these methods, consider the following recommendations:

- Double-Check Addresses: Cryptocurrency transactions are irreversible. Verify wallet addresses character-by-character before sending funds, as errors result in permanent loss.

- Start Small: For initial attempts, convert a modest amount of fiat to gain familiarity with the process and minimize risk in case of mistakes or unforeseen issues.

These steps and precautions equip individuals with the knowledge to convert fiat into cryptocurrency confidently. Each method caters to different preferences—centralized exchanges for ease, P2P for flexibility, and ATMs for immediacy—ensuring options for all users embarking on this financial journey.

Security and Best Practices

After successfully converting fiat currency into cryptocurrency, safeguarding those digital assets becomes paramount. Cryptocurrency offers unparalleled control, but with that control comes responsibility.

This section outlines essential security measures and best practices to protect funds from theft, loss, or fraud. By adhering to these guidelines, individuals can navigate the cryptocurrency landscape with greater confidence and peace of mind.

Importance of Private Keys and Seed Phrases

The foundation of cryptocurrency security lies in private keys and seed phrases.

A private key is a cryptographic code that grants access to an individual’s cryptocurrency holdings, while a seed phrase—typically a sequence of 12 to 24 words—serves as a backup to regenerate the private key if lost. These elements are the sole means of accessing and managing funds in a wallet.

Storing them securely is critical. Write the seed phrase on paper and keep it in a safe, offline location, such as a locked drawer or a safety deposit box.

Avoid digital storage, such as screenshots or cloud drives, as these are vulnerable to hacking.

Losing the private key or seed phrase without a backup results in permanent loss of access to the cryptocurrency, with no central authority available to recover it.

Two-Factor Authentication (2FA) Setup

Enhancing account security on exchanges or wallets requires enabling two-factor authentication (2FA).

This adds a second layer of verification beyond a password, typically a time-sensitive code generated by an application like Google Authenticator or Authy.

To set up 2FA, access the security settings of the platform, select the 2FA option, and scan the provided QR code with the authenticator app.

Record the backup code provided during setup and store it offline.

Each login or transaction will then require this code, significantly reducing the risk of unauthorized access even if a password is compromised.

Avoiding Scams

The cryptocurrency space attracts fraudulent schemes, necessitating vigilance. Common threats include phishing emails mimicking legitimate platforms, fake websites posing as exchanges, and offers promising unrealistic returns.

To avoid these:

- Verify website URLs before entering credentials, ensuring they match the official domain.

- Ignore unsolicited messages offering deals or requesting private keys.

- Research platforms thoroughly, favoring those with established reputations.

Regularly Updating Software and Monitoring Transactions

Maintaining security involves proactive upkeep.

Regularly update wallet software, exchange applications, and devices to patch vulnerabilities. Check for updates monthly or enable automatic updates where available.

Additionally, monitor transactions by reviewing wallet activity and exchange histories weekly.

Promptly investigate unfamiliar withdrawals or deposits, as early detection can mitigate losses. Combining these habits ensures ongoing protection in an ever-evolving digital environment.

By prioritizing private key safety, enabling 2FA, avoiding scams, and staying proactive with updates and monitoring, individuals can secure their cryptocurrency effectively.

These practices form the bedrock of a safe and rewarding experience.

After Conversion – What’s Next?

With cryptocurrency now in possession, the journey does not conclude—it evolves. This section explores the critical next steps: determining how to store the assets, deciding how to utilize them, and understanding potential tax obligations.

Each choice shapes the individual’s experience in the cryptocurrency ecosystem, balancing security, utility, and compliance.

Below, these aspects are examined to guide users toward informed decisions.

Storing Cryptocurrency: Hot vs. Cold Wallets

Secure storage is the first priority after conversion. Two primary options exist: hot wallets and cold wallets, each suited to different needs.

Hot wallets are software-based and connected to the internet, such as mobile apps (e.g., Trust Wallet) or browser extensions (e.g., MetaMask).

They offer convenience for frequent access, making them ideal for small amounts or active use.

However, their online nature increases vulnerability to hacking or malware, necessitating robust security measures like two-factor authentication.

Cold wallets, conversely, are offline solutions, such as hardware devices (e.g., Ledger Nano S) or paper wallets (printed keys).

These provide superior security by isolating funds from internet threats, making them preferable for long-term storage or significant holdings.

The trade-off is reduced accessibility; retrieving funds requires connecting the device or manually entering keys. Selecting between hot and cold depends on usage frequency and the value of the assets stored.

Using Cryptocurrency: Spending, Trading, or Holding

Once stored, cryptocurrency can serve various purposes. Spending it is an option where merchants accept it—online platforms like Overstock or select physical stores allow purchases with Bitcoin or Ethereum.

This requires a hot wallet for quick transactions.

Trading involves exchanging one cryptocurrency for another or back to fiat, often on centralized or decentralized exchanges.

This suits individuals seeking profit from market fluctuations, though it demands time, research, and risk tolerance due to volatility.

Holding, commonly termed “HODLing,” entails retaining cryptocurrency long-term, anticipating value appreciation.

Popular among investors, this passive approach aligns with Bitcoin’s finite supply or Ethereum’s growing utility. The chosen path—spending, trading, or holding—should reflect the goals established prior to conversion.

Tax Implications

A brief note on taxes is essential, as cryptocurrency transactions often carry fiscal consequences. In many jurisdictions, such as the United States, selling or trading cryptocurrency triggers capital gains tax, calculated as the difference between purchase and sale prices.

Spending may also be taxable, treated as a disposal event. Reporting requirements vary—some countries mandate detailed records of every transaction, while others apply lighter oversight.

Consulting a tax professional or reviewing local regulations (e.g., IRS guidelines in the U.S. or HMRC rules in the U.K.) ensures compliance.

Maintaining records of purchase dates, amounts, and values simplifies this process.

Bottom Line

Converting fiat currency into cryptocurrency involves a structured yet accessible process, as outlined in this guide.

It begins with preparation—defining goals, researching cryptocurrencies, and gathering tools like a secure wallet.

Next comes method selection, where individuals weigh options such as centralized exchanges, peer-to-peer platforms, crypto ATMs, or decentralized exchanges, each with distinct advantages and trade-offs.

Execution follows, requiring careful steps to transform fiat into digital assets, whether through a verified trade or a cash deposit at an ATM.

Finally, security ensures those assets remain protected, with practices like safeguarding private keys and enabling two-factor authentication.

For beginners, the cryptocurrency world may seem daunting, but starting small offers a practical entry point. A modest initial conversion allows experimentation without significant risk, fostering learning through experience. Mistakes are part of the journey; each transaction builds understanding. The key is patience and persistence—skills sharpen over time.

This guide concludes with a call to action: explore the cryptocurrency space responsibly. Stay informed about market trends, regulatory shifts, and security best practices. The opportunities are vast, from investment to global transactions, but so are the responsibilities.

Begin today, proceed cautiously, and embrace the potential of this evolving financial frontier.

Comparison Table: Fiat-to-Crypto Conversion Methods

| Method | Speed | Ease of Use | Fees | Privacy | Availability | |

|---|---|---|---|---|---|---|

| Risk Level | ||||||

| Centralized Exchanges | Fast (minutes) | High | Moderate (0.1-2%) | Low (KYC required) | High | Medium (hacks) |

| Peer-to-Peer (P2P) | Moderate (hours) | Medium | Varies (0-5%) | High | Medium | High (scams) |

| Crypto ATMs | Fast (minutes) | High | High (5-10%) | Medium | Low | Low |

| Decentralized Exchanges | Moderate (minutes) | Low | Low (gas fees) | High | Medium | Medium (tech) |