In the ever changing world of finance, crypto wealth management has emerged as a transformative approach for high net worth individuals (HNWI) looking to protect and expand their assets or wealth.

This innovative approach integrates the dynamic potential of cryptocurrencies with the stability of traditional wealth preservation methods, offering a sophisticated solution tailored to the unique needs of wealthy investors.

As global markets shift and digital currencies gain popularity, high net worth individuals find themselves drawn to crypto investing, due to its promise of diversification, security, and growth.

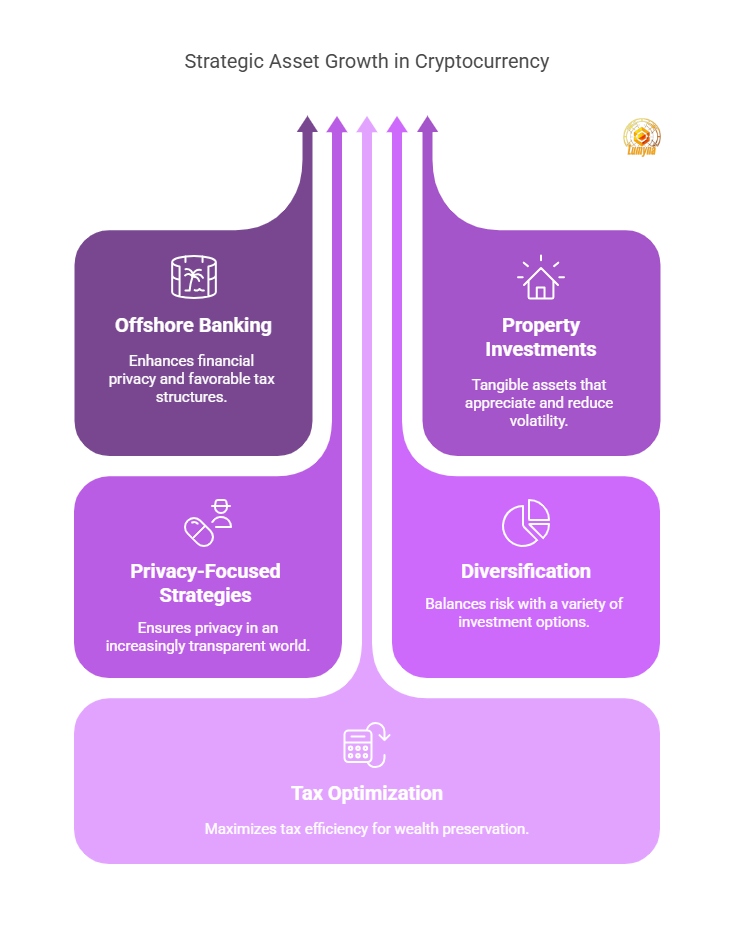

This guide gives the reasons behind this trend, exploring the important role of offshore banking and property investments as pillars of a strong crypto wealth management framework.

For high net worth individuals, the appeal of cryptocurrencies lies in their ability to go beyond traditional financial systems.

These digital assets provide a hedge against inflation, currency devaluation, and geopolitical uncertainty—challenges that often threaten traditional stock portfolios.

By including offshore banking, investors improve their financial privacy while accessing jurisdictions with favorable tax structures and regulatory environments.

Meanwhile, property investments offer a tangible complement to the volatility of digital currencies, connecting wealth with physical assets that appreciate over time.

Together, these elements create a balanced strategy that aligns with the priorities of those who value privacy, resilience, and long-term prosperity.

This guide is a comprehensive resource for high net worth individuals eager to navigate the complexities of crypto investing and wealth management.

Readers will discover how offshore banking solutions unlock new possibilities for asset protection, why property investments are key to wealth-building, and how privacy-focused strategies ensure peace of mind in an increasingly transparent world.

Each section provides actionable insights, drawing from current trends and expert perspectives to give investors the knowledge needed to thrive in crypto investing.

Whether the goal is to diversify holdings, optimize tax efficiency, or secure a legacy for future generations, this guide offers a clear path forward.

Crypto wealth management is changing how high net worth individuals protect and grow their assets in 2025.

To unlock the full potential of this approach, readers are invited to explore the detailed chapters that follow.

This journey promises not only to inform but also to empower, delivering the tools and understanding required to master wealth management in the age of cryptocurrency.

Crypto Wealth Management FAQ

What are the best offshore banks for crypto wealth management in 2025?

High net worth individuals seeking secure and flexible banking solutions for their crypto assets can turn to institutions in jurisdictions like Switzerland, the Cayman Islands, and Singapore. Banks such as SEBA Bank in Switzerland and Cayman National Bank stand out for their ability to handle digital currencies, offering custody, trading, and tax-efficient accounts tailored to substantial portfolios.

How can HNWIs use crypto to buy property tax-efficiently?

Purchasing property with cryptocurrency allows high net worth individuals to bypass capital gains taxes in jurisdictions with favorable regulations, such as Portugal or the Bahamas. By directly transferring Bitcoin to sellers in these locations, investors avoid converting to fiat, preserving wealth and streamlining the transaction process.

What privacy tools should crypto investors use for wealth protection?

To shield their crypto wealth from scrutiny, investors can employ tools like multi-signature wallets, which require multiple keys for access, and cold storage devices such as the Ledger Nano X. These measures, combined with custodial services from firms like BitGo, ensure robust protection against theft and unauthorized exposure.

Which countries offer citizenship by investment with cryptocurrency?

Nations like St. Kitts and Nevis and Antigua and Barbuda accept Bitcoin for citizenship-by-investment programs, granting high net worth individuals passports in exchange for digital assets. These options provide tax advantages and enhanced mobility, appealing to those diversifying their global presence.

How does DeFi enhance crypto wealth management for HNWIs?

Decentralized finance platforms like Aave and Curve Finance enable high net worth individuals to generate passive income through lending or liquidity provision. These tools diversify revenue streams within a crypto portfolio, leveraging blockchain technology to maximize returns without traditional intermediaries.

What are the tax benefits of offshore crypto banking?

Offshore banking in places like Bermuda or the Cayman Islands offers zero capital gains tax on crypto transactions, allowing high net worth individuals to retain more of their profits. This tax neutrality, paired with privacy protections, creates an efficient environment for managing digital wealth.

How do HNWIs secure large crypto portfolios offshore?

Securing substantial crypto holdings offshore involves using cold storage solutions and partnering with custodians in privacy-focused jurisdictions like Switzerland. High net worth individuals can also establish trusts in these locations, ensuring assets remain protected from domestic risks and accessible only to designated beneficiaries.

Can crypto wealth management replace traditional financial planning?

While crypto wealth management offers unique advantages—such as decentralization and global access—it complements rather than replaces traditional planning. High net worth individuals benefit from integrating crypto with conventional assets like real estate and equities, creating a balanced approach suited to modern markets.

What are the risks of buying real estate with cryptocurrency?

Purchasing property with crypto carries risks, including price volatility that may alter the asset’s value mid-transaction. Legal uncertainties in some jurisdictions, alongside potential tax reporting errors, also pose challenges, necessitating expert guidance to ensure a smooth process.

How do offshore trusts work with crypto assets for estate planning?

Offshore trusts in jurisdictions like Malta or the Cayman Islands hold cryptocurrency under a legal structure managed by trustees, protecting assets from domestic taxes and ensuring seamless transfer to heirs. This setup preserves wealth across generations, aligning with long-term estate goals.

Section 1: Why Crypto Wealth Management Matters for HNWIs

The emergence of cryptocurrency as a suitable asset class has redefined wealth management for high net worth individuals in 2025.

For rich investors, crypto wealth management goes beyond mere speculation, offering a strategic avenue to enhance portfolios with diversification, privacy, and access to global markets unavailable in traditional finance.

This section explores why this innovative asset class holds relevance for those with alot of wealth, shedding light on its transformative impact and the risks of overlooking its potential.

The Rise of Crypto Millionaires

The year 2025 marks a significant milestone in the rise of crypto millionaires, a group of high net worth individuals who have used digital currencies to accumulate considerable wealth.

This surge comes from the massive appreciation of assets like Bitcoin and Ethereum, alongside the growth of decentralized finance platforms that reward early adopters.

Market data reveals a growing number of individuals whose fortunes now exceed tens of millions, driven by strategic investments in blockchain technologies and tokenized ventures.

For high net worth crypto investors, this phenomenon highlights cryptocurrency’s capacity to generate returns that outdo traditional markets, cementing its status as a foundation of modern wealth creation.

How Crypto Fits into a Diversified HNWI Portfolio

Including cryptocurrency into a diversified investment portfolio offers high net worth individuals a powerful tool to mitigate risk and capture growth.

Unlike stocks or bonds, digital assets operate independently of centralized financial systems, providing a buffer against inflation and currency fluctuations.

This independence allows rich crypto investors to balance their holdings, pairing the stability of real estate and fixed-income securities with the high-growth potential of crypto markets.

For instance, allocating a portion of wealth to Bitcoin can serve as a hedge, while investments in tokenized real estate bridge the gap between digital and tangible assets.

This blend supports resilience, ensuring portfolios remain strong even during economic uncertainty.

Risks of Ignoring Crypto in Wealth Planning

Failing to engage with cryptocurrency comes with significant risks for high net worth individuals.

As digital assets gain mainstream acceptance, those who exclude them from their strategies may miss opportunities to diversify and protect wealth.

Inflationary pressures in traditional financial markets could erode purchasing power, while crypto’s decentralized nature offers a safeguard.

Moreover, regulatory shifts favoring digital currencies in key jurisdictions such as the US signal a future where exclusion equates to obsolescence.

Ignoring this asset class risks leaving portfolios vulnerable to stagnation, as competitors leverage crypto wealth management to beat traditional wealth making approaches.

Practical Advice for High Net Worth Crypto Investors

To integrate cryptocurrency effectively, high net worth individuals must adopt a proactive approach.

Monitoring crypto market trends weekly to identify opportunities for portfolio rebalancing is important.

Consider the following steps:

- Track Market Movements: Review price fluctuations and trading volumes of major cryptocurrencies weekly to identify entry or exit points.

- Assess Portfolio Allocation: Evaluate the percentage of wealth in crypto relative to other assets, adjusting as market conditions shift.

- Stay Informed on Regulation: Monitor legal developments in key jurisdictions to ensure compliance and optimize tax strategies.

Sample portfolio allocation for a high net worth individual integrating crypto:

| Asset Type | Percentage | Purpose |

| Cryptocurrency (e.g., Bitcoin, Ethereum) | 15% | Growth and inflation hedge |

| Real Estate | 40% | Stability and appreciation |

| Equities | 30% | Diversification and income |

| Cash/Fixed Income | 15% | Liquidity and risk buffer |

This structured approach in the above portfolio ensures high net worth crypto investors capitalize on opportunities while maintaining balance.

Crypto wealth management matters because it gives wealthy individuals the tools to navigate a rapidly changing financial landscape, blending innovation with the prudence required to preserve and grow substantial wealth.

Section 2: Offshore Banking for Crypto Wealth Management

For high net worth individuals, offshore banking is the foundation of crypto wealth management, offering tailored solutions that align with their financial goals.

These institutions provide secure, tax-efficient frameworks to manage digital assets, ensuring both privacy and compliance in an era of heightened scrutiny.

Offshore banks support crypto wealth strategies by creating a protective shield around holdings, allowing affluent individuals to optimize their portfolios while navigating the complexities of global finance.

This section explores the pivotal role of offshore banking in crypto wealth management offshore, detailing its benefits, key jurisdictions, and practical steps for implementation.

Benefits of Offshore Banking for Crypto

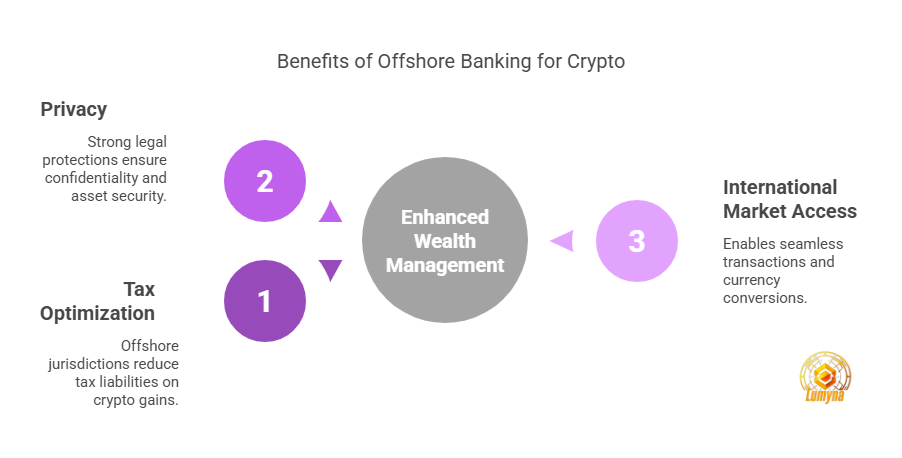

Offshore banking delivers unique advantages for high net worth individuals managing cryptocurrency.

Tax optimization is the primary benefit, with jurisdictions offering favorable structures that reduce liabilities on crypto gains.

These locations often impose minimal or no capital gains taxes, preserving wealth that might otherwise diminish under domestic investment regulations.

Privacy is another advantage, as offshore banks prioritize confidentiality through strong legal protections.

This discretion protects assets from public exposure, a priority for individuals safeguarding substantial fortunes.

Additionally, offshore accounts provide access to international markets, enabling seamless transactions and currency conversions that support liquidity for crypto holdings.

Top 5 Offshore Jurisdictions for Crypto Banking

Certain jurisdictions excel in supporting offshore banking crypto due to their progressive regulations and established financial ecosystems.

Switzerland leads with its long-standing reputation for banking secrecy and a growing acceptance of digital assets, supported by institutions like SEBA Bank.

The Cayman Islands follow, offering tax-neutral environments and a thriving crypto-friendly infrastructure, appealing to investors seeking flexibility.

Singapore ranks high with its clear regulatory framework and innovation-driven economy, making it a hub for crypto wealth management offshore.

Malta, known as the “Blockchain Island,” provides a supportive legal landscape for digital currencies, attracting high net worth individuals.

Finally, the United Arab Emirates, particularly Dubai, emerges as an option with its tax-free zones and ambitious blockchain initiatives.

How to Open an Offshore Account for Crypto Holdings

Establishing an offshore account for cryptocurrency requires careful planning to ensure compliance and efficiency.

High net worth individuals must select a jurisdiction aligned with their financial objectives, then identify a bank equipped to handle digital assets.

The process involves gathering documentation, such as proof of identity, source of funds, and residency details, to meet regulatory standards.

Once approved, investors deposit crypto or fiat currency, leveraging the bank’s services to manage and grow their wealth.

This structured approach integrates cryptocurrency into a broader offshore strategy, enhancing security and accessibility.

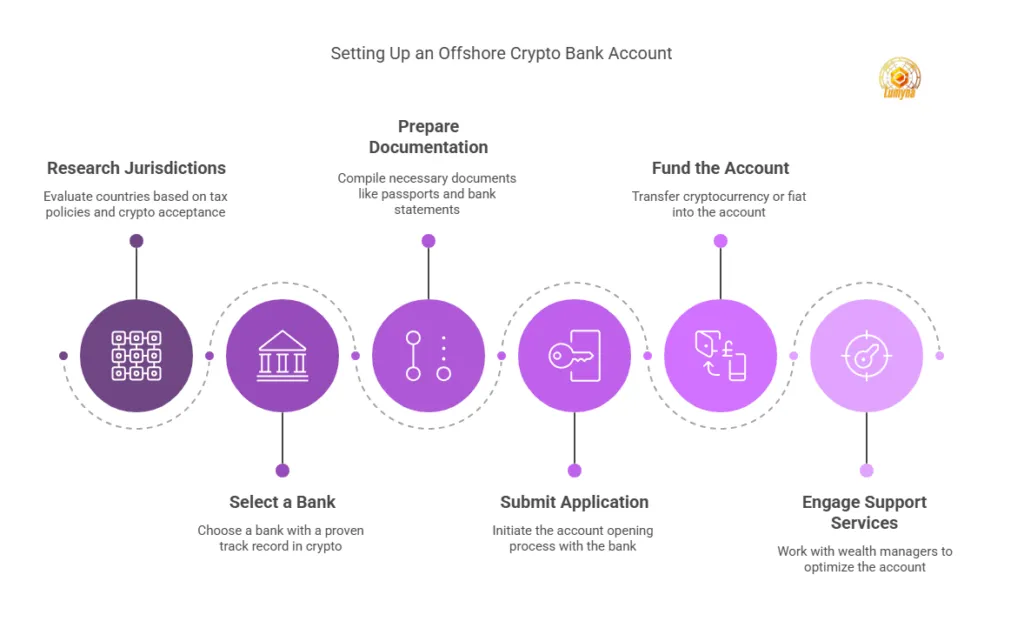

Guide: Step-by-Step: Setting Up an Offshore Crypto Bank Account

To streamline the process, follow this detailed guide:

- Research Jurisdictions: Evaluate countries like Switzerland or the Cayman Islands based on tax policies, privacy laws, and crypto acceptance.

- Select a Bank: Choose an institution with a proven track record in handling cryptocurrency, ensuring it offers desired services like multi-currency accounts.

- Prepare Documentation: Compile passports, utility bills, bank statements, and evidence of crypto wealth origins to satisfy compliance requirements.

- Submit Application: Contact the bank to initiate the account opening process, providing all requested materials for review.

- Fund the Account: Transfer cryptocurrency or fiat into the account once approved, utilizing secure blockchain or wire transfer methods.

- Engage Support Services: Work with the bank’s wealth managers to tailor the account to specific investment goals, such as tax optimization or asset protection.

5 Crypto-Friendly Offshore Banks HNWIs Should Consider

High net worth individuals benefit from partnering with reputable offshore banks.

Consider these five institutions:

- SEBA Bank (Switzerland): Offers crypto custody, trading, and banking services with a focus on security and regulatory compliance.

- Cayman National Bank (Cayman Islands): Provides flexible accounts for crypto investors in a tax-neutral jurisdiction.

- DBS Bank (Singapore): Combines traditional banking with digital asset solutions, catering to Asia-focused investors.

- Bank of Valletta (Malta): Supports blockchain-based transactions in a crypto-friendly regulatory environment.

- Emirates NBD (UAE): Facilitates crypto wealth management in Dubai’s tax-free financial hubs.

Practical Advice for High Net Worth Individuals

Choosing the right offshore bank requires balancing compliance with privacy.

Select institutions with strong Know Your Customer processes to ensure adherence to international standards without compromising confidentiality.

Verify that the bank supports cryptocurrency transactions and offers secure storage options, such as cold wallets or insured vaults.

Review fee structures to confirm cost-effectiveness, and consult legal experts to align the account with personal tax obligations.

This diligence preserves the integrity of crypto wealth management offshore, positioning high net worth individuals to thrive in a globalized financial landscape.

Offshore banking transforms how affluent individuals manage digital assets, merging the innovation of cryptocurrency with the stability of established financial systems.

By using these jurisdictions and institutions, high net worth individuals secure their wealth, optimize returns, and maintain the discretion essential to their status.

This strategic integration explain why offshore banking remains indispensable to crypto wealth management in 2025.

Section 3: Buying Property with Crypto: A New Frontier for HNWIs

In 2025, high net worth individuals are at the threshold of a transformative investment opportunity: acquiring real estate with cryptocurrency.

This innovative approach allows wealthy investors to buy property with crypto, harnessing digital assets like Bitcoin to secure luxury offshore residences while sidestepping the delays of traditional banking systems.

As crypto wealth management property strategies gain traction, they offer a blend of efficiency, accessibility, and prestige that resonates with those managing substantial fortunes.

This section explores the mechanics of this frontier, detailing its advantages, legal challenges , and the markets leading the charge.

Why Crypto Is Ideal for Property Purchases

Cryptocurrency offers many benefits for real estate transactions, making it an appealing choice for high net worth individuals.

The speed of blockchain-based transfers stands out, with payments often processed in minutes rather than the days required for international wire transfers.

This efficiency enables investors to seize opportunities in fast-moving markets, securing properties before competition intensifies.

Additionally, crypto provides global access, eliminating barriers posed by currency exchange rates or regional banking restrictions.

For individuals holding significant digital wealth, this method transforms dormant assets into actionable capital, facilitating purchases across continents with ease and precision.

Legal and Tax Considerations for Crypto Real Estate Deals

Engaging in crypto property transactions demands a clear understanding of legal and tax implications.

In many jurisdictions, exchanging cryptocurrency for real estate triggers capital gains tax, as the appreciation of digital assets becomes a taxable event upon sale or transfer.

High net worth individuals must maintain strong records of their crypto’s value at the transaction point to ensure compliance with local authorities.

Legal acceptance of crypto payments varies—some nations embrace it as a valid tender, while others require you to convert it into fiat currency, adding complexity.

Offshore jurisdictions often provide tax advantages, such as exemptions on gains, though adherence to anti-money laundering protocols remains a critical requirement.

Emerging Markets Accepting Crypto for Property

A select group of markets in 2025 distinguishes itself by welcoming cryptocurrency for real estate purchases.

Dubai is one of the destinations, with its ambition to lead in blockchain technology reflected in developers accepting Bitcoin for high-end apartments and villas.

Portugal follows, offering a tax-friendly haven where crypto transactions incur no capital gains levies, drawing buyers to its scenic properties.

Miami thrives as a U.S. hotspot, with real estate firms marketing luxury condos payable in Ethereum.

The Bahamas caters to elite investors, facilitating crypto-funded acquisitions of private estates in a tax-neutral paradise.

Thailand, particularly Phuket, rounds out the list, with its resort properties increasingly available for digital payment.

Guide: How to Purchase Offshore Property with Crypto in 5 Steps

High net worth individuals can navigate this process with confidence by following these steps:

- Locate a Suitable Property: Identify an offshore property in a crypto-friendly market, confirming the seller accepts digital currency.

- Review Legal Framework: Investigate the destination’s regulations on crypto payments and property ownership to ensure a smooth transaction.

- Assemble a Team: Engage a real estate agent, attorney, and accountant experienced in crypto deals to guide the purchase.

- Transfer Funds: Send the agreed cryptocurrency amount to the seller’s wallet, documenting the blockchain transaction for transparency.

- Complete the Purchase: Finalize contracts and register the property with local authorities, securing legal title.

Top 5 Destinations for Crypto Property Investments

These destinations excel as prime locations for crypto real estate ventures:

- Dubai, UAE: Features a booming market for Bitcoin-paid luxury homes, backed by progressive policies.

- Lisbon, Portugal: Offers tax exemptions on crypto gains, ideal for coastal property investments.

- Miami, USA: Attracts buyers with Ethereum-ready condos in a vibrant urban setting.

- Nassau, Bahamas: Provides tax-free crypto purchases of exclusive island retreats.

- Phuket, Thailand: Showcases tropical villas available for digital currency transactions.

Practical Advice for High Net Worth Individuals

Success in buying real estate with crypto depends on your preparation.

Work with a crypto-savvy real estate attorney to navigate local regulations, ensuring compliance with property and tax laws.

Verify the seller’s payment details to avoid errors, and consider escrow services to protect funds during the transfer process.

Partner with financial advisors to assess tax implications and structure the deal for maximum benefit.

This approach safeguards investments while capitalizing on the unique advantages of crypto wealth management property strategies.

Purchasing property with cryptocurrency represents a bold move for high net worth individuals, merging the agility of digital assets with the enduring value of real estate.

By embracing speed, global reach, and strategic markets, wealth investors consolidate their portfolios and redefine wealth preservation in 2025.

This frontier offers a tangible link between the virtual and physical, empowering those with vision to shape their legacies through innovation.

Section 4: Advanced Crypto Wealth Management Strategies

High net worth individuals have a unique opportunity to refine their financial portfolios through advanced crypto wealth management strategies.

These sophisticated techniques—involving decentralized finance, stablecoins, and offshore trusts—offer tailored solutions to preserve and grow substantial wealth.

By integrating these elements, wealthy investors can navigate the complexities of cryptocurrency markets while securing their assets for the long term.

This section outlines how these strategies enhance an HNWI crypto portfolio, providing practical guidance for implementation and highlighting tools to achieve stability and profitability.

Using Stablecoins to Hedge Volatility

Stablecoins are an important instrument for high net worth individuals seeking to mitigate the volatility of cryptocurrency markets.

Pegged to assets like the U.S. dollar or gold, these digital currencies maintain consistent value, offering a reliable anchor amid price fluctuations in Bitcoin or Ethereum.

For investors with significant crypto holdings, stablecoins provide a mechanism to preserve capital during downturns without exiting the digital ecosystem.

This stability enables strategic timing, allowing individuals to re-enter volatile markets when conditions favor growth.

Including stablecoins into a portfolio balances risk, ensuring wealth remains intact through unpredictable cycles.

Leveraging DeFi for Passive Income

Decentralized finance, or DeFi, presents high net worth individuals with ways to generate passive income from their crypto assets.

Unlike traditional finance, DeFi operates on blockchain platforms, enabling users to lend, stake, or provide liquidity in exchange for yields.

For example, staking Ethereum on networks like Ethereum 2.0 offers consistent returns, while supplying assets to liquidity pools on protocols like Uniswap generates fees.

These opportunities allow wealthy investors to put idle crypto holdings to work, creating revenue streams without relinquishing ownership.

DeFi’s permissionless nature and high yield potential make it a compelling addition to sophisticated wealth management strategies.

Setting Up Offshore Trusts with Crypto Assets

Offshore trusts provide a strong structure for high net worth individuals to safeguard crypto wealth across generations.

By placing digital assets into a trust in jurisdictions like the Cayman Islands or Bermuda, investors shield their holdings from domestic taxes and legal claims.

These trusts offer flexibility, allowing trustees to manage crypto investments while adhering to the grantor’s objectives, such as wealth preservation or charitable distribution.

The decentralized nature of cryptocurrency aligns seamlessly with offshore frameworks, ensuring privacy and security.

This approach strengthens an HNWI crypto portfolio against external pressures, cementing a legacy for heirs.

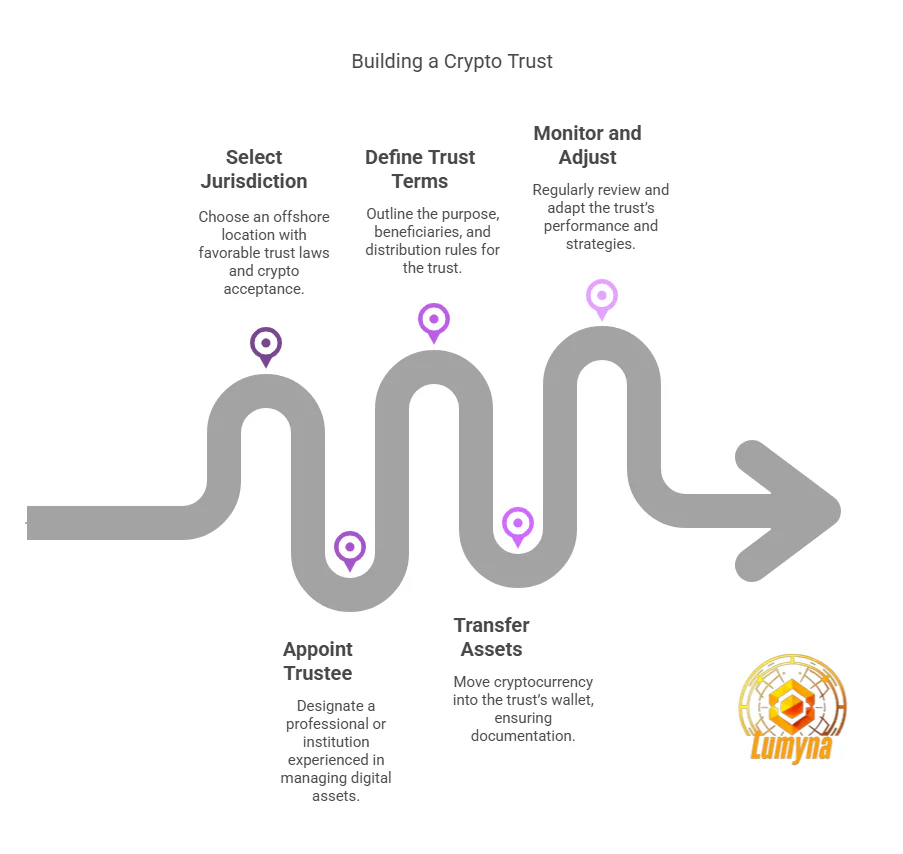

Guide: How to Build a Crypto Trust for Wealth Preservation

Establishing a crypto trust requires deliberate steps to ensure legal and financial integrity:

- Select a Jurisdiction: Choose an offshore location with favorable trust laws and crypto acceptance, such as the Cayman Islands.

- Appoint a Trustee: Designate a professional or institution experienced in managing digital assets to oversee the trust.

- Define Trust Terms: Outline the purpose, beneficiaries, and distribution rules, specifying how crypto holdings will be handled.

- Transfer Assets: Move cryptocurrency into the trust’s wallet, documenting the transaction for transparency and compliance.

- Monitor and Adjust: Regularly review the trust’s performance with the trustee, adapting to market changes or legal updates.

3 DeFi Platforms HNWIs Should Explore

High net worth individuals can enhance their portfolios by engaging with these DeFi platforms:

- Aave: Facilitates lending and borrowing of crypto assets, offering competitive interest rates for passive income.

- Curve Finance: Specializes in stablecoin trading, providing low-risk liquidity pools with steady returns.

- Compound: Enables users to earn interest by supplying crypto to lending pools, balancing accessibility and profitability.

Practical Advice for High Net Worth Individuals

To optimize these strategies, allocate 10-20% of your crypto portfolio to stablecoins for stability.

This portion acts as a buffer, preserving value during market dips while keeping funds liquid for reinvestment.

When considering DeFi, prioritize platforms with audited smart contracts to minimize security risks, and diversify across multiple protocols to spread exposure.

For offshore trusts, consult legal and tax professionals to ensure compliance with both the trust’s jurisdiction and your home country’s regulations.

This measured approach maximizes the benefits of advanced crypto wealth management strategies while maintaining control.

Section 5: Privacy and Security in Crypto Wealth Management

For high net worth individuals, privacy and security form the bedrock of effective crypto wealth management.

As digital assets grow in prominence, the need to shield substantial holdings from scrutiny and theft becomes paramount.

Privacy-focused offshore solutions offer a shield, protecting HNWI crypto wealth while ensuring compliance with global standards.

This section explores why discretion matters, the tools available to secure investments, and the jurisdictions that excel in safeguarding affluent investors’ digital fortunes.

Why Privacy Matters for HNWIs in Crypto

Privacy holds an important place for high net worth individuals managing cryptocurrency.

The public nature of blockchain transactions, where wallet addresses can potentially be traced, poses a risk to those with significant wealth.

Exposure of asset holdings could attract unwanted attention, from regulatory bodies to malicious actors seeking to exploit vulnerabilities.

For wealthy investors, maintaining confidentiality preserves their financial autonomy and protects personal safety.

Crypto wealth management privacy ensures that wealth remains a private affair, allowing individuals to operate with confidence in an increasingly transparent world.

This discretion also aligns with the strategic use of cryptocurrency as a tool for independence from traditional oversight.

Tools for Securing Crypto Assets

Securing crypto investments requires robust tools tailored to the needs of high net worth individuals.

Cold storage stands as a primary method, involving offline devices like hardware wallets to store private keys, rendering assets inaccessible to online threats.

Custodial services, offered by reputable firms, provide an alternative, managing crypto on behalf of investors with institutional-grade security measures such as encryption and insurance.

Multi-signature wallets add another layer, requiring multiple approvals for transactions, which deters unauthorized access.

These tools collectively fortify secure crypto investments, ensuring that wealth remains protected against hacking, phishing, and other digital risks prevalent in 2025.

Offshore Jurisdictions Offering the Best Privacy Protections

Certain offshore jurisdictions excel in providing privacy for crypto wealth management.

Switzerland leads with its centuries-old tradition of banking secrecy, reinforced by laws that protect client data and accommodate digital assets.

The Cayman Islands offer a tax-neutral environment with strong confidentiality statutes, making them a haven for discreet crypto holdings.

Bermuda stands out with its progressive digital asset regulations and privacy-focused trust laws, appealing to high net worth individuals structuring long-term plans.

Panama provides strong anonymity through its bearer share laws and lack of mandatory public disclosure.

Liechtenstein rounds out the list, blending strict privacy protections with a forward-thinking approach to blockchain technology.

5 Essential Security Tools for Crypto HNWIs

High net worth individuals can strengthen their defenses with these security tools:

- Ledger Nano X: A hardware wallet offering cold storage with Bluetooth connectivity for secure, portable access.

- BitGo Custody: A custodial service providing insured, multi-signature storage for institutional-grade protection.

- Trezor Model T: A cold storage device with a touchscreen interface, supporting a wide range of cryptocurrencies.

- Casa Keymaster: A multi-signature solution designed for ease of use, requiring multiple keys to authorize transactions.

- Fireblocks: An enterprise platform integrating secure asset transfers and storage for large-scale crypto portfolios.

Practical Advice for High Net Worth Individuals

To improve security, use multi-signature wallets to safeguard large crypto holdings.

This approach distributes control across multiple keys, ensuring that no single point of failure compromises the entire portfolio.

Store the majority of assets in cold storage, keeping only small amounts in hot wallets for immediate use.

Partner with custodians that offer audited security protocols and insurance to cover potential losses.

Regularly update software and backup private keys in secure, offline locations to prevent access by unauthorized parties.

These measures fortify crypto wealth management privacy, aligning protection with the scale of an HNWI’s digital investments.

Privacy and security in crypto wealth management represent more than precautions—they embody a strategic imperative for high net worth individuals.

By prioritizing privacy through offshore jurisdictions and employing cutting-edge tools, affluent investors shield their wealth from external threats while preserving the autonomy that cryptocurrency promises.

Section 6: Lifestyle and Investment Opportunities with Crypto

In 2025, cryptocurrency goes beyond its role as a financial asset for high net worth individuals, opening doors to a distinctive lifestyle and diverse investment opportunities.

Crypto wealth management lifestyle choices reflect the unique flexibility and prestige that digital currencies afford, enabling affluent investors to secure offshore citizenship, acquire luxury goods, and launch business ventures.

This section explores how HNWI crypto investments enhance both personal enjoyment and strategic growth, showcasing the tangible benefits of integrating crypto into a high net worth portfolio.

Buying Citizenship or Yachts with Crypto

Cryptocurrency facilitates exclusive lifestyle purchases that align with the aspirations of high net worth individuals.

Several nations, such as St. Kitts and Nevis or Antigua and Barbuda, now accept Bitcoin for citizenship-by-investment programs, granting passport privileges in exchange for digital funds.

This opportunity provides visa-free travel and tax advantages, enhancing global mobility.

Similarly, yacht brokers in markets like Monaco and Miami welcome crypto payments for luxury vessels, allowing investors to convert digital wealth into symbols of status.

These transactions demonstrate how crypto streamlines access to elite privileges, bypassing traditional financial hurdles.

Crypto-Backed Loans for Luxury Assets

Crypto-backed loans offer high net worth individuals a mechanism to leverage their digital holdings without selling them.

Lenders in jurisdictions like Switzerland or Singapore accept cryptocurrency as collateral, issuing fiat loans to fund luxury purchases such as private jets, art collections, or vacation homes.

This approach preserves the potential appreciation of crypto assets while unlocking liquidity for immediate use.

For example, pledging Bitcoin to secure a loan enables the purchase of a Mediterranean villa, blending investment strategy with lifestyle enhancement.

These loans reflect the evolving utility of HNWI crypto investments, merging financial prudence with opulent living.

Networking in Crypto-Friendly Offshore Hubs

Offshore hubs that support cryptocurrency serve as vibrant networking centers for affluent investors.

Locations like Dubai, Malta, and the Cayman Islands host conferences and events where high net worth individuals connect with entrepreneurs, blockchain developers, and wealth managers.

These gatherings foster relationships that lead to joint ventures, investment opportunities, or insider knowledge of emerging trends.

Engaging in these crypto-friendly ecosystems positions investors at the forefront of innovation, amplifying both their social and financial capital.

The lifestyle perk of global connectivity complements the strategic advantages of crypto wealth management.

5 Luxury Purchases You Can Make with Crypto

High net worth individuals can indulge in these expensive purchases using cryptocurrency:

- Private Island in the Bahamas: Secure an exclusive retreat with Bitcoin in a tax-neutral paradise.

- Lamborghini Aventador: Purchase this iconic supercar from dealers accepting Ethereum in Miami.

- Rolex Daytona: Acquire a luxury timepiece from jewelers in Dubai paid with crypto.

- Vacation Chalet in Switzerland: Own a ski retreat in the Alps, funded through Bitcoin transactions.

- Custom Yacht: Commission a bespoke vessel from Monaco brokers with digital currency.

Practical Advice for High Net Worth Individuals

To maximize these opportunities, attend crypto conferences in tax havens to build valuable connections.

Events in places like Singapore or Bermuda offer access to industry leaders and potential partners, enhancing both lifestyle and investment prospects.

Verify the legitimacy of vendors accepting crypto for high-value purchases, ensuring secure wallet addresses and escrow where applicable.

Consult tax advisors to navigate the implications of citizenship or loan arrangements, aligning them with broader wealth goals.

This proactive stance ensures that crypto wealth management lifestyle benefits integrate seamlessly with financial strategy.

Cryptocurrency elevates the lifestyle of high net worth individuals, transforming digital wealth into tangible rewards and strategic opportunities.

From securing citizenship to funding luxury assets and forging influential networks, HNWI crypto investments unlock a world of possibilities in 2025.

This fusion of prestige and pragmatism underscores the profound impact of crypto on both personal fulfillment and portfolio expansion.

Navigating Crypto Taxation for High Net Worth Individuals

Tax Obligations for Crypto Transactions

High net worth individuals face distinct tax obligations when managing cryptocurrency in 2025.

In many countries, selling or exchanging digital assets triggers capital gains tax, calculated based on the difference between the purchase price and the value at the time of the transaction.

For example, converting Bitcoin to fiat currency or using it to purchase property constitutes a taxable event.

Income tax may also apply to earnings from staking or decentralized finance yields, treated as ordinary income in jurisdictions like the United States.

These obligations require meticulous tracking of every transaction, as tax authorities increasingly scrutinize crypto activities among affluent investors.

Offshore Solutions to Reduce Tax Burdens

Offshore jurisdictions provide high net worth individuals with opportunities to manage crypto tax for HNWIs more efficiently.

Locations such as the Cayman Islands and Bermuda impose no capital gains or income taxes, allowing investors to retain a greater portion of their wealth.

By holding cryptocurrency through offshore entities like trusts or corporations, individuals can defer or eliminate domestic tax liabilities, depending on their home country’s rules.

For instance, transferring crypto to a trust in Malta—where gains remain untaxed under certain conditions—offers a legal pathway to minimize burdens.

These solutions align with crypto wealth management tax goals, balancing compliance with optimization.

Reporting Requirements in Key Jurisdictions

Compliance with reporting requirements proves essential for high net worth individuals across major jurisdictions.

In the United States, the Internal Revenue Service mandates disclosure of crypto holdings on tax returns, including details of sales, trades, and income, with penalties for non-compliance.

The United Kingdom requires similar reporting to HM Revenue and Customs, treating crypto as property subject to capital gains tax.

Conversely, jurisdictions like Singapore and Switzerland impose lighter requirements, often exempting personal crypto gains from taxation while still demanding transparency for offshore accounts.

Understanding these variations ensures that affluent investors meet legal standards without exposing unnecessary details.

–

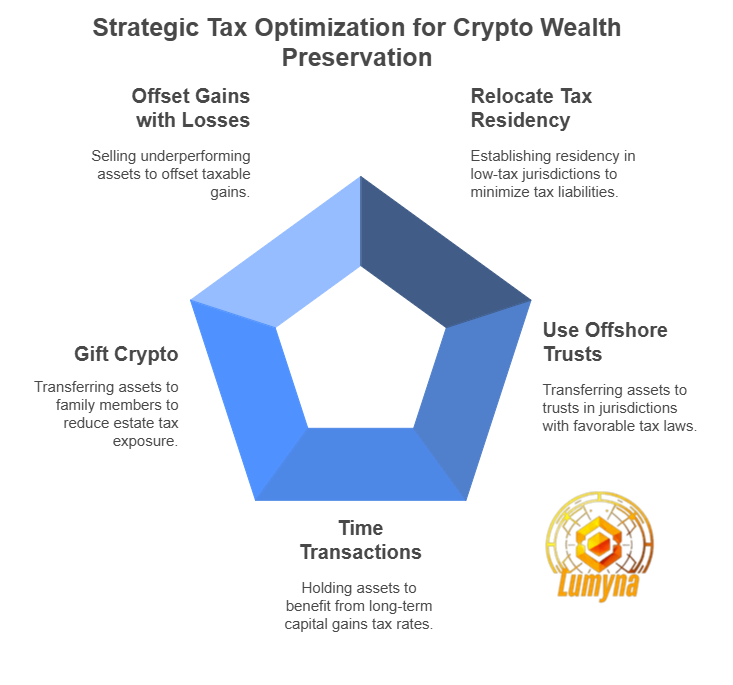

5 Tax Strategies for Crypto Wealth Management

High net worth individuals can adopt these strategies to navigate crypto taxation:

- Relocate Tax Residency: Establish residency in a low-tax jurisdiction like Portugal, where crypto gains face no capital gains tax.

- Use Offshore Trusts: Transfer crypto assets to a trust in the Bahamas to shield gains from domestic taxation.

- Time Transactions: Hold assets for over a year in jurisdictions offering long-term capital gains tax rates, such as the United States.

- Gift Crypto: Transfer digital assets to family members in tax-free jurisdictions to reduce estate tax exposure.

- Offset Gains with Losses: Sell underperforming crypto assets to offset taxable gains, a practice permitted in many countries.

Practical Advice for High Net Worth Individuals

To manage crypto wealth effectively, engage a tax professional with crypto expertise to ensure accurate filings.

Maintain detailed records of every transaction, including dates, values, and wallet addresses, to substantiate tax calculations.

Review the tax policies of both your home country and offshore jurisdictions annually, as regulations evolve rapidly. Coordinate with legal advisors to structure offshore solutions within permissible bounds, avoiding scrutiny from authorities.

This diligence safeguards wealth while aligning with the complexities of crypto wealth management tax obligations.