Picture this: a world where you can turn a small investment into a big win through crypto trading—or lose it all in a flash—just by tapping your phone.

Welcome to crypto trading, where digital currencies like Bitcoin, Ethereum, and countless others are bought and sold for profit on online platforms.

It’s a high-stakes game of timing and strategy, driven by the ups and downs of a market that never sleeps. In simple terms, crypto trading is about jumping in when prices dip and cashing out when they soar. And in 2025, it’s not just for tech wizards or Wall Street tycoons, it’s for anyone willing to learn.

Why does it matter?

To begin with, it is accessible: all you need is an internet connection and a few bucks to get started. The rewards can be jaw-dropping—think life-changing gains if you play it smart. Just last week, I checked in with my friend Sarah, a total newbie to finance. She’d put $150 into Ethereum back in January after hearing about its eco-friendly upgrades.

We pulled up her account and noted she’d turned that into $420 by selling at the right moment. It’s not millions, but for someone who’d never traded before, it was a thrill—and proof of crypto’s growing pull. By 2025, with markets buzzing and new coins popping up, more people than ever are jumping in, drawn by stories like hers.

But here’s the catch: it’s not all easy wins. Sarah also lost $30 once, chasing a hyped-up coin that tanked. That’s why this guide exists—to help you avoid those pitfalls. If you’re a beginner trader with no previous experience, you’re in the right place.

This article is your step-by-step roadmap to crypto trading, from understanding the basics to making your first trade. We’ll cover how it works, setting up your account, simple strategies, and staying safe, all tailored for someone starting from scratch. By the end, you’ll know exactly how to dip your toes into this exciting, unpredictable world, just like Sarah did. Ready to unlock the potential of crypto trading?

Let’s dive in.

First below is a quick youtube video showing you how to trade crypto in 10 minutes.

Understanding Crypto Trading: The Basics

What Is Crypto Trading?

Crypto trading is the act of buying and selling cryptocurrencies, like Bitcoin, Ethereum, or even newer coins, on online platforms called exchanges, with the goal of making a profit.

Think of it as a digital marketplace where you swap one currency for another or cash out when prices rise. It’s all about timing: you buy low, wait for the value to climb, and sell high.

For example, imagine purchasing one Bitcoin at $50,000.

A week later, its price jumps to $55,000, and you sell—pocketing a cool $5,000 profit (minus fees). That’s crypto trading in a nutshell.

How is it different from traditional trading, like stocks or forex?

-* For one, crypto markets run 24/7, unlike the 9-to-5 stock exchanges, giving you constant opportunities (and risks). There’s no central authority, blockchain technology powers it, not banks or governments.

Plus, crypto’s crazy price swings make it more volatile than most stocks or currencies; a 10% jump in a day isn’t rare. While stocks rely on company performance and forex on national economies, crypto prices often hinge on hype, tech breakthroughs, or market sentiment. It’s a unique beast—fast-paced, decentralized, and thrillingly unpredictable for beginners stepping in.

How Does Crypto Trading Work?

Crypto trading is like a global, non-stop marketplace, and it’s easier to grasp once you see how the pieces fit.

It all happens on exchanges, platforms like Binance, Coinbase, or KuCoin, where cryptocurrencies are swapped. Each exchange has an order book, a real-time tally of buy and sell requests.

Traders use two main order types: market orders execute instantly at the going rate (e.g., buying Ethereum at $2,100), while limit orders let you name your price (e.g., “Sell at $2,300”) and wait for someone to take it. The exchange matches these orders, and the trade is done, logged securely on a blockchain.

Who makes this happen? Traders, you and me, are the ones placing orders, chasing profits or cutting losses.

Exchanges are the hubs, facilitating trades and charging a tiny fee (often 0.2% or less). Blockchain networks, like Bitcoin’s or Ethereum’s, are the invisible backbone—recording every move so it’s tamper-proof and transparent. Unlike stock markets with middlemen, this trio keeps crypto trading decentralized and always open.

Here’s the simplified process:

First, sign up on an exchange—pick one, register, and verify your ID (a quick 15-minute task).

Then, deposit funds—send cash via bank transfer (like $50 USD) or crypto from a wallet (like 0.001 BTC).

Next, trade: choose a coin, pick your order type, and buy or sell.

Finally, withdraw—move your profits (or what’s left) to your bank or a secure wallet. Say you deposit $100, buy Bitcoin at $51,000, and sell at $52,000—you’d withdraw $101 after fees. It’s a cycle you can repeat anytime, anywhere.

For beginners, it’s about starting small and learning the rhythm of this fast-moving, tech-driven world.

Why Trade Crypto in 2025?

Benefits: 24/7 Markets, Volatility, Decentralization

Cryptocurrency trading in 2025 offers unique advantages that set it apart from traditional markets.

Unlike stocks or forex, crypto markets operate 24/7, giving traders unparalleled flexibility to act on opportunities anytime, anywhere. This round-the-clock access is perfect for those who thrive in fast-paced environments or live across different time zones.

Volatility is a double-edged sword—prices can swing dramatically, offering the potential for significant profits (or losses) in short windows. For skilled traders, this dynamism is a goldmine.

Then there’s decentralization, the beating heart of crypto. Free from central banks or government oversight, cryptocurrencies empower individuals to control their finances, appealing to those wary of traditional systems.

In 2025, these benefits continue to draw a diverse crowd, from day traders to long-term believers in blockchain’s promise.

Trends: Adoption, New Coins, Regulatory Shifts

The crypto landscape in 2025 is buzzing with momentum. Adoption is surging, businesses, institutions, and even governments are embracing digital assets, making crypto less a niche and more a mainstream player.

New coins are popping up, fueled by innovation in decentralized finance (DeFi), AI-driven platforms, and niche use cases, offering fresh trading opportunities. Regulatory shifts are also reshaping the market.

While some regions tighten rules, others, like the U.S. under a potentially crypto-friendly administration, signal clearer frameworks that could boost confidence and capital inflows.

These trends make 2025 a great year for traders.

Stats: Market Cap Growth, Trading Volume

The numbers speak volumes.

As of early 2025, the global crypto market cap has soared past $3 trillion, a leap from $2.5 trillion in mid-2024 (CoinGecko).

Trading volume reflects this growth—daily averages now exceed $260 billion, up significantly from last year (CoinMarketCap).

These stats underscore crypto’s expanding footprint, making it a compelling arena for traders in 2025.

Getting Started: Your First Steps in Crypto Trading

Choosing a Crypto Exchange

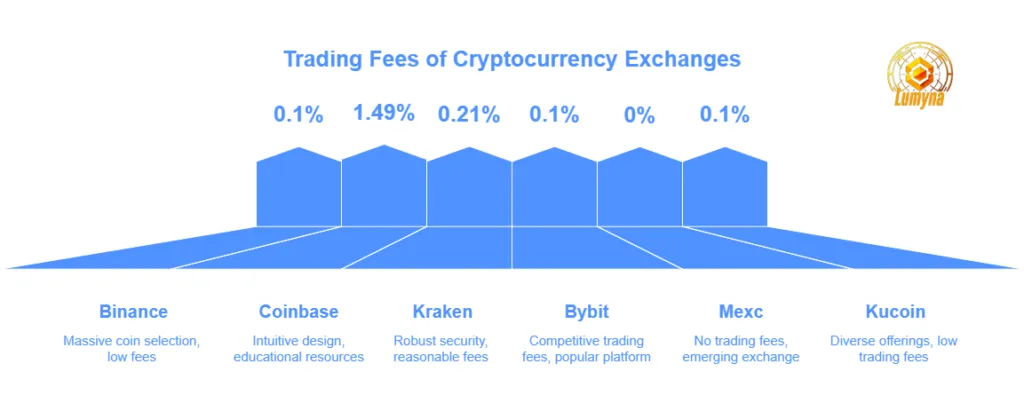

Getting into crypto trading in 2025 starts with picking the right exchange—a decision that can shape your entire experience. With so many platforms out there, knowing what to prioritize is key.

- First, consider fees. Trading costs, withdrawal charges, and deposit fees vary widely—some exchanges like Binance offer low rates (as little as 0.1% per trade), while others might nickel-and-dime you. Look for transparency and calculate how fees fit your trading style.

- Next, security is non-negotiable. Hacks still happen, so opt for platforms with strong track records—think two-factor authentication (2FA), cold storage for funds, and insurance policies. Coinbase, for instance, insures USD balances up to $250,000 via FDIC, a rare perk.

- Finally, ease of use matters, especially if you’re new. A clean interface, clear instructions, and responsive customer support can make or break your early trades.

For beginners, three exchanges stand out. Binance is a powerhouse—massive coin selection, low fees (0.1%), and a beginner mode for novices, though its advanced features might be overwhelming at first. Coinbase shines for simplicity—its intuitive design and educational resources (earn crypto while learning!) make it a go-to, despite higher fees (around 1.49% per trade). Kraken strikes a balance—robust security, reasonable fees (0.16%-0.26%), and a straightforward layout, perfect for those who value reliability without complexity. Each has its strengths, so your choice depends on what clicks for you—cost, safety, or a gentle learning curve.

Tip: Start with a user-friendly platform. Jumping into a complex exchange can lead to costly mistakes. Coinbase or Kraken are solid picks to dip your toes in—set up an account, verify your identity, and start small. Once you’re comfortable, explore Binance’s depth. Take it slow, prioritize security, and you’ll be trading like a pro in no time.

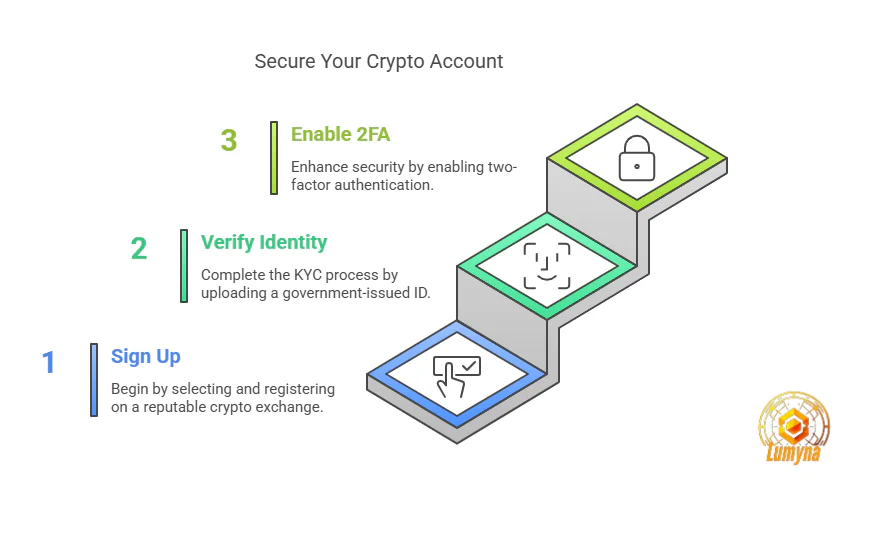

Setting Up Your Account

Setting up your crypto trading account is straightforward but demands careful attention to security. Follow these simple steps to get started safely and efficiently:

1. Sign Up on a Reputable Crypto Exchange: Begin by selecting a reputable cryptocurrency exchange such as Binance, Coinbase, Kraken, or another trusted platform. Navigate to their homepage and click on the “Sign Up” or “Register” button. Fill in the required details—usually your email address, a strong password, and basic personal information.

2. Verify Your Identity (KYC): Exchanges require identity verification, known as Know Your Customer (KYC), to ensure compliance and enhance security. Prepare a government-issued ID (passport, driver’s license, or national ID) and follow the platform’s instructions to upload a clear photo or scan of your document. Typically, this verification process is quick, taking anywhere from 10 to 30 minutes.

3. Enable Two-Factor Authentication (2FA): Protect your account by enabling two-factor authentication (2FA). Use apps like Google Authenticator or Authy instead of SMS for better security. This additional step greatly reduces your vulnerability to unauthorized access.

Common Pitfalls to Avoid:

- Weak Passwords: Always create a unique, complex password. Avoid predictable combinations such as birthdays or common words.

- Skipping Security Measures: Never skip enabling 2FA. It significantly reduces your risk of losing assets due to compromised passwords.

- 2.3 Funding Your Trading Account (250 words)

Once you’ve securely set up your crypto trading account, the next essential step is funding it. Here’s how you can deposit funds efficiently and securely:

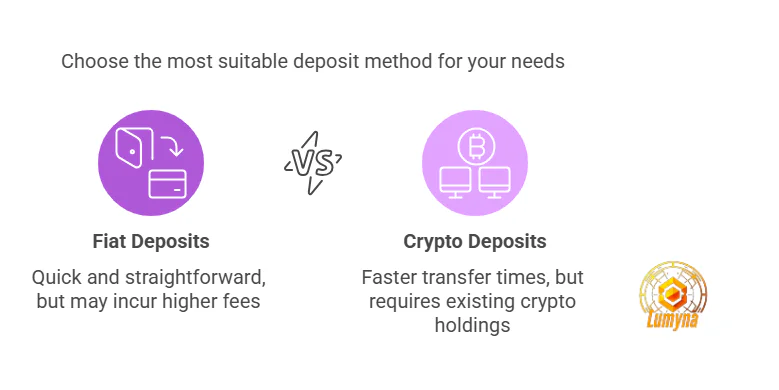

Funding Options:

- Fiat Deposits (USD, EUR): Most exchanges support deposits through fiat currencies, primarily USD or EUR. Depositing fiat is usually straightforward and involves bank transfers or credit/debit card payments. Bank transfers may take 1-3 business days, while card payments are often instantaneous but may come with higher fees.

- Crypto Deposits (BTC, ETH): Alternatively, if you already hold cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), you can transfer them directly to your exchange wallet. Crypto deposits generally take between 10 minutes and an hour, depending on network congestion.

How to Fund Your Account:

- Bank Transfer: Log into your exchange, find the “Deposit” section, and select your preferred fiat currency. Enter your bank details as prompted. Double-check your information to avoid delays.

- Credit/Debit Card: Typically quicker, card payments involve providing your card details directly on the exchange. Confirm your payment method and transaction amount clearly before proceeding.

- Wallet Transfer: For crypto deposits, access your exchange wallet and copy the provided wallet address carefully. From your external wallet, paste the copied address, verify accuracy, then initiate the transfer.

Fees to Watch:

Always check deposit and withdrawal fees beforehand. Bank transfers usually have low or zero fees, while card payments and crypto transfers may incur higher costs. Stay informed to optimize your trading budget.

Picking Your First Cryptocurrency

Choosing your first cryptocurrency wisely sets the tone for your trading experience. As a beginner, focus on well-established coins with proven stability, liquidity, and global recognition.

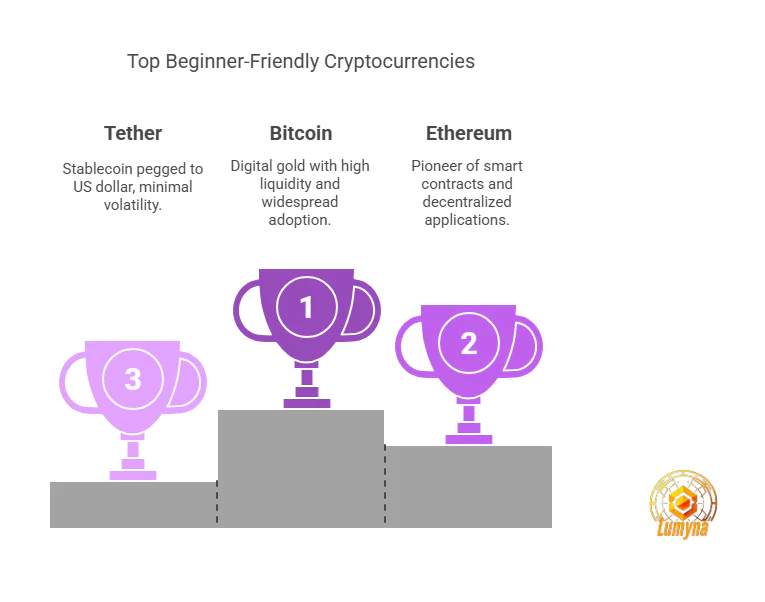

Recommended Beginner-Friendly Coins:

- Bitcoin (BTC): Often considered digital gold, Bitcoin remains the most recognized cryptocurrency globally. Its substantial liquidity makes buying or selling easy at any time. Bitcoin’s widespread adoption provides a secure starting point for beginners.

- Ethereum (ETH): Known for pioneering smart contracts and decentralized applications (DApps), Ethereum holds high liquidity and a strong community. It offers excellent exposure to innovative blockchain technologies beyond basic currency exchanges.

- Tether (USDT): This stablecoin maintains its value pegged to the US dollar, offering minimal volatility. Tether is ideal for traders looking to preserve capital, especially useful when markets fluctuate.

Why These Coins?

These cryptocurrencies offer a balanced introduction, combining liquidity, stability, and extensive market support. They reduce potential risks, letting you learn the ropes without extreme volatility.

Avoid Early On:

Steer clear of obscure altcoins or hyped tokens promising quick riches. These often lack liquidity, transparency, and have unpredictable volatility, making them unsuitable for beginners.

Start simple, build confidence, and diversify gradually as you become more experienced.

Crypto Trading Essentials: What You Need to Know

Types of Crypto Trading

As you begin your crypto trading journey, understanding the different trading strategies can help you select an approach that matches your goals, availability, and risk tolerance. Here’s an overview of the three primary trading styles:

Day Trading:

Day traders buy and sell cryptocurrencies within a single trading day, capitalizing on short-term price fluctuations. Trades last from minutes to hours, rarely overnight.

Pros:

- Quick profits possible from rapid price movements.

- No overnight risk due to closing positions daily.

Cons- Requires significant market knowledge, analytical skills, and constant attention.

- Higher stress and risk, potential for substantial losses due to volatility.

Swing Trading:

Swing traders hold positions from a few days to weeks, aiming to profit from medium-term market movements.

- Pros:

- Less intensive than day trading; doesn’t require constant monitoring.

- Offers more planning time to analyze and strategize.

- Cons:

- Exposure to overnight/weekend market risk.

- May miss shorter-term trading opportunities.

HODLing (Long-term Investing):

HODLing involves buying and holding cryptocurrencies for an extended period—typically months or years—with confidence in their long-term growth potential.

- Pros:

- Lowest time commitment and least stress compared to active trading strategies.

- Potentially significant returns over time, benefiting from market growth.

- Cons:

- Requires patience and strong discipline during market downturns.

- Limited short-term profits; might miss opportunities during volatile price swings.

Which Approach Suits Beginners?

For beginners, swing trading and HODLing typically offer safer entry points. Swing trading provides balanced risk exposure, manageable commitment, and opportunities for moderate profit.

HODLing is ideal if you prefer minimal stress, focusing on long-term gains rather than quick profits. Conversely, day trading, although exciting, demands experience, market knowledge, and higher risk tolerance, making it less beginner-friendly.

Understanding Market Orders and Limit Orders

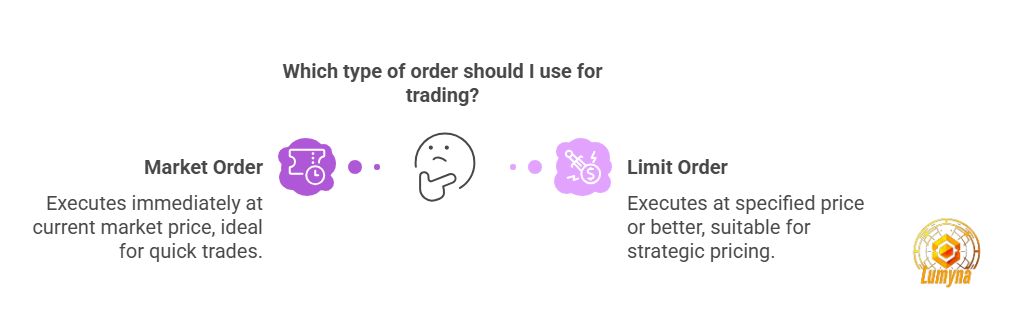

When placing your first crypto trade, understanding the difference between market orders and limit orders is essential to achieving the best outcomes for your trading strategy.

Market Orders:

A market order executes immediately at the current market price. It’s the simplest and quickest method for buying or selling cryptocurrencies.

- Pros:

- Instant execution ensures you don’t miss opportunities.

- Useful when timing is more critical than price precision.

- Cons:

- You have less control over the exact price, potentially buying at higher-than-expected prices during volatile market conditions.

- Risk of price slippage, especially in markets with low liquidity.

Limit Orders:

Limit orders allow you to specify exactly what price you’re willing to buy or sell at. Your order executes only when the market reaches your set price or better.

- Pros:

- Provides precise control over entry and exit points.

- Helps manage risks by ensuring trades occur within predefined price ranges.

- Cons:

- Your order may not execute if the market never hits your set price.

- Missed opportunities if prices move quickly beyond your desired range.

Example:

Imagine Ethereum (ETH) currently trades at a market price of $2,050. You want to buy ETH, but prefer paying no more than $2,000.

- With a market order, you instantly buy ETH at $2,050. The benefit here is immediate acquisition, though slightly higher than your desired price.

- Using a limit order, you set the buy price at $2,000. The order remains open until ETH’s price falls to $2,000 or below. This approach saves money if the market dips, but there’s no guarantee that the price will reach your limit.

For beginners, limit orders are generally recommended because they help you manage risk, ensure better pricing, and foster disciplined trading habits.

Reading Crypto Charts: A Crash Course

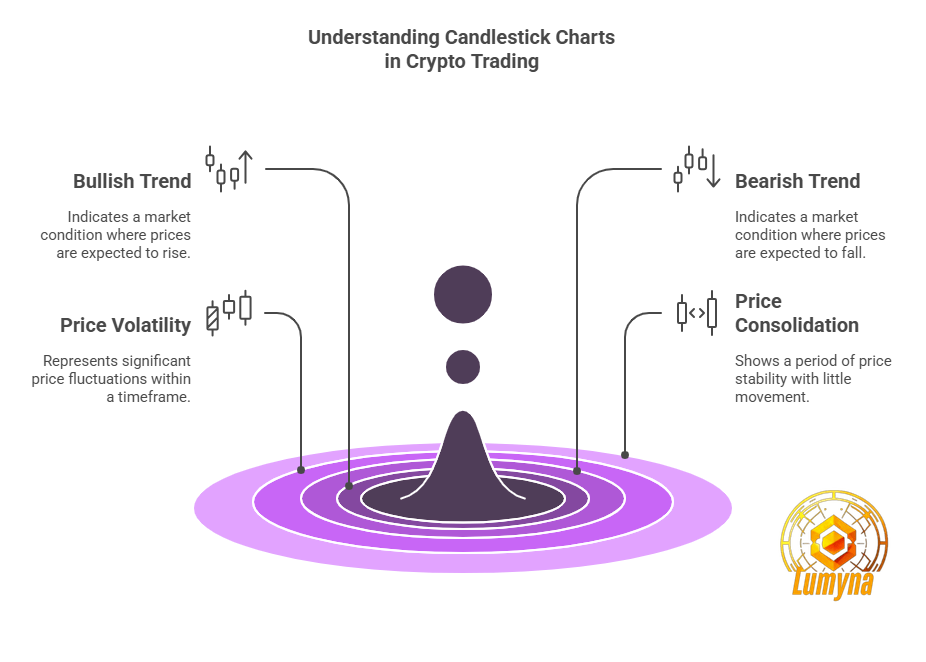

To succeed in crypto trading, learning to read charts is crucial. Crypto charts provide visual data, highlighting historical and current price movements, allowing traders to make informed decisions. Here’s a quick guide to mastering the essentials:

Chart Basics:

- Candlesticks:

Candlestick charts visually represent price movements over specific timeframes (minutes, hours, days). Each candlestick has a body and wicks:- Body: Shows the opening and closing price. A green candle means the price closed higher than it opened (bullish). A red candle indicates it closed lower (bearish).

- Wicks (shadows): Represent the highest and lowest prices reached within that timeframe. Longer wicks indicate significant price volatility.

- Price Trends:

Understanding price trends is fundamental. Trends can be:- Uptrend: Prices making higher highs and higher lows (bullish sentiment).

- Downtrend: Prices consistently making lower highs and lower lows (bearish sentiment).

- Sideways (consolidation): Prices moving horizontally, showing uncertainty or balance between buying and selling pressures.

- Trading Volume:

Volume represents how many units of a cryptocurrency were traded during a specific period. High volume often confirms strong market moves, whereas low volume can signal weak interest or indecision.

Tools to Use:

- TradingView:

An intuitive charting platform that provides extensive tools and indicators. Beginners appreciate TradingView’s simplicity, customizable layouts, and large community sharing ideas. - Exchange Charts:

Many crypto exchanges offer built-in charts, providing easy access to data directly where you trade. They’re excellent for quick analysis, though they may have fewer advanced features than TradingView.

Simple Chart Pattern – Support and Resistance Levels:

- Support Level:

A price level where buying activity is strong enough to halt or reverse a downward trend. Prices tend to bounce upward from support levels. - Resistance Level:

A price level at which selling pressure becomes strong enough to stop or reverse an upward trend. Prices typically struggle or reverse downward from resistance.

For example, if Bitcoin repeatedly drops to $30,000 and then rises, $30,000 becomes a support level. Conversely, if it consistently struggles to surpass $35,000, this level acts as resistance. Traders often buy at support and sell near resistance, capitalizing on predictable market reactions.

By mastering these basic chart-reading skills, you’ll gain confidence and clarity in your trading strategy.

Key Trading Terms for Beginners

As you venture into crypto trading, understanding basic terminology helps avoid confusion and empowers confident decisions. Here’s a concise glossary with practical examples:

- Wallet:

A digital wallet securely stores your cryptocurrencies. Think of it as your personal bank account for crypto assets.

Example: Popular wallets include MetaMask (software wallet) and Ledger (hardware wallet). - Blockchain:

A decentralized digital ledger recording all cryptocurrency transactions transparently and securely. It ensures transactions are permanent and verifiable.

Example: Bitcoin’s blockchain transparently tracks all BTC transfers, enabling trust without centralized control. - Volatility:

Refers to rapid, unpredictable price fluctuations. High volatility means prices change quickly, offering trading opportunities but also risks.

Example: Bitcoin might fluctuate 10% in a single day, highlighting volatility and potential trading opportunities or risks. - Liquidity:

Measures how easily a cryptocurrency can be bought or sold without significantly affecting its price. High liquidity indicates active trading and stable prices.

Example: Bitcoin and Ethereum have high liquidity, allowing you to buy/sell quickly with minimal price impact, whereas smaller tokens may lack buyers or sellers.

Why These Terms Matter:

Understanding these concepts is crucial to your trading success. Knowing what a wallet does secures your assets; blockchain knowledge provides trust and transparency; recognizing volatility prepares you for market risks; and grasping liquidity ensures smooth trading experiences.

Mastering these foundational terms clears confusion and positions you confidently in the rapidly evolving crypto trading world.

Strategies to Start Trading Crypto

- 4.1 Simple Trading Strategies for Beginners

Getting started in crypto doesn’t require complex trading methods. Here are two straightforward, beginner-friendly strategies with proven track records:

1. Dollar-Cost Averaging (DCA)

Dollar-cost averaging is an investing method where you consistently invest a fixed amount at regular intervals, regardless of the asset’s price. By spreading your buys, you avoid trying to perfectly time the market.

- Benefits & Statistics:

- According to historical data, investors using DCA for Bitcoin over the last 3 years saw average returns of around 40–60% annually.

- Removes emotional trading, minimizing panic buys or sells.

- Reduces the risk of buying at peak prices, smoothing out volatility.

- Example:

Suppose you invest $100 each month into Bitcoin. Over one year (12 months), you would have invested a total of $1,200. Historical averages suggest that regular monthly investing in Bitcoin over the past five years yielded significantly higher returns than trying to time market bottoms or tops.

2. Buy Low, Sell High

This traditional method involves purchasing cryptocurrencies when prices decline and selling when they rise, capitalizing on volatility.

- Timing Tips & Statistics:

- Historically, Bitcoin has seen average annual volatility exceeding 60%, providing frequent opportunities for profit through buying dips.

- Prices typically drop by 20–40% during short-term corrections; using these dips to buy often leads to substantial gains when prices recover.

- Example:

If Ethereum typically trades near $2,000 but drops temporarily to $1,500 during market downturns (a 25% decline), buying at these lows can yield a potential gain of over 30% when prices rebound.

Which Strategy is Better?

Dollar-Cost Averaging remains the easiest and safest approach for beginners. Data from crypto exchanges shows that new investors employing DCA consistently outperform those attempting short-term market timing, especially during periods of uncertainty.

Tools to Boost Your Trading

Leveraging helpful trading tools can significantly improve your crypto experience, making trading simpler and more efficient. Here are beginner-friendly tools to consider:

1. Trading Apps:

- CoinStats:

CoinStats is a user-friendly portfolio management app that tracks your cryptocurrency investments across multiple exchanges and wallets. It provides real-time price updates, detailed analytics, and personalized market insights, simplifying your portfolio management. - Coinigy:

Coinigy connects various crypto exchange accounts into a single intuitive platform. It features advanced charting, in-depth analytics, and real-time market data, ideal for tracking market movements and making informed trades.

2. Trading Bots – Are They Worth it for Beginners?

Trading bots automate trading based on predefined strategies or technical indicators. While appealing due to their efficiency, bots require experience to set up correctly.

- Pros: Bots operate 24/7, capture rapid market moves, and reduce emotional trading mistakes.

- Cons: Improper configuration can lead to unexpected losses. Bots also require monitoring and regular adjustments.

For beginners, it’s advisable first to learn trading fundamentals manually. As you gain confidence, explore bots gradually.

3. Price Alerts:

Price alerts notify you when a cryptocurrency reaches your set price target, helping you manage trades without constant monitoring. Apps like TradingView, CoinStats, or built-in alerts on exchanges such as Binance or Coinbase ensure you’re promptly updated on significant market movements.

Bottom Line:

Beginners will find immediate value in portfolio trackers (like CoinStats) and price alerts. Bots can enhance your trading but are better suited once you’re more experienced and comfortable with trading fundamentals.

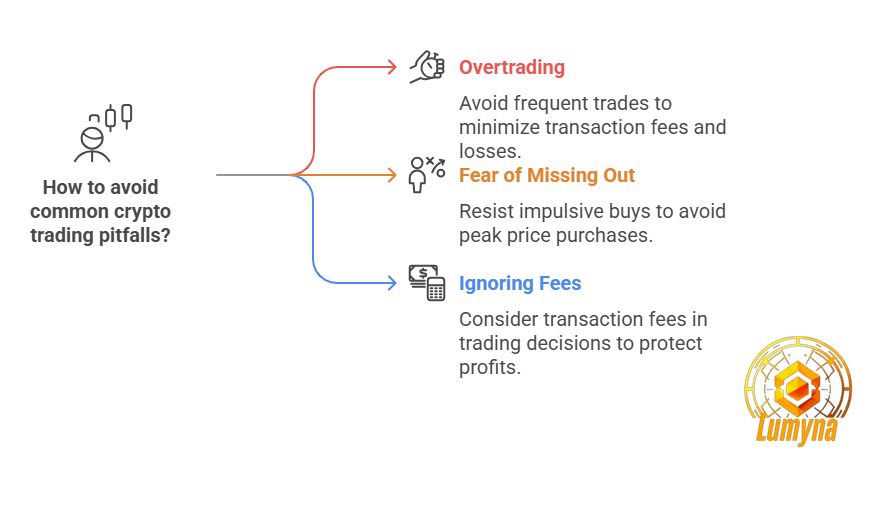

Common Mistakes to Avoid

When starting out in crypto trading, knowing common pitfalls can save you from costly mistakes. Here are the top mistakes beginners often make:

1. Overtrading:

Frequent buying and selling driven by impatience or excitement can quickly drain your funds through transaction fees and market losses. Resist the urge to chase every small market fluctuation; instead, trade with clear goals.

2. Fear of Missing Out (FOMO):

FOMO pushes traders to impulsively buy coins during rapid price increases, often leading to buying at peak prices. Always remember: markets move in cycles, and opportunities will recur.

3. Ignoring Fees:

Crypto exchanges charge transaction fees that can significantly eat into your profits, especially if you trade frequently or with small amounts. Always factor fees into your trading decisions.

Real Story – A Beginner’s $500 Loss:

Consider Jason, a beginner trader who lost $500 after investing impulsively in a hyped-up “scam coin” promising rapid gains. Without research, Jason bought at peak price only to see the coin collapse, losing everything within hours.

How to Avoid These Mistakes:

- Start Small: Invest minimal amounts initially, gradually increasing as you learn and become more confident.

- Do Your Research: Thoroughly research any cryptocurrency before investing—check reviews, community feedback, and reliable market analyses.

- Control Your Emotions: Set clear entry and exit strategies beforehand to avoid emotional decisions.

Following these tips ensures you avoid common beginner errors, protecting your funds and enabling a safer, more enjoyable trading experience.

Risks and Safety in Crypto Trading

Crypto trading can be rewarding, but it’s essential to recognize the risks involved to avoid costly mistakes. Here are key risks every beginner should understand:

1. Volatility: Cryptocurrencies are notoriously volatile, with prices frequently experiencing large swings within short periods. Bitcoin, for instance, regularly sees daily price changes of 5–10%, and altcoins can experience even more extreme fluctuations. This volatility offers trading opportunities but also risks significant losses if you’re unprepared.

- Real example: In 2021, Bitcoin’s price fell nearly 50%, from a high near $64,000 in April down to approximately $30,000 in July.

2. Scams and Fraud: Crypto markets attract scammers due to limited regulation. Common scams include:

- Pump-and-Dump Schemes: Fraudsters artificially inflate the price of obscure coins by misleading investors, then quickly sell off their holdings, leaving others holding worthless tokens.

- Fake Exchanges and Wallets: Scammers may create fake platforms or wallets to steal deposits.

Always verify platform credibility by checking reviews, licenses, and community feedback.

3. Potential Loss of Funds: Crypto trading can lead to significant financial losses, especially without proper planning or knowledge. According to market research, a substantial percentage of beginner traders lose money in their first year due to poor risk management and impulsive trades.

Example:

If you invested $1,000 in a volatile altcoin that dropped 50%, your investment would shrink to $500 overnight. Without safeguards or stop-loss strategies, losses can quickly compound.

Why It Matters:

Understanding these risks allows beginners to trade responsibly, implement safety measures (like stop-loss orders), and manage expectations realistically. Educating yourself on volatility, performing diligent research, and recognizing common scams protect your investments and significantly increase your odds of trading success.

How to Stay Safe While Trading

Crypto trading can be lucrative, but protecting your investments should always be your top priority. Here’s how to trade securely and responsibly:

1. Prioritize Security Measures:

- Enable Two-Factor Authentication (2FA):

Always activate two-factor authentication (2FA) on your exchange and wallet accounts. Use authenticator apps like Google Authenticator or Authy, rather than SMS, to reduce vulnerability to SIM-swapping attacks. - Cold Storage:

Consider storing significant crypto holdings in cold storage—a hardware wallet not connected to the internet—such as Ledger or Trezor. Cold wallets dramatically reduce risks from hacking and cyber-attacks. - Strong Passwords:

Weak passwords are a significant security risk. Always create complex passwords using a combination of letters, numbers, and special characters. Regularly update your passwords, avoid reusing passwords across multiple sites, and consider using secure password managers like LastPass or 1Password.

Conduct Thorough Research:

- Exchange Reputation:

Before choosing an exchange, review user experiences, ratings, and the exchange’s security history. Exchanges with a solid track record of security, such as Coinbase or Binance, are safer choices compared to newer, lesser-known platforms. - Coin Legitimacy:

Always investigate cryptocurrencies before investing. Check for active communities, transparent teams, credible whitepapers, and verified use-cases. Avoid investing in coins that promise unrealistic returns or lack transparency.

Example – Avoiding Phishing Sites:

Phishing sites imitate legitimate exchanges or wallets to steal your credentials. For example, a phishing email may mimic Coinbase’s login page. If unsuspecting traders enter credentials on this fake site, their accounts become compromised. Always verify URLs carefully (e.g., coinbase.com instead of coinbaze.com) and avoid clicking suspicious links from emails or messages.

Bottom Line:

Staying secure requires vigilance, reliable tools (like 2FA and hardware wallets), and thorough research. Building these security habits early will ensure your crypto journey remains safe and enjoyable, significantly reducing the risk of losses.

Managing Your Money: Risk Control

Proper risk management is vital to your success in crypto trading. As a beginner, carefully consider the following strategies to protect your capital:

1. Set a Budget:

Adopt a disciplined approach by allocating a fixed trading budget. Start small, typically between $100 to $500, an amount you’re comfortable potentially losing. This ensures your financial stability isn’t compromised if markets move unfavorably. As you gain experience, gradually increase your investment—but never invest more than you can comfortably lose.

2. Utilize Stop-Loss Orders:

Stop-loss orders automatically sell your cryptocurrency if it drops to a predetermined price, preventing substantial losses if the market moves against you.

- Example: If you buy Bitcoin at $30,000 and set a 5% stop-loss ($28,500), your position will automatically sell if BTC declines to that price, limiting your loss to 5%.

Why This Matters:

- Minimizes emotional trading decisions, preventing panic-selling in downturns.

- Allows strategic planning, helping you set clear exit points before entering a trade.

2. Dollar-Value Guidelines (e.g., $100–$500):

Start trading with modest amounts—typically between $100 and $500—to keep your risk manageable. Trading smaller amounts allows you to build experience safely, learn from mistakes without significant financial stress, and gradually scale as your confidence grows.

Bottom Line:

Risk management is crucial in crypto trading. Always adhere to your set budget, consistently use stop-loss orders, and never trade money you can’t afford to lose. This disciplined approach ensures your trading experience is safer, more structured, and ultimately more profitable in the long run.

Related Questions in Crypto Trading

- What exactly is cryptocurrency trading, and how does it differ from stock trading?

Crypto trading involves buying and selling digital currencies like Bitcoin on online platforms to profit from price changes. Unlike stock trading, it operates 24/7, isn’t tied to a central authority, and often involves higher volatility.

- Why should someone consider trading crypto in 2025?

In 2025, crypto offers 24/7 markets, potential high returns due to volatility, and growing mainstream adoption. It’s an exciting space with new coins and regulatory clarity driving opportunities.

- What are the basic terms every crypto trader should know (e.g., wallet, blockchain, altcoin)?

A wallet stores your crypto, blockchain is the tech recording transactions, and an altcoin is any cryptocurrency besides Bitcoin. Knowing these helps you navigate the market confidently.

- How does a cryptocurrency exchange work, and what’s its role in trading?

An exchange is an online platform where you buy, sell, or trade crypto using fiat or other coins. It acts as the marketplace connecting traders globally.

- What are the main benefits of trading crypto compared to traditional investments?

Crypto offers constant trading hours, decentralization free from banks, and high volatility for profit potential. It’s also accessible to anyone with an internet connection.

- What risks should beginners be aware of when starting crypto trading?

Price swings can lead to losses, scams are common, and exchanges can get hacked. Beginners should start small and research thoroughly.

- How much money do I need to start trading cryptocurrency?

You can start with as little as $10 on many exchanges, though $50-$100 gives more flexibility. It depends on the platform’s minimums and your goals.

- What’s the difference between spot trading, margin trading, and futures in crypto?

Spot trading is buying and selling crypto instantly at current prices, margin trading uses borrowed funds for bigger bets, and futures involve contracts to buy/sell later. Each carries different risks and rewards.

- How do I choose the best cryptocurrency exchange for my needs?

Look for low fees, strong security (like 2FA), and a user-friendly interface. Binance, Coinbase, and Kraken are great beginner options.

- What security measures should I take to protect my crypto investments?

Use 2FA, store funds in a hardware wallet, and avoid sharing private keys. Always double-check URLs to dodge phishing scams.

- Can I trade crypto 24/7, and how does that affect my strategy?

Yes, crypto markets never close, unlike stocks, letting you react instantly to news. It means staying disciplined with timing and sleep!

- What are the most popular cryptocurrencies to trade for beginners (e.g., Bitcoin, Ethereum)?

Bitcoin and Ethereum lead due to their stability, liquidity, and wide acceptance. They’re less risky starting points than newer altcoins.

- How do fees work on crypto exchanges, and how can I minimize them?

Exchanges charge trading fees (e.g., 0.1%-1%) and withdrawal costs, varying by platform. Use limit orders and pick low-fee exchanges like Binance to save.

- What tools or apps can help me track prices and manage my trades?

CoinGecko and CoinMarketCap track prices, while TradingView offers charts. Many exchanges have built-in tools too.

- How do I set up a crypto wallet, and do I need one to start trading?

Download a software wallet (e.g., Trust Wallet) or buy a hardware one (e.g., Ledger), then follow setup steps. You don’t need one initially—exchanges provide wallets—but it’s safer long-term.

- What’s the role of volatility in crypto trading, and how can I use it to my advantage?

Volatility drives big price swings, creating profit opportunities. Buy low during dips and sell high, but watch for sudden drops.

- How do regulations impact crypto trading, and what should I watch for in 2025?

Regulations can limit or boost markets—tax rules or bans affect prices. Watch for U.S. policy shifts or EU’s MiCA updates in 2025.

- What are some simple trading strategies for beginners to try?

Try “buy and hold” for long-term gains or “dollar-cost averaging” to spread risk. Start small and avoid chasing hype.

- How can I avoid common mistakes new crypto traders make?

Don’t invest more than you can lose, avoid emotional trades, and research before buying. Stick to reputable platforms and ignore “get rich quick” promises.

- Where can I find reliable resources to learn more about crypto trading?

Check Binance Academy, Coinbase Learn, or YouTube channels like Coin Bureau. Forums like Reddit’s r/CryptoCurrency and lumyna crypto forum offer real trader insights.