- What Is Cryptocurrency? A Simple Explanation

- Crypto vs. Cash: A Clear Comparison

- How Does Cryptocurrency Work? The Basics of Blockchain

- Blockchain: A Shared Digital Ledger

- How a Crypto Transaction Works

- Blockchain vs. Traditional Banking

- Why It Matters

- Why Invest in Cryptocurrency? Benefits and Risks

- Five Benefits of Crypto Investing

- Popular Cryptocurrencies You Should Know

- How to Buy Cryptocurrency: A Step-by-Step Guide

- Top Exchanges for Beginners

- Making Your First Purchase

- Choosing a Crypto Wallet: Your Guide to Storage

- Comparing Two Wallets

- Wallet Fact: Hardware Wallets Are Like Digital Safes

- Understanding Crypto Prices: Why Do They Change?

- Four Factors Driving Crypto Prices

- Bitcoin Price History

- Making Sense of Volatility

- Avoiding Crypto Scams: 5 Tips for Beginners

- A Cautionary Tale

- Five Scam Types to Avoid

- Staying Safe in Crypto

- Crypto Taxes for Beginners: What You Need to Know

- Getting Started with Crypto: Your Action Plan for 2025

- A Simple Start

- Five Steps to Begin

- Beginner Checklist

- Your 2025 Crypto Plan

- Conclusion: Your Crypto Journey Starts Here

- FAQ: Related Questions About Cryptocurrency

Imagine Jane, a schoolteacher who loves her job but worries about saving enough for the future.

One day, she hears a friend talk about Bitcoin and how it’s changing the way people think about money. It sounds exciting, but also a bit scary, there’s so much to learn, and what if she makes a mistake?

Does that sound like you? If you’re curious about crypto basics but feel overwhelmed, you’re not alone. This article is here to help you understand what cryptocurrency is and take your first steps with confidence.

So, what is cryptocurrency?

In one sentence: It’s digital money secured by something called blockchain, which keeps transactions safe and transparent.

Unlike cash you hold or money in a bank, crypto exists online and isn’t controlled by any single government or company.

That’s what makes it interesting, and sometimes confusing, for beginners like Jane.

If you’ve ever wondered how crypto works or why so many people are talking about it, this article is for you.

We’ll break it down into simple ideas, so you don’t need to be a tech expert to get it.

By the end, you’ll have a clear picture of the basics, like what makes crypto different from regular money and how people use it.

We’ll also talk about why some investors see it as a way to grow their savings, even if they start small.

Most importantly, we’ll share practical tips on how to start safely, so you can explore crypto without feeling lost or risking too much.

Whether you’re saving for a big goal, like Jane, or just curious about this new world of digital money, we’re here to guide you.

Ready to learn what cryptocurrency is all about and why it might matter to you? Keep reading, and let’s get started together.

What Is Cryptocurrency? A Simple Explanation

Cryptocurrency is a type of digital money that exists only online, designed to make transactions faster, cheaper, and more independent of traditional financial systems.

If you’re asking, “What is cryptocurrency?” this guide will explain the crypto basics for beginners, without needing any prior knowledge.

It’s not like cash you can hold or money in a bank account—it’s a new way to think about value, powered by technology called blockchain.

Let’s explore what makes cryptocurrency unique, how it compares to cash, and why it matters.

At its core, cryptocurrency lets you send and receive money directly over the internet, without a bank or government in the middle.

Blockchain, the technology behind it, acts like a digital ledger that records every transaction across many computers.

This setup ensures that the money can’t be copied or spent twice, solving a big problem for digital currencies.

Unlike traditional money, which relies on banks to verify transactions, cryptocurrency uses math and computer networks to keep things secure and trustworthy.

Three Key Traits of Cryptocurrency

Here are three features that define cryptocurrency and set it apart:

- Decentralized: No single authority, like a bank or government, controls cryptocurrency. Instead, a global network of computers agrees on transactions, giving users more control over their money.

- Secure: Blockchain uses advanced encryption to protect transactions. Each one is locked into the ledger, making it extremely difficult to alter or steal without detection.

- Transparent: The blockchain ledger is public, meaning anyone can view the history of transactions. While personal details stay private, this openness builds trust in the system.

Crypto vs. Cash: A Clear Comparison

To understand how cryptocurrency differs from the money you use every day, here’s a straightforward table:

| Feature | Cryptocurrency | Cash |

|---|---|---|

| Form | Digital (online only) | Physical (coins, bills) |

| Storage | Digital wallet (phone or computer) | Physical wallet or bank account |

| Control | Blockchain (no middleman) | Banks and governments |

| Transactions | Global, often faster, lower fees | Slower for international, higher fees |

Crypto Fact: Bitcoin Started It All

A quick fact: Bitcoin, launched in 2009, was the first cryptocurrency.

It paved the way for thousands of others coins, like Ethereum and Cardano, each offering different uses, from smart contracts to faster payments.

By knowing these crypto basics, what cryptocurrency is, how it’s decentralized, secure, and transparent, you can see why it’s more than just a trend.

It’s a tool for sending money across borders, investing, or even paying for goods, all without relying on traditional banks. Keep reading to learn how it works and how to start safely.

How Does Cryptocurrency Work? The Basics of Blockchain

Understanding how cryptocurrency works can feel challenging, but it’s simpler than it seems.

Cryptocurrency is digital money that operates without banks, powered by a technology called blockchain.

If you’re curious about how crypto works, this guide will explain the blockchain basics in clear terms for beginners.

Think of it as a new way to handle money—secure, transparent, and global.

Let’s dive into what makes it unique, step by step, and compare it to the banking system you already know.

Blockchain: A Shared Digital Ledger

Imagine a notebook where everyone in a group writes down every trade or payment they make.

This notebook isn’t kept by one person—it’s copied across the group, and everyone checks to make sure the entries match.

If someone tries to change a page, the others notice because their copies don’t line up.

That’s blockchain: a digital ledger shared across thousands of computers worldwide. Each “page” (called a block) lists transactions, and these blocks link together in a chain, creating a permanent, tamper-proof record.

This is what keeps cryptocurrency safe and trustworthy without needing a bank.

Blockchain’s design ensures that no single person or company can control or fake transactions.

Every computer in the network, called a node, has a copy of the ledger and helps verify new entries.

This setup makes cryptocurrency different from traditional money, which relies on banks to track and approve payments.

With blockchain, the system is open, and anyone can check the records, though personal details like names stay hidden for privacy.

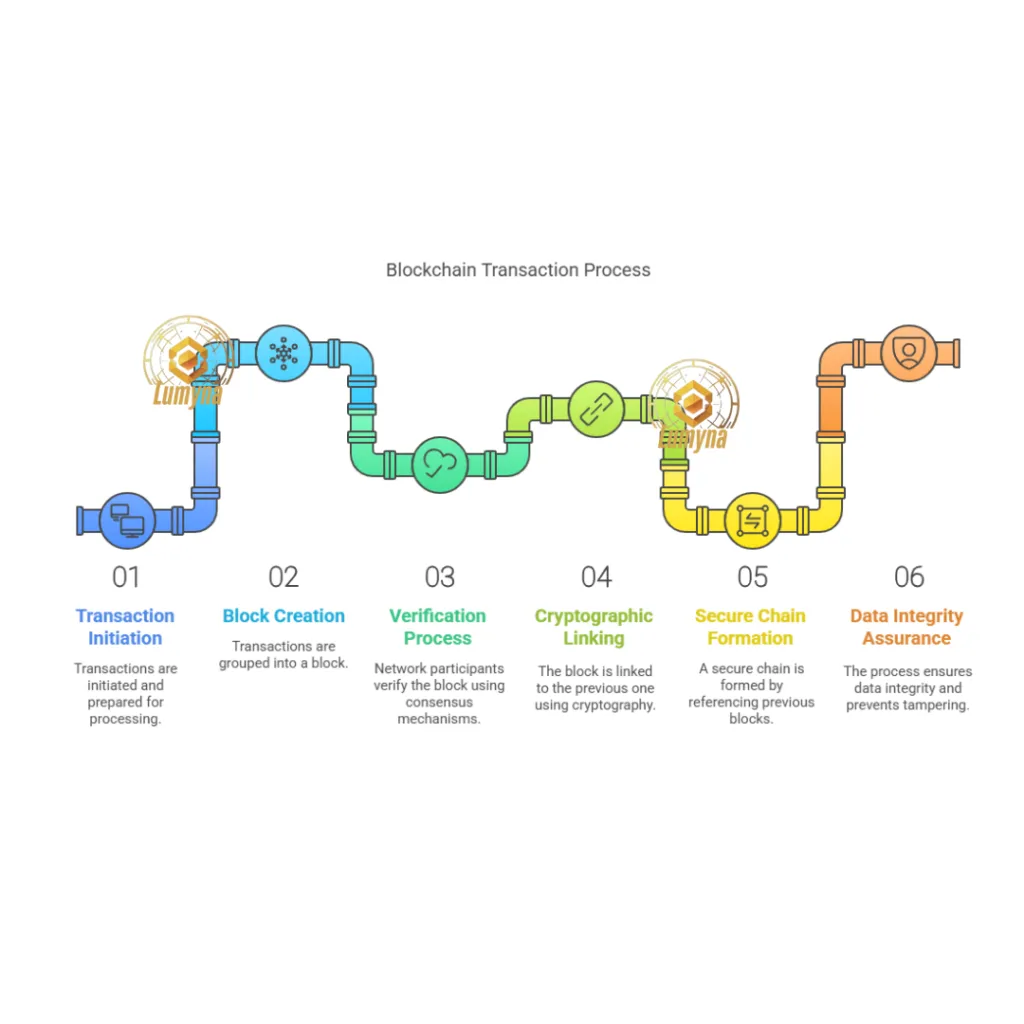

How a Crypto Transaction Works

To see how crypto moves from one person to another, here are the four main steps:

- Send: You decide to send cryptocurrency, like Bitcoin, to someone. Using a digital wallet (an app or software), you enter their wallet address and the amount.

- Verify: Your transaction is broadcast to the blockchain network. Computers (nodes) check if you have enough crypto and if the details are correct.

- Record: Once verified, the transaction is grouped with others into a block. This block is added to the blockchain ledger, visible to all nodes.

- Confirm: The network double-checks the block, ensuring it fits with the chain’s history. After confirmation, the recipient gets the crypto in their wallet.

Blockchain vs. Traditional Banking

This process can take minutes or less, depending on the cryptocurrency, and it’s designed to be secure and final.

Here’s a table to show how blockchain compares to the banking system:

| Feature | Blockchain | Traditional Banking |

|---|---|---|

| Control | Decentralized (no single authority) | Centralized (banks, governments) |

| Speed | Often minutes, global | Hours to days, especially international |

| Fees | Lower, varies by network | Higher, especially for transfers |

| Transparency | Public ledger, anyone can view | Private, only banks see details |

Why It Matters

Understanding how crypto works means seeing blockchain’s power. It cuts out banks, lowers fees, and speeds up global payments.

For example, sending money overseas with crypto can cost less and arrive faster than a bank wire.

Blockchain also ensures no one can alter past transactions, building trust.

Whether you’re paying for goods, investing, or exploring new tech, these blockchain basics show why crypto is a game-changer.

Next, we’ll cover why people invest and how to start safely.

Why Invest in Cryptocurrency? Benefits and Risks

Deciding whether to invest in cryptocurrency can feel like standing at a crossroads.

You’ve likely heard stories of Bitcoin’s value increasing from pennies to thousands of dollars, sparking curiosity about crypto investing.

But you’ve also seen headlines about price crashes or scams, raising the question, “Is crypto safe to invest in?”

This guide will walk you through why invest in crypto by laying out the benefits and risks clearly, helping beginners make informed choices without needing to be experts.

The Potential and the Pitfalls

Cryptocurrency has shown remarkable growth. For example, Bitcoin, launched in 2009, grew from worth almost nothing to over $60,000 at its peak in 2021.

Early investors who bought small amounts saw life-changing returns.

This potential draws people in, as crypto offers a chance to grow wealth in ways traditional investments like stocks or bonds might not.

Yet, the same Bitcoin has also dropped sharply, sometimes losing half its value in weeks.

This up-and-down nature shows both the opportunity and the challenge of crypto investing—high rewards often come with high uncertainty.

Five Benefits of Crypto Investing

Here are five reasons why people choose to invest in cryptocurrency:

- High Returns: Some cryptocurrencies have grown massively, offering bigger gains than many stocks or real estate, though past performance isn’t a guarantee.

- Diversification: Adding crypto to a portfolio spreads risk, as it often moves differently from traditional assets like stocks or gold.

- Accessibility: Anyone with an internet connection can invest, often starting with small amounts. Platforms like Binance make it easy to buy crypto.

- Innovation: Crypto funds new technologies, like blockchain apps for finance or gaming, letting investors support cutting-edge ideas.

- Inflation Hedge: Some see crypto, like Bitcoin, as a store of value, protecting against rising prices when traditional money loses purchasing power.

Four Risks to Understand

Investing in crypto isn’t without challenges. Here are four key risks to know:

- Price Swings: Crypto prices can change wildly. A coin worth $100 today might be $50 tomorrow—or $200—making it unpredictable.

- Scams: Fake projects or phishing attacks target newcomers. Fraudsters may promise quick riches, only to disappear with your money.

- Regulation: Governments may change rules, affecting crypto’s value or legality. Some countries have banned certain coins, adding uncertainty.

- Tech Complexity: Managing crypto requires learning about wallets and security. Mistakes, like losing a password, can lock you out of your funds forever.

Risk Tip: Only Invest What You Can Afford to Lose

A golden rule for crypto investing: Never put in money you need for rent, bills, or emergencies. Treat it like a calculated bet—exciting but not your lifeline.

Weighing Your Decision

So, why invest in crypto despite the risks? It’s about balance.

The chance for high returns, supporting innovation, or diversifying your savings can be appealing, especially if you start small.

Platforms like Binance or Coinbase simplify the process, letting you buy crypto with a few clicks.

But the risks, volatility, scams, or complex tech, mean you need to stay cautious.

Research coins before buying, use trusted exchanges, and keep your funds secure. Crypto investing can be rewarding, but it’s not a get-rich-quick scheme.

By understanding both sides, you can decide if it fits your goals. Next, we’ll cover how to start safely with practical steps.

Popular Cryptocurrencies You Should Know

If you’re new to crypto and wondering where to start, you’ve likely heard of Bitcoin, but what about other coins? Many beginners ask, “What are altcoins?”

Simply put, altcoins are any cryptocurrencies besides Bitcoin.

With thousands of coins out there, picking the right ones can feel overwhelming.

This guide introduces the best cryptocurrencies for beginners—Bitcoin, Ethereum, Solana, and stablecoins like USDT and USDC—explaining what they do and why they matter.

By understanding these, you’ll get a clear picture of the crypto world and how altcoins fit in.

Bitcoin: The Original Crypto

Bitcoin is the first and most famous cryptocurrency, launched in 2009.

Think of it as digital gold, a way to store value that isn’t controlled by banks or governments.

Its price has grown dramatically, from cents to tens of thousands of dollars, because only a limited number of Bitcoins will ever exist.

People use it to save wealth, pay for goods, or send money globally.

For beginners, Bitcoin is a solid starting point due to its widespread use and recognition, though its price can fluctuate a lot.

Ethereum: More Than Money

Ethereum, launched in 2015, is the second-biggest crypto and a key altcoin.

Unlike Bitcoin, Ethereum isn’t just about payments, it powers apps called “smart contracts.”

Smart contracts are digital agreements that run automatically, used for things like online games, finance tools, or even art sales.

Ethereum’s coin, called Ether, pays for these apps to run. It’s popular because it supports innovation, making it a favorite for investors who believe in new technology.

However, its complexity and fees can be a hurdle for newcomers.

Solana: Fast and Scalable

Solana, started in 2020, is a newer altcoin designed for speed and low costs.

Imagine Ethereum but faster and cheaper—that’s Solana’s goal.

It supports apps for trading, gaming, and more, competing with Ethereum for developers’ attention. Its price has risen as more projects use it, but it’s riskier than Bitcoin or Ethereum because it’s younger and less proven.

For beginners, Solana offers a glimpse into crypto’s future, though its value can swing sharply.

Stablecoins: USDT and USDC

Stablecoins like USDT (Tether) and USDC are altcoins tied to regular money, like the U.S. dollar, so their value stays steady—usually $1 per coin.

They’re used for trading, saving, or sending money without the wild price changes of other cryptos.

USDT is the most traded stablecoin, while USDC is known for transparency, as its reserves are regularly checked.

For beginners, stablecoins are a safe way to hold value in crypto without worrying about crashes, though they don’t offer big growth.

Comparing the Coins

Here’s a table to show how Bitcoin, Ethereum, and USDC differ:

| Feature | Bitcoin | Ethereum | USDC |

| Purpose | Store of value, payments | Smart contracts, app platform | Stable value, trading/saving |

| Launched | 2009 | 2015 | 2018 |

| Price Stability | Volatile | Volatile | Stable ($1) |

| Use Case | Wealth storage, global transfers | Building apps, innovation | Holding value, low-risk transfers |

Bitcoin Fact: Only 21 Million Will Ever Exist

A quick note: Bitcoin’s supply is capped at 21 million coins, making it scarce like gold, which drives its value over time.

Three Things to Check Before Buying Cryptocurrency

Before you buy any cryptocurrency, do these three checks to stay smart:

- Use Case: What does the coin do? Bitcoin stores value, Ethereum runs apps, and USDC holds steady. Pick coins with clear purposes.

- Team: Who’s behind it? Look for experienced developers or companies, like Ethereum’s Vitalik Buterin or USDC’s Circle.

- Market Cap: How big is the coin? Larger market caps, like Bitcoin’s, often mean more stability, while smaller ones, like Solana’s, can be riskier.

Getting Started

These coins—Bitcoin, Ethereum, Solana, USDT, and USDC—are great entry points to understand crypto and altcoins. Want to dive deeper?

How to Buy Cryptocurrency: A Step-by-Step Guide

Ready to take your first step into crypto and wondering, “How do I buy Bitcoin?” Buying cryptocurrency is easier than you might think, even if you’re starting from scratch.

This guide will walk you through how to buy cryptocurrency in a clear, beginner-friendly way, focusing on choosing a platform, setting up an account, and making your first purchase.

By following these steps, you’ll be able to buy crypto like Bitcoin or others safely and confidently, without needing to be a tech expert.

Getting Started with Crypto

Imagine you’re signing up for an online bank account, but instead of holding dollars, it lets you buy digital money like Bitcoin or Ethereum.

That’s what a crypto exchange does—it’s a website or app where you trade regular money for cryptocurrency.

To begin, you’ll pick a trusted exchange, verify your identity (like you would for a bank), and then buy your chosen coin.

It’s straightforward, but you’ll want to follow each step carefully to keep your money secure.

Five Steps to Buy Cryptocurrency

Here’s a simple list of the five steps to buy crypto:

- Sign Up: Choose an exchange like Coinbase, Binance, or Kraken. Create an account with your email and a strong password.

- Verify Identity: Upload a photo ID (like a driver’s license) and sometimes a selfie. This step, called KYC, is required by most exchanges to prevent fraud.

- Deposit Money: Link a bank account, debit card, or credit card to add funds (dollars, euros, etc.). Some exchanges also accept PayPal or wire transfers.

- Select a Coin: Browse the exchange for coins like Bitcoin, Ethereum, or stablecoins like USDC. Check the price and decide how much you want to buy.

- Buy and Store: Place your order (often a “market” buy for the current price). Once purchased, move your crypto to a digital wallet for extra security, like a software app or hardware device.

Top Exchanges for Beginners

To help you choose, here’s a table comparing three beginner-friendly exchanges:

| Exchange | Fees | Ease of Use | Security |

| Coinbase | Higher (1–4% per trade) | Very easy, clean interface | Strong, insured storage |

| Binance | Lower (0.1–0.5% per trade) | Slightly complex but powerful | Good, with two-factor authentication |

| Kraken | Moderate (0.9–2% per trade) | Simple for beginners, detailed options | High, with robust protections |

Pro Tip: Start with $10 to Test the Waters

A quick tip: Don’t feel pressured to invest a lot. Try buying just $10 worth of Bitcoin or another coin to learn how it works without stress.

Making Your First Purchase

Now, let’s tie it together.

Start by picking an exchange—Coinbase is great for its simplicity, while Binance offers more coins, and Kraken balances ease and security.

Sign up, verify your ID (it usually takes a day or less), and deposit a small amount, like $20. Choose a coin—Bitcoin’s a popular first pick—and buy it with a few clicks.

After buying, consider transferring your crypto to a wallet for safekeeping, though leaving it on a trusted exchange is okay for small amounts.

Check fees before trading, as they vary. With these steps, you’re ready to buy cryptocurrency confidently. Want to learn more? Explore our guide on storing crypto safely next.

Choosing a Crypto Wallet: Your Guide to Storage

Once you’ve bought cryptocurrency, keeping it safe is crucial, but what’s a good crypto wallet?

A crypto wallet stores your digital money, like Bitcoin or Ethereum, securely. Think of it as a keychain for your crypto—without it, you can’t access your funds.

This guide explains how to choose the best crypto wallet for beginners, focusing on safety and ease. We’ll cover the main types, compare options, and help you pick one that fits your needs, so you can store your crypto with confidence.

Hot vs. Cold Wallets: The Basics

Picture your crypto as cash. A hot wallet is like a mobile app you carry everywhere—convenient for quick payments but riskier if your phone gets hacked.

Hot wallets, like MetaMask, are software apps connected to the internet, making them easy to use for trading or spending.

A cold wallet, like a Ledger device, is like a safe at home—offline and harder to steal from, perfect for saving large amounts.

For beginners, hot wallets are simpler to start with, but cold wallets offer stronger protection for long-term storage.

Three Types of Crypto Wallets

Here are the three main wallet types, with their pros and cons:

- Software Wallets (e.g., MetaMask)

- Pros: Free, easy to set up, great for daily use like trading or app payments.

- Cons: Online, so vulnerable to hacks if your device is compromised.

- Hardware Wallets (e.g., Ledger, Trezor)

- Pros: Offline, highly secure, ideal for storing large amounts long-term.

- Cons: Costs money ($60–$150), less convenient for frequent transactions.

- Paper Wallets (printed keys)

- Pros: Free, offline, safe from online attacks if stored properly.

- Cons: Easy to lose or damage, not practical for regular use.

Comparing Two Wallets

Here’s a table comparing two popular wallets for beginners:

| Wallet | Cost | Ease of Use | Security |

| MetaMask | Free | Simple, browser or app-based | Moderate, online risks |

| Ledger | $60–$150 | Easy setup, USB-like device | High, offline storage |

Wallet Fact: Hardware Wallets Are Like Digital Safes

A quick note: Hardware wallets, like Ledger or Trezor, are the safest way to store crypto, keeping your keys offline like a vault.

Picking the Best Crypto Wallet

Choosing the best crypto wallet for beginners depends on your goals. If you’re testing with small amounts or trading often, a software wallet like MetaMask is free and user-friendly—just keep your device secure.

For saving larger sums, a hardware wallet like Ledger or Trezor is worth the cost for its offline protection.

Avoid paper wallets unless you’re very careful, as they’re tricky to manage. Always back up your wallet’s recovery phrase (a secret word list) and never share it. Start with a trusted wallet, and you’ll keep your crypto safe as you learn more.

Understanding Crypto Prices: Why Do They Change?

If you’ve ever checked the price of Bitcoin or another cryptocurrency, you might have noticed it jumping or dropping in just hours.

This rollercoaster ride can be confusing, so why do crypto prices change so much? The answer lies in a mix of supply and demand, news, and how people feel about crypto.

This guide will explain why crypto prices move, highlight key factors behind the shifts, and help beginners understand the volatility without needing to be financial experts.

Cryptocurrency prices work like any market—when more people want to buy than sell, prices rise; when selling overtakes buying, prices fall.

Unlike stocks or gold, crypto is still new, so its prices are extra sensitive.

For example, when a big company announces it’s accepting Bitcoin, demand spikes, pushing prices up. But if a government bans crypto trading, fear spreads, and prices can crash. Market sentiment—what people think and feel—plays a huge role too.

A single tweet from a well-known figure or a rumor about a hack can send prices soaring or tumbling, making crypto feel like a wild ride.

Four Factors Driving Crypto Prices

Here are four major reasons why crypto prices change:

- Adoption: When more businesses or people use crypto—like shops accepting Bitcoin—demand grows, raising prices. Wider use signals trust and value.

- Regulation: New laws can shake markets. A country supporting crypto can boost prices, while strict rules or bans often cause drops.

- Hacks and Security: News of exchange hacks or scams scares investors, leading to sell-offs that lower prices. Trust is key in crypto.

- Trends and News: Big events, like Bitcoin’s halving (cutting new coin supply), or media hype around new coins, can drive prices up or down.

Bitcoin Price History

To show how prices move, here’s a table of Bitcoin’s value over recent years, based on CoinMarketCap data:

| Year | Price (Approx.) | Key Event |

| 2020 | $29,000 | Post-halving rally, institutional interest |

| 2024 | $60,000 | Bitcoin ETF approvals, market growth |

| 2025 | $80,000 | Pro-crypto policies, adoption surge |

Price Tip: News Can Swing Markets—Stay Informed

A quick note: Crypto prices react fast to news, like regulatory changes or tech upgrades. Check trusted sources like CoinMarketCap to track prices and stay updated.

Making Sense of Volatility

Understanding why crypto prices change helps you navigate the ups and downs. Supply and demand set the baseline, but adoption, regulation, hacks, and trends add fuel to the fire.

For instance, Bitcoin’s price climbed from $29,000 in 2020 to around $80,000 in 2025 as more companies invested and policies softened. Yet, hacks or bans can still spark sudden drops.

To stay ahead, follow market news on platforms like CoinMarketCap, which tracks live prices. Crypto’s volatility can be a chance to learn, but always invest carefully, knowing prices can shift quickly.

Avoiding Crypto Scams: 5 Tips for Beginners

When you start exploring cryptocurrency, one question often pops up: “Is crypto safe?”

The truth is, while crypto can be secure, scams are a real danger for beginners. Scammers target newcomers with tricks that can drain your funds in minutes.

This guide will help you avoid crypto scams by sharing practical tips, common traps to watch for, and ways to spot trouble.

With the right knowledge, you can stay safe and build trust in your crypto journey.

A Cautionary Tale

Imagine Alex, excited to buy his first Bitcoin. He gets an email that looks like it’s from his exchange, asking him to log in and confirm his details.

The website seems real, but after entering his password, his account is empty. Alex fell for a phishing scam—a fake site designed to steal his login.

Stories like this are common, but you can avoid Alex’s mistake by learning what to watch out for.

Five Scam Types to Avoid

Here are five common crypto scams and how to steer clear:

- Fake ICOs: Scammers create new coins, promising huge profits, then vanish after collecting money. Research any project’s team and goals before investing.

- Phishing: Fraudsters send emails or texts pretending to be your exchange or wallet, tricking you into sharing passwords. Always check website URLs carefully.

- Pump-and-Dumps: Groups hype a cheap coin to inflate its price, then sell, leaving others with worthless coins. Avoid coins with sudden, unexplained spikes.

- Fake Giveaways: Ads claim, “Send us 1 Bitcoin, get 2 back!” These are lies—never send crypto to unknown addresses promising returns.

- Imposter Apps: Bogus wallet or exchange apps steal your funds. Only download from official app stores or verified sites.

Red Flags vs. Legit Signs

This table helps you spot scams versus trustworthy platforms:

| Red Flags | Legit Signs |

| Promises of guaranteed profits | Clear risks explained |

| Unverified or unknown team | Transparent, reputable company |

| Urgent demands to send crypto | No pressure, secure process |

| Suspicious URLs or typos | Official, verified website |

Scam Alert: Never Share Your Wallet Key

A quick tip: Your wallet’s private key or recovery phrase is like a bank PIN—never share it with anyone, no matter who they claim to be.

Staying Safe in Crypto

To avoid crypto scams, stay cautious and proactive.

Always double-check emails and websites for signs of phishing—use a VPN like NordVPN to browse securely. Research coins and platforms thoroughly, sticking to well-known exchanges like Coinbase or Binance.

Be wary of deals that sound too good to be true, like fake giveaways or sky-high returns. Check scam trackers, such as CoinMarketCap’s scam alerts, for warnings about shady projects.

Finally, keep your private keys offline and private. By following these steps, you’ll answer “Is crypto safe?” with confidence, knowing you’re protected from fraud.

Crypto Taxes for Beginners: What You Need to Know

If you’re new to cryptocurrency, you might wonder, “Are cryptocurrencies legal?” In most countries, the answer is yes, but with a catch—you need to understand taxes.

Crypto taxes can seem tricky, but they’re manageable once you know the basics.

This guide on crypto tax for beginners explains how taxes work, what triggers them, and tools to make it easier, so you can stay on the right side of the law without feeling overwhelmed.

Understanding Crypto Taxes

Crypto is treated like property in many places, such as the United States, meaning you don’t pay taxes just for holding it. But when you make money from crypto, like selling Bitcoin for a profit, you owe taxes on that gain.

Think of it like selling a car you bought cheap—if you sell it for more, you pay tax on the difference, called a capital gain. For example, if you buy one Bitcoin for $30,000 and sell it for $50,000, you owe tax on the $20,000 profit.

Tax rules vary by country, but the idea is similar: track your gains and report them honestly.

Three Taxable Crypto Events

Here are three common actions that can trigger taxes:

- Selling: When you sell crypto for regular money, like dollars, you calculate the profit (sale price minus what you paid) and report it as a capital gain.

- Trading: Swapping one crypto for another, like Bitcoin for Ethereum, counts as selling the first coin, so you owe tax on any profit from its price change.

- Spending: Using crypto to buy goods or services, like paying for coffee with Bitcoin, triggers a tax if the crypto’s value grew since you bought it.

Tax Tools to Simplify Tracking

To help manage your crypto taxes, consider these tools:

| Tool | Cost | Features |

| Koinly | $49–$179/year | Tracks trades, generates tax reports |

| CoinTracker | $59–$299/year | Syncs with exchanges, calculates gains |

Tax Tip: Track Every Trade to Avoid Surprises

A quick note: Write down every crypto buy, sell, or trade, including dates and prices. Tools like Koinly or CoinTracker can automate this for you.

Staying on Top of Crypto Taxes

Grasping crypto tax for beginners means knowing crypto is legal but taxable in most places.

You don’t owe taxes for buying or holding, but selling, trading, or spending crypto can create a tax bill based on your profits.

Tax rates depend on how long you held the crypto—short-term gains (under a year) often face higher rates than long-term ones. Use tools like Koinly or CoinTracker to track transactions and create reports for your tax return.

Check your country’s rules (like IRS guidelines in the U.S.) and consider a tax pro if you’re unsure. With good records, you’ll handle crypto taxes confidently and avoid headaches

Getting Started with Crypto: Your Action Plan for 2025

Ready to dip your toes into cryptocurrency but unsure where to begin? Starting with crypto doesn’t have to be intimidating, even in 2025.

This guide answers, “How to start with crypto?” with a clear, beginner-friendly roadmap. Think small, learn as you go, and you’ll build confidence without stress.

Whether you want to invest a little or just explore, these steps will help you start crypto investing safely and smartly.

A Simple Start

Picture yourself setting aside $20 for something new, like trying a hobby.

Crypto can be like that—start with a small amount, maybe $10, to learn without risking much. You don’t need to understand everything at once.

By taking one step at a time, like signing up for an exchange or securing a wallet, you’ll see how crypto fits into your goals, whether it’s saving, investing, or learning about new tech.

Five Steps to Begin

Here’s a straightforward plan to kick off your crypto journey:

- Learn: Read about Bitcoin, Ethereum, and blockchain basics. Websites like CoinMarketCap explain coins and trends clearly.

- Budget: Decide what you can afford to invest—money you won’t need for bills. Even $10 is enough to start.

- Buy: Sign up on a trusted exchange like Coinbase or Binance. Buy a small amount of Bitcoin or another coin.

- Store: Move your crypto to a wallet for safety. Try a free software wallet like MetaMask or a hardware one like Ledger.

- Track: Monitor your crypto’s value with apps like CoinTracker to stay organized and plan future moves.

Beginner Checklist

This table ensures you’re ready to start:

| Task | Status | Tool/Example |

| Exchange | Signed up | Coinbase |

| Wallet | Secured | MetaMask or Ledger |

| Budget | Set ($10–$50 to start) | Personal plan |

Start Now: $10 Can Buy Your First Crypto

A quick tip: You don’t need hundreds to begin—$10 can buy a fraction of Bitcoin or other coins to get you started.

Your 2025 Crypto Plan

Starting crypto investing in 2025 is about small, smart steps.

Learn the basics, set a tiny budget, and use trusted platforms like Coinbase or Binance. Secure your coins with a wallet like MetaMask, and track progress with CoinTracker.

Stay curious, avoid rushing, and you’ll grow comfortable with crypto. Your journey starts with one action—sign up today and explore the possibilities.

Conclusion: Your Crypto Journey Starts Here

Cryptocurrency offers a world of possibilities, from growing your savings to exploring new technology.

By now, you’ve learned the crypto basics—what it is, how it works, and why it’s worth considering.

Crypto investing can be exciting, with chances for high returns and innovation, but it comes with risks like price swings and scams.

The key is to start small, stay informed, and use trusted tools. Whether you’re eyeing Bitcoin’s potential or Ethereum’s apps, you don’t need to jump in big—just a few dollars can get you started.

Ready to buy? Check our guides on Best Crypto Exchanges 2025

Sign up with a reliable platform like Coinbase to purchase your first coin, and secure it with a wallet like Ledger for peace of mind.

Crypto isn’t a race—take your time to learn and grow. With the right approach, you can explore this digital frontier confidently. Start today, even with $10, and see where crypto investing takes you in 2025!

FAQ: Related Questions About Cryptocurrency

New to crypto? Here are answers to common questions Retail Investors ask, covering who can join, what to buy, and more. Each answer is short, clear, and points you to deeper insights to fuel your journey.

Who Can Invest in Cryptocurrency?

Anyone with internet access can invest in cryptocurrency, from beginners to experts, as long as they’re willing to learn. Start with small amounts and explore safely by checking our Getting Started with Crypto (#getting-started-with-crypto-your-action-plan-for-2025) guide.

What Is the Best Cryptocurrency for Beginners?

Bitcoin and Ethereum are top picks for beginners due to their widespread use and strong track records. Learn more about them in our Popular Cryptocurrencies You Should Know (#popular-cryptocurrencies-you-should-know) section.

When Is the Best Time to Buy Cryptocurrency?

Timing crypto markets is hard, but spreading purchases over time (dollar-cost averaging) lowers risk. Dive into smarter strategies with our Crypto Investing Strategies guide.

Where Do I Buy Cryptocurrency Safely?

Trusted exchanges like Coinbase or Binance offer secure platforms for beginners to buy crypto. Follow our step-by-step advice in How to Buy Cryptocurrency (#how-to-buy-cryptocurrency-a-step-by-step-guide) to start confidently.

Why Is Cryptocurrency So Volatile?

Crypto prices swing due to supply and demand, news, and market trends, making research key. Understand the causes in our Understanding Crypto Prices (#understanding-crypto-prices-why-do-they-change) section.

How Do I Store Cryptocurrency Securely?

A hardware wallet like Ledger keeps your crypto offline, protecting it from hacks. Get the full scoop on storage in Choosing a Crypto Wallet (#choosing-a-crypto-wallet-your-guide-to-storage).

Are Cryptocurrencies Legal?

In most countries, cryptocurrencies are legal, but you must follow tax rules, like reporting gains. Check the details in our Crypto Taxes for Beginners (#crypto-taxes-for-beginners-what-you-need-to-know) guide.

Are Crypto Investments Risky?

Yes, crypto can be risky due to price swings and scams, but starting small and staying informed helps. Explore the pros and cons in Why Invest in Cryptocurrency? (#why-invest-in-cryptocurrency-benefits-and-risks).

How Much Money Do I Need to Start Investing in Crypto?

You can start with as little as $10, buying fractions of coins like Bitcoin. See how to begin in our Getting Started with Crypto (#getting-started-with-crypto-your-action-plan-for-2025) action plan.

Why Should I Care About Blockchain?

Blockchain powers crypto’s security and transparency, making it a game-changer beyond just money. Learn its basics in How Does Cryptocurrency Work? (#how-does-cryptocurrency-work-the-basics-of-blockchain).