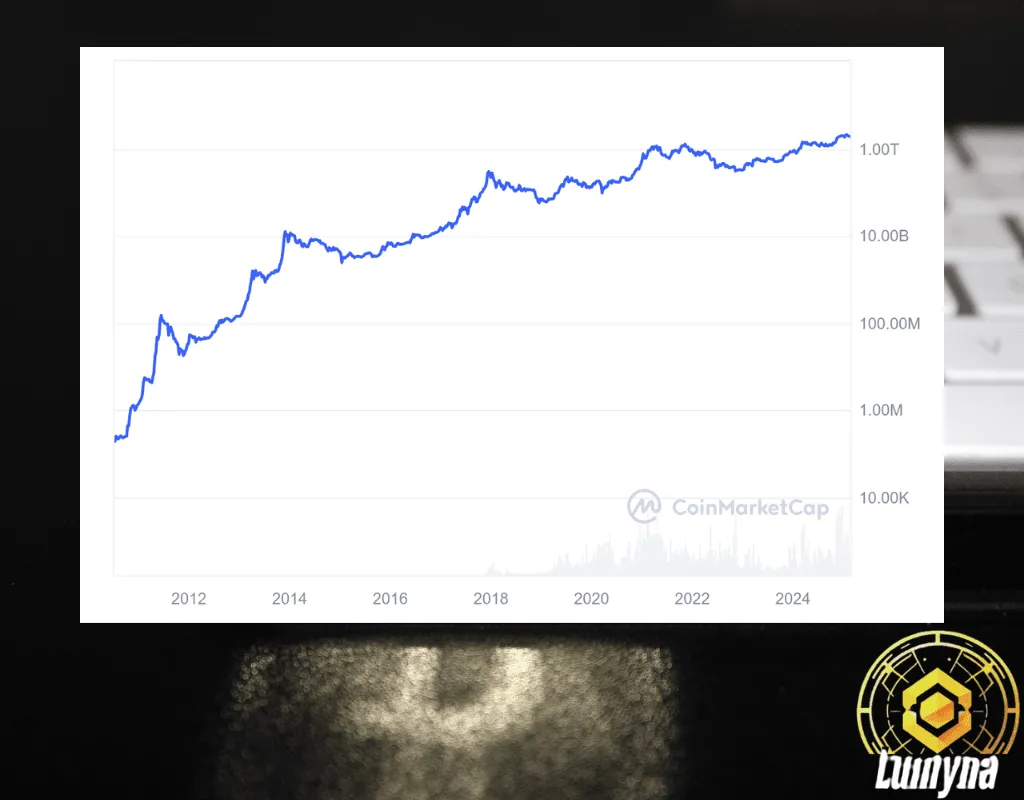

Bitcoin’s journey since its inception in 2009 has been nothing short of remarkable. But will Bitcoin Reach $200K? From being an experimental digital currency to becoming the leading cryptocurrency with a market cap in the hundreds of billions, Bitcoin has experienced extreme volatility along the way. Its price has soared to record highs, including the notable peak of nearly $69,000 in late 2021, while also facing sharp corrections that have tested investor confidence. This volatility has become a hallmark of Bitcoin, drawing both excitement and skepticism from the global financial community.

The $200,000 price target has become a significant psychological and financial milestone within the crypto community. Reaching this mark would not only reinforce Bitcoin’s dominance in the digital asset space but also signal growing acceptance and adoption of cryptocurrencies in mainstream finance. For many investors, $200K represents the next big leap, while others view it as an overly ambitious goal.

In this article, we will explore expert predictions on Bitcoin’s potential to reach $200K, analyze current market trends, examine key factors driving Bitcoin’s price, and discuss challenges that could hinder its path to this coveted milestone. Whether you’re a seasoned investor or new to the crypto space, this analysis will provide valuable insights into Bitcoin’s future trajectory.

2. Bitcoin’s Price History and Milestones

Early Days: From Cents to $1,000 (2009-2017)

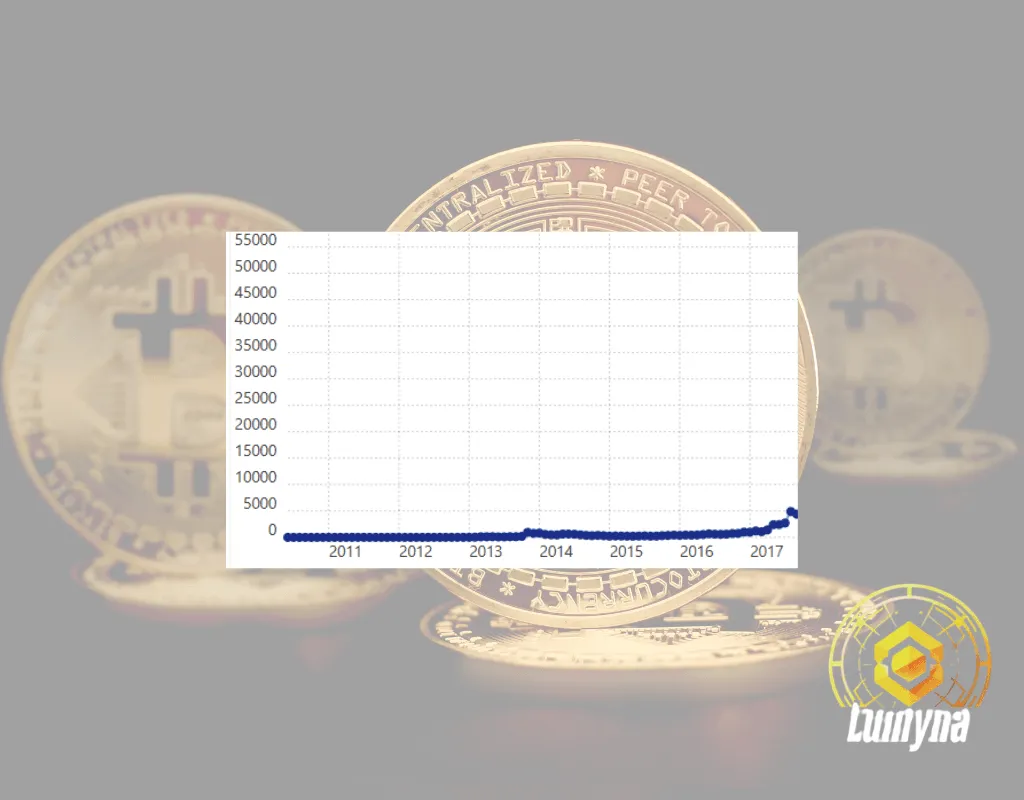

Bitcoin’s inception in 2009 marked the birth of decentralized digital currency. In its early years, Bitcoin traded for mere cents, with its first recorded price in October 2009 at $0.0009. Over the next few years, Bitcoin gained traction among tech enthusiasts and early adopters. By 2011, it reached $1, and by late 2013, it surged to $1,000 for the first time. This period laid the foundation for Bitcoin’s reputation as a volatile yet promising asset, though it faced setbacks like the Mt. Gox exchange collapse in 2014.

First Bull Run: Reaching $20,000 in 2017

Bitcoin’s first significant bull run occurred in 2017, driven by growing public awareness, media coverage, and increased adoption. Starting the year at around $1,000, Bitcoin experienced exponential growth, reaching an all-time high of nearly $20,000 in December 2017. This milestone brought Bitcoin into the mainstream financial conversation, though the rapid rise was followed by a steep correction, with prices plummeting to around $3,000 by the end of 2018.

2021 Peak: All-Time High of ~$69,000

The next major milestone came in 2021, fueled by institutional investment, increased retail participation, and macroeconomic factors like inflation fears. Bitcoin hit its all-time high of approximately $69,000 in November 2021, driven by growing acceptance from companies like Tesla and the introduction of Bitcoin futures ETFs. However, the market soon faced headwinds, including regulatory crackdowns and global economic uncertainty, leading to another significant correction.

Current Trends in 2024/2025: Recent Performance and Market Sentiment

As of early 2025, Bitcoin has achieved a significant milestone, surpassing $100,000 for the first time in its history. This new all-time high has been fueled by a combination of growing institutional adoption, including the approval of multiple spot Bitcoin ETFs in the United States and Europe, and increasing interest from corporate treasuries and high-net-worth investors. Additionally, macroeconomic factors such as persistent inflation concerns, geopolitical tensions, and the desire for decentralized financial assets have bolstered Bitcoin’s appeal as a store of value.

Market sentiment remains optimistic, with many analysts predicting further price appreciation driven by Bitcoin’s limited supply, the upcoming halving event in 2024, and continuous innovation within the crypto ecosystem. However, challenges such as regulatory uncertainties and global economic volatility remain key factors that could influence Bitcoin’s trajectory. Despite these risks, the recent $100K milestone has renewed confidence in Bitcoin’s long-term potential, setting the stage for future price targets like $150K and $200K.

3. Key Factors Driving Bitcoin’s Potential Rise to $200K

Institutional Adoption

One of the most significant drivers of Bitcoin’s price growth is the increasing involvement of institutional investors. Companies like MicroStrategy, which holds over 190,000 BTC, and Tesla, which invested $1.5 billion in Bitcoin, have set the stage for broader corporate adoption. Additionally, the approval of multiple Bitcoin ETFs in key markets, including the U.S. and Europe, has provided institutional investors with regulated and accessible ways to gain exposure to Bitcoin. As more hedge funds, family offices, and publicly traded companies integrate Bitcoin into their portfolios, demand is expected to surge, potentially driving the price towards the $200K mark. Recently as of 2025, blackrock investment continues to accumulate their bitcoin reserve

Global Economic Conditions

Bitcoin’s appeal as a hedge against economic instability continues to grow amidst global economic challenges. Rising inflation rates, the devaluation of fiat currencies, and periodic economic crises have pushed investors to seek alternative stores of value. Bitcoin’s decentralized nature and capped supply of 21 million coins make it an attractive option for wealth preservation. In regions experiencing economic turmoil, such as hyperinflation in parts of Latin America and Africa, Bitcoin adoption has surged, further contributing to its global demand and price appreciation potential.

Bitcoin Halving 2024 Impact

The upcoming Bitcoin halving in 2024 is a critical factor that could propel prices higher. Halving events, which occur approximately every four years, reduce the block reward for miners by half, effectively decreasing the rate at which new Bitcoin enters circulation. Historically, Bitcoin’s price has surged significantly in the months following a halving event. For example, after the 2016 halving, Bitcoin rose from around $650 to nearly $20,000 in 2017. Similarly, after the 2020 halving, the price climbed from $9,000 to $69,000 in 2021. The 2024 halving is expected to create a supply shock, potentially driving prices toward $200K as demand continues to grow while supply tightens.

Increased Retail Adoption

Retail adoption of Bitcoin is also on the rise, with more individuals using the cryptocurrency for payments, savings, and investments. Payment platforms like PayPal and Cash App now allow users to buy, sell, and hold Bitcoin, making it more accessible to everyday consumers. Additionally, an increasing number of merchants are accepting Bitcoin payments, from small businesses to large corporations. As more individuals incorporate Bitcoin into their financial lives, the growing user base is expected to fuel further demand and price increases.

Regulatory Developments

Regulatory clarity is another key factor that could drive Bitcoin’s price to $200K. While regulatory uncertainty has often been a headwind for Bitcoin, recent developments indicate a trend towards clearer and more favorable regulations. Jurisdictions like Switzerland, Singapore, and the United States are establishing comprehensive regulatory frameworks for digital assets, providing investors with greater confidence. The introduction of crypto-specific regulations, including tax guidelines, custody rules, and exchange licensing, is likely to attract more institutional and retail investors to Bitcoin.

Technological Advancements

Technological advancements aimed at improving Bitcoin’s scalability and usability are also playing a crucial role. The development of the Lightning Network, a layer-2 solution, enables faster and cheaper Bitcoin transactions, making it more suitable for everyday use. Additionally, ongoing improvements in Bitcoin’s infrastructure, including enhanced security protocols and integration with decentralized finance (DeFi) platforms, are expanding its functionality. These technological innovations are expected to enhance Bitcoin’s adoption and utility, further driving demand and supporting higher price targets.

4. Expert Predictions on Bitcoin Hitting $200K

Bullish Predictions

Michael Saylor (MicroStrategy)

Michael Saylor, Executive Chairman of MicroStrategy, remains one of the most vocal Bitcoin advocates. Saylor believes that Bitcoin’s scarcity and growing adoption make $200K not just possible but inevitable in the long term. He argues that Bitcoin is the ultimate store of value, often comparing it to digital gold. Saylor’s prediction is rooted in the increasing corporate adoption of Bitcoin as a treasury reserve asset, with MicroStrategy itself holding over 190,000 BTC. According to Saylor, as more companies and institutional investors follow suit, the demand surge will drive Bitcoin well beyond $200K.

Cathie Wood (ARK Invest)

Cathie Wood, CEO of ARK Invest, has consistently maintained a bullish outlook on Bitcoin. Wood’s projections are based on the growing inflow of institutional investments into Bitcoin, especially through financial products like Bitcoin ETFs. She has stated that if institutional allocation to Bitcoin reaches just 5% of their portfolios, Bitcoin could easily surpass $200K. Wood also emphasizes Bitcoin’s potential in developing markets as a hedge against inflation and currency devaluation, further boosting its global demand and price.

PlanB’s Stock-to-Flow Model

PlanB, the pseudonymous analyst behind the widely followed Stock-to-Flow (S2F) model, has consistently predicted high price targets for Bitcoin based on its scarcity. According to the S2F model, which compares Bitcoin’s supply flow to its existing stock, Bitcoin’s price is projected to reach $200K within the current market cycle. PlanB highlights that previous halvings have resulted in exponential price increases, and with the 2024 halving reducing new supply even further, the $200K target aligns with historical price patterns.

Bearish/Neutral Predictions

Peter Schiff

Peter Schiff, a well-known gold investor and Bitcoin skeptic, remains unconvinced that Bitcoin can reach $200K. Schiff argues that Bitcoin lacks intrinsic value and is driven primarily by speculative trading. He warns that regulatory crackdowns and potential technological vulnerabilities could limit Bitcoin’s growth. According to Schiff, while Bitcoin may experience short-term price surges, its volatility and lack of fundamental backing make it an unreliable long-term investment, casting doubt on the $200K target.

JP Morgan

JP Morgan’s stance on Bitcoin is more measured, reflecting cautious optimism. The bank acknowledges Bitcoin’s growing role in diversified portfolios, especially as a hedge against inflation. However, JP Morgan ties its Bitcoin price predictions to macroeconomic stability. Analysts at JP Morgan suggest that while Bitcoin could reach $200K in a bullish market scenario, it would require stable global economic conditions, clear regulatory frameworks, and continued institutional support. In less favorable conditions, JP Morgan sees Bitcoin’s price remaining below this target due to market volatility and regulatory uncertainties.

Consensus/Market Sentiment

A survey of top analysts and hedge funds reveals a mixed but generally optimistic outlook. Many believe that Bitcoin’s limited supply, increasing adoption, and the upcoming halving event could push prices toward $200K within the next few years. However, they also caution that regulatory developments, particularly in major markets like the US and EU, could significantly influence Bitcoin’s trajectory. The consensus is that while $200K is achievable, it will depend on a combination of market conditions, technological advancements, and institutional participation.

5. Technical Analysis of Bitcoin’s Price Trends

Historical Patterns: Comparison to Past Bull Cycles

Bitcoin’s price movements have often followed cyclical patterns, primarily driven by its halving events. Historical bull cycles, such as those in 2013, 2017, and 2021, were characterized by exponential growth following halving events. In 2017, Bitcoin surged from under $1,000 to $20,000, while the 2020 halving set the stage for Bitcoin’s rise from $9,000 to its previous all-time high of $69,000 in late 2021. Analyzing these past cycles suggests that Bitcoin often enters a parabolic growth phase 12 to 18 months after each halving, indicating that the 2024 halving could spark another major rally, potentially pushing Bitcoin towards $200K by late 2025 or early 2026.

Current Chart Analysis: Key Support and Resistance Levels in 2025

As of early 2025, Bitcoin is trading above the critical psychological level of $100,000, having recently hit an all-time high. Key support levels include $85,000 and $100,000, with strong buying interest observed at these points. On the upside, the next major resistance levels are around $120,000 and $150,000, where profit-taking and market hesitancy could slow further price increases. Breaking above these resistance zones with significant volume could pave the way for Bitcoin to reach $200K, with many analysts targeting $175,000 as a key midpoint.

Indicators to Watch: RSI, Moving Averages, On-Chain Metrics

Technical indicators are crucial for understanding Bitcoin’s price momentum and potential reversals:

- Relative Strength Index (RSI): Currently hovering around 70 on the daily chart, Bitcoin is nearing overbought territory, suggesting a potential short-term pullback. However, in previous bull runs, the RSI remained above 70 for extended periods, indicating strong bullish momentum.

- Moving Averages: Bitcoin’s price is currently well above its 50-day and 200-day moving averages, a bullish sign. The Golden Cross (when the 50-day MA crosses above the 200-day MA) occurred in late 2024, historically signaling the start of strong upward trends.

- On-Chain Metrics: On-chain data reveals increasing whale accumulation (large Bitcoin holders adding to their positions) and declining exchange reserves, indicating that investors are holding rather than selling. Additionally, the network hash rate is at an all-time high, reflecting strong network security and miner confidence.

Potential Timelines: When Bitcoin Could Realistically Reach $200K

Based on historical cycles and current technical indicators, many analysts predict that Bitcoin could reach $200K within the next 12 to 24 months. The period following the 2024 halving is expected to be critical, with price acceleration likely in the second half of 2025 as supply constraints intensify. If Bitcoin maintains its current momentum and breaks through key resistance levels, a price target of $200K could be realistic by late 2025 or early 2026. However, this timeline is contingent on favorable macroeconomic conditions, sustained institutional interest, and technological advancements within the crypto ecosystem.

6. Challenges and Risks to Bitcoin’s $200K Target

Regulatory Crackdowns

Regulatory uncertainty remains one of the biggest threats to Bitcoin’s price trajectory. Governments worldwide are increasingly focusing on cryptocurrency regulations, with potential bans, strict KYC/AML requirements, and high tax rates on crypto transactions posing significant risks. For example, the U.S. Securities and Exchange Commission (SEC) continues to scrutinize crypto-related activities, and regions like China have already implemented comprehensive bans. If major economies introduce unfavorable regulations, Bitcoin’s growth could stall, making the $200K target harder to achieve.

Market Manipulation

Bitcoin’s decentralized and relatively young market is often vulnerable to market manipulation. Whales , large holders of Bitcoin , can influence price movements through massive buy or sell orders, leading to artificial price surges or crashes. Pump-and-dump schemes, where the price is artificially inflated and then rapidly sold off, remain a concern. Such manipulations can erode investor confidence, deter institutional participation, and create volatility that prevents Bitcoin from maintaining a stable upward trajectory.

Macroeconomic Uncertainty

The broader macroeconomic environment plays a crucial role in Bitcoin’s price performance. Factors like global recessions, rising interest rates, and geopolitical instability can impact investor sentiment. As central banks tighten monetary policies to combat inflation, risk assets like Bitcoin often face selling pressure. A prolonged economic downturn or unexpected financial crises could divert capital away from speculative assets, slowing Bitcoin’s climb to $200K.

Technological Risks

While Bitcoin’s blockchain is renowned for its security, no system is entirely immune to technological risks. Potential security breaches, including exchange hacks and wallet vulnerabilities, pose threats to investor assets and market trust. Additionally, scalability issues remain a concern. Although the Lightning Network offers faster transactions, Bitcoin still faces challenges in handling high transaction volumes compared to newer blockchains. Without ongoing technological improvements, Bitcoin’s utility could be overshadowed by more scalable competitors.

Competition from Other Cryptos

The cryptocurrency market is becoming increasingly competitive, with blockchains like Ethereum, Solana, and emerging Layer-1 and Layer-2 solutions offering advanced functionalities such as smart contracts, DeFi ecosystems, and faster transactions. As these platforms continue to innovate and attract users, Bitcoin’s dominance could be challenged. Increased competition could divert capital from Bitcoin, slowing its path to $200K unless it continues to innovate and maintain its position as the leading store of value in the digital asset space.

7. Bitcoin Use Cases That Could Drive Future Growth

Store of Value (“Digital Gold”)

Bitcoin’s most well-known use case is its role as a store of value, often referred to as “Digital Gold.” With a fixed supply of 21 million coins, Bitcoin provides a hedge against inflation and currency devaluation, especially in times of economic uncertainty. As central banks continue to print fiat money, investors are increasingly turning to Bitcoin to preserve their wealth, much like gold has been used for centuries.

Global Payments

Bitcoin’s ability to facilitate low-cost, borderless transactions makes it an attractive option for global payments. Traditional financial systems often involve high fees and long processing times for cross-border transactions, especially for remittances. Bitcoin’s decentralized nature allows users to send funds anywhere in the world with minimal fees and without intermediaries, making it a preferred choice for international transfers and payments.

Decentralized Finance (DeFi)

The rise of Decentralized Finance (DeFi) has opened new opportunities for Bitcoin integration. While Ethereum currently dominates the DeFi space, Bitcoin is increasingly being used as collateral for lending and borrowing platforms, thanks to wrapped BTC (WBTC) and emerging Bitcoin-native DeFi solutions. This integration allows Bitcoin holders to earn yield, access liquidity, and participate in decentralized financial services without selling their assets.

Tokenization and Smart Contracts

Bitcoin’s functionality is expanding through innovations like the RSK (Rootstock) platform and the Taproot upgrade. RSK brings smart contract capabilities to Bitcoin, enabling decentralized applications (dApps) and tokenization directly on its blockchain. Taproot, a significant upgrade implemented in 2021, enhances Bitcoin’s privacy, scalability, and smart contract flexibility, paving the way for more complex financial products and use cases built on top of the Bitcoin network.

8. Market Sentiment and Social Media Influence

Influence of Social Media

Social media platforms like Twitter, Reddit, and YouTube have become powerful drivers of Bitcoin’s price movements. Crypto discussions on Reddit’s r/Bitcoin and r/CryptoCurrency often spark buying or selling frenzies, while Twitter serves as a real-time news hub where opinions, predictions, and breaking news spread instantly. Viral tweets or trending hashtags can lead to rapid shifts in market sentiment, influencing Bitcoin’s price within hours. YouTube channels dedicated to crypto analysis also play a key role, offering price predictions, technical analysis, and market updates to millions of subscribers.

Role of Influencers

High-profile figures like Elon Musk and Jack Dorsey have a significant impact on Bitcoin’s market sentiment. Musk’s tweets, whether supportive or critical, have repeatedly caused sharp price fluctuations. His endorsement of Bitcoin, as well as Tesla’s investment in BTC, fueled bullish sentiment, while his remarks on environmental concerns around Bitcoin mining led to temporary sell-offs. Jack Dorsey, former Twitter CEO and a long-time Bitcoin advocate, promotes Bitcoin’s decentralized ethos, often influencing both retail and institutional perspectives. Additionally, popular crypto analysts like PlanB, Willy Woo, and Michael van de Poppe shape market sentiment through their regular technical analysis and predictions.

Sentiment Analysis Tools

The rise of sentiment analysis tools has provided traders with insights into how social media mood affects Bitcoin’s price. Platforms like LunarCrush and The TIE analyze millions of social media posts, tracking mentions, sentiment, and engagement related to Bitcoin. Positive sentiment often precedes price rallies, while negative sentiment can signal impending corrections. Traders and investors increasingly rely on these tools to gauge market mood and make informed decisions, highlighting the growing importance of social media in the Bitcoin ecosystem.

9.Final Take

Bitcoin’s potential to reach $200K remains one of the most debated topics in the crypto community. On the bullish side, growing institutional adoption, the impact of the upcoming 2024 halving, and continuous technological advancements provide strong arguments for significant price appreciation. Experts like Michael Saylor and Cathie Wood emphasize Bitcoin’s role as a store of value and its increasing presence in institutional portfolios as key drivers for future growth.

However, challenges such as regulatory crackdowns, market manipulation, and macroeconomic uncertainties cannot be ignored. Skeptics like Peter Schiff and institutions like JP Morgan highlight these risks as potential barriers to Bitcoin reaching the $200K mark in the near term.

While Bitcoin’s journey has always been marked by volatility, its resilience and growing adoption continue to inspire optimism among investors. Staying informed, monitoring market trends, and understanding both opportunities and risks are essential for any crypto investor.

For the latest insights, expert analysis, and up-to-date news on Bitcoin and the broader crypto market, follow Lumyna — your trusted source for everything crypto.

FAQs : Will Bitcoin Reach $200K? Frequently Asked Questions

- What is the highest Bitcoin price predicted in 2025?

Some analysts predict Bitcoin could reach between $200K and $250K by the end of 2025, driven by institutional adoption, the 2024 halving, and global economic conditions. - What could prevent Bitcoin from reaching $200K?

Regulatory crackdowns, economic recessions, market manipulation, and competition from other cryptocurrencies could prevent Bitcoin from hitting $200K. - How does Bitcoin halving affect the price?

Bitcoin halving reduces the supply of new BTC entering the market, historically leading to price increases due to supply-demand dynamics. - Is Bitcoin a safe investment in 2025?

Bitcoin remains a volatile asset. While it offers high growth potential, it also carries significant risks. Investors should diversify and stay informed. - Which companies are investing in Bitcoin?

Major companies like MicroStrategy, Tesla, and Square have significant Bitcoin holdings, fueling confidence in its future growth. - When is Bitcoin expected to hit $200K?

Predictions range from late 2025 to early 2026, with the post-2024 halving period being a critical time for price movement. - How does institutional adoption impact Bitcoin’s price?

Institutional investment brings large capital inflows, increasing demand, reducing volatility, and boosting Bitcoin’s credibility as an asset. - What is the Bitcoin Stock-to-Flow model?

The Stock-to-Flow model predicts Bitcoin’s price based on its scarcity, suggesting a price target of $200K in the current cycle. - Can Bitcoin outperform other cryptocurrencies?

Bitcoin’s first-mover advantage, security, and adoption make it a strong contender, but competition from Ethereum, Solana, and others remains fierce. - How can I stay updated on Bitcoin market trends?

Follow reliable crypto news sources like Lumyna, social media channels, and use market analysis tools for real-time updates and insights.